Unit trusts are a form of collective investment that allows investors to pool their funds to be invested in a portfolio of securities or other assets. Unit trusts are unincorporated mutual funds that pass profits directly to investors rather than reinvesting in the fund. They are established under a trust deed, and the investor is the beneficiary. Unit trusts are managed by a fund manager who invests the pooled funds in a portfolio of assets, which may include shares, bonds, gilts, properties, mortgages, and cash equivalents. The fund manager makes money through the difference between the buying and selling prices of the units, known as the bid-offer spread. Unit trusts offer several advantages, such as diversification, liquidity, and professional fund management. However, there are also disadvantages, including less control over the exact assets and potential costs even if the fund performs poorly.

| Characteristics | Values |

|---|---|

| Type of Investment | Collective investment |

| Investment Structure | Trust deed |

| Investment Management | Fund manager |

| Investment Options | Securities, shares, bonds, gilts, properties, mortgages, cash equivalents |

| Investment Accessibility | Access to a wide range of investments |

| Investment Returns | Income distribution and capital appreciation |

| Investment Risk | Not guaranteed, may lose money |

| Investment Flexibility | Open-ended, grows and shrinks with investors buying and selling units |

| Investment Costs | Initial charge, annual management charge, bid-offer spread |

| Investor Profile | Investors with savings, neither time nor inclination to hold direct investments |

What You'll Learn

Access to a wide range of investments

Investing in a unit trust fund provides access to a wide range of investments not normally available to individual investors. Unit trusts pool investors' money, allowing them to buy into a portfolio of securities or other assets that they might not be able to access otherwise. This includes shares, bonds, gilts, properties, mortgage and cash equivalents.

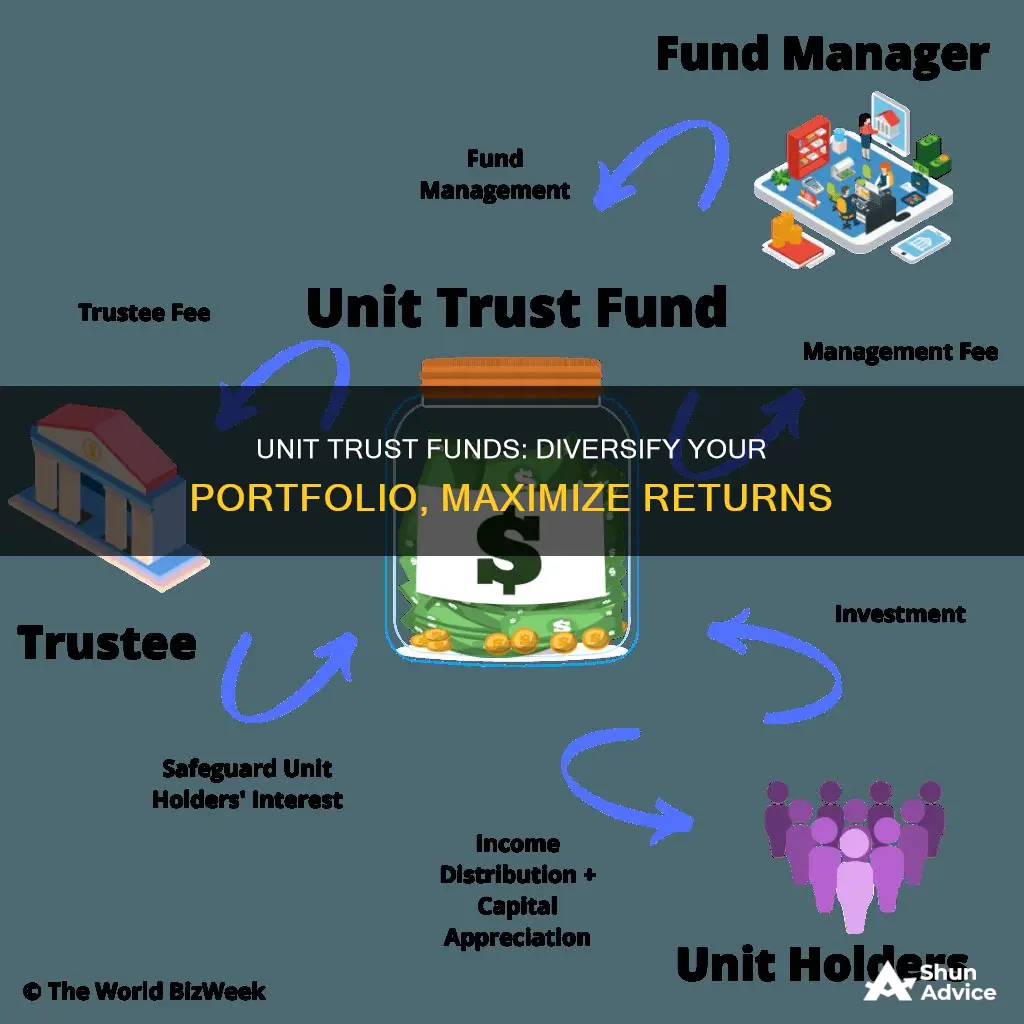

Unit trusts are a form of collective investment, where investors with similar investment objectives pool their funds. A fund manager then invests the pooled funds in a portfolio of securities or other assets. The fund manager's role is to direct the investments of the unit trust, and they are paid a management fee for this service, which is typically based on a percentage of the assets they manage.

Unit trusts are unincorporated mutual funds, meaning they pass profits directly to investors rather than reinvesting them into the fund. The investor is the beneficiary and owns "units", whose price is called the ""net asset value" (NAV). The number of units is not fixed; when more money is invested in a unit trust, more units are created.

Unit trusts are open-ended, meaning the fund will grow and shrink as investors buy and sell units. The price of each unit depends on the underlying value of the assets (NAV), and this is usually calculated each day.

Unit trusts provide investors with access to a wide range of investments, allowing them to spread their money across various asset classes simultaneously. For example, an investor could gain exposure to the property market, global equity markets, and the bond market all at the same time through a unit trust. This diversification of investments helps to hedge against market volatility and reduce risk.

Unit trusts are an attractive option for those who want to invest but don't have the time or inclination to manage a portfolio of direct investments or shares. They offer a simple way to invest in assets such as equities, bonds, and property, although it's important to note that these investments come with associated risks.

Maximizing Your HSA: Mutual Fund Investing Strategies

You may want to see also

Managed by a financial professional

Unit trusts are a form of collective investment, allowing investors to pool their funds to be invested in a portfolio of securities or other assets. The fund is then managed by a financial professional, known as a fund manager, who is assigned to invest the money in line with the fund's objectives. The fund manager is appointed by a trustee, who also ensures that the manager acts in the best interests of the beneficiaries.

The fund manager makes investment decisions based on their expertise and experience, which should ideally generate above-average returns for investors. Their training and background ensure that decision-making is structured and follows sound investment principles. Unit trusts are an ideal way for investors to gain exposure to a wide range of investments that may not normally be available to them. The fund manager's role is to provide easy access to these investment opportunities.

The fund manager runs the trust for a management fee, which is typically a percentage of the assets managed. This fee covers the costs of managing the portfolio and other administrative expenses. In some cases, the fund manager may also receive a performance fee.

While unit trusts offer the benefit of professional fund management, it is important to remember that the performance of the trust heavily depends on the fund manager's skills and decisions. The returns generated by the trust are influenced by the manager's ability to invest in well-performing assets.

Unit trusts provide a hands-off approach for investors, allowing them to invest in assets such as equities, bonds, and property without actively managing the portfolio themselves. This type of investment suits those who want to pool their money with others and have it managed by a financial professional.

Investment Trust vs Fund: What's the Difference?

You may want to see also

No obligation or fixed investment term

Investing in a unit trust fund offers the advantage of no obligation or fixed investment term. This means that investors are not locked into a long-term commitment and can exit the fund at any time. The flexibility of unit trust funds allows for new contributions and withdrawals, making it a dynamic and adaptable investment option.

Unit trust funds are established under a trust deed, with investors as beneficiaries. They are unincorporated mutual funds that pass profits directly to investors rather than reinvesting them into the fund. This structure allows for new contributions and withdrawals, making it a dynamic and adaptable investment option.

The ability to exit the fund at any time reduces the risk of being tied to an underperforming investment. Investors can sell their units at the bid price, although to make a profit, the bid price must be higher than the initial offer price. This exit option provides investors with greater control over their investment decisions and allows them to respond to changing market conditions or personal financial needs.

Unit trust funds are managed by financial professionals who direct the fund's portfolio and investment strategies. While the performance of the trust depends on the fund manager's expertise, investors can rest assured that their investment is being actively overseen and managed. The fund manager's goal is to achieve the fund's investment objectives and protect the interests of the beneficiaries.

In summary, the absence of a fixed investment term in unit trust funds offers investors flexibility, liquidity, and control over their investments. This feature sets unit trust funds apart from other investment options that may lock investors into long-term commitments, providing an attractive option for those seeking dynamic and adaptable investment opportunities.

Index Funds: Understanding Their Typical Investment Strategies

You may want to see also

Returns are not guaranteed

The performance of the fund depends on the skill and expertise of the fund manager, and their decisions can impact the amount generated by the fund. The fund manager makes a profit from the difference between the purchase price of the unit and the sale value, known as the bid-offer spread. This spread can vary depending on the type of assets held and can range from a few basis points for liquid assets to 5% or more for illiquid assets. The bid-offer spread is designed to allow the manager to control liquidity and goes directly to the trust management as profit.

Fees and charges can also impact the returns on unit trust investments. These include initial charges, which are typically a percentage of the amount invested, and annual management charges, which cover the cost of managing the portfolio and administrative expenses. Even if the fund performs poorly, these fees are usually payable and will reduce the value of the investment over time.

While unit trusts aim to maximise returns and outperform inflation, there is no guarantee of a fixed rate of return. The returns will depend on the performance of the underlying assets, and in the short term, the certainty of investment returns may be lower than that of fixed deposits. However, over the medium to long term (3-20 years), unit trust investments generally provide better returns at acceptable levels of risk.

The Right Time to Invest in Index Funds

You may want to see also

Liquidity

Unit trusts are also beneficial because they are bought and sold without any commission. The fund manager makes a profit from the difference between the purchase price of the unit, or offer price, and the sale value of the unit, or bid price. This difference is known as the bid-offer spread and will vary depending on the type of assets held. For very liquid assets, such as UK or US government bonds, the bid-offer spread may be just a few basis points. However, for less liquid assets, such as property, the bid-offer spread could be 5% or more.

It is important to note that the secondary market for unit trusts that are not listed may be illiquid, which may affect the prices at which investors buy or sell.

Baillie Gifford Fund: Where Should Your Money Go?

You may want to see also