NIO, a Chinese electric vehicle manufacturer, has been a topic of interest for investors seeking long-term growth opportunities. With its innovative approach to sustainable mobility, the company has experienced significant growth since its inception. However, like any investment, it's crucial to consider various factors before making a decision. This paragraph will delve into the key aspects that investors should evaluate when assessing NIO as a long-term investment, including its market position, financial performance, and future prospects.

What You'll Learn

- Financial Performance: Assess NIO's revenue growth, profitability, and market share trends

- Electric Vehicle Market: Analyze demand, competition, and technological advancements in the EV sector

- Supply Chain and Manufacturing: Evaluate NIO's production capacity, supply chain resilience, and manufacturing efficiency

- Brand and Customer Loyalty: Explore NIO's brand reputation, customer satisfaction, and loyalty programs

- Regulatory and Policy Environment: Understand government incentives, subsidies, and policies impacting NIO's long-term prospects

Financial Performance: Assess NIO's revenue growth, profitability, and market share trends

NIO, a Chinese electric vehicle (EV) manufacturer, has been making significant strides in the automotive industry, and its financial performance is a key aspect to consider when evaluating its long-term investment potential. Here's an analysis of its financial health and growth prospects:

Revenue Growth: NIO has demonstrated impressive revenue growth since its inception. In 2020, the company's revenue reached $1.5 billion, a substantial increase from its initial years. This growth can be attributed to the successful launch of its premium electric vehicles, particularly the ES6 and ES8 models, which have gained popularity among environmentally conscious consumers. The company's strategic focus on direct sales and an efficient supply chain has contributed to its ability to manage costs and increase revenue. As of the latest financial reports, NIO's revenue has continued to surge, showcasing a strong market presence and consumer demand for its products.

Profitability: Assessing profitability is crucial for understanding NIO's financial sustainability. The company has been working towards improving its profit margins. In 2020, NIO's net loss narrowed significantly, indicating a move towards profitability. This positive trend is further supported by the company's ability to manage costs effectively, especially in research and development, which has led to a more efficient production process. As NIO expands its product line and market reach, it aims to sustain and potentially increase its profitability, making it an attractive long-term investment opportunity.

Market Share and Expansion: NIO's financial success is also reflected in its market share gains. The company has been rapidly expanding its presence in the Chinese EV market and has set its sights on international markets as well. With a strong focus on innovation and design, NIO has been able to differentiate itself from competitors. The introduction of new models and features has further solidified its position in the market. As NIO continues to expand its global footprint, it is likely to capture a larger market share, especially with the increasing demand for sustainable transportation solutions worldwide.

In summary, NIO's financial performance showcases a promising trajectory, with substantial revenue growth, a narrowing net loss, and a strong market position. The company's strategic approach to sales, cost management, and product development has contributed to its success. As NIO continues to innovate and expand, it is well-positioned to capture a significant share of the growing electric vehicle market, making it a compelling long-term investment prospect. This assessment provides a snapshot of NIO's financial health, which is essential for investors seeking to understand the company's potential for sustained growth.

Master Long-Term Investing: A Comprehensive Research Guide

You may want to see also

Electric Vehicle Market: Analyze demand, competition, and technological advancements in the EV sector

