Schools, like any other organization, need to manage their finances effectively to achieve their goals and maintain financial stability. This is where investment management comes in. Investment management involves selecting and monitoring a portfolio of assets that align with an organization's financial objectives, risk tolerance, and timeframes. By effectively managing their investments, schools can maximize their returns, minimize risks, and ensure their financial resources are optimally utilized to support their educational mission.

Investment management professionals, often referred to as investment or portfolio managers, play a crucial role in this process. They work closely with schools to understand their unique needs and develop customized investment strategies. These professionals possess specialized knowledge of capital markets and investments, enabling them to make informed decisions on behalf of their clients. They also provide regular reports and updates to keep schools informed about the performance of their investments.

In addition to their financial expertise, investment managers offer valuable communication and analytical skills. They can explain complex investment concepts to their clients and tailor their strategies to meet the specific needs of the educational institution. Their analytical abilities help them interpret market data, identify investment opportunities, and make data-driven decisions to optimize the financial resources available to the school.

By engaging the services of investment management professionals, schools can benefit from their expertise in areas such as asset allocation, risk management, and tax strategies. This ensures that the school's financial assets are managed effectively, in line with their long-term goals, and with a focus on maximizing returns while minimizing potential losses.

| Characteristics | Values |

|---|---|

| Investment management process | Selecting investments to build a portfolio |

| Investment management service | Can be done independently or with a professional's help |

| Investment management goals | Maximizing return within given risk parameters |

| Investment management fee structure | Portfolio management fee, percentage of profits, salaried, flat fee |

| Investment management client types | Individuals, major corporations, universities, charities, trusts |

| Investment management job duties | Client evaluation, investment strategizing, investment monitoring |

| Investment management job skills | Communication skills, analytical reasoning, informed prediction, calm demeanor, organization |

What You'll Learn

To maximise returns and minimise risk

Investment management is the process of making decisions about investments to build a portfolio that meets specific goals. For schools, this could mean maximising returns while minimising risk.

An investment manager can help schools by assessing and managing risk, selecting investments, and tracking and rebalancing the portfolio over time.

Firstly, an investment manager will help the school determine its financial objectives and create a strategy to reach them. This involves understanding the school's risk tolerance and financial priorities, and then selecting appropriate investments that match these criteria. For example, a school may be comfortable with high-risk, high-reward investments, or it may prefer low-risk investments to protect its funds.

Secondly, investment managers track market conditions and adjust the portfolio to maximise returns while mitigating risks. They do this by monitoring the performance of existing investments and staying informed about market news, tax laws, and economic events that may impact the portfolio's performance. By staying up to date, investment managers can make better decisions about when to buy and sell assets to maximise returns.

Through careful portfolio management, investment managers strive to maximise gains while minimising losses over time, with attention to tax efficiency and liquidity. They can also help schools with other financial needs, such as cash-flow planning, insurance, or debt management.

Overall, investment management can help schools make the most of their money and ensure their investment portfolios are well-managed and aligned with their financial goals and risk tolerance.

Savings vs Investments: What's the Real Difference?

You may want to see also

To ensure portfolios are well-diversified

Investment management is a process that involves building a portfolio of stocks, bonds, and other investments to align with an investor's goals. Schools, like any other organisation with financial assets, can benefit from investment management to ensure their portfolios are well-diversified.

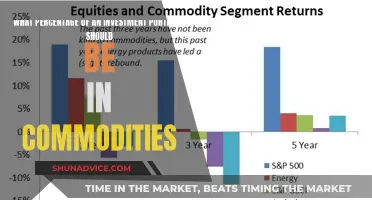

Diversification is a management strategy that blends different investments within a single portfolio. The idea is to spread out risk and increase returns by allocating capital across various investment types and industries. A well-diversified portfolio can include a mix of asset classes, such as equities (stocks), fixed-income investments (bonds), cash and cash equivalents, and real assets like property.

For example, a school could invest in a package delivery company and a videoconferencing platform company. If there is a gas shortage, the package delivery company's stock price may drop, but the videoconferencing platform company's stock price could increase as more people work from home. This strategy of investing in complementary assets can help reduce the overall risk of the portfolio.

Additionally, schools can diversify their portfolios by investing in international markets. Investing in foreign assets like stocks and bonds from companies in other countries can provide a hedge against country-specific risks and create a more well-rounded portfolio.

