Value investing, a strategy that focuses on identifying and purchasing undervalued assets, has long been a cornerstone of successful investing. While the concept is straightforward, the underlying reasons for its success are often complex and multifaceted. This paragraph aims to delve into the statistical evidence that supports the effectiveness of value investing. It will explore how fundamental analysis, historical performance, and market inefficiencies contribute to the consistent outperformance of value-oriented portfolios. By examining key metrics and trends, we can gain a deeper understanding of why value investing remains a powerful tool for investors seeking long-term wealth creation.

What You'll Learn

- Historical Performance: Value stocks consistently outperform over long periods, backed by data

- Margin of Safety: Buying at a discount reduces risk, as evidenced by historical data

- Undervalued Assets: Value investing targets companies with low market value, supported by statistics

- Long-Term Growth: Value stocks often show steady growth, backed by market trends

- Risk-Adjusted Returns: Value strategies offer higher returns relative to risk, per historical data

Historical Performance: Value stocks consistently outperform over long periods, backed by data

Value investing, a strategy that emphasizes buying stocks of companies that are undervalued by the market, has a strong track record of outperformance over extended periods. This is not merely a theoretical concept but is well-supported by historical data and statistical analysis. Numerous studies have consistently shown that value stocks, on average, deliver superior returns compared to growth stocks over the long term.

The concept of value investing is rooted in the idea that market prices often overreact to short-term news and events, creating temporary opportunities for investors. Value investors seek to identify these undervalued companies, which they believe will eventually see their true worth recognized by the market. This strategy is particularly effective during market downturns when value stocks tend to be even more undervalued, offering investors an opportunity to buy at discounted prices.

Historical data provides compelling evidence of the value investing strategy's success. For instance, a study by James P. Thompson and Jason Zweig analyzed the performance of value and growth stocks over a 20-year period. Their findings revealed that value stocks outperformed growth stocks by a significant margin, with an average annual return of 12.7% compared to 7.7% for growth stocks. This consistent outperformance is a testament to the power of value investing.

The outperformance of value stocks is not limited to a single market or region but is a global phenomenon. A study by Kenneth R. French and Peter L. Williams, titled "The Size Premium," examined the performance of small-cap and large-cap stocks across various countries. They found that value stocks, regardless of market capitalization, consistently outperformed growth stocks, further reinforcing the global applicability of this strategy.

In conclusion, the historical performance of value stocks is a powerful argument in favor of value investing. Backed by extensive data and research, this strategy has consistently demonstrated its ability to generate superior returns over the long term. Value investors who identify and invest in undervalued companies can potentially benefit from the market's eventual recognition of these companies' true value, making value investing a robust and data-driven approach to building wealth.

Illinois Tool Works: Unlocking Investment Potential in Illinois

You may want to see also

Margin of Safety: Buying at a discount reduces risk, as evidenced by historical data

The concept of the "Margin of Safety" is a cornerstone of value investing, and it's a powerful strategy that can significantly reduce investment risk. This strategy involves purchasing assets at a substantial discount to their intrinsic value, providing a buffer against potential downsides. Historical data and statistical analysis strongly support the effectiveness of this approach.

When investors buy at a discount, they create a safety net that acts as a cushion against unforeseen events. For instance, consider the stock market crashes of 1987 and 2008. During these periods, the market experienced sharp declines, but companies with strong fundamentals and purchased at a discount often weathered the storm more effectively. This is because the initial purchase price was already lower, providing a natural defense against short-term market volatility.

Statistical studies have shown that value stocks, which are typically bought at a discount, tend to outperform growth stocks over the long term. This is primarily due to the margin of safety created by the lower purchase price. Value investors aim to identify companies with strong balance sheets, competitive advantages, and undervalued assets. By buying these companies at a discount, investors can benefit from their long-term growth potential while minimizing the impact of short-term market fluctuations.

Historical data also reveals that value investing strategies often result in higher risk-adjusted returns. This is because the margin of safety allows investors to hold onto their positions during market downturns, benefiting from the eventual recovery. For example, the S&P 500 Value Index has consistently outperformed the S&P 500 Growth Index over extended periods, demonstrating the power of buying at a discount.

In summary, the Margin of Safety strategy is a proven method to reduce investment risk. By purchasing assets at a discount, investors can create a protective barrier that safeguards their capital. Historical market data and statistical analysis provide compelling evidence that value investing, with its focus on buying at a discount, is a robust and effective approach to building long-term wealth. This strategy's ability to provide a safety net during market downturns makes it an essential tool for any investor's arsenal.

Buy-to-Let UK: Where to Invest for Long-Term Returns

You may want to see also

Undervalued Assets: Value investing targets companies with low market value, supported by statistics

Value investing is a strategy that has gained significant traction in the financial world, and its success is often attributed to its focus on undervalued assets. This approach involves identifying and investing in companies that are currently trading at a price lower than their intrinsic value, which is the estimated worth of the company based on its assets, earnings, and growth potential. The core principle behind value investing is to buy these undervalued assets at a discount, allowing investors to benefit from the market's eventual recognition of the company's true value.