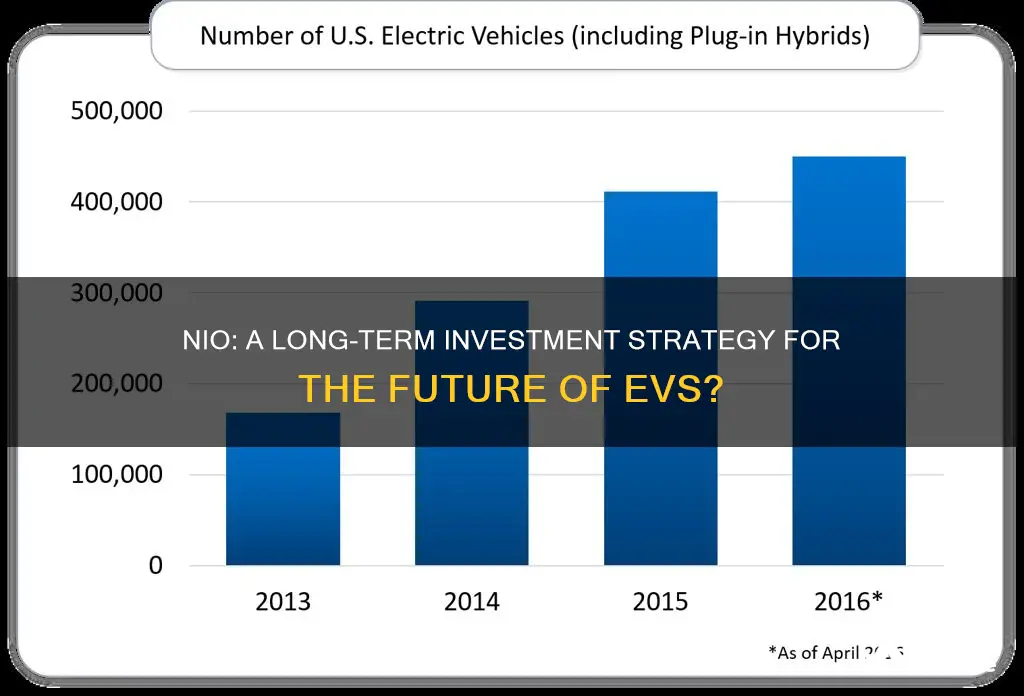

The electric vehicle (EV) market is experiencing rapid growth and transformation, driven by a combination of consumer demand, environmental concerns, and technological advancements. This sector is a key area of focus for investors, particularly with the rise of companies like NIO, which has captured the attention of many in the automotive industry. Here's an analysis of the market dynamics and its potential as a long-term investment:

Market Demand: The demand for electric vehicles is soaring globally, fueled by several factors. Firstly, consumers are increasingly environmentally conscious, seeking sustainable transportation options. Governments worldwide are implementing incentives and subsidies to encourage EV adoption, making them more affordable and attractive. Additionally, the rising cost of traditional fuel and the desire for energy independence have further propelled the demand. This shift in consumer behavior and policy support has created a favorable environment for EV manufacturers.

Competition and Market Players: The EV market is highly competitive, with numerous established automakers and new entrants vying for market share. Traditional automakers like Tesla, Volkswagen, and General Motors have made significant investments in EV technology, resulting in a wide range of models available to consumers. Startups, such as NIO, Rivian, and Lucid, are also disrupting the industry with innovative designs, advanced technologies, and unique business models. This competitive landscape is driving innovation, with companies constantly pushing the boundaries of battery technology, charging infrastructure, and vehicle performance.

Technological Advancements: Technological advancements are a key differentiator in the EV sector. Battery technology has seen remarkable progress, with improvements in energy density, charging speed, and overall lifespan. Solid-state batteries, for instance, offer higher energy storage capacity and faster charging, addressing range anxiety and charging infrastructure challenges. Additionally, the development of advanced driver-assistance systems (ADAS) and autonomous driving capabilities is enhancing safety and convenience. Companies are also investing in smart connectivity, allowing vehicles to communicate with each other and the surrounding infrastructure, further improving efficiency and user experience.

The EV market's growth is expected to continue, driven by supportive policies, rising consumer awareness, and technological breakthroughs. As the industry matures, we can anticipate further consolidation and innovation, with companies that can offer sustainable solutions, efficient production, and superior customer experiences gaining a competitive edge. For investors, this market presents opportunities to capitalize on the long-term trend of electrification and the potential for significant returns as the industry scales.

In summary, the electric vehicle market's demand, competition, and technological advancements collectively contribute to its potential as a long-term investment. NIO, as a prominent player, is well-positioned to benefit from these market dynamics, offering innovative products and contributing to the overall growth of the EV sector.

Unleash Short-Term Treasury Profits: A Beginner's Guide to Quick Wins

You may want to see also

Supply Chain and Manufacturing: Evaluate NIO's production capacity, supply chain resilience, and manufacturing efficiency

NIO, a Chinese electric vehicle (EV) manufacturer, has been making significant strides in the global market, and its long-term investment potential is a topic of interest for many investors. When assessing NIO's prospects, a critical aspect to consider is its supply chain and manufacturing capabilities.

