An investment portfolio is a collection of invested assets such as stocks, bonds, funds, and other financial assets. It is important because it provides a framework for your money, helping you to manage your investments and diversify your assets. By investing in a variety of assets, you can reduce the risk of losing money and improve your returns. Additionally, an investment portfolio can help you outpace inflation, accumulate wealth, diversify your income, and protect your assets. Building an investment portfolio can seem intimidating, but it is a crucial step towards achieving your financial goals and long-term financial security.

| Characteristics | Values |

|---|---|

| Purpose | Provides a framework for your money |

| Helps you oversee and manage your investments | |

| Helps diversify your assets | |

| Spreads your risk across stocks, bonds, and other types of investments | |

| Considerations | Risk tolerance |

| Time horizon | |

| Benefits | Outpace inflation |

| Accumulate wealth | |

| Diversify your income | |

| Protect your assets |

What You'll Learn

Outpace inflation

Investment portfolios are important as they help individuals manage their finances and oversee their investments. Portfolios can also help individuals diversify their assets and spread their risk across stocks, bonds, and other types of investments.

Inflation can significantly impact investment portfolios, and it is crucial to understand this relationship to make informed investment decisions. Inflation erodes purchasing power, affecting not just the cost of groceries but all areas of the economy, including investment returns. Over time, inflation can reduce the value of an investment portfolio.

To maintain the value of an investment portfolio, it is essential to focus on investments that can outpace inflation. This means that the nominal interest rate, or the stated interest rate without adjustment for inflation, must keep up with or exceed the inflation rate. Inflation-protected assets are crucial in this regard.

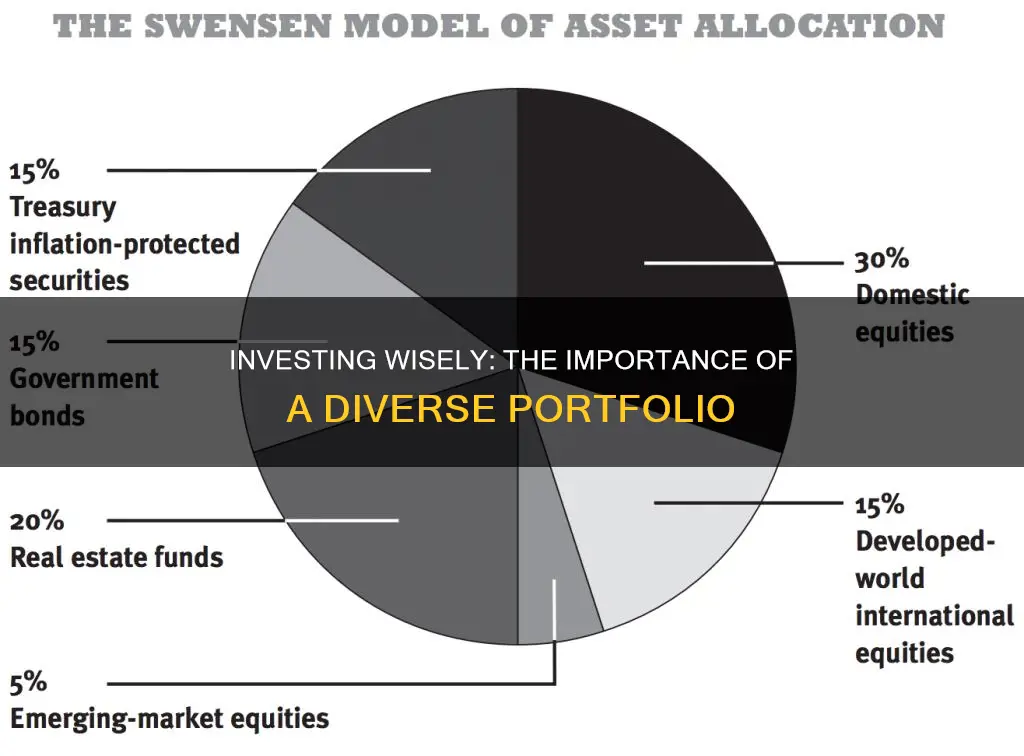

One example of an inflation-protected asset is Treasury Inflation-Protected Securities (TIPS). TIPS are guaranteed by the US government to provide returns indexed to inflation. As inflation rises, so does the value of TIPS, and the interest paid on these securities also increases. TIPS can be purchased directly from the US Treasury or through mutual funds and exchange-traded funds (ETFs).

Another way to protect against inflation is to invest in commodities, such as oil, copper, or gold. Commodity prices tend to rise during inflationary periods, and investors can gain exposure to these assets through direct purchases, mutual funds, or ETFs.

Additionally, certain types of stocks and bonds can serve as inflation hedges. For example, stocks in the consumer staples sector tend to perform well during inflationary times since these companies can pass their rising input costs on to customers. Inflation-indexed bonds, such as TIPS, also offer a variable interest rate tied to the inflation rate, protecting investors from the negative impacts of inflation.

