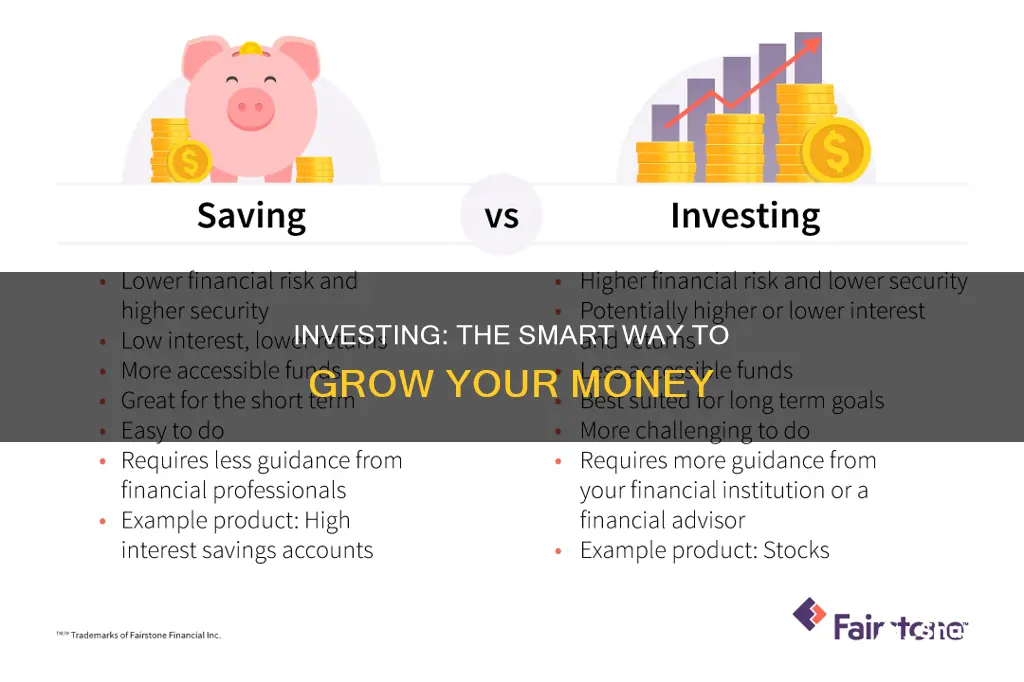

Saving and investing are both important concepts for building a sound financial foundation, but they are not the same thing. While both can help you achieve a more comfortable financial future, it's crucial to understand the differences and know when to save and when to invest. Saving is generally considered lower risk, while investing can come with greater risks and potential rewards. In this article, we will explore why investing is a more powerful tool for building long-term wealth than simply saving.

| Characteristics | Values |

|---|---|

| Risk | Saving is generally considered lower risk, whereas investing can come with greater risks and potential rewards. |

| Returns | Saving has lower and more predictable returns, whereas investing has the potential for higher returns. |

| Time horizon | Saving is better for short-term goals, whereas investing is better for long-term goals. |

| Liquidity | Savings are more liquid, whereas investments may have penalties or taxes for early withdrawal. |

| Inflation | Savings may lose purchasing power over time due to inflation, whereas investing can help counteract inflation. |

| Taxes | Savings in a bank account are protected by FDIC insurance, whereas contributions to investment accounts often have tax benefits. |

What You'll Learn

- Investing can help you achieve long-term financial goals, such as saving for a house, retirement, or your children's education

- Investing can help you build wealth over time and achieve financial independence

- Investing can provide higher returns than savings accounts, with the potential to grow your wealth significantly

- Investing allows you to take advantage of compound interest, which can lead to exponential growth of your investments over time

- Investing provides an opportunity to save on taxation through various tax deductions, write-offs, and lower tax rates on long-term gains

Investing can help you achieve long-term financial goals, such as saving for a house, retirement, or your children's education

Investing is a powerful tool for achieving long-term financial goals, such as saving for a house, retirement, or your children's education. While saving is crucial for financial security and short-term goals, investing offers the potential for higher returns and wealth accumulation. Here's how investing can help you achieve your long-term aspirations:

Compounding Returns:

Compounding, often referred to as the "eighth wonder of the world," is a key advantage of investing. It involves earning profits on the profits generated by your initial investments. Over time, this compounding effect can turn modest sums into substantial amounts. For example, an investment of $10,000 at a 7% annual return will grow to nearly $20,000 in 10 years, $40,000 in 20 years, and a significant $76,000 in 30 years. This exponential growth highlights the power of investing for the long term.

Beating Inflation:

Saving accounts often offer interest rates that barely keep up with inflation, which erodes the purchasing power of your money over time. In contrast, investing in stocks, bonds, or mutual funds offers the potential to outperform inflation and increase your purchasing power. Historically, the stock market has returned around 7%–10% annually after accounting for inflation. This allows your money to grow faster than the rising prices of goods and services.

