Paying a 1% annual fee to a financial advisor is a pretty standard rate, but it's not necessarily the right amount for every investor. This type of fee usually covers investment management, portfolio monitoring, and performance reporting services. While a 1% annual fee may seem like a small price to pay for professional investment guidance and financial planning, it can significantly eat into your portfolio returns over long periods.

Financial advisors can offer valuable insight to help you reach your financial goals. They can help you manage your money and guide your financial decision-making, creating a financial plan designed for your unique goals. For example, they can help you save for retirement or build a college savings fund for your children.

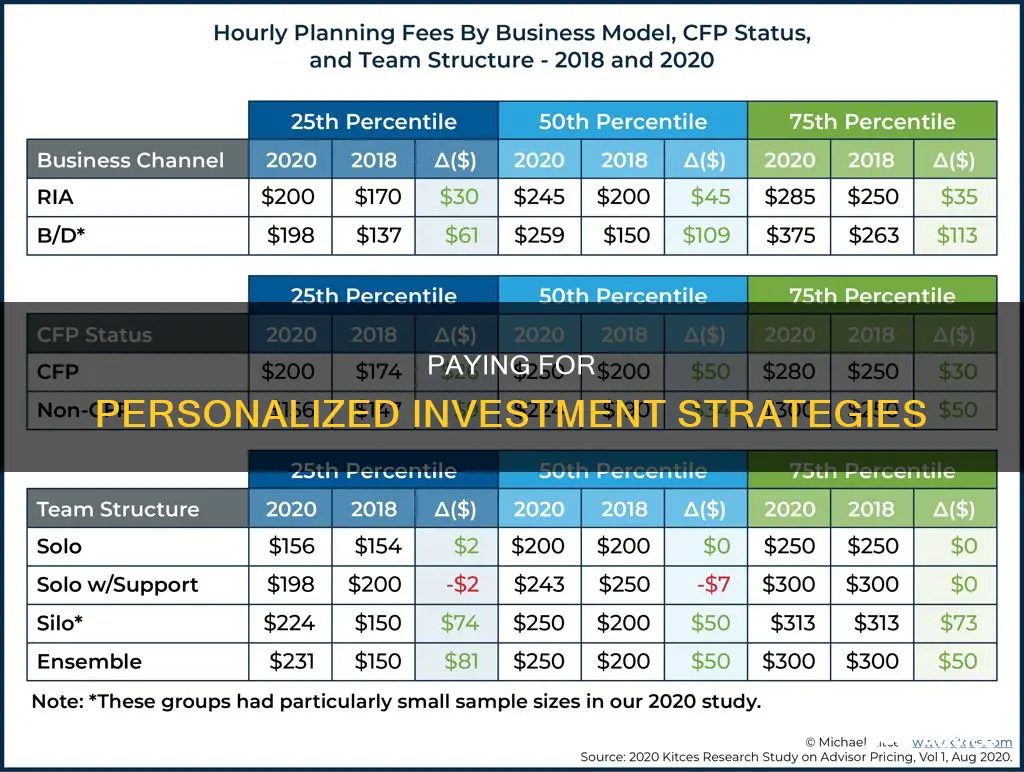

However, it's important to consider the value they bring to your financial journey and whether their fees are justified. Some financial advisors may be open to negotiating fees, and there are alternative fee models to consider, such as hourly rates, flat fees, or hybrid structures. Ultimately, the decision to pay a 1% fee to a financial advisor depends on your unique situation and goals.

| Characteristics | Values |

|---|---|

| Typical fee | 1% of assets under management |

| Alternative fee models | Flat fee, hourly rate, hybrid fee structure |

| Benefits of financial advisors | Budgeting, debt management, insurance optimisation, tax planning, retirement planning, estate planning, investment management |

| When to opt for the 1% fee | Lack of time and expertise, complex financial affairs, approaching retirement, need for market-specific assistance |

What You'll Learn

- A flat fee may be more financially sensible for those with over $1 million in assets

- Percentage fees are more suitable for smaller balances

- Financial advisors can offer a broad range of services, including tax planning and estate planning

- Robo-advisors are a cost-saving alternative to human financial advisors

- A fee-based advisor is incentivised to grow their client's assets

A flat fee may be more financially sensible for those with over $1 million in assets

A flat fee charged by a financial advisor often makes more financial sense for those with over $1 million in assets. This is because the flat fee is usually charged at a set amount for each household, such as under $10,000 or around $7,500 per year, which can be paid monthly or quarterly. This means that the effective percentage of the total assets decreases as the total assets increase. For example, a flat fee of $7,500 on a $2.5 million portfolio would equate to a fee of 0.3%, which is significantly lower than the industry standard of 1%.

