India's investment in Africa has been increasing over the years, with the country becoming the fifth-largest investor in the continent. In 2017, India's cumulative investments in Africa were valued at over $54 billion, with significant investments in oil and gas, mining, banking, pharmaceuticals, and textiles. India's economic engagement with Africa is driven by various factors, including historical ties, shared developmental challenges, and the potential for growth in African markets. Additionally, India has been an important partner in Africa's development, offering concessional credit lines, grant assistance, and capacity-building initiatives.

What You'll Learn

- India's investment in Africa is driven by a desire to strengthen historical ties and shared challenges

- India is the 5th largest investor in Africa, with investments in oil and gas, mining, banking, and pharma

- India's investment in Africa is growing, with a focus on sustainable development and mutual benefit

- India's proximity, shared language, and cultural popularity give it advantages over China in Africa

- India's investment in Africa is not without criticism, particularly regarding project delivery and land-grabbing

India's investment in Africa is driven by a desire to strengthen historical ties and shared challenges

India's investment in Africa is driven by a desire to strengthen historical ties and address shared challenges. For centuries, India and Africa have shared deep cultural, social, economic, and political ties. Many African countries gained independence at the same time as India, and both regions continue to face common challenges such as poverty, low levels of education, and healthcare access.

India has demonstrated its commitment to its African partners by offering support and leadership in addressing these shared developmental challenges. This is reflected in strategic initiatives such as the "Focus Africa" campaign launched in 2002, the India-Africa Forum Summit in 2008, and the Asia-Africa Growth Corridor established in 2017. Trade between Africa and India has increased significantly, with India becoming the third-largest national trading partner of Africa.

India's investments in Africa are not limited to economic gains alone. The country has also taken the lead in helping Africa overcome its digital divide with projects like the Pan Africa e-Network, which provides free tele-education and medical education to African countries. Additionally, Africa already receives nearly 20% of Indian pharmaceuticals, and India hosted the first India-Africa Health Sciences Meet in 2015.

India's engagement with Africa is further strengthened by their shared history of fighting against colonialism and racial discrimination. This foundation has led to a special relationship where India was one of the first countries to announce duty-free access to low-income African countries. Moreover, India's investments in Africa are not limited to a few sectors but span oil and gas, mining, banking, pharmaceuticals, and textiles, among others.

In recent years, India has completed various significant projects in Africa, including the construction of the Presidential Office in Ghana, the National Assembly building in Gambia, and the Kosti Power plant in Sudan. India has also established IT centers, vocational training centers, technology centers, and food processing business incubation centers across the continent.

India's investment in Africa is driven by a desire to strengthen historical ties and address shared challenges while promoting economic growth and social development on the continent.

Active Investment Management: Why It's Worth the Effort

You may want to see also

India is the 5th largest investor in Africa, with investments in oil and gas, mining, banking, and pharma

India's economic reforms in the 1990s liberalised the rules and procedures for outward investments, making it easier for Indian companies to invest abroad. Additionally, India's high growth rates have increased its energy requirements, making energy security a central concern of its foreign policy. To address this, India has sought to diversify its energy suppliers and invest in oil and gas ventures abroad.

Indian public sector companies, such as Oil and Natural Gas Corporation-Videsh Limited (OVL), have been particularly active in Africa's oil and gas sector. OVL has made significant investments in Mozambique, Egypt, and Sudan. However, Indian public sector companies have faced challenges in Africa's energy market, with some having to relinquish blocks due to poor commercial prospects or inability to meet contractual agreements.

Indian private sector companies have also made substantial investments in Africa, particularly in manufacturing, petrochemicals, fast-moving consumer goods, and hotels. Large private sector companies like Reliance, Varun Beverages, Bharti Airtel, and the TATA Group have made "big-ticket" investments in select African countries. Additionally, there are numerous small and medium-sized Indian enterprises operating across the continent.

Indian investments in Africa's pharmaceutical sector are also notable. For example, Glenmark Pharma invested about $7.6 million in Egypt between 2008 and 2011. The sector is expected to grow further, with the implementation of the African Continental Free Trade Area (AfCFTA) agreement, which will harmonise regulatory systems and boost intra-African trade in medicines and pharmaceuticals.

Indian investments in Africa's banking sector are also worth mentioning. Three Indian public sector banks—Bank of Baroda, Bank of India, and Central Bank of India—invested in Zambia in 2015.

Overall, India's investments in Africa are driven by a range of factors, including energy security, market entry strategies, and access to raw materials. While the majority of investments have been in the energy sector, Indian companies have also made significant investments in other sectors, contributing to Africa's economic development.

