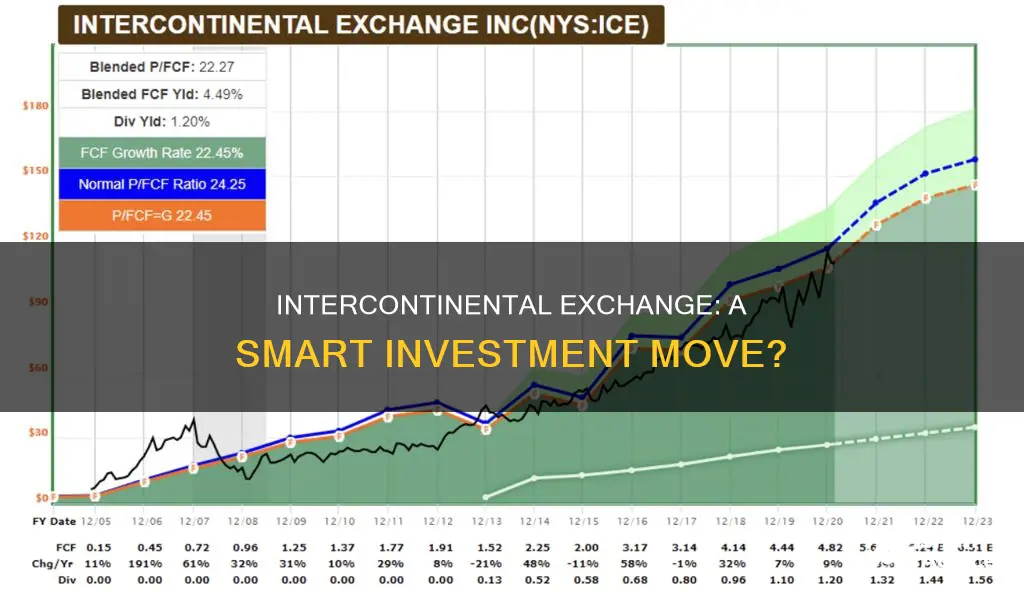

Intercontinental Exchange (ICE) is an American multinational financial services company that operates global financial exchanges and clearing houses, and provides mortgage technology, data, and listing services. The company has a market capitalisation of $77.209 billion and its stock price has risen by 35.56% over the last 52 weeks. Intercontinental Exchange has a diverse range of products and services, including exchange-traded futures and options, crude oil and refined products, and over-the-counter instruments. The company has a strong track record of growth and expansion through acquisitions, and its subsidiaries include ICE Futures Europe, ICE Futures Singapore, and ICE Clear Netherlands, among others. Intercontinental Exchange's largest commodity futures product is the ICE Brent crude futures contract. The company's revenue is generated through its exchanges business (56%), mortgage technology business (15%), and fixed-income and data services segment (29%). Intercontinental Exchange has a presence in major financial centres around the world, including Atlanta, New York, London, and Singapore. With its diverse business segments, global reach, and strong financial performance, Intercontinental Exchange could be a promising investment opportunity. However, it is important to conduct thorough research and consult with a financial advisor before making any investment decisions.

| Characteristics | Values |

|---|---|

| Industry | Investment banking & investment services |

| Headquarters | Atlanta, Georgia |

| Stock Symbol | ICE |

| Stock Exchange | NYSE |

| Market Capitalization | $77.209 billion |

| Net Revenue | Exchanges business: 56% |

| Mortgage technology business: 15% | |

| Fixed-income and data services segment: 29% | |

| Subsidiaries | ICE Futures Europe, ICE Futures Singapore, ICE Swap Trade & Creditex, ICE Clear Netherlands |

| Offices | Atlanta, New York, London, Chicago, Bedford, Houston, Winnipeg, Amsterdam, Calgary, Washington, D.C., San Francisco, Pleasanton, Tel Aviv, Rome, Hyderabad, Singapore, Melbourne |

What You'll Learn

Intercontinental Exchange's (ICE) market infrastructure and technology solutions

Intercontinental Exchange, Inc. (ICE) is an American multinational financial services company that owns and operates global financial exchanges and clearing houses. It provides market infrastructure and technology solutions in the form of data and listing services.

ICE was founded in 2000 by Jeffrey Sprecher, a power plant developer who recognised the need for a seamless market in natural gas for fuelling power stations. The company was backed by major financial institutions such as Goldman Sachs, Morgan Stanley, BP, and Deutsche Bank.

ICE operates 12 regulated exchanges and marketplaces, including:

- ICE futures exchanges in the United States, Canada, and Europe

- Liffe futures exchanges in Europe

- The New York Stock Exchange

- Equity options exchanges

- OTC energy, credit, and equity markets

In addition, ICE owns and operates six central clearing houses: ICE Clear U.S., ICE Clear Europe, ICE Clear Singapore, ICE Clear Credit, ICE Clear Netherlands, and ICE NGX.