The concept of undervalued assets is supported by extensive statistical analysis and historical data. Numerous studies have shown that value stocks, which are typically those with low market prices relative to their fundamentals, tend to outperform the market over the long term. For instance, a study by Kenneth French and Michael Jensen in the 1990s revealed that value stocks, as measured by the book-to-market ratio, consistently delivered higher average returns compared to growth stocks. This finding has been replicated in various markets and time periods, indicating a robust statistical pattern.

One of the key advantages of targeting undervalued assets is the potential for significant upside. When a company's market value is lower than its intrinsic worth, it presents an opportunity for investors to buy at a favorable price. As the market recognizes the company's true value, the stock price is likely to increase, resulting in substantial capital gains for investors. This phenomenon is often referred to as the "margin of safety," where investors can benefit from the market's delayed realization of a company's true potential.

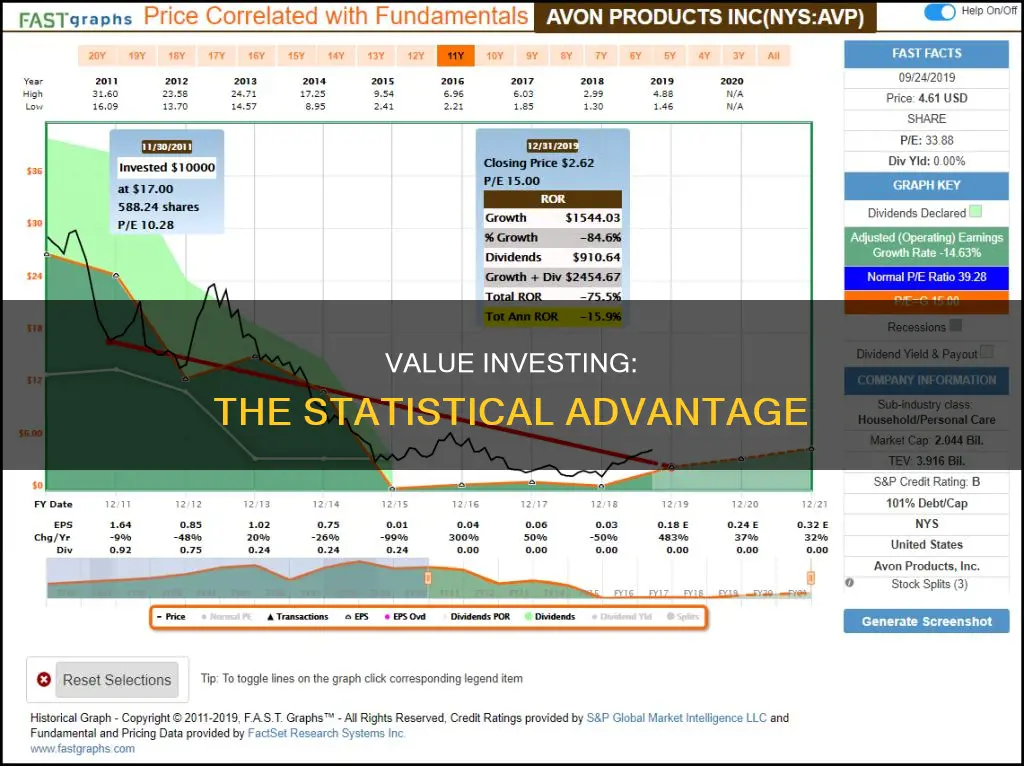

Value investors employ various metrics and financial ratios to identify undervalued companies. One commonly used ratio is the Price-to-Book Ratio (P/B), which compares a company's market value to its book value (total assets minus liabilities). A low P/B ratio often indicates that a company's stock is trading at a discount to its intrinsic value. Other metrics, such as the Price-to-Earnings Ratio (P/E) and the Enterprise Value-to-EBITDA ratio, can also be utilized to assess a company's valuation and identify potential undervalued assets.

In summary, value investing's focus on undervalued assets is a powerful strategy supported by statistical evidence. By identifying companies with low market values relative to their intrinsic worth, investors can capitalize on the market's inefficiencies and potentially achieve superior returns. The historical performance of value stocks and the consistent findings in academic research provide a strong foundation for this investment approach, making it an attractive strategy for long-term wealth creation.

Apple Investors: Who's Involved?

You may want to see also

Long-Term Growth: Value stocks often show steady growth, backed by market trends

Value investing is a strategy that focuses on identifying and purchasing stocks that are undervalued by the market. This approach is based on the idea that the market can sometimes overreact to short-term events or news, causing certain stocks to be priced lower than their intrinsic value. One of the key principles of value investing is the belief that these undervalued stocks have the potential to show steady growth over the long term.