By ensuring their portfolios are well-diversified, schools can benefit from reduced risk, increased returns, and a more stable financial future.

Comparing Portfolio Investments: Strategies for Success

You may want to see also

To monitor and adjust investment strategies

Investment management is the process of making decisions about investments, including researching, selecting, and monitoring a portfolio of assets that match an investor's goals, risk profile, and timeframes.

Monitoring and adjusting investment strategies is a critical aspect of investment management. Here are four to six paragraphs detailing the importance of this function:

Understanding Market Trends and Adjusting Accordingly

Investment managers need to stay abreast of market trends, economic shifts, and news that can impact their clients' portfolios. By closely monitoring market conditions, they can identify potential risks and opportunities. For example, shifts in the political landscape, changes in interest rates, or industry-specific news can all influence investment strategies. Keeping a close eye on these factors enables investment managers to make timely adjustments to their clients' portfolios, such as buying or selling certain assets to align with the clients' goals and risk tolerance.

Risk Management and Mitigation

A key aspect of monitoring and adjusting investment strategies is risk management. Investment managers must continually assess and manage risk to protect their clients' assets. This involves understanding the client's risk tolerance and employing strategies to mitigate potential losses. By regularly monitoring the performance of different investments within the portfolio, investment managers can identify areas of concern and take appropriate action. This may include diversifying the portfolio by investing in a range of asset classes, such as stocks, bonds, real estate, or alternative investments.

Maximising Returns

Monitoring and adjusting investment strategies also play a crucial role in maximising returns for clients. Investment managers strive to optimise their clients' portfolios by identifying investments with strong growth potential and adjusting the asset allocation accordingly. They analyse the performance of different investments and make strategic decisions to enhance returns while staying within the client's risk boundaries. This may involve taking advantage of market opportunities, such as investing in growth stocks or emerging sectors, or rebalancing the portfolio to ensure it remains aligned with the client's financial objectives.

Tax Efficiency

Another important consideration in investment management is tax efficiency. Investment managers need to stay updated on tax regulations and changes to ensure their clients' portfolios are structured in a tax-efficient manner. This may include taking advantage of tax-exempt investments, such as certain types of bonds, or implementing strategies to minimise capital gains taxes. By regularly monitoring and adjusting the portfolio, investment managers can help their clients maximise their after-tax returns.

Long-Term Financial Goals

Monitoring and adjusting investment strategies is essential for helping clients stay on track with their long-term financial goals. Whether it's saving for retirement, funding education, or achieving other financial milestones, investment managers can tailor their strategies to meet these goals. They can adjust the portfolio allocation, recommend specific investments, and provide guidance on time horizons to ensure their clients' investments are working towards their desired objectives.

Regulatory Compliance

Investment managers also need to consider regulatory requirements when monitoring and adjusting investment strategies. They must stay informed about any changes in laws and regulations that may impact their clients' portfolios. This includes understanding the rules governing retirement accounts, such as 401(k)s and IRAs, and ensuring that their investment strategies comply with these regulations. By staying compliant, investment managers protect their clients' interests and avoid potential legal issues.

Monitoring Your Investment Portfolio: How Frequently Should You Check?

You may want to see also

To provide financial analysis expertise

Investment management is the process of making decisions about investments, and it involves researching, selecting, and monitoring a portfolio of assets that match an investor's goals, risk profile, and timeframes. Financial analysis is a crucial aspect of investment management, and here's why:

Expertise in Financial Analysis

Financial analysis is a critical skill for investment managers as it enables them to understand the financial situation of their clients and devise strategies to meet their investment goals. By analysing financial statements, investment managers can identify investable income and help clients make informed decisions about their investment possibilities. This skill is particularly important when dealing with complex financial scenarios, such as retirement planning, tax strategies, or legacy planning.

Risk Assessment and Management

Investment managers must be able to assess and manage risk effectively. Financial analysis plays a vital role in this process by providing data and insights that help investment managers evaluate the potential risks associated with different investment options. This ensures that investment strategies are tailored to the client's risk tolerance and financial objectives.

Portfolio Management

Financial analysis is essential for effective portfolio management. By analysing the performance of different investments and the market conditions, investment managers can make informed decisions about buying, selling, or adjusting the mix of assets in a client's portfolio. This ensures that the portfolio remains aligned with the client's goals and risk tolerance while maximising returns and minimising risks.