By including inflation-protected assets, commodities, and carefully selected stocks and bonds in an investment portfolio, individuals can help maintain the value of their portfolio and ensure that their investments continue to grow, even during periods of high inflation.

Accessing Your ENT Investment Portfolio: A Step-by-Step Guide

You may want to see also

Accumulate wealth

Accumulating wealth is a priority for many individuals seeking to secure their financial future. A well-structured investment portfolio can help you achieve this goal by providing a framework for your money and allowing you to meet your long-term financial objectives.

- Diversification: Diversification is a cornerstone of portfolio management. By spreading your investments across different asset classes, such as stocks, bonds, cash, real estate, and commodities, you can minimise risk and maximise returns. This is because different assets perform differently under various economic conditions, and some have greater risks and rewards than others. Diversification ensures that you are not overly exposed to a particular asset class, helping to mitigate risk and providing more stable returns.

- Risk management: Portfolios allow you to align your investments with your risk tolerance and financial goals. The primary tool for managing risk is diversification, which helps insulate your portfolio from the poor performance of any single investment or market sector. Additionally, you can further manage risk by regularly rebalancing your portfolio to ensure that your asset allocation remains within your desired risk parameters.

- Long-term wealth creation: Holding onto your investments for the long term is a strategy advocated by many successful investors, including Warren Buffett. By investing for the long term, you can put your money to work without requiring constant attention and market timing. This frees up your time, allowing you to focus on other income-generating activities.

- Compound interest: Compound interest is a powerful tool for growing your wealth over time. By reinvesting the interest earned on your initial investment, you can experience exponential growth in your portfolio. The earlier you begin investing, the more time your money has to compound and grow, allowing you to accumulate significant wealth over time.

- Strategic investment choices: Your investment portfolio should reflect your knowledge, expertise, and goals. If you are confident in your ability to analyse a specific market or asset class, focus your portfolio on those areas. Additionally, consider your risk tolerance, time horizon, and financial obligations when selecting investments.

- Tax efficiency: Different assets and accounts are subject to varying tax treatments, which can significantly impact your returns. By incorporating tax-efficient investment choices into your portfolio, you can minimise tax liabilities and increase your after-tax returns.

- Regular investments: Consistency is key when it comes to building wealth. Making regular, incremental investments allows you to achieve your financial goals without straining your liquidity.

In conclusion, an investment portfolio is a powerful tool for accumulating wealth. By diversifying your assets, managing risk, investing for the long term, utilising compound interest, and making strategic investment choices, you can maximise your wealth-building potential and secure your financial future.

Best Sites for Tracking Your Investment Portfolio

You may want to see also

Diversify your income

An investment portfolio is a collection of assets and can include stocks, bonds, mutual funds, exchange-traded funds (ETFs), and other items of value such as gold, art, real estate, and cryptocurrency.

Diversifying your income is an important aspect of investing. Diversification helps to protect your assets and income sources. If your business faces hard times or is forced to close, you will want to have a secondary source of income to fall back on.

- Invest in multiple asset classes: Diversification can be achieved by investing in multiple asset classes such as stocks, bonds, ETFs, mutual funds, and real estate. By spreading your investments across different asset classes, you reduce the risk associated with putting all your eggs in one basket. This helps to balance out the riskier investments with safer ones.

- Utilize investment funds: Investment funds pool money from multiple investors to invest in a range of businesses. This allows you to diversify your holdings with a single purchase. Investment funds can be actively or passively managed. Actively managed funds have a team of investment managers trying to outperform an index, while passively managed funds track a stock market or market index like the FTSE 100.

- Consider different types of investments: You can invest in stocks, which are riskier but offer higher growth potential, or bonds, which are considered safer but have lower returns. You can also explore other options like rental properties, precious metals, or annuities, depending on your risk tolerance and financial goals.

- Review and rebalance your portfolio periodically: It is important to periodically review and rebalance your investment portfolio to ensure it aligns with your risk tolerance and financial goals. The younger you are, the more risk you can generally tolerate, so you may start with a portfolio focused on riskier assets and gradually shift to include more stable assets.

- Invest in a broad market ETF: If you are unsure where to start, consider investing in a broad market ETF that tracks a major index. This allows you to diversify your holdings and reduce the impact of downturns in specific industries or areas.

Investing Savings Wisely: Your Path to Home Ownership

You may want to see also

Protect your assets

An investment portfolio is a collection of financial investments such as stocks, bonds, commodities, cash, and cash equivalents, including closed-end funds and exchange-traded funds (ETFs). Portfolios are important because they provide a framework for your money, helping you to manage your investments and spread your risk across different types of investments.

Diversify your investments

Diversification is a key concept in portfolio management. It is the idea of not putting all your eggs in one basket. By spreading your investments across different financial instruments, industries, and categories, you reduce the risk of losing all your money at once. Diversification aims to maximise returns by investing in different areas that would each react differently to the same event.