On the other hand, if a 1% fee is charged on a $2.5 million portfolio, the fee would amount to around $25,000 per year. This is a substantial sum and represents a significant portion of the investment returns. By opting for a flat fee instead, clients with a high net worth can avoid paying increasingly high fees simply because their investments have increased in value.

Additionally, a flat fee can provide more equitable pricing for clients with large portfolios. For instance, with a flat fee, a client with $4 million in assets would not be paying twice as much as a client with $2 million, even though they are receiving similar services.

It is worth noting that the 1% fee structure is typically applied to the Assets Under Management (AUM) and is common in the financial advisory industry. This fee usually covers investment management, portfolio monitoring, and performance reporting services. However, for financial planning and other services, hourly or fixed fees are more common, although percentage-based fees can still apply.

Ultimately, the decision to opt for a flat fee or a percentage-based fee depends on various factors, including the client's unique situation, goals, and financial complexity.

Startups: Invest or Avoid?

You may want to see also

Percentage fees are more suitable for smaller balances

When it comes to financial advisors, there are a variety of ways in which they can be compensated for their services. Some charge a flat fee, while others use a combination of commissions and fees, or even an annual retainer fee. However, a common method is to charge a percentage of the client's assets under management (AUM). While 1% of AUM is a standard fee, it is more suitable for smaller balances. Here's why:

For clients with larger asset balances, a flat fee structure is often more financially sensible. For example, consider a client with $3 million to invest. A typical financial advisor fee of 0.8% to 1% would result in annual costs of $25,000 to $30,000. In contrast, a flat fee for the same client could be less than $10,000 per year, resulting in significant savings.

The $1 million threshold is often used as a guideline to determine whether a percentage or flat fee is more appropriate. Below this threshold, the flat fee may consume a substantial percentage of the client's account, making it an unwise choice. On the other hand, for clients with over $1 million in investable assets, a flat fee may be more economical.

Additionally, percentage fees are more equitable for clients with varying asset levels. For instance, a client with $4 million in assets pays twice as much as a client with $2 million when using a flat fee structure, despite receiving a similar service. With a percentage-based fee, the amount paid is directly proportional to the size of the client's portfolio.

Furthermore, percentage fees provide flexibility during market corrections or fluctuations. If a client's portfolio value drops by 20%, the value provided by the financial advisor hasn't necessarily decreased by the same amount. Percentage-based pricing remains affordable for both advisors and clients within a certain portfolio range, typically between $250,000 and $1 million.

While 1% of AUM is a standard fee for financial advisors, it is more suitable and affordable for clients with smaller balances. For larger asset balances, a flat fee structure becomes more financially advantageous, providing cost savings and equitable pricing relative to the services provided.

Paying Down Debt vs. Investing: Where Should Your Money Go?

You may want to see also

Financial advisors can offer a broad range of services, including tax planning and estate planning

Financial advisors can offer a wide range of services, including tax planning and estate planning.

Tax Planning

Tax planning is a big part of a financial advisor's role. They can help clients reduce their overall tax bill and make the most of available tax deductions and credits. This includes preparing tax returns, suggesting tax-minimization moves, and making the most of deductions. For example, a tax plan may suggest selling money-losing investments before the end of the year to create a deduction that will shelter profits from more successful investments.

Estate Planning

Financial advisors can also assist with estate planning, helping their clients to transfer wealth and plan for retirement. This includes deciding between investing in a tax-deferred traditional IRA or a taxed Roth IRA, and estate taxes and the use of trusts.

