E*TRADE is an online brokerage platform that offers a wide range of investment options, including stocks, bonds, mutual funds, and ETFs. It provides various tools and resources to help investors make informed decisions, such as market research, analysis tools, and educational content. One of its key features is the Core Portfolios, a robo-advisor service that offers automated portfolio management for a low annual fee. While E*TRADE does not offer crypto or forex trading, it provides commission-free trades on US-listed stocks, ETFs, and mutual funds, making it a popular choice for both beginner and advanced investors.

| Characteristics | Values |

|---|---|

| Account minimum | $0 |

| Investment options | Stocks, bonds, ETFs, mutual funds, options, futures, IPOs, CDs |

| Commission fees | $0 for online US-listed stocks, ETFs, and mutual funds; $0.65 per options contract; $1.50 per futures contract; $6.95 for OTC stocks |

| Robo-advisor fee | 0.30% |

| Margin interest rates | 14.20% for balances under $10,000; 12.20% for balances of $250,000 or more |

| Bond transaction fees | $1 per bond with a minimum of $10 and a maximum of $250 |

| Full account transfer fee | $75 |

| Mobile app | ETRADE mobile app and Power ETRADE mobile app |

What You'll Learn

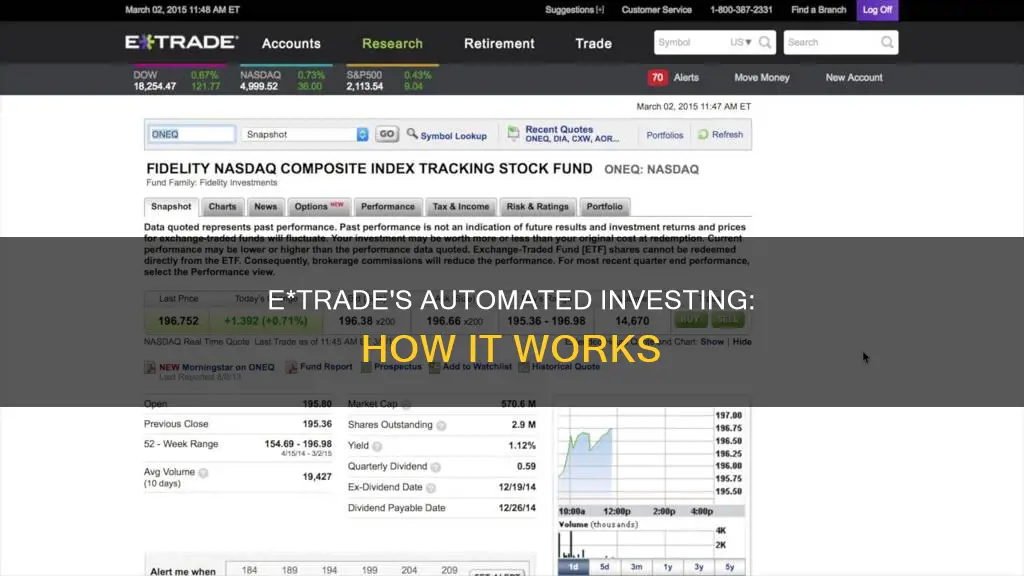

Automated investment management

E*TRADE offers automated investment management through its Core Portfolios, which are robo-advisor services. Core Portfolios provide personalized and automated portfolio management. Users need at least $500 to set up an account and pay an asset-based annual fee of 0.30%.

The Core Portfolios account uses one type of investment: ETFs. The brokerage uses asset classes that strive to generate high returns over the long haul (usually a minimum of three years). It gives you the option of socially responsible ETFs or smart beta ETFs (smart beta ETFs are funds that aim to outperform the stock market).

E*TRADE says it selects ETFs by analyzing things like historical performance, liquidity, tracking error, and expenses. For instance, E*TRADE automated investing offers specialized portfolios for goals such as wealth-building, retirement-saving, or buying a home.

Individual, joint, and custodial brokerage accounts qualify for Core Portfolios. Rollover, traditional, Roth, and SEP IRAs are also eligible. You can adjust your risk tolerance and add or remove specific investing focuses at any time.

E*TRADE's automated investment management is best for long-term, passive investors with a time horizon of at least one year.

Principal or Investment: Where Should Your Money Go?