Production Capacity: NIO has demonstrated a remarkable ability to scale up its production. The company's manufacturing facilities, including its Gigafactory in Hefei, China, are designed to produce a high volume of electric vehicles. As of 2022, NIO's production capacity was approximately 200,000 vehicles annually, with plans to expand further. This capacity is essential for the company's growth strategy, especially as it aims to increase its market share in the competitive EV space. The company's focus on vertical integration, where it controls various stages of production, from battery manufacturing to vehicle assembly, ensures a more efficient and consistent output.

Supply Chain Resilience: Building a robust supply chain is crucial for any manufacturer, and NIO has been actively working on this front. The company sources its raw materials and components from various suppliers worldwide, ensuring a diverse and resilient supply network. NIO's supply chain management has been a key differentiator, especially during the global chip shortage, where the company's strategic sourcing and inventory management helped mitigate production delays. By maintaining a balanced and flexible supply chain, NIO can adapt to market fluctuations and ensure a steady supply of vehicles to its customers.

Manufacturing Efficiency: NIO's manufacturing processes are designed to optimize production and reduce costs. The company employs advanced robotics and automation to streamline assembly lines, improving efficiency and reducing human error. Additionally, NIO has invested in training its workforce to maintain high standards of quality control. The company's focus on efficiency is evident in its ability to launch new models and variants quickly, keeping up with market trends and consumer demands. NIO's manufacturing strategy also includes a commitment to sustainability, with initiatives to reduce waste and energy consumption during production.

In summary, NIO's supply chain and manufacturing operations showcase a well-thought-out approach to production and supply management. The company's ability to scale production, maintain a resilient supply chain, and ensure manufacturing efficiency positions it favorably in the long term. As NIO continues to expand its global presence and product portfolio, investors can expect a well-managed and adaptable company, making it an attractive long-term investment prospect in the EV industry.

Long-Term Investments: Assets or Liabilities? Unlocking the True Value

You may want to see also

Brand and Customer Loyalty: Explore NIO's brand reputation, customer satisfaction, and loyalty programs

NIO, a Chinese electric vehicle (EV) manufacturer, has been making waves in the automotive industry with its innovative approach to sustainable mobility. When considering NIO as a long-term investment, understanding its brand reputation, customer satisfaction, and loyalty programs is crucial. Here's an analysis of these aspects:

Brand Reputation: NIO has successfully carved out a unique position in the market by focusing on premium electric vehicles and a customer-centric approach. The company's brand identity emphasizes innovation, sustainability, and a premium experience. NIO's commitment to cutting-edge technology, particularly in battery swapping and autonomous driving, has attracted tech-savvy consumers. The brand's reputation for delivering high-quality, stylish vehicles has been a significant draw for environmentally conscious and tech-enthusiast customers. This reputation has led to a dedicated fan base and a positive image in the EV market.

Customer Satisfaction: NIO's customer satisfaction levels are impressive, with many owners praising the vehicles' performance, design, and the overall user experience. The company's focus on customer feedback and continuous improvement has resulted in a high level of satisfaction. NIO's user-friendly app and comprehensive after-sales service have contributed to a positive customer journey. Additionally, the brand's commitment to transparency and open communication regarding vehicle performance and updates has fostered trust among its customers.

Loyalty Programs: NIO's loyalty programs are designed to reward and engage its customers, encouraging long-term relationships. The company offers various incentives, including exclusive events, early access to new models, and personalized offers. NIO's membership program provides members with benefits such as priority charging, complimentary maintenance, and access to a dedicated customer support team. These loyalty programs not only enhance customer retention but also create a sense of community and exclusivity, fostering a strong bond between the brand and its customers.

NIO's focus on building a strong brand identity, delivering exceptional customer satisfaction, and implementing effective loyalty programs positions it well for long-term success. The company's commitment to innovation and sustainability, coupled with its dedication to customer experience, makes NIO an attractive investment opportunity in the rapidly growing electric vehicle market. As the brand continues to expand its global presence, its reputation and customer loyalty are likely to further strengthen, making it a promising long-term investment prospect.

Is CIV a Long-Term Investment? Unlocking the Potential of a Crypto Project

You may want to see also

Regulatory and Policy Environment: Understand government incentives, subsidies, and policies impacting NIO's long-term prospects

The regulatory and policy environment plays a crucial role in determining the long-term prospects of any investment, and this is especially true for the electric vehicle (EV) industry, where government incentives and subsidies can significantly impact the success and sustainability of companies like NIO (NIO Inc.). Understanding these factors is essential for investors to make informed decisions.