Other Services

Financial advisors can also help with:

- Budgeting

- Saving

- Retirement planning

- Investment management

- Insurance

- Saving for college

- Portfolio management

- Managing debt

- Small business financial plans

- Divorce financial planning

- Life transition planning

- Pre- and post-divorce budgeting

- Spousal maintenance payments

- Inheritance and beneficiaries

- Defined contribution plans

- Retirement income planning

- Stock option planning

- Financial health assessment

Best Asian Investment Spots for Your $100K

You may want to see also

Robo-advisors are a cost-saving alternative to human financial advisors

Robo-advisors are often inexpensive and require low opening balances, making them accessible to retail investors. They tend to charge a management fee of about 0.25% of your assets annually, or $25 for every $10,000 invested. This is significantly lower than the typical 1% charged by human financial advisors.

Robo-advisors offer several benefits over human advisors:

- They are relatively cheap and efficient, saving you time and money.

- They provide easy and quick account setup, often with no minimum balance requirements.

- They automate tedious and mundane tasks such as daily tax-loss harvesting, which involves buying and selling securities to secure tax breaks.

- They are always accessible online, allowing you to log in and check your investments 24/7.

However, robo-advisors also have limitations:

- They lack human interaction and empathy, which may be important for clients seeking personalised advice.

- They may not be suitable for complex financial issues such as estate planning, complicated tax management, or retirement planning.

- They operate based on the assumption that clients have defined financial goals and a clear understanding of their financial circumstances, which may not always be the case.

Ultimately, the decision between a robo-advisor and a human financial advisor depends on your individual needs and preferences. If you require specialised advice or a high level of personalisation, a human advisor may be more suitable. However, if you are comfortable with a more hands-off approach and are primarily seeking cost-effective investment management, a robo-advisor could be a great choice.

Should I Liquidate My Investments to Pay Off Debt?

You may want to see also

A fee-based advisor is incentivised to grow their client's assets

A fee-based advisor is incentivised to grow their clients' assets in several ways. Firstly, by charging a flat fee or hourly rate, fee-based advisors are compensated for their time and expertise, which can include creating comprehensive financial plans, providing investment advice, and managing their clients' portfolios. This structure ensures that the advisor's interests are aligned with those of their clients, as the advisor's income is directly tied to the success and growth of the client's assets.

Additionally, fee-based advisors have more opportunities to grow their business and attract new clients. By transitioning from a transactional, commission-based model to a fee-based one, advisors free up their time, allowing them to pursue bigger and better growth opportunities. Instead of constantly searching for new prospects and sales to earn commissions, they can invest their time in expanding their business, networking, and providing more services to their existing clients. This, in turn, can lead to stronger client relationships, increased assets under management, and higher revenues.

Fee-based advisors also have the advantage of a more stable and predictable revenue stream. With a consistent fee structure, they are not solely dependent on the number of transactions or sales they make, reducing the pressure to engage in excessive trading or selling products that may not be in the client's best interests. This stability can make it easier for fee-based advisors to hire additional staff and invest in their business's growth.

Furthermore, fee-based advisors often have more time to focus on their clients' financial goals and provide personalised advice. This personalised approach can lead to better investment decisions, helping their clients' assets grow over time.

Overall, the fee-based model incentivises advisors to provide valuable services that contribute to the growth of their clients' assets, while also creating a sustainable and profitable business for themselves.

Investments: Votes and Voice

You may want to see also

Frequently asked questions

Financial advisors can provide valuable insight and guidance on your overall financial plan, including investment strategies, and help you reach your financial goals.

Financial advisors typically charge a percentage of the client's total assets under management (AUM) as an annual fee. This can range from 0.59% to 1.18% per year, with an average of 1.02% for $1 million in AUM. They may also charge hourly or flat fees, or a combination of fees and commissions.

The value of paying a 1% fee depends on various factors, such as the specific services provided, the performance of your investments, and your financial goals and situation. While some people may find it beneficial, others may prefer alternative options like robo-advisors or managing their investments independently.

To reduce costs, consider using a fee-based advisor, negotiating a lower fee, or opting for a newcomer to the field, who may charge less. Additionally, certain advisors provide lower fees for larger asset balances.

Alternatives to hiring a traditional financial advisor include using robo-advisors, which are algorithm-based, or managing your investments independently. Robo-advisors typically charge lower fees, but they offer a more hands-off approach. Managing your own investments can save on fees, but it requires financial knowledge and experience.