The portfolio approach to investing is a strategy that involves creating a diversified portfolio of investments. This means not putting all your eggs in one basket. By adopting this approach, investors can avoid disastrous outcomes and reduce the overall risk associated with their wealth. Diversification allows investors to spread the downside risk across different assets and securities, without necessarily decreasing the expected rate of return.

A portfolio is a collection of financial investments like stocks, bonds, commodities, cash, and cash equivalents, including closed-end funds and exchange-traded funds (ETFs). The key to successful portfolio management is diversification, which tries to reduce risk by allocating investments across various financial instruments, industries, and other categories.

The right mix of assets in a portfolio depends on an individual's risk tolerance, financial goals, and timeline. It is important to regularly review and rebalance a portfolio to ensure it remains aligned with the investor's goals and risk tolerance.

| Characteristics | Values |

|---|---|

| Purpose | Reduce risk without compromising investment returns |

| Diversification | Not putting all your eggs in one basket |

| Risk | Heavy losses if not diversified |

| Returns | Expected rate of return is not decreased |

| Risk reduction | 75% reduction in standard deviation for a portfolio of 3 equally weighted assets |

| Modern Portfolio Theory | Investors should focus on the relationship among individual securities within the portfolio |

| Tactical approach | Actively buying and selling assets for short-term gains |

| Strategic approach | Buying financial assets with the intention of holding them long-term |

| Risk tolerance | Depends on age, finances, need for liquidity, and market conditions |

| Time horizon | Investors should move towards a conservative asset allocation as their goal date approaches |

What You'll Learn

- Diversification reduces risk without compromising returns

- A portfolio approach is important regardless of future financial goals

- A portfolio approach helps investors avoid disastrous outcomes

- A portfolio approach helps investors avoid putting all their eggs in one basket

- A portfolio approach helps investors evaluate individual investments

Diversification reduces risk without compromising returns

Diversification is a key concept in portfolio management and a cornerstone of investing in the markets. It is the process of spreading investments across different asset types, industries, and other categories to reduce risk. By investing in different areas, each reacting differently to the same event, diversification aims to maximise returns without compromising them.

The benefits of diversification are often summarised by the saying, "don't put all your eggs in one basket". If an investor places all their bets on a single stock and that company goes bankrupt, they risk losing their entire portfolio. However, by diversifying across multiple assets, the impact of any single asset's poor performance on the portfolio is reduced.

Diversification does not mean sacrificing returns. Studies of past returns on major markets conclusively support that diversification can reduce risk without compromising returns. For example, consider a portfolio of three different assets with a mean annual return of 15% and a standard deviation lower than the average of the three standard deviations. This illustrates how risk is reduced without impacting the expected rate of return.

The Modern Portfolio Theory (MPT) also supports diversification. MPT suggests that investors should focus on the relationship among individual securities within the portfolio to achieve the maximum benefit of diversification, which is to reduce asset-specific risk.