You may want to see also

Retirement planning

E*TRADE offers a range of retirement planning options to help you work towards your dreams for tomorrow. With easy-to-use tools and solutions, you can start investing for your future today. Here are some key features of E*TRADE's retirement planning services:

Easy-to-Use Retirement Solutions

E*TRADE offers simple retirement solutions to help you set realistic savings goals and create an actionable plan to achieve them. You can make your money work harder without the stress of complex strategies.

Variety of Retirement Accounts

E*TRADE provides a range of retirement account options, including Roth, Traditional, and Rollover IRAs. These accounts offer potential tax benefits, such as tax-deductible contributions and tax-deferred compounding. You can also explore rolling over your old 401(k) plan into an E*TRADE IRA, consolidating assets from a former employer's retirement plan.

No Account Fees or Minimums

With E*TRADE IRAs, there are no account fees and no minimum balance requirements to worry about. This makes it accessible for anyone to start saving for retirement, regardless of their financial situation.

Tools and Guidance

E*TRADE offers various tools, such as the IRA Selector tool, to help you determine the best retirement account for your needs. Additionally, they provide guidance and resources to help you navigate the world of retirement planning and make informed decisions.

Tax Advantages

Retirement accounts with E*TRADE offer tax advantages, such as tax-free growth potential and tax-deductible contributions. This means you can make contributions without paying income taxes and let your earnings grow tax-deferred until you withdraw them in retirement.

Educational Resources

E*TRADE provides a wealth of educational resources, including webinars, online investing courses, and a thematic investing section. These resources can help you make informed investment decisions and learn about various retirement planning strategies.

Automated Investment Management

If you prefer a more hands-off approach, E*TRADE's automated investment management service may be ideal. Their experienced team and automated technology handle the investing while keeping you informed and in control of your investment strategy.

In summary, E*TRADE offers comprehensive retirement planning services with a range of account options, educational resources, and tools to help you work towards your financial goals. Their accessible platform and guidance make retirement planning and investing straightforward, so you can confidently prepare for the future.

Analyzing Investment Opportunities: Strategies for Success

You may want to see also

Brokerage accounts

E*TRADE offers a range of brokerage accounts, including taxable brokerage accounts, retirement accounts, and custodial accounts for minors.

Here's a step-by-step guide to opening a brokerage account:

- Determine the type of brokerage account you need: Choose between a traditional (taxable) brokerage account or a retirement brokerage account like an IRA. If you're self-employed, there are also special options like a SIMPLE IRA, SEP IRA, or individual 401(k).

- Compare the costs and incentives: Consider the fees and incentives offered by different brokerage firms, especially if you plan on trading options, mutual funds, ETFs, or bonds, as these often come with additional costs.

- Consider the services and conveniences offered: Look beyond pricing and evaluate other factors like access to research, foreign trading capabilities, fractional share trading, trading platforms, convenience, and other features.

- Decide on a brokerage firm: Weigh the pros and cons of each brokerage firm based on their costs, fees, and the conveniences they offer, and select the one that best aligns with your investment objectives.

- Fill out the new account application: You can typically apply for a new account online. Provide the required identifying information, such as your Social Security number and driver's license, and any additional forms if you're requesting margin privileges or options trading.

- Fund your account: Your broker will provide options to fund your account, including electronic funds transfer, wire transfer, checks, asset transfer, or stock certificates. Keep in mind the minimum funding requirements for different account types.

- Start researching investments: Once your account is open and funded, it's time to dive into investing in stocks, bonds, or funds. Educate yourself on how to responsibly choose investments and create a well-diversified portfolio that aligns with your goals and risk tolerance.

By following these steps, you can open a brokerage account and begin your investment journey.

Investments: Vanguard's Guide to Choosing Wisely

You may want to see also

Robo-advisors

E*TRADE is an online brokerage platform that offers automated investment management services, known as robo-advisors, to its clients. These services are designed to provide professional money management advice and guidance to people, regardless of their income level or portfolio size.

The process of setting up a Core Portfolio account is straightforward. E*TRADE's algorithm asks a series of questions about the client's goals and preferences, and then creates a personalised ETF portfolio aligned with their risk tolerance. The algorithm also provides a graph showing the hypothetical returns on a $100,000 investment to help clients better understand their risk level.