Speculation Strategies: Managing Investment Risks and Rewards

You may want to see also

India's investment in Africa is growing, with a focus on sustainable development and mutual benefit

India's investment in Africa has been growing, with a focus on sustainable development and mutual benefit. The country is the fifth-largest investor in Africa, with a cumulative investment of over $54 billion in the last few years. This investment has been spread across various sectors, including oil and gas, mining, banking, pharmaceuticals, and textiles, creating jobs for local African citizens.

India and Africa have shared deep cultural, social, economic, and political ties for centuries. Many African countries gained independence at the same time as India, and both regions face common challenges such as poverty, low levels of education, and healthcare issues. India has always stood in solidarity with African countries, often leading by example when addressing shared developmental challenges.

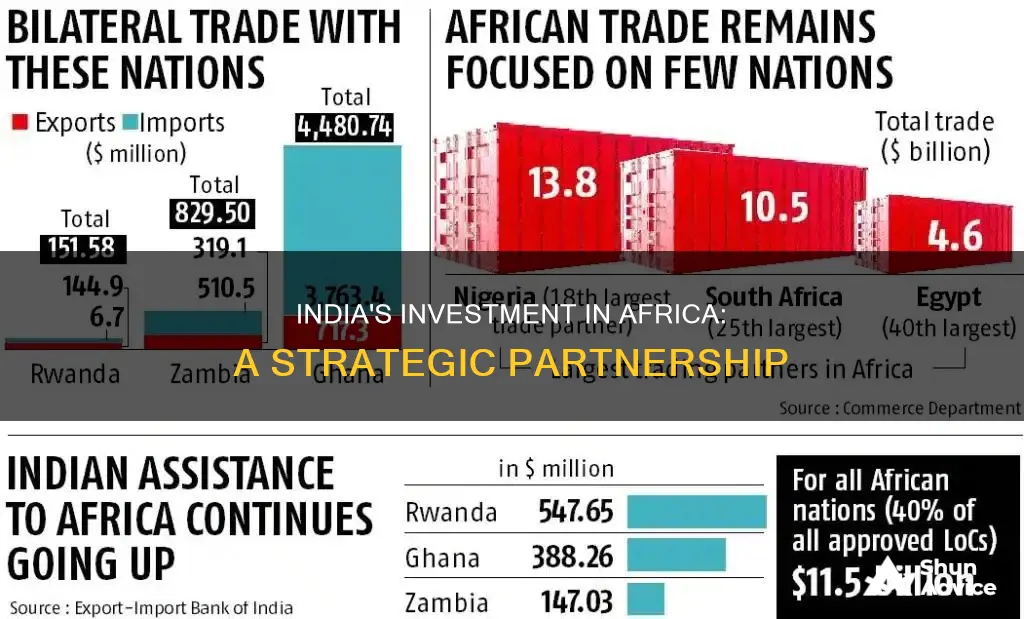

The Indian government has launched several strategic initiatives to boost trade and investment with Africa, including "Focus Africa" in 2002, the India-Africa Forum Summit in 2008, and the Asia-Africa Growth Corridor in 2017, an economic cooperation agreement between India, Japan, and multiple African countries. These efforts have yielded significant results, with trade between Africa and India increasing more than eightfold from $7.2 billion in 2001 to $62.6 billion in 2017-2018. India now accounts for more than 6.4% of total African trade, making it the third-largest national trading partner of Africa.

India's investment in Africa is not just about economic gains but also about sustainable development and mutual benefit. For example, India has taken the lead in helping Africa overcome its digital divide by launching the 2nd phase of the Pan Africa e-Network project, e-VidhyaBharati, and e-ArogyaBharati Network Project (E-VBAB). This project aims to provide free tele-education and medical education to African countries, benefiting students, doctors, nurses, and paramedics. Additionally, Africa already receives nearly 20% of Indian pharmaceuticals, and India hosted the first India-Africa Health Sciences Meet in 2015. Many Indian pharmaceutical companies have established units in various parts of Africa, including Ethiopia, Uganda, DRC, Zambia, and Ghana.

India's engagement with Africa is based on a model of cooperation that is responsive, demand-driven, and free of conditions. The country has also established itself as a trusted partner during the COVID-19 pandemic by supplying essential medicines to African nations. India's investment in Africa is expected to increase further with the African Continental Free Trade Area (AfCFTA), which merges 54 African countries into a single market. Indian investors can benefit from this unified market by creating supply chains between India and Africa. Additionally, investors in the 33 Least Developed Countries (LDCs) in Africa can export to India at zero duty under India's unilateral tariff preference schemes.

India's investment in Africa is not without its challenges and criticisms. There have been concerns about India's slow delivery on development partnership commitments and the displacement of the local population by some Indian agribusiness firms. However, India has made positive strides in completing various big-ticket projects in recent years, including the construction of presidential offices, national assembly buildings, power plants, factories, water treatment projects, and IT parks across several African countries.