Long-Term Growth:

Investing is particularly effective for long-term goals due to its ability to generate higher returns over extended periods. The longer you invest, the more time your money has to grow and the better your chances of riding out short-term market fluctuations. This makes investing ideal for goals like retirement, where consistent contributions over decades can result in a substantial nest egg.

Diversification:

A well-diversified investment portfolio can help manage risk and improve long-term returns. By spreading your investments across different asset classes, industries, and geographies, you reduce the impact of any single investment performing poorly. Diversification ensures that if one investment underperforms, others may perform well, balancing out your overall returns.

Tax Benefits:

Certain investment vehicles, such as 401(k) retirement plans, offer tax advantages that enhance your long-term wealth accumulation. Contributions to a 401(k) are typically tax-deductible, lowering your taxable income. Additionally, the investments in your 401(k) grow tax-deferred, allowing your money to compound without the drag of taxes. You only pay taxes when you withdraw the funds during retirement.

Achieving Financial Goals:

Investing is a powerful tool for achieving long-term financial milestones. Whether it's saving for a down payment on a house, funding your children's education, or building a comfortable retirement nest egg, investing offers the potential for higher returns than saving alone. By consistently investing over time and taking a long-term perspective, you can work towards achieving these significant financial goals.

In conclusion, investing is a more powerful tool than saving when it comes to achieving long-term financial goals. It offers the potential for higher returns, compounding growth, and the ability to beat inflation. However, it's important to remember that investing also carries more risk than saving. A balanced approach that includes both saving and investing is ideal, ensuring financial security and the potential for wealth accumulation to achieve your long-term aspirations.

Investment Opportunities in Pakistan: Where to Invest Your Savings

You may want to see also

Investing can help you build wealth over time and achieve financial independence

Investing is a powerful tool for building wealth over time and achieving financial independence. Here's how:

Tackling Inflation

Saving is important for financial security and short-term goals, but it often doesn't keep up with inflation. Inflation erodes the purchasing power of your money over time. Most savings accounts offer interest rates that barely keep up with inflation, and even high-interest savings accounts may not always outpace it. As a result, your savings might show a higher balance, but the amount you can buy with that money may not increase proportionately and could even decrease.

Growing Your Wealth

Investing, on the other hand, offers the potential to grow your wealth significantly over time. When you invest, your money works for you. The average annual return of the stock market over the past century has been around 7-10% each year, outpacing inflation. This means that your investments can grow at a much faster rate than they would in a savings account, leading to substantial gains over the long term.

Compound Interest

Another advantage of investing is the power of compound interest. Compound interest is when you earn profits on the profits of your initial investments, creating an exponential growth effect. For example, if you invest $10,000 at a 7% annual return, it will grow to nearly $20,000 in 10 years, $40,000 in 20 years, and over $76,000 in 30 years. This exponential growth is a key reason why investing can significantly outperform saving in the long run.

Long-Term Financial Goals

Investing is particularly well-suited for long-term financial goals, such as retirement planning, saving for college, or building generational wealth. The longer you can invest, the more risk you can take, as you have more time to ride out market volatility. Additionally, investing in a diversified portfolio of stocks, bonds, and other assets can further reduce risk and improve your chances of achieving your financial goals.

Tax Benefits

Investing also provides tax benefits that can enhance your returns. Contributions to investment accounts often come with tax advantages, and gains on investments held for a certain period may be taxed at a lower rate. Active investors can also take advantage of various tax deductions and write-offs to further maximize their returns.

In conclusion, investing is a powerful tool for building wealth over time and achieving financial independence. By understanding the benefits of investing and making strategic decisions, individuals can take control of their finances and work towards a more secure and prosperous future.

Savings and Investment Spending: Friends or Foes?

You may want to see also

Investing can provide higher returns than savings accounts, with the potential to grow your wealth significantly

While saving is a crucial part of financial planning, investing can be a powerful tool to achieve higher returns and grow your wealth significantly. Here's why investing can provide higher returns than savings accounts:

Higher Returns Potential

Investing offers the potential for higher returns compared to traditional savings accounts. The stock market, for example, has historically generated returns of around 7%–10% annually over the past century, even after accounting for inflation. In contrast, savings accounts often offer interest rates that barely keep up with inflation, resulting in a lower purchasing power over time.

Compound Interest

Compound interest is a powerful force in investing. It allows your investments to grow exponentially by earning profits on the profits of your initial investments. For example, an investment of $10,000 at a 7% annual return will grow to nearly $20,000 in 10 years, $40,000 in 20 years, and over $76,000 in 30 years. This exponential growth is a key advantage of investing over saving.