E*TRADE Core Portfolios offer several benefits to investors. Firstly, they provide access to live financial consultants for guidance. Secondly, they give investors the option of socially responsible ETFs or smart beta ETFs, which aim to outperform the stock market. Additionally, E*TRADE selects ETFs based on various factors, including historical performance, liquidity, tracking error, and expenses. The platform also offers specialised portfolios for specific financial goals, such as wealth-building, retirement savings, or buying a home.

It is important to note that E*TRADE's robo-advisory fee of 0.30% is not as competitive as similar platforms, and there is a higher minimum investment requirement of $500 compared to some other robo-advisors. However, the Core Portfolios service provides a convenient and accessible way for individuals to receive professional investment advice and create a diversified portfolio through the use of automated technology and expert oversight.

Where to Invest Your Money

You may want to see also

Investment options

E*TRADE offers a wide range of investment options, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), options, futures, and more. Here is a more detailed overview of the investment options available with E*TRADE:

- Stocks: ETRADE offers commission-free trading on US-listed stocks, making it easy for investors to buy and sell stocks without incurring additional fees.

- Exchange-Traded Funds (ETFs): ETRADE provides commission-free trading on a wide range of ETFs, allowing investors to diversify their portfolios and invest in various industries or themes.

- Mutual Funds: With over 6,000 mutual funds available, ETRADE offers a comprehensive selection, including no-load and no-transaction-fee funds, providing investors with numerous options to choose from.

- Options: ETRADE supports options trading with a per-contract fee of $0.65, or $0.50 for active traders who execute at least 30 trades per quarter. This gives investors the flexibility to implement various options strategies.

- Bonds: ETRADE offers trading in various types of bonds, including corporate bonds, municipal bonds, Treasury bonds, and more. Bond trades incur a fee of $1 per online secondary trade.

- Futures: ETRADE enables investors to trade futures contracts, with a fee of $1.50 per contract, providing access to commodities, indices, and other underlying assets.

- Initial Public Offerings (IPOs): Investors can participate in IPOs and invest in newly public companies through ETRADE.

- Certificates of Deposit (CDs): ETRADE provides access to CDs, offering a low-risk investment option with fixed interest rates and terms.

- Core Portfolios (Robo-Advisor): ETRADE's Core Portfolios is a robo-advisory service that constructs and manages personalized portfolios of ETFs based on an investor's goals and risk tolerance. It has a $500 minimum account balance and a 0.30% annual advisory fee.

- Automated Investment Management: ETRADE offers automated investment management services, where their team and technology handle the investing while keeping clients informed and in control of their investment strategy. This service is available for a low annual advisory fee of 0.30% and a $500 minimum balance.

- Premium Savings Account: This savings account offers a competitive yield with an Annual Percentage Yield (APY) that is 10 times the national average, along with FDIC protection of up to $500,000.

- Retirement Accounts: ETRADE provides various retirement account options, including Traditional and Roth IRAs, Rollover IRAs, Beneficiary IRAs, and IRAs for minors. They also offer resources and tools to help individuals save for retirement.

- Education Savings Accounts (ESAs): ETRADE enables parents and guardians to save for their child's education with tax-advantaged accounts, allowing tax-free withdrawals for qualified educational expenses.

- Custodial Brokerage Accounts: These accounts give minors investing access under the management of a parent or designated custodian, offering $0 commissions, tax advantages, and investment education tools.

Investing for Freedom: Early Retirement Strategies

You may want to see also

Frequently asked questions

E-Trade is an online brokerage offering financial and investment services suitable for beginner and experienced investors. Trade multiple asset classes in retirement, custodial, and automated brokerage accounts equipped with advanced charting tools and expert-curated investment strategies.

E-Trade offers a range of investment options, including stocks, bonds, mutual funds, ETFs, and options. You can use their website, desktop platform, or mobile app to buy and sell investments, monitor the market, and manage your portfolio.

E-Trade has no account minimum and provides commission-free trades on US-listed stocks, ETFs, and mutual funds. However, there are fees for trading options, bonds, and futures. There is also a $75 fee for transferring your account out of E-Trade.

Yes, E-Trade offers a user-friendly interface, low fees, simplified trading strategies, and commission-free trading. They also provide educational resources, such as guides, webinars, and videos, to help beginners get started with investing.