The savings-investment spending identity is a macroeconomic concept that states that the amount of money saved in an economy is the same amount that will be invested in new capital. It is an accounting identity, meaning it is true by definition. The identity illustrates the relationship between a nation's savings and its investments, and is used in national income accounting. In a closed economy, savings are equal to investments. However, in an open economy, the savings-investment spending identity changes depending on whether the nation is running a trade surplus or deficit. The identity helps us understand how savings relate to investments and a country's ability to invest in capital.

| Characteristics | Values |

|---|---|

| What is the savings-investment spending identity? | An identity used in national accounting to prove that the amount of money saved in an economy is the same amount of money that will be invested into new capital. |

| What is included in the savings-investment spending identity? | New capital purchases like machinery, or new store inventory. |

| What is the formula for the savings-investment spending identity in a closed economy? | Y = C + I + G |

| What is the formula for the savings-investment spending identity in an open economy? | Y = C + I + G + (X-M) |

| What is the relationship between savings and investment? | The level of a country's national savings in macroeconomics determines its wealth and its ability to invest in capital both in the present and in the future. |

What You'll Learn

- The savings-investment spending identity is an equation that illustrates the relationship between a nation's savings and its investments

- In a closed economy, savings are equal to investments

- In an open economy, savings do not equal investments, as trade must be accounted for

- The savings-investment spending identity can be used to understand the determinants of the trade and current account balance

- The savings-investment spending identity can be used to predict the rising and falling of trade deficits

The savings-investment spending identity is an equation that illustrates the relationship between a nation's savings and its investments

The savings-investment spending identity is an economic concept that illustrates the relationship between a nation's savings and its investments. It is an equation that shows that the amount of money saved in an economy is the same as the amount of money invested in new capital. This relationship is true by definition, as it is based on the understanding that all money that is not spent must be saved, and vice versa. This concept is particularly useful for understanding the determinants of a country's trade and current account balance.

The savings-investment spending identity can be expressed as:

> Y – C – G = I

> or

> S = I

Where:

- Y = GDP/Total Domestic Output

- C = Consumption

- G = Government Spending

- I = Investment

- S = Savings

In an open economy, which trades with other countries, the identity is slightly different and includes net exports:

> Y = C + I + G + (X – M)

> or

> I = S + (M – X)

Here, X = Exports and M = Imports.

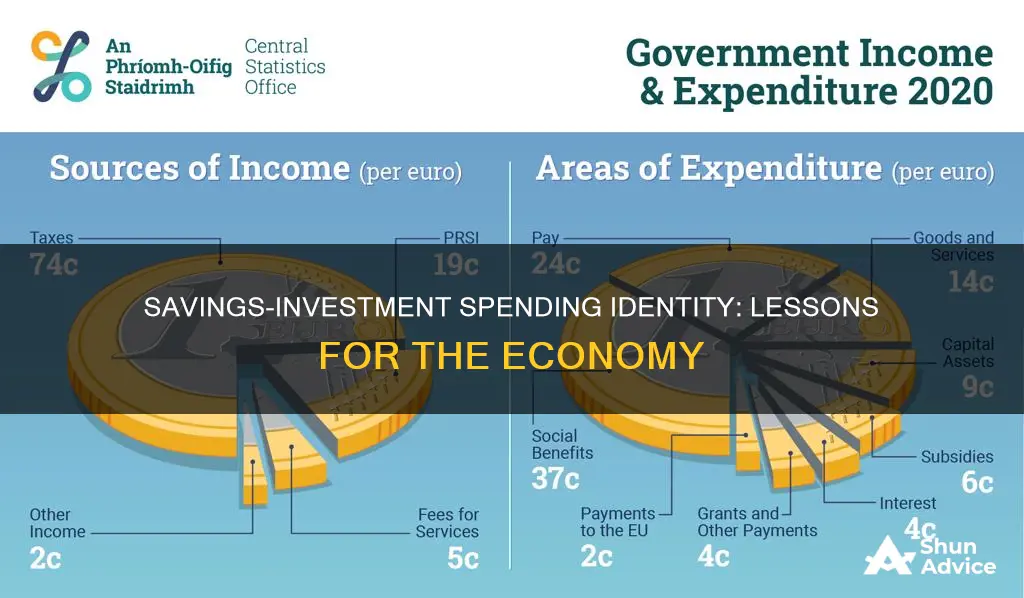

The savings-investment spending identity is important because it shows that a nation's level of savings determines its ability to invest in capital, which is necessary for economic growth and technological advancement. It also highlights the connection between trade balances and the flow of savings and investments, demonstrating that a nation's balance of trade is determined by its levels of domestic saving and investment.

Explore Saving and Investment Options for Your Future

You may want to see also

In a closed economy, savings are equal to investments

The savings-investment spending identity is a concept in national income accounting. It states that the amount saved in an economy will be the amount invested in new physical capital, such as machinery and inventory. In other words, savings and investments are equal. This is true by definition, as the variables in the equation are defined this way.

In a closed economy, the Gross Domestic Product (GDP) is equal to the total income or expenditure of the economy, including consumer spending, government spending, and investments. There is no trade with other countries, so the GDP equation is:

> GDP = Consumer Spending + Government Spending + Investments

This can be written as:

> Y = C + I + G

Where Y is the GDP or total output, C is consumer spending, I is investment, and G is government spending.

If we subtract consumption and government spending from both sides of the equation, we get:

> Y - C - G = I

Since Y - C - G is also the amount saved in the economy, we can say that savings (S) are equal to investments (I):

> S = I

This equation shows that in a closed economy, savings are equal to investments.