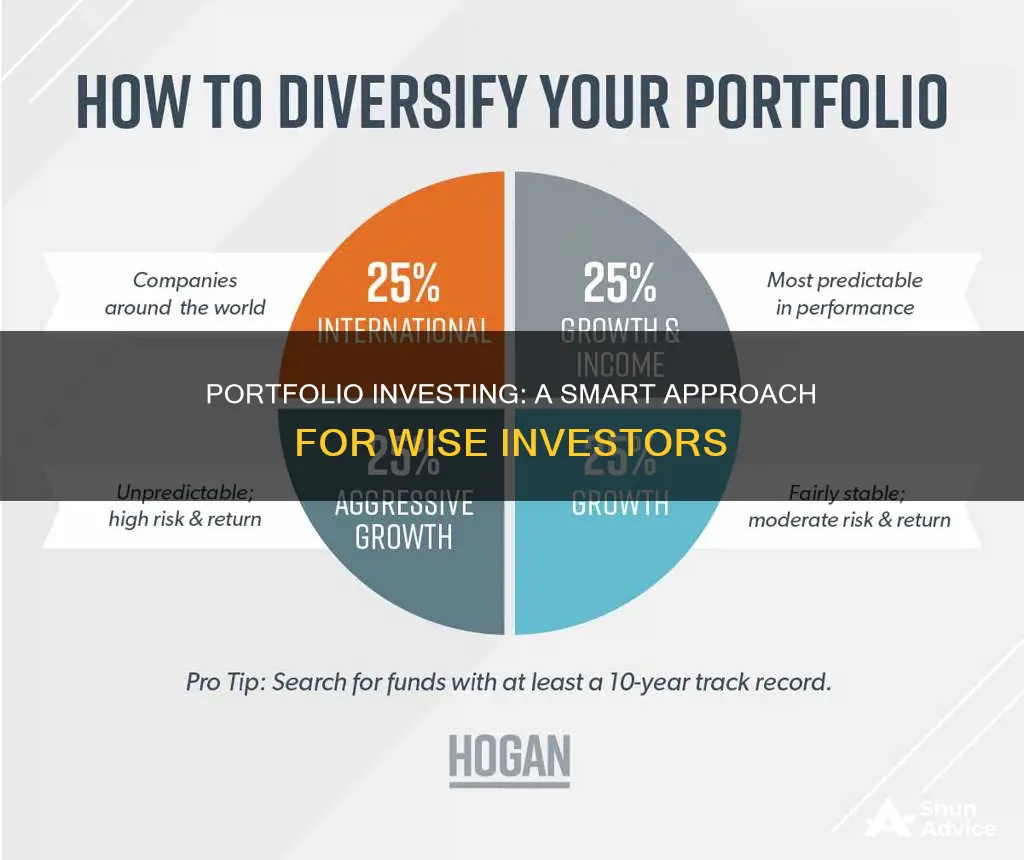

There are many ways to diversify a portfolio. Investors can spread their investments across various asset classes, including stocks, bonds, cash, real estate, commodities, and alternative investments. They can also diversify within each asset category. For example, for stocks, this means including securities that vary by sector, industry, geographic region, and market capitalisation. Additionally, investors can diversify their tax exposure by maintaining a combination of traditional and Roth accounts.

Overall, diversification is a powerful tool for investors to reduce risk and improve returns without compromising one for the other.

National Saving Scheme: Smart Investment Strategies

You may want to see also

A portfolio approach is important regardless of future financial goals

A portfolio approach to investment is important regardless of future financial goals. It enables an investor to create a diversified investment portfolio. Diversification is a key concept in portfolio management, and it is based on the idea of "not putting all your eggs in one basket".

A portfolio is a collection of financial investments like stocks, bonds, commodities, cash, and cash equivalents, including closed-end funds and exchange-traded funds (ETFs). While stocks, bonds, and cash are generally considered the core of a portfolio, it is not a rule. Portfolios can also contain a wide range of assets, including real estate, art, and private investments.

The benefits of a diversified portfolio are that it lowers the overall risk and volatility of an investment portfolio. If a portfolio is too heavily allocated to one individual security, and that security fails for some reason, an investment portfolio can be reduced to zero. Diversification allows investors to spread some of the downside risk associated with any one investment position without necessarily decreasing the expected rate of return.

Each security has a historical risk and return profile. By combining securities within a portfolio, we can produce a risk and return profile for the portfolio itself. Through the examination of different portfolios, we can determine the portfolio composition that produces the best risk-return profile.

While diversification is important, it is not an absolute failsafe for investors. A diversified portfolio may not protect an investor from losses during market turmoil. This is because the correlation between asset prices is not fixed. As was the case during the 2007-2008 financial crisis, previously uncorrelated assets can become correlated when markets are stressed. This is known as contagion.

Despite this limitation, diversification is still considered a cornerstone for portfolio managers. Most investment professionals agree that, although it does not guarantee against loss, diversification is a key component for reaching long-range financial goals while minimizing risk.

Savings and Investments: A Comprehensive Guide

You may want to see also

A portfolio approach helps investors avoid disastrous outcomes

A portfolio approach to investing is important for investors to avoid disastrous outcomes. The old adage "don't put all your eggs in one basket" is a good summary of the benefits of diversification. If an investor puts all their money into one stock and that company goes bankrupt, they could lose their entire investment. Diversification allows investors to spread the risk across different assets, so that if one investment performs poorly, it does not affect the entire portfolio.