ICE has a strong focus on digitisation and was the first to digitise exchanges. This has led to increased price transparency, efficiency, liquidity, and reduced costs compared to manual trading. Their data services provide extensive, high-quality data and end-to-end solutions to drive decision-making.

ICE's technology solutions include automating the entire mortgage process to reduce costs and increase efficiency. The company has also introduced a global hardware procurement and managed services solution.

ICE's market infrastructure and technology solutions are designed to streamline systems, increase efficiency, and provide valuable insights to its customers, which include global financial institutions, asset managers, and individual investors.

Funding Your Invention: How Investors Can Help

You may want to see also

ICE's derivatives exchanges

Intercontinental Exchange, Inc. (NYSE: ICE) is an American company that owns and operates financial and commodity marketplaces and exchanges. It was founded in 2000 and became a publicly traded company in 2005. ICE has a market capitalisation of $77.209 billion as of March 2024 and its shares gained 35.56% of their value in the previous 52 weeks.

ICE offers a diverse suite of equity futures and options contracts, including single stock futures and options. For example, ICE offers over 90 MSCI index futures covering a wide range of global, regional, country-specific, sector and factor indices. ICE also offers highly liquid, cost-effective and margin-efficient tools for managing UK equity risk, such as the FTSE 100 Index Total Return Future.

Toxic People: Invest Time Wisely

You may want to see also

ICE's mortgage technology business

Intercontinental Exchange Inc (ICE) is an American multinational financial services company that was founded in 2000. ICE operates global financial exchanges and clearing houses and provides mortgage technology, data and listing services.

ICE's mortgage technology platform offers a range of features, including:

- A device-agnostic, comprehensive, and highly configurable multiple listing service (MLS) platform.

- Web-based access to property reports, automated valuations, and a comprehensive property record database.

- Cost-effective lead generation solutions to help mortgage and real estate companies grow their businesses.

- A customer relationship management (CRM) and mortgage marketing engine that helps mortgage professionals win new business and drive repeat business.

- An online mortgage application process that allows borrowers to engage with loan officers and securely upload and eSign documents.

- A pricing engine that improves the loan officer experience and allows lenders to access rate sheets and stay on top of changes affecting loan scenarios.

Kyrgyzstan: The Next Construction Hub?

You may want to see also

ICE's market capitalisation

Intercontinental Exchange Inc (ICE) is a leading global operator of regulated exchanges, clearing houses, and listing venues. It also provides data services for commodity, financial, fixed-income, and equity markets.

ICE has a diverse range of subsidiaries and has expanded its business through a series of acquisitions. It has a presence in various markets, including energy, soft commodities, foreign exchange, equity index futures, and mortgage technology. The company's largest commodity futures product is the ICE Brent crude futures contract.

Why Invest in Entertainment?

You may want to see also

ICE's stock price

Intercontinental Exchange Inc. (ICE) is an American multinational financial services company that was formed in 2000. It operates global financial exchanges and clearing houses and provides mortgage technology, data and listing services. ICE is listed on the NYSE and its stock price as of May 31, 2024, was 133.24.

ICE has a strong financial performance and has been named to the Fortune 500 and the Fortune Future 50. It has a history of successful acquisitions and has expanded its business into new markets, such as derivatives, mortgage technology, and fixed-income and data services. Its largest commodity futures product is the ICE Brent crude futures contract.

ICE's business model is strong, and it has a diverse range of products and services. The company has a global presence and serves a wide range of customers, including financial institutions, corporations, and government entities. It is also a leading provider of technology and data, with its ICE Data Services offering a combination of exchange data, valuations, analytics, and software.

In conclusion, ICE has a strong financial position, a history of successful acquisitions, and a diverse range of products and services. Its stock price has been performing well and it has a positive outlook from analysts. Therefore, investing in Intercontinental Exchange right now could be a good decision, but it is important to conduct comprehensive analysis and assess the potential risks before making any investment decisions.

Investing in People: Debt as an Asset

You may want to see also

Frequently asked questions

Intercontinental Exchange has a strong history of growth through acquisition, with its most recent acquisitions including Ellie Mae in 2020 and Black Knight in 2022. The company was also the first to digitize exchanges and continues to be a leader in price discovery, capital raising, and indexing. Intercontinental Exchange has a market capitalization of $77.209 billion as of March 2024 and its shares gained 35.56% of their value over the last 52 weeks.

Intercontinental Exchange (ICE) is an American multinational financial services company that owns and operates financial and commodity marketplaces and exchanges. The company was founded in 2000 and has been publicly traded since 2005.

Intercontinental Exchange operates regulated marketplaces for listing, trading, and clearing a range of derivatives contracts and financial securities. The company also offers data services and technology solutions for financial institutions, corporations, and government entities.

Intercontinental Exchange is headquartered in Atlanta, Georgia.

Intercontinental Exchange stock (NYSE:ICE) closed at $134.40 per share on March 18, 2024. The one-month return was -0.92%, and its shares gained 35.56% of their value over the last 52 weeks.