Choose non-correlating assets

Non-correlating assets are those that do not move in tandem with the stock market. Examples include bonds, commodities, currencies, and real estate. By adding these to your portfolio, you can reduce systematic risk, which is the risk associated with investing in the markets. Non-correlating assets smooth out the volatility of your portfolio's overall worth, providing more balanced returns.

Monitor your accounts

Keep a close eye on your investment accounts for any suspicious activity. Regularly review your account statements and confirm that you have authorised all transactions. Be vigilant for any changes to your account information, such as your address, phone number, or bank details. This will help protect your assets from fraud or unauthorised access.

Understand your risk tolerance

Your risk tolerance is your ability to accept investment losses without panicking. It depends on factors such as your financial goals, mental resilience, and how much time you have before reaching your financial goal. A higher risk tolerance allows for more aggressive investment strategies, while a lower risk tolerance may call for a more conservative approach.

Regularly review and rebalance your portfolio

Over time, the allocation of assets in your portfolio may get out of balance. For example, if one of your stocks rises sharply in value, it may come to dominate your portfolio. Periodically review your portfolio to ensure it still aligns with your risk tolerance and financial goals, and make adjustments as necessary.

In summary, by diversifying your investments, choosing non-correlating assets, monitoring your accounts, understanding your risk tolerance, and regularly reviewing and rebalancing your portfolio, you can help protect your assets and give them the best chance to grow.

Understanding the Risks: What to Avoid in Your Investment Portfolio

You may want to see also

Reduce the temptation to react to short-term volatility

Investing can be daunting, especially for beginners. One of the most common questions new investors have is whether or not it is a good time to enter the market. The answer is that there is no perfect time. Stock markets don't move in a linear fashion, and even professionals cannot predict the best days to invest.

Therefore, it is important to focus on the long term and create a diversified portfolio with a range of investments. This will help you reduce the temptation to react to short-term volatility. Here are some strategies to achieve this:

- Diversify your portfolio: Don't put all your eggs in one basket. Diversifying your investments across different asset classes, sectors, and geographic regions will help reduce the impact of short-term volatility on your portfolio. By spreading your investments, you lower the risk of losing money due to market fluctuations.

- Invest regularly: Instead of trying to time the market, focus on investing regularly, such as through dollar-cost averaging. This strategy involves investing a fixed amount at regular intervals, regardless of the market conditions. By doing so, you buy more when prices are low and less when prices are high, averaging out the cost of your investments over time.

- Avoid knee-jerk reactions: Stock markets will experience ups and downs, and sometimes the value of your investments will fall. Avoid making impulsive decisions during market downturns. Remember that the value of your investments only matters if you want to sell them. If you sell during a downturn, you risk missing out on the recovery.

- Commit to long-term investments: Give your investments time to grow. By committing to long-term investments, you increase the chances of your portfolio recovering from any short-term losses. Riding out market cycles can help you reap the benefits of long-term growth.

- Understand risk tolerance: Before investing, assess your risk tolerance, which is your ability to accept investment losses. If you have a low-risk tolerance, consider investing in more stable assets or adopting a defensive portfolio strategy. This will help you stick to your investment plan during volatile periods.

- Monitor your portfolio: Regularly review and rebalance your portfolio to ensure it aligns with your investment goals and risk tolerance. By actively managing your portfolio, you can make adjustments to reduce the impact of short-term volatility.

- Seek professional advice: If you are unsure about investing, consider seeking advice from a financial advisor or robo-advisor. They can help you build and manage a portfolio that aligns with your risk tolerance and investment goals, providing guidance during volatile periods.

Remember, market volatility is inevitable, and trying to time the market is challenging. By adopting a long-term perspective, diversifying your investments, and maintaining a well-thought-out strategy, you can reduce the temptation to react to short-term volatility and improve your chances of investment success.

Savings-Investment Spending Identity: Lessons for the Economy

You may want to see also

Frequently asked questions

An investment portfolio is a collection of invested assets such as stocks, bonds, funds, and other financial assets. It is a framework for your money and helps you manage your investments.

An investment portfolio is important because it helps you diversify your assets and spread your risk across different investments. It also provides a long-term framework for your money, allowing you to build wealth over time.

By having an investment portfolio, you can invest in a range of different assets, such as stocks, bonds, real estate, and commodities. This diversification helps to reduce the risk associated with any single investment or market sector.

An investment portfolio allows you to balance risk and return by allocating your investments across different asset classes. The right mix of assets depends on your risk tolerance, financial goals, and timeline.

An investment portfolio can provide access to more opportunities and help spread risk. It also allows you to take a hands-off approach, as you don't need to actively manage your investments day-to-day.

To build an investment portfolio, you need to consider your risk tolerance and financial goals. Choose an account or advisor, select investments that align with your preferences and goals, and regularly review and rebalance your portfolio as needed.