Investment Strategy Formulation

Financial analysis is a key input in the formulation of investment strategies. It helps investment managers identify suitable investments for their clients by evaluating different asset classes, market trends, and historical performance. This analysis enables them to create customised investment plans that consider the client's specifications, such as their risk appetite, investment horizon, and financial goals.

Performance Evaluation and Growth Opportunities

Financial analysis is used to track the performance of investments over time. By analysing the financial data, investment managers can identify areas where the portfolio is meeting or exceeding expectations, as well as areas that require improvement. This information is crucial for making data-driven decisions about rebalancing the portfolio to maximise gains and minimise losses while also considering tax efficiency and liquidity.

In conclusion, financial analysis expertise is vital for investment management as it enables investment managers to make informed decisions about their clients' investments. It helps them understand their clients' financial situations, assess and manage risk, effectively manage portfolios, formulate investment strategies, and evaluate performance to identify growth opportunities. By leveraging financial analysis, investment managers can provide valuable expertise and guidance to their clients, helping them to make the most of their investments.

Public Investment Portfolio: Understanding Government's Investment Strategies

You may want to see also

To advise on asset allocation

Investment management is the process of making decisions about investments, including researching, selecting, and monitoring a portfolio of assets that match an investor's goals, risk profile, and timeframes. One of the key functions of investment managers is to advise on asset allocation.

Asset allocation is how investors divide their portfolios among different assets, including equities, fixed-income assets, and cash and its equivalents. The ideal asset allocation will depend on the investor's financial goals, risk tolerance, and time horizon. For example, a younger investor with a long-term investment account will have a higher tolerance for risk and can expect to recover from market fluctuations, whereas a couple nearing retirement may not want to jeopardise their accumulated wealth.

There are several different strategies for establishing asset allocations, each with a different management approach. Here are some of the most common strategies:

- Strategic Asset Allocation: This method establishes a base policy mix, or a proportional combination of assets, based on expected rates of return for each asset class. It also takes into account the investor's risk tolerance and investment time frame. This strategy may be similar to a buy-and-hold strategy and usually suggests diversification to reduce risk and improve returns.

- Constant-Weighting Asset Allocation: With this approach, the portfolio is continually rebalanced. For example, if one asset declines in value, the investor would purchase more of that asset, and if the asset value increases, they would sell it.

- Tactical Asset Allocation: This strategy involves making short-term, tactical deviations from the original mix to capitalise on unusual or exceptional investment opportunities. It adds a market-timing component to the portfolio, allowing the investor to participate in economic conditions that are more favourable for certain asset classes.

- Dynamic Asset Allocation: With this active strategy, the mix of assets is constantly adjusted as markets and the economy rise and fall. The investor sells assets that decline and purchases assets that increase.

- Insured Asset Allocation: This strategy establishes a base portfolio value that the portfolio should not drop below. If the portfolio achieves a return above its base, the investor exercises active management, relying on analytical research, forecasts, judgment, and experience to decide which securities to buy, hold, and sell. If the portfolio drops to the base value, the investor switches to risk-free assets, such as Treasuries, to fix the base value.

- Integrated Asset Allocation: This strategy considers both the investor's economic expectations and their risk tolerance when establishing an asset mix. It includes aspects of all the previous strategies, accounting for expectations and actual changes in capital markets and the investor's risk tolerance.

It is important to note that there is no one-size-fits-all approach to asset allocation, and the ideal mix of investments will vary depending on the specific circumstances of the investor.

Portfolio Theory: Investment Analysis Fundamentals Explained

You may want to see also

Frequently asked questions

Investment management is the process of making decisions about investments. It involves researching, selecting, and monitoring a portfolio of assets that match an investor’s goals, risk profile, and timeframes. Schools, like any other organization, have financial goals and a certain risk appetite. Investment management can help them maximize their financial assets and ensure their investment strategies are aligned with their goals and risk appetite.

Investment management can help schools make the most of their money and ensure their financial assets are optimized. It can also help schools consolidate their investment accounts and streamline their financial life.

An investment manager is a person or company that manages an investment portfolio on behalf of a client. They research potential investments, monitor the performance of existing investments, analyze market trends, create investment plans tailored to individual clients, and recommend changes to help meet their long-term goals.