A portfolio approach can also help investors manage their risk. By investing in a range of assets, investors can choose assets with different levels of risk. For example, stocks are generally considered riskier than bonds, so an investor might choose to invest in both to balance their risk.

The right mix of assets in a portfolio depends on the investor's risk tolerance, financial goals, and time horizon. For example, a young person saving for retirement might invest mostly in stocks, as they have time to recover from any losses, whereas an older investor might choose to invest more in bonds as they are more stable.

It is important to note that diversification does not guarantee protection from losses. During times of market turmoil, even uncorrelated assets can become correlated, as was seen during the 2008 financial crisis. However, overall, a portfolio approach can help investors manage their risk and avoid disastrous outcomes.

RBI's Portfolio Investment Scheme: A Guide

You may want to see also

A portfolio approach helps investors avoid putting all their eggs in one basket

A portfolio approach to investing is a way to avoid putting all your eggs in one basket. This is a common saying that reflects the core principle of portfolio management: diversification.

Diversification is a risk-management strategy that involves spreading investments across different assets, industries, and categories. By doing so, investors can reduce the overall risk associated with their wealth without necessarily decreasing their expected rate of return.

For example, if an investor places all their bets on a single stock and that company goes bankrupt, they risk heavy losses. However, if they hold a diversified portfolio, the impact of any single asset's poor performance is mitigated. This is because different assets perform differently under various economic conditions, and some have greater risks with greater potential rewards than others.

By combining securities within a portfolio, investors can produce a risk and return profile that is more stable and less vulnerable to the performance of any one individual security.

There are many ways to diversify a portfolio. Investors can spread their investments across various asset classes, such as stocks, bonds, cash, real estate, commodities, and alternative investments. They can also diversify within each asset category. For example, for stocks, this could mean including securities from different sectors, industries, and geographic regions, with varying market capitalizations.

Additionally, investors can diversify their tax exposure by investing in both traditional and Roth accounts, which have different tax treatments.

It is important to note that diversification does not guarantee protection against investment losses, especially during market turmoil when previously uncorrelated assets can become correlated. However, it is still a critical strategy for reaching long-range financial goals while minimizing risk.

The Investment Savings Curve: A Guide to Financial Strategy

You may want to see also

A portfolio approach helps investors evaluate individual investments

A portfolio approach is a cornerstone of investing in the markets. It is a collection of financial investments like stocks, bonds, commodities, cash, and cash equivalents, including closed-end funds and exchange-traded funds (ETFs).

For example, a portfolio of three different assets with equal proportions will have a lower risk than any one of the individual assets. This is because the standard deviation of the portfolio is lower than the average of the three standard deviations of the individual assets.

The Modern Portfolio Theory (MPT) suggests that investors should focus on how individual securities in the portfolios are related to one another to achieve the maximum benefit of diversification, which is to reduce the asset-specific risk of the portfolio.

By combining securities within a portfolio, investors can produce a risk and return profile for the portfolio itself. Through the examination of different portfolios, investors can determine the portfolio composition that produces the best risk-return profile.

Additionally, a portfolio approach allows investors to evaluate and include asset categories with investment returns that move up and down under different market conditions. This helps protect against significant losses. For example, historically, the returns of the three major asset categories—stocks, bonds, and cash—have not moved up and down simultaneously.

In summary, a portfolio approach helps investors evaluate individual investments by allowing them to diversify their investments, assess the risk and return profile of the portfolio, and include different asset categories to protect against losses.

Importing Your Portfolio to Investing.com: A Step-by-Step Guide

You may want to see also

Frequently asked questions

Diversification is important in portfolio investing because it helps investors avoid disastrous investment outcomes. By not putting all their eggs in one basket, investors can reduce the overall risk associated with their wealth without necessarily decreasing their expected rate of return.

Diversification allows investors to spread some of the downside risk associated with any one investment position without necessarily decreasing the expected rate of return. Diversified portfolios have a lower portfolio risk or volatility than any individual position within the portfolio.

Diversification tries to reduce risk by allocating investments among various financial instruments, industries, and other categories. It aims to maximize returns by investing in different areas that would each react differently to the same event.