The savings-investment spending identity helps us understand the relationship between savings and investments. It also highlights the importance of national savings and investments in encouraging economic growth and technological advancement. For example, savings can be used to invest in better infrastructure, education, or nutrition, which can lead to a more productive and advanced economy.

National Saving Certificates: Smart Investment Strategies

You may want to see also

In an open economy, savings do not equal investments, as trade must be accounted for

The savings-investment spending identity is a macroeconomic concept that states that the amount of money saved in an economy is the same amount that will be invested in new capital. This is true by definition, as it is an identity.

In an open economy, the savings-investment spending identity is:

> S = I + G – T + (X – M)

Where:

- S = Savings

- I = Investment

- G = Government spending

- T = Taxes

- X = Exports

- M = Imports

In an open economy, savings do not equal investments because trade must be accounted for. This is reflected in the equation by the inclusion of exports (X) and imports (M). The balance of trade, or net exports (X – M), is the total inflow of funds into a country minus the total outflow of funds out of a country.

If there is a trade deficit, where imports are greater than exports, then foreign countries are investing their savings into the domestic economy. In this case, the investments that the country can make are equal to the amount of domestic and foreign savings combined.

On the other hand, if there is a trade surplus, the domestic economy is investing its savings into the foreign economy. This can be interpreted as the amount of national savings being equal to investment and savings gained from the trade surplus combined.

The savings-investment spending identity helps us understand how savings relate to investments. A country's national savings determine its wealth and its ability to invest in capital, which will allow the nation to grow and become more advanced.

Reviving Nature: Planting vs. Preservation, Where Should We Invest?

You may want to see also

The savings-investment spending identity can be used to understand the determinants of the trade and current account balance

The savings-investment spending identity is a macroeconomic concept that can be used to understand the determinants of the trade and current account balance. This identity states that the amount of money saved in an economy is the same amount that will be invested in new capital. In other words, the money saved in an economy is spent on investments.

In a closed economy, the savings-investment spending identity is represented by the equation:

> S = I

Where:

- S = Savings

- I = Investment

However, in an open economy, the savings-investment spending identity includes net exports, as foreign investment can impact the amount of money available for investment. In this case, the equation becomes:

> I = S + NX

Where:

- I = Investment

- S = Savings

- NX = Net Exports (Exports minus Imports)

The savings-investment spending identity also illustrates the relationship between a country's savings, investment, and trade balance. For example, if a country has a trade deficit, it means that capital is flowing into the country from abroad, and the domestic investment exceeds domestic savings. On the other hand, if a country has a trade surplus, it indicates that domestic savings are higher than domestic investment, and the excess financial capital is invested abroad.

In summary, the savings-investment spending identity provides a framework for understanding the interplay between savings, investment, and trade balances in an economy. It highlights the equality between the amount saved and the amount invested, while also considering the impact of trade in open economies.

How Interest Rates Affect Savings and Investments

You may want to see also

The savings-investment spending identity can be used to predict the rising and falling of trade deficits

The savings-investment spending identity is a macroeconomic concept that can be used to understand the relationship between a country's savings and its investments. It states that the amount of money saved in an economy will be reflected in investments in new physical capital, such as machinery and inventory. This identity is particularly useful for predicting the rise and fall of trade deficits.

In an open economy, where international trade and capital flows occur, the savings-investment spending identity takes into account net exports (NX), which is the difference between imports (M) and exports (X). When exports exceed imports, resulting in a positive NX, there is a trade surplus. Conversely, when imports exceed exports, leading to a negative NX, there is a trade deficit.

The savings-investment spending identity equation for an open economy is:

> S = I + G – T + NX

> Savings = Investment + Government Spending – Taxes + Net Exports

In the context of trade deficits, this equation demonstrates that an increase in domestic investment without a corresponding increase in domestic savings will lead to a higher trade deficit. This is because the additional financial capital for investment must come from abroad, resulting in a net inflow of foreign capital. On the other hand, if domestic savings increase while domestic investment remains unchanged, the trade deficit will decrease as there is less reliance on foreign capital.

Additionally, changes in government spending can impact the trade balance. If the government switches from a budget surplus to a budget deficit, it becomes a borrower rather than a supplier of financial capital, contributing to the trade deficit. Conversely, if government savings increase, it can help reduce the trade deficit.

The savings-investment spending identity highlights the interplay between savings, investment, and trade in an economy. By understanding this relationship, economists can predict the rise and fall of trade deficits and gain insights into the overall economic health of a nation.

Equity Linked Savings Schemes: A Smart Investment Guide

You may want to see also

Frequently asked questions

The savings-investment spending identity is an equation that illustrates the relationship between a nation's savings and its investments. It states that the amount of money saved in an economy is the same amount that will be invested in new capital.

The purpose of national savings and investments is to encourage economic growth and fund technological advancements. Savings and investments are important for a nation's economic growth and can help make a country more advanced and productive.

In a closed economy, the main components are consumption, government spending, and investments. In an open economy, they are the same, but net exports are also included.

In a closed economy, the savings-investment spending identity is represented by the equation: Savings = Investment. This is because when consumption and government spending are subtracted from the GDP, what remains is the output that has been saved and can now be invested.

The level of a country's national savings determines its wealth and its ability to invest in capital. Investing in capital allows a nation to grow and become more advanced. Therefore, national savings are a good indicator of a country's financial health.