A revolving loan facility, also called a revolving credit facility or simply revolver, is a form of credit issued by a financial institution that provides the borrower with the ability to draw down or withdraw, repay, and withdraw again. A revolving loan is considered a flexible financing tool due to its repayment and re-borrowing accommodations. However, it is not considered a term loan because, during an allotted period of time, the facility allows the borrower to repay the loan or take it out again.

| Characteristics | Values |

|---|---|

| Practical limitations | Amount companies can borrow from the revolver is commonly constrained by a “borrowing base”. |

| Borrowing base | Represent the amount of liquid assets securing the revolver, which are usually accounts receivable and inventory. |

| Formula | 80% of “liquidation value” of inventory + 90% of accounts receivable. |

| Use | Companies primarily use a revolver to fund short-term working capital shortfalls, rather than long-term cash losses. |

| Circularity | Model plugs can create potentially problematic circularities in Excel. |

What You'll Learn

Revolvers are primarily used for short-term working capital

The revolver is a way to handle a situation in which deficits are projected, while surpluses simply increase the cash balance. A related issue that emerges in forecasting is that model plugs can create potentially problematic circularities in Excel.

The amount companies can borrow from the revolver is commonly constrained by a “borrowing base”. The borrowing base represents the amount of liquid assets securing the revolver, which are usually accounts receivable and inventory. Formulas can vary, but a typical formula is: 80% of “liquidation value” of inventory + 90% of accounts receivable.

If your model’s revolver balance is growing, perhaps you’re forecasting poor performance, too much spending on capital expenditures, dividends, high paydown of long-term debt, etc.

Unveiling Short-Term Investments: A Guide to Balancing Your Books

You may want to see also

Practical limitations on how much a company can draw

A revolving loan facility, also called a revolving credit facility or simply revolver, is a form of credit issued by a financial institution that provides the borrower with the ability to draw down or withdraw, repay, and withdraw again. A revolving loan is considered a flexible financing tool due to its repayment and re-borrowing accommodations. It is not considered a term loan because, during an allotted period of time, the facility allows the borrower to repay the loan or take it out again.

The revolver is a way to handle a situation in which deficits are projected, while surpluses simply increase the cash balance. There’s also a practical limitation on how much a company can draw on its revolver. Specifically, the amount companies can borrow from the revolver is commonly constrained by a “borrowing base.” The borrowing base represents the amount of liquid assets securing the revolver, which are usually accounts receivable and inventory. Formulas can vary, but a typical formula is: 80% of “liquidation value” of inventory + 90% of accounts receivable.

If your model’s revolver balance is growing, perhaps you’re forecasting poor performance, too much spending on capital expenditures, dividends, high paydown of long-term debt, etc. To reflect this concept, it’s preferable to reflect the additional required borrowings in long-term debt.

Most systems do not directly support Global Loans so a typical solution is to set up the facility as two separate security lines and transfer the book cost from revolver to Term Loan as it is drawn down.

Warren Buffett's Investment Strategy: The One President He Didn't Back

You may want to see also

Borrowing base represents liquid assets securing the revolver

The borrowing base represents the amount of liquid assets securing the revolver, which are usually accounts receivable and inventory. Formulas can vary, but a typical formula is: 80% of “liquidation value” of inventory + 90% of accounts receivable.

The borrowing base is commonly constrained by a borrowing base. This means that the amount companies can borrow from the revolver is limited.

The revolver is a way to handle a situation in which deficits are projected, while surpluses simply increase the cash balance. A related issue that emerges in forecasting is that model plugs can create potentially problematic circularities in Excel.

The revolver is a form of credit issued by a financial institution that provides the borrower with the ability to draw down or withdraw, repay, and withdraw again. A revolving loan is considered a flexible financing tool due to its repayment and re-borrowing accommodations.

The revolver is primarily used to fund short-term working capital shortfalls, rather than long-term cash losses.

