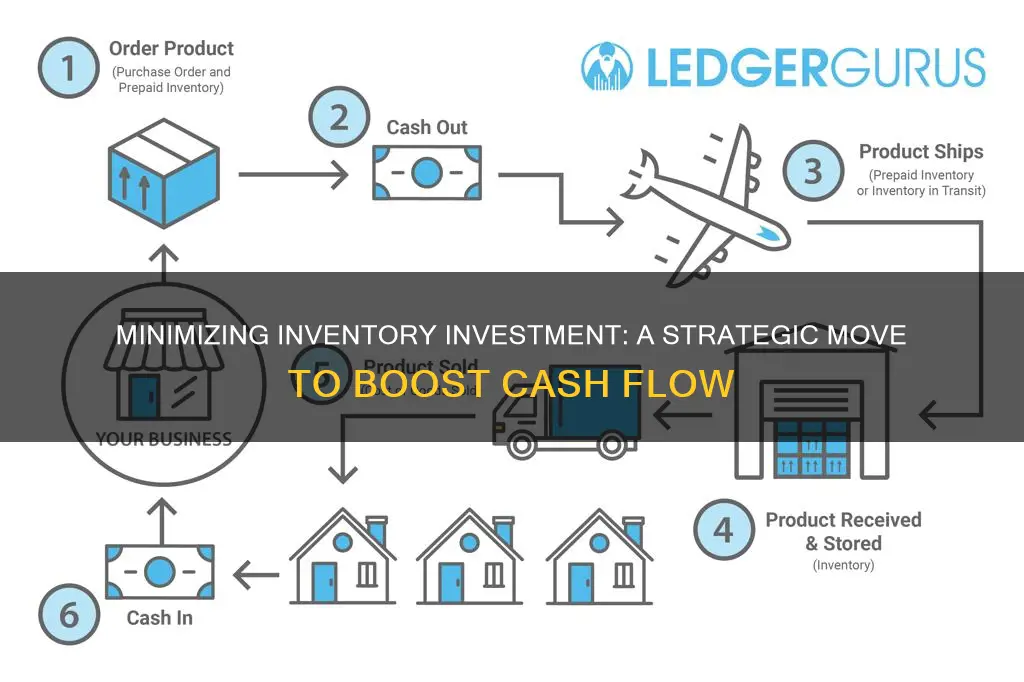

Minimizing investment in inventory can be a great way to improve cash flow. Cash flow is essential to keeping a business running and, for product-based businesses, inventory is one of the biggest factors in managing cash flow. It is easy to tie up a lot of cash in inventory, and optimizing your inventory management process allows you to keep enough free cash available for other operational expenses.

Inventory management and cash flow are closely linked. Poor inventory management can lead to a surplus, resulting in extra expenses and not enough sales to make up for production costs. It can also lead to the opposite problem: not having enough product to meet demand, causing a company to lose money to competitors.

By minimizing investment in inventory, a business can reduce expenses and avoid having cash tied up in products that sit on shelves. This improves cash flow and can free up resources to invest in other areas of the business.

| Characteristics | Values |

|---|---|

| Impact on cash flow | Positive |

| Inventory management | Important |

| Inventory and cash flow | Interlinked |

| Inventory stock increase | Negative |

| Inventory stock decrease | Positive |

| Inventory as a cash outlay | Negative |

| Inventory as a business asset | Positive |

| Inventory optimization | Positive |

| Inventory management software | Helpful |

What You'll Learn

Inventory management impacts cash flow

Inventory management and cash flow are closely linked. Poor inventory management can lead to a negative cash flow, while good inventory management can improve it.

The Impact of Poor Inventory Management

Poor inventory management can lead to a business having too much or too little product. If there is too much product, money is spent on storing the extra product, eating into cash flow. If there is too little product, demand may exceed supply, causing the business to lose money to competitors and reducing cash flow.

The Impact of Good Inventory Management

Good inventory management can help a business avoid the problems caused by poor inventory management. By knowing exactly how much product is needed to meet customer demands, a business can avoid overspending on production and warehousing costs, and ensure that it is able to fill orders, thereby improving cash flow.

Inventory Turnover Ratio

The inventory turnover ratio is a key measure of how well a business is doing. It is calculated by dividing net sales by the average inventory over a given period of time, typically one year. A high inventory turnover ratio indicates strong sales and high demand, while a low ratio indicates slow sales and weak demand.

Improving Inventory Management

There are several ways to improve inventory management, including investing in an inventory management system, implementing internal controls to avoid inventory shrinkage, and focusing on keeping inventory levels up for the best-selