Unit trusts are unincorporated mutual funds that pass profits directly to investors instead of reinvesting in the fund. Unit investment trusts (UITs) are a type of investment company that offers a fixed portfolio of stocks and bonds to investors for a specific period. UITs are similar to open-ended and closed-end mutual funds, in that they all consist of collective investments where funds from multiple investors are pooled and managed by a portfolio manager. UITs are bought and sold directly from the issuing investment company, and they have a stated expiration date. UITs are not actively traded, meaning securities are bought or sold only in response to a change in the underlying investment.

| Characteristics | Values |

|---|---|

| Definition | A unit investment trust (UIT) is an investment company that offers a fixed portfolio of stocks, bonds, or other securities to investors for a specific period of time. |

| Investment Structure | UITs are similar to open-ended and closed-end mutual funds as they are all collective investments where investors pool their funds to be managed by a portfolio manager. |

| Buying and Selling | UITs are bought and sold directly from the issuing company, but can also be bought on the secondary market. |

| Initial Public Offering (IPO) | UITs are issued via an IPO, similar to closed-end funds. |

| Investment Objective | UITs offer a definitive investment objective, aiming to provide capital appreciation, dividend income, or both. |

| Minimum Investment | UITs often have low minimum investment requirements, making them accessible to a wider range of investors. |

| Redemption | Investors can redeem their holdings at any time by selling them back to the issuing company at the current underlying value. |

| Expiration | UITs have a stated expiration date, usually based on the investments held in its portfolio, after which investors receive their share of the net assets. |

| Trading Activity | UITs are not actively traded, meaning securities are held with little to no change for the duration of the investment. |

| Taxation | UITs are generally structured as pass-through entities, avoiding taxes at the trust level, and passing tax liabilities to investors. |

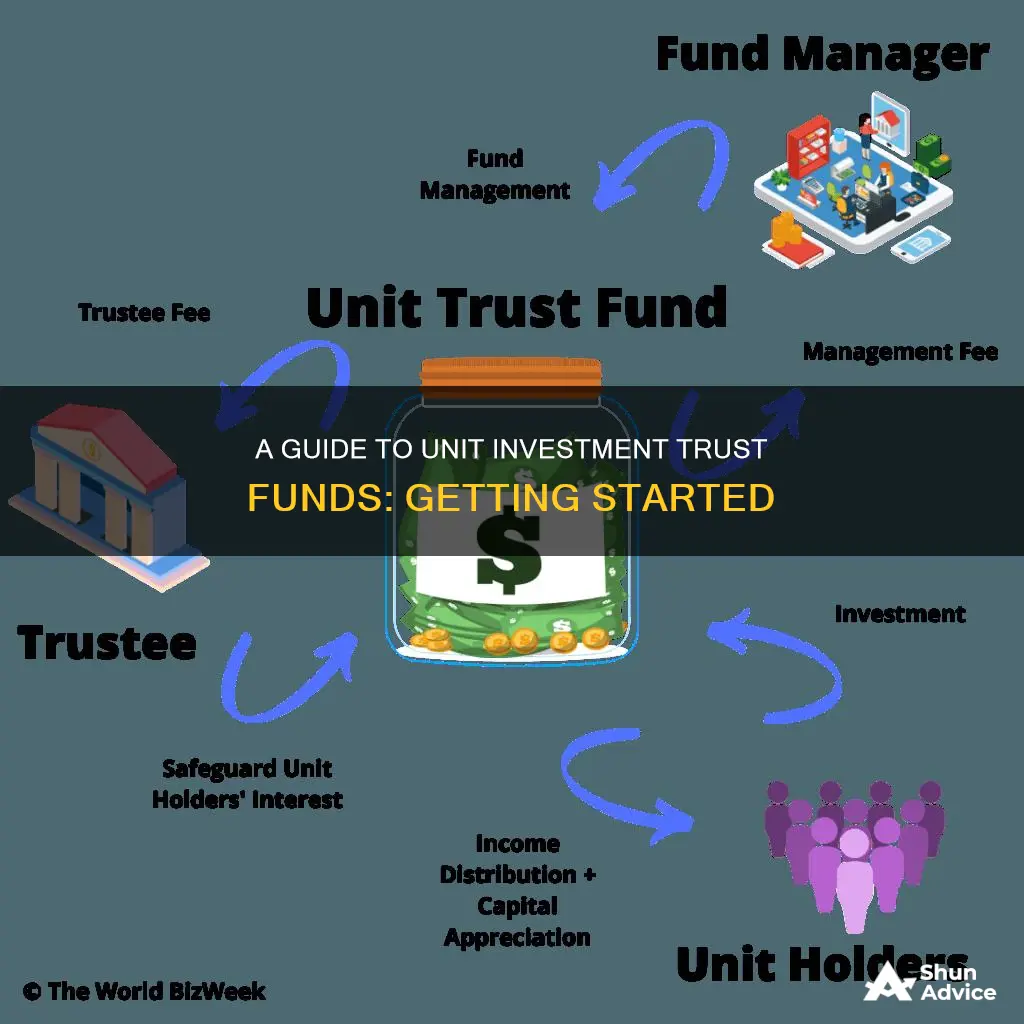

| Fees | UITs typically charge management fees, trustee fees, and sales charges (loads). |

| Types | There are two main types of UITs: stock trusts and bond trusts. |

What You'll Learn

Cash or Lump Sum Investments

One way to invest in unit trusts is to use a lump sum of money. This is where an investor has a large amount of money to invest in a unit trust fund. Over time, the initial investment will grow as the fund earns income. When the investor redeems their units, the unit redemption price will reflect the accumulation and compounding of the invested capital over the relevant periods. It is this compounding effect over time that makes investment in unit trust funds attractive.

If you are investing a large lump sum, you can phase it into a fund and the markets in which that fund invests by breaking up the large sum into smaller investment amounts. This is helpful when markets are volatile.

You can choose whether you want to invest irregular sums of money in a unit trust fund, or contribute smaller regular amounts by way of a monthly direct debit. You need to be aware of the minimum investment amounts for your chosen fund or funds and/or the investment platform you are using.

The benefit of investing regularly is that it creates a savings habit and you are less likely to notice the smaller amounts you sacrifice to save for your goal. Committing to a regular direct debit does not prevent you from stopping your unit trust investment at any time if you can no longer afford your monthly investment amount.

If you invest regular amounts monthly, the fluctuating value of the units in the portfolio is smoothed out over the period for which you invest. Referred to as rand-cost averaging, this approach prevents you from trying to time the markets with one large lump sum. You will end up buying low in some months when shares and bonds and other securities are cheap and high in others, but ultimately you will achieve a “rand-cost” average.

Invest in Fidelity: New Millennium Fund for Future Growth

You may want to see also

Regular Savings

With regular savings, investors make regular (e.g. monthly or quarterly) investments to their fund. This is a disciplined and useful way to generate capital for a future need. By making equal and regular contributions over a period of time, the sum accumulated at the end of the period will increase. This is known as dollar-cost averaging. The longer the holding and contribution period, the more noticeable the effect. This form of savings is the basis of most pension fund accumulations, such as the Employees Provident Fund.

Unit trusts are a form of collective investment set up under a trust deed. They allow investors to pool their money with others and have it managed for them. A fund manager is assigned to invest the money in line with the fund's objectives, and there is a trustee in place to safeguard the assets and ensure the fund manager acts in the best interests of the beneficiaries. The fund is divided into units, and each investor buys one or more of these units to become a beneficiary.

The Future Fund: Investing in Tomorrow's Opportunities

You may want to see also

Investment through EPF savings

Investing through your EPF savings is a great way to boost your retirement savings without needing to invest any additional cash. Here's a step-by-step guide on how to do it:

Step 1: Understand the Basics

Before investing through your EPF savings, it's important to understand the basics of the EPF Members Investment Scheme (EPF-MIS). This scheme allows you to transfer a portion of your EPF savings from Account 1 to invest in unit trust funds. By doing so, you have the potential to earn higher returns compared to leaving your savings in Account 1. However, it's important to remember that investing in unit trusts comes with higher risks and fees that could affect your retirement savings.

Step 2: Compare Returns and Risks

When considering investing through EPF-MIS, carefully compare the returns and risks of unit trust funds with those of EPF savings. EPF guarantees a minimum dividend of 2.5% annually and has achieved an annualised return of 6.1% from 2011 to 2020. On the other hand, unit trust funds offered through EPF-MIS have had varying performance, with some funds performing better than EPF and others falling short. Research the past performance of the specific unit trust funds offered through EPF-MIS to assess if they align with your retirement goals. Remember, past performance doesn't guarantee future returns.

Step 3: Understand Investment Destinations

Your EPF savings are typically invested in a range of financial instruments, such as Malaysian Government Securities, stocks, loans, bonds, money market instruments, and real estate. EPF decides how your savings are allocated across these investments. When you invest through EPF-MIS, you gain slightly more control over where your money is invested, as you can choose from a list of unit trust funds shortlisted by EPF based on their 3-year performance.

Step 4: Weigh the Risks

It's important to understand the risks involved when withdrawing your EPF savings to invest in unit trust funds. Your EPF savings are guaranteed by the federal government, so you don't risk losing your principal if you keep your money in EPF. However, if you withdraw your EPF savings to invest in unit trusts, your capital is no longer protected. Poor performance by the unit trust fund could result in losing the money you've withdrawn from your EPF savings. Therefore, investing in unit trusts through EPF-MIS carries slightly more risk than leaving your savings in EPF.

Step 5: Consider the Fees

Fees play a significant role in any investment decision. If you invest through EPF-MIS, you'll be charged a sales fee ranging from 0 to 3%, depending on whether you invest online or through an agent/counter. Additionally, there may be other fees, such as annual management fees, transfer fees, and redemption fees. These fees will reduce your overall returns and slow down the growth of your retirement savings.

Step 6: Make an Informed Decision

After considering the potential returns, risks, and fees, you can make an informed decision about investing through EPF-MIS. Remember, investing in unit trusts through EPF-MIS offers the potential for higher returns and more control over your investments, but it also comes with higher risks and fees. If you decide to proceed, ensure you carefully research the available unit trust funds and choose reputable fund managers to work with.