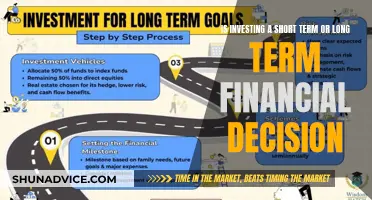

Understanding the Essentials of Long-Term Investment Strategies

You may want to see also

Model plugs can create circularities in Excel

A revolving loan facility, also called a revolving credit facility or simply revolver, is a form of credit issued by a financial institution that provides the borrower with the ability to draw down or withdraw, repay, and withdraw again. A revolving loan is considered a flexible financing tool due to its repayment and re-borrowing accommodations. It is not considered a term loan because, during an allotted period of time, the facility allows the borrower to repay the loan or take it out again.

When a fund ‘goes long' on a revolver it is selling the ‘right to borrow’ to a counterparty. This paper outlines the concept within the framework of traditional bonds and how you would treat the facility and ensuing term loan using standard accounting functionality for bonds. It addresses the fundamental challenge with Global Loan Revolvers. Most systems do not directly support Global Loans so a typical solution is to set up the facility as two separate security lines and transfer the book cost from revolver to Term Loan as it is drawn down.

A revolving loan is primarily used to fund short-term working capital shortfalls, rather than long-term cash losses. There’s also a practical limitation on how much a company can draw on its revolver. Specifically, the amount companies can borrow from the revolver is commonly constrained by a “borrowing base.” The borrowing base represents the amount of liquid assets securing the revolver, which are usually accounts receivable and inventory. Formulas can vary, but a typical formula is: 80% of “liquidation value” of inventory + 90% of accounts receivable.

If your model’s revolver balance is growing, perhaps you’re forecasting poor performance, too much spending on capital expenditures, dividends, high paydown of long-term debt, etc. To reflect this concept, it’s preferable to reflect the additional required borrowings in long-term debt. The revolver is a way to handle a situation in which deficits are projected, while surpluses simply increase the cash balance. A related issue that emerges in forecasting is that model plugs can create potentially problematic circularities in Excel.

For further learning on the mechanisms and how to handle the circularity created by the revolver, go to the “Circularity” section of this article on financial modeling best practices.

UK Short-Term Savings: Strategies for Quick Growth

You may want to see also

Revolvers are not considered a term loan

A revolving loan facility, also called a revolving credit facility or simply revolver, is a form of credit issued by a financial institution that provides the borrower with the ability to draw down or withdraw, repay, and withdraw again. A revolving loan is considered a flexible financing tool due to its repayment and re-borrowing accommodations. It is not considered a term loan because, during an allotted period of time, the facility allows the borrower to repay the loan or take it out again.

When a fund 'goes long' on a revolver, it is selling the 'right to borrow' to a counterparty. This paper outlines the concept within the framework of traditional bonds and how you would treat the facility and ensuing term loan using standard accounting functionality for bonds. It addresses the fundamental challenge with Global Loan Revolvers. Most systems do not directly support Global Loans so a typical solution is to set up the facility as two separate security lines and transfer the book cost from revolver to Term Loan as it is drawn down.

The revolver is a way to handle a situation in which deficits are projected, while surpluses simply increase the cash balance. A related issue that emerges in forecasting is that model plugs can create potentially problematic circularities in Excel. For further learning on the mechanisms and how to handle the circularity created by the revolver, go to the “Circularity” section of this article on financial modeling best practices.

A revolving loan facility is a form of credit issued by a financial institution that provides the borrower with the ability to draw down or withdraw, repay, and withdraw again. A revolving loan is considered a flexible financing tool due to its repayment and re-borrowing accommodations. It is not considered a term loan because, during an allotted period of time, the facility allows the borrower to repay the loan or take it out again.

The revolver is a way to handle a situation in which deficits are projected, while surpluses simply increase the cash balance. A related issue that emerges in forecasting is that model plugs can create potentially problematic circularities in Excel. For further learning on the mechanisms and how to handle the circularity created by the revolver, go to the “Circularity” section of this article on financial modeling best practices.

Understanding Long-Term Investment Strategies: Key Factors to Consider

You may want to see also

Frequently asked questions

A revolver is a credit facility that provides the borrower with the ability to draw down or withdraw, repay, and withdraw again.

A revolver is not considered a long-term investment because it is a flexible financing tool that allows the borrower to repay the loan or take it out again during an allotted period of time.

The primary use of a revolver is to fund short-term working capital shortfalls, rather than long-term cash losses.