Savings and Investments: Economy's Growth Engine

You may want to see also

India's proximity, shared language, and cultural popularity give it advantages over China in Africa

India's proximity to Africa, shared language, and cultural popularity give it several advantages over China when it comes to investing in the continent. Firstly, India's geographical proximity to Africa, connected by the Indian Ocean, has facilitated historical economic and societal ties with countries in the eastern and southern parts of the continent. This proximity has also led to stronger historical roots and fraternal relationships with African countries compared to China.

Moreover, India shares a common language with many African countries, which can act as a bridge for communication and collaboration. English is widely spoken in both India and Africa, and Indian languages like Hindi and Gujarati are also spoken in some African communities due to historical trade and societal connections. This shared language creates a sense of familiarity and ease of communication, fostering stronger relationships and understanding between Indian and African partners.

In addition to proximity and shared language, Indian culture, including Bollywood, has gained immense popularity in Africa. This cultural soft power enhances India's appeal and influence in Africa, creating a favourable perception of Indian engagement. Indian culture's reach and resonance in Africa provide a unique advantage that China does not possess to the same extent.

Furthermore, India's democratic values and appeal also set it apart from China in the eyes of many Africans. India's democratic system and its commitment to developing together as equals with African countries resonate with the values of freedom and self-determination that many African nations hold dear. This shared belief in democracy and mutual respect strengthens the foundation of India-Africa relations.

In summary, India's proximity to Africa, shared language, cultural popularity, and democratic values give it a competitive edge over China when it comes to investing in and engaging with the continent. These advantages have contributed to India's growing influence and impact in Africa, fostering a partnership based on mutual respect and shared aspirations.

Investing in a Portfolio: Pros and Cons

You may want to see also

India's investment in Africa is not without criticism, particularly regarding project delivery and land-grabbing

India's involvement in Africa has been criticised for its poor track record when it comes to project delivery and implementation. Compared to China, India is viewed as slow in delivering on its development partnership commitments. This criticism is not without merit, as India has indeed been slow in delivering on its promises. However, in recent years, India has stepped up its game and completed various big-ticket projects in due time. These include the construction of the Presidential Office in Ghana, the National Assembly building in Gambia, the Kosti Power plant in Sudan, and the Rift Valley Textiles factory in Kenya, among others.

Another concern regarding India's investment in Africa is the issue of land-grabbing and the displacement of the local population. Indian companies have been accused of acquiring land in Africa at throwaway prices, causing environmental damage, and exporting food while locals continue to starve. This practice, known as "land-grabbing," has been compared to neo-colonialism, as Indian companies take over agricultural land and export produced food at the cost of locals. For example, in Ethiopia, Indian companies have acquired more than 600,000 hectares of land for agro-industrial projects, often at the expense of indigenous communities who have been displaced and marginalised. Similar issues have been reported in other African countries, such as Kenya, Madagascar, Senegal, and Mozambique.

The Indian government has been accused of facilitating this process by providing concessional lines of credit to developing country governments and financial institutions, as well as by implementing economic incentives such as duty-free tariff preference schemes to encourage private companies to invest in land abroad. In defence of their actions, Indian companies reject the characterisation as neo-colonialists and insist they are just doing business. They claim that land acquisitions are simply strategies for expansion and vertical integration.

In conclusion, while India's investment in Africa has had some positive impacts, there are also legitimate criticisms regarding project delivery and land-grabbing. These issues need to be addressed to ensure that India's partnership with Africa is mutually beneficial and does not lead to further marginalisation and exploitation of local communities.

Managing External Municipal Investment Managers: Strategies for Success

You may want to see also

Frequently asked questions

India has a long history of standing in solidarity with its African partners, and the two regions share deep cultural, social, economic, and political ties. India has also always been keen to help Africa overcome its challenges, such as the digital handicap, and has launched initiatives like the Pan Africa e-Network project.

India is investing in a range of sectors in Africa, including oil and gas, mining, banking, pharma, and textiles.

India's investment in Africa has grown significantly over the years. Trade between the two regions increased more than eight-fold from $7.2 billion in 2001 to $62.6 billion in 2017-18. India is now the third-largest national trading partner of Africa, accounting for greater than 6.4% of total African trade in 2017.

Africa is a continent of growth and opportunities, with a young and fast-growing population and considerable natural resources and human capital. Africa is poised to be a significant growth factor in the global economy, and India, being in close proximity, can benefit from this growth.

China is a much bigger player in FDI in Africa compared to India. However, India is not an insignificant player either and has several advantages over China, including proximity, a common language, and the popularity of Indian culture.