In the context of NIO, investors should closely monitor the policies and regulations set by governments worldwide, particularly in regions where the company operates or aims to expand. Governments often introduce incentives to promote the adoption of electric vehicles, aiming to reduce carbon emissions and encourage a shift towards sustainable transportation. These incentives can take various forms, such as tax credits, rebates, or subsidies provided to EV manufacturers and consumers. For instance, in the United States, the Inflation Reduction Act offers significant tax credits for EV purchases, making it an attractive market for NIO. Similarly, European countries like Norway and Germany have implemented favorable policies, including tax exemptions and subsidies, to boost the EV market.

Subsidies and grants provided by governments can directly impact NIO's financial performance and market position. These financial incentives can help reduce production costs, improve cash flow, and enhance NIO's competitiveness against traditional automakers. Additionally, government policies related to charging infrastructure are vital for the long-term success of NIO. Governments are increasingly investing in charging networks to support the widespread adoption of electric vehicles. NIO's ability to leverage these policies and establish a robust charging network can significantly influence its market share and customer satisfaction.

Staying informed about international trade policies and agreements is also essential. NIO, as a Chinese EV manufacturer, may be affected by trade tensions and tariffs between countries. Changes in trade policies can impact the cost structure and market accessibility for NIO's vehicles. For example, the China-US trade war has led to increased tariffs on Chinese goods, which could potentially affect NIO's exports to the US market. Investors should analyze how these trade dynamics might influence NIO's long-term growth prospects.

Furthermore, investors should consider the potential impact of future regulatory changes on NIO's business model. As the EV industry evolves, governments may introduce new policies related to emissions standards, vehicle safety regulations, or even ownership restrictions. Adapting to these changes and ensuring compliance will be crucial for NIO's sustainability. In summary, the regulatory and policy environment is a critical aspect of assessing NIO's long-term investment potential. Investors should actively monitor government incentives, subsidies, and policies to gauge the company's ability to navigate market dynamics, compete effectively, and capitalize on emerging opportunities in the global EV market.

Speculative Land: A Long-Term Investment Strategy or a Risky Bet?

You may want to see also

Frequently asked questions

NIO is a Chinese electric vehicle (EV) manufacturer that has gained significant attention for its innovative designs and rapid growth. As a long-term investment, it offers several advantages. Firstly, the company has a strong market position in China, the world's largest EV market, which provides a solid foundation for its business. NIO's focus on premium EVs with advanced technology and a unique battery-as-a-service model has helped it build a loyal customer base. Secondly, the global shift towards sustainable transportation and the increasing demand for electric vehicles present a favorable long-term outlook for the industry. NIO's commitment to research and development and its ability to expand internationally could further enhance its growth prospects. However, like any investment, there are risks. The company's reliance on government subsidies and incentives in China is a concern, and the highly competitive nature of the EV market means NIO faces strong competition from established automakers. A long-term investment strategy would require careful monitoring of these factors and a balanced approach to risk management.

When assessing NIO as a long-term investment, several critical factors come into play. Firstly, the company's financial health and growth prospects are essential. NIO's revenue and profitability have been growing, but it is crucial to analyze its financial statements for any red flags, such as increasing debt or declining cash flow. Secondly, market dynamics and competition are vital. The EV market is evolving rapidly, and NIO's ability to adapt to changing consumer preferences and technological advancements is key. Keep an eye on its product pipeline and any strategic partnerships that could impact its market share. Additionally, consider the regulatory environment in China and globally, as policies supporting EV adoption can significantly influence the industry's growth. Lastly, assess NIO's management team's expertise and vision. Their ability to execute the company's strategy and navigate challenges will be crucial for long-term success.

NIO's business model and market position present both opportunities and challenges for long-term investors. The company's unique battery-as-a-service model, which allows customers to lease batteries instead of purchasing them, has been a differentiator in the market. This approach provides NIO with a recurring revenue stream and a competitive edge in terms of customer retention. However, it also means the company has to manage a large battery inventory and ensure efficient utilization. In terms of market position, NIO has successfully captured a significant share in China, but expanding internationally is a crucial aspect of its long-term strategy. The company's presence in Europe and the United States is growing, and its ability to navigate these new markets will impact its overall growth. Additionally, NIO's focus on premium EVs and its commitment to innovation could lead to a strong brand reputation, which is essential for long-term success in a competitive industry.