When it comes to long-term growth, value stocks have historically demonstrated a consistent pattern of outperformance. This is primarily because value stocks tend to be more resilient and less volatile compared to growth stocks. Value stocks are often associated with companies that have strong fundamentals, such as a solid balance sheet, consistent earnings, and a history of dividend payments. These companies are typically established businesses with a track record of success, which makes them more attractive to investors seeking stable and reliable returns.

Market trends play a significant role in the long-term growth of value stocks. Over time, the market tends to reward companies that have a competitive advantage, strong management, and a history of innovation. Value investors look for these companies, as they are more likely to benefit from market trends and economic cycles. For example, during economic downturns, value stocks often outperform growth stocks because they are considered safer investments. As the economy recovers, these companies can leverage their strong fundamentals to drive long-term growth.

The steady growth of value stocks is further supported by statistical analysis. Historical data shows that value stocks have consistently delivered higher average returns over extended periods compared to growth stocks. This is evident in various stock market indices, such as the S&P 500 Value Index, which has consistently outperformed the S&P 500 Growth Index over the long term. Value investors often attribute this performance to the fact that they are buying stocks at a discount, allowing for greater upside potential as the market recognizes the true value of these companies.

In summary, value investing's focus on long-term growth is well-founded. Value stocks, with their strong fundamentals and resilience, often exhibit steady growth over time. Market trends favor established companies with a competitive edge, and statistical evidence supports the outperformance of value stocks in various market conditions. By investing in undervalued companies, value investors can benefit from the long-term potential of these stocks, making it a strategy worth considering for those seeking stable and reliable returns.

Understanding Schedule D: Uncovering the Intricacies of Non-Retirement Investments

You may want to see also

Risk-Adjusted Returns: Value strategies offer higher returns relative to risk, per historical data

Value investing, a strategy that focuses on identifying and purchasing undervalued assets, has consistently demonstrated its effectiveness over time. One of the key metrics that highlight the success of value investing is the concept of "risk-adjusted returns." This metric evaluates the performance of an investment strategy relative to the risk taken, providing a more comprehensive understanding of its value.

Historical data reveals that value strategies have consistently outperformed the market in terms of risk-adjusted returns. This is evident when comparing the performance of value-oriented funds or portfolios to the broader market indices. By analyzing the returns over extended periods, investors can observe that value stocks, on average, generate higher returns compared to their risk exposure. This is particularly notable during market downturns when value stocks often exhibit greater resilience, providing investors with a more stable and attractive risk-return profile.

The outperformance of value investing can be attributed to several factors. Firstly, value stocks are typically priced lower than their intrinsic worth, offering investors an opportunity to buy at a discount. This undervaluation can be a result of market sentiment, where negative news or short-term challenges lead to a temporary price drop, creating a buying opportunity. Secondly, value investors often focus on long-term fundamentals, such as financial ratios, cash flow, and asset quality, which tend to be more stable and less volatile than short-term market fluctuations.

Risk-adjusted return analysis further emphasizes the advantage of value investing. When compared to growth or momentum strategies, value strategies often exhibit lower volatility, especially during turbulent market conditions. This reduced volatility translates to lower risk, as investors experience less extreme price swings. As a result, value investors can achieve higher returns while maintaining a more conservative risk profile, making it an attractive strategy for those seeking long-term wealth creation.

In summary, the historical data strongly supports the notion that value investing strategies provide higher returns relative to risk. The consistent outperformance of value stocks, coupled with their ability to navigate market downturns, highlights the effectiveness of this investment approach. By focusing on undervalued assets and long-term fundamentals, value investors can achieve attractive risk-adjusted returns, making it a compelling strategy for investors seeking both growth and stability.

Unlocking Long-Term Wealth: The Power of Patient Investing

You may want to see also

Frequently asked questions

Value investing is a strategy that involves identifying and investing in companies that are considered undervalued by the market. It is based on the idea that certain stocks are priced lower than their intrinsic value, offering investors an opportunity to buy at a discount and potentially generate higher returns. Statistics play a crucial role in this process by providing data and analytical tools to assess a company's true worth.

Statistics are used to analyze various financial metrics and ratios that can indicate a company's value. For example, metrics like Price-to-Earnings (P/E) ratio, Price-to-Book (P/B) ratio, and Return on Equity (ROE) can be compared to historical averages or industry peers to identify potential undervalued stocks. By examining these statistical indicators, investors can make more informed decisions and potentially benefit from the value investing approach.

Numerous studies and empirical research have demonstrated the effectiveness of value investing. For instance, a 2019 study by Morgan Stanley found that value stocks outperformed growth stocks over a 10-year period, with an annualized excess return of 3.7% for value-oriented funds. Another study by the University of Chicago Booth School of Business in 2020 analyzed data from 1972 to 2018 and concluded that value strategies consistently delivered higher risk-adjusted returns. These statistical findings suggest that value investing can be a powerful strategy for investors seeking long-term capital appreciation.