Market Downturn: Mutual Fund Investment Strategies and Tips

You may want to see also

Understanding the risks

As with any investment, there are risks involved in investing in a unit trust. Here are some key risks to consider before investing in a unit investment trust:

Risk of Loss

Unit investment trusts (UITs) are not actively traded, meaning the securities are generally not bought or sold unless there is a significant change in the underlying investment, such as a corporate merger or bankruptcy. While this passive investment strategy provides simplicity and peace of mind, it also means that investments are locked into a plan that may not change even if the assets are underperforming. As a result, investors may lose money.

Lack of Control

Investors have little control over the investments made by the trust. UITs have a fixed portfolio of securities and a set investment strategy, and in some cases, poor performers are retained without any changes in strategy. This lack of flexibility can be a downside if you want more influence over your investment decisions.

Limited Diversification

While UITs provide some level of diversification, they typically invest in a specific market sector or asset class. This means they may not offer the same level of diversification as more broadly diversified investments. If you are seeking extensive diversification, UITs may not be the best option.

Long-Term Holding Periods

UITs are designed as long-term investments, and early redemption or exchange may result in incurring fees or losing money. If you need access to your funds on short notice, UITs may not be suitable as they are intended for investors willing to hold their investments for the long term.

Limited Liquidity

UITs are not traded on exchanges like mutual funds, which means they may be less liquid and more challenging to buy or sell. Investors may need to be prepared for higher costs or difficulties in purchasing or selling UIT units.

Fees and Expenses

UITs typically incur various fees and expenses, including sales charges, management fees, and trustee fees. These fees can impact your overall returns, so it is essential to carefully review and understand all the associated costs before investing.

Market and Economic Conditions

The performance of a unit trust can be influenced by changing economic, political, or market conditions. The value of the assets in the fund may fluctuate, affecting the fund's net asset value (NAV) or trading prices. This risk is inherent in any investment and underscores the importance of understanding the fund's investment objectives, strategy, and potential risks before investing.

Maximizing Your HSA: A Guide to Investing Your Funds

You may want to see also

Evaluating fund performance

Evaluating a Unit Investment Trust Fund's Performance

When evaluating the performance of a unit investment trust (UIT) fund, there are several key factors to consider. UITs have characteristics that distinguish them from other types of investment companies, and understanding these features is essential for assessing their performance. Here are some critical aspects to consider:

Investment Objectives and Strategies

Firstly, it is crucial to understand the investment objectives and strategies of the UIT. UITs typically have a fixed portfolio of stocks, bonds, or other securities, and they are designed to provide capital appreciation, dividend income, or both. The investment objective could be capital appreciation, income generation, or a combination of both. Ensure that the fund's investment strategies align with your objectives and risk tolerance.

Fund Manager's Track Record

The fund manager plays a pivotal role in the performance of a UIT. Evaluate the fund manager's qualifications, experience, and track record. While past performance does not guarantee future results, reviewing the manager's historical returns and investment decisions can provide valuable insights into their capabilities.

Fees and Expenses

Fees and expenses can significantly impact the overall returns on your investment. UITs typically have management fees, trustee fees, and, in some cases, sales charges or loads. Carefully review the fee structure and assess if the costs are justified by the potential returns. Compare the fees charged by different UITs with similar investment objectives to identify if there are any excessive or avoidable fees.

Risk Profile

Understanding the risk profile of the UIT is essential. UITs may invest in a specific market sector or asset class, which can increase risk due to lack of diversification. Assess if the level of risk aligns with your investment goals and comfort level. Consider factors such as interest rate movements, foreign currency fluctuations, and the financial health of counterparties when evaluating risk.

Performance Indicators

Monitor the performance of the UIT regularly by reviewing the fund manager's reports and disclosures. Key indicators such as excess returns, active share, and tracking error can provide insights into how the fund is performing relative to its benchmarks and expectations. Remember that UITs are typically passive investments, so their performance may be more predictable than actively managed funds.

Redemption and Exchange Policies

Understand the UIT's redemption and exchange policies. While UITs are designed for long-term holding, some may offer early redemption or exchange options. Evaluate the potential impact of selling your holdings before the specified termination date, as there may be costs or reduced returns associated with early redemption.

Regulatory Compliance

Ensure that the UIT is registered and compliant with relevant regulatory bodies, such as the SEC in the United States. This provides an added layer of oversight and protection for investors.

Investor Suitability

Finally, evaluate the UIT's suitability for your investment needs and goals. Consider your investment horizon, risk tolerance, and financial resources. Assess if the UIT aligns with your investment objectives and whether you are comfortable with the level of risk and potential returns offered by the fund.

By carefully considering these factors, you can make a more informed decision about investing in a UIT and evaluating its performance over time. Remember that investing carries risks, and past performance does not guarantee future results. Diversification and due diligence are essential for making prudent investment choices.

Vanguard Windsor II: Uncovering its Security Strategy

You may want to see also