Long-Term Wealth Accumulation

Investing is particularly effective for long-term financial goals, such as retirement planning or saving for college. The longer you invest, the more time your money has to grow and recover from any short-term downturns. Additionally, investing allows you to take advantage of compound interest, which accumulates over time.

Beating Inflation

Saving alone may not be sufficient to tackle inflation, as it causes money to lose its purchasing power. Investing, on the other hand, can help counteract inflation by providing returns that exceed the inflation rate. By investing in the stock market, real estate, or other assets, you can maintain and grow the value of your money over time.

Tax Benefits

Investing also offers tax advantages that can enhance your overall returns. Contributions to investment accounts often come with tax benefits, and gains on investments held for a certain period may be taxed at a lower rate. Active investors can also take advantage of various tax deductions, write-offs, and estate planning strategies to further reduce their tax liability.

Social Security Investment Strategies: Maximizing Your Savings

You may want to see also

Investing allows you to take advantage of compound interest, which can lead to exponential growth of your investments over time

Investing allows you to take advantage of compound interest, which can lead to exponential growth in your investments over time. Compound interest is a powerful tool for building wealth, and it involves earning profits not just on your initial investment, but also on the interest accrued over time. This creates a snowball effect, resulting in significant growth of your investments.

For example, if you invest $10,000 at a 7% annual return, your investment will grow to nearly $20,000 in 10 years, $40,000 in 20 years, and over $76,000 in 30 years. This exponential growth highlights the power of compound interest and how it can significantly increase your wealth over time.

By investing, you can harness the power of compound interest to achieve long-term financial goals, such as saving for retirement, a child's education, or building generational wealth. It's important to remember that investing comes with risks, and there is always the possibility of losing money. However, by diversifying your portfolio and investing for the long term, you can potentially mitigate these risks and maximize your returns.

Additionally, investing allows you to take advantage of tax benefits associated with investment accounts, such as tax deductions, lower tax rates on long-term gains, and tax breaks upon death with a proper estate plan. These tax advantages further enhance the power of investing compared to simply saving.

While saving is important for short-term financial goals and building an emergency fund, investing is a more powerful tool for long-term wealth creation. By investing, you can harness the power of compound interest and potentially achieve exponential growth in your investments over time.

Savings to Investment: The Role of Financial Institutions

You may want to see also

Investing provides an opportunity to save on taxation through various tax deductions, write-offs, and lower tax rates on long-term gains

Investing is a powerful tool for financial management. While saving is crucial for building a financial safety net and achieving short-term goals, investing offers the potential for significant wealth growth over time. One advantage of investing is the opportunity to save on taxes through various strategies and account types.

One way to save on taxes is by investing in tax-efficient vehicles, such as index funds, exchange-traded funds (ETFs), and certain mutual funds. These investments have built-in tax efficiencies, helping to minimise the tax drag on returns. ETFs, for instance, can avoid triggering some capital gains taxes due to the way their transactions settle.

Another strategy is to utilise tax-advantaged accounts, such as traditional Individual Retirement Accounts (IRAs) and 401(k) plans. These accounts provide upfront tax breaks, allowing investors to defer taxes until they withdraw their money in retirement. Alternatively, Roth IRAs and Roth 401(k)s are tax-exempt, allowing tax-free growth and withdrawals in retirement, though contributions are made with after-tax dollars.

Additionally, investors can take advantage of lower long-term capital gains tax rates. By holding investments for more than a year, individuals can benefit from reduced tax rates of 0%, 15%, or 20%, depending on their income and tax bracket. This strategy also helps investors avoid short-term capital gains taxes, which are typically taxed at a higher, ordinary income rate.

Furthermore, investors can use tax-loss harvesting to offset taxable capital gains. If realised investment losses exceed gains in a given year, individuals can claim up to $3,000 in net losses to reduce their taxable income. Any additional losses can be carried forward to future tax years.

Lastly, investors can consider opening a health savings account (HSA), which allows them to set aside money on a pre-tax basis for qualified medical expenses. Unused funds can remain in the account for future tax-free medical withdrawals, providing another opportunity for tax savings.

By employing these strategies and utilising the right types of accounts, investors can effectively reduce their tax burden and maximise their after-tax returns.

Invest Your Savings Wisely: A Guide for Nigerians

You may want to see also

Frequently asked questions

Investing has the potential to grow your wealth significantly over time. When you invest, your money works for you, earning higher returns than a savings account.

Saving is an excellent way to meet short-term financial goals and prepare for unexpected situations. Savings are generally low-risk, meaning your money is safe, but the interest rates received are also low.

Investing offers the potential for higher returns and can help achieve long-term financial goals. It also provides an opportunity to save on taxation through various deductions and lower tax rates.

The choice between saving and investing depends on your financial goals and risk tolerance. Saving is generally recommended for short-term goals and emergencies, while investing is better suited for long-term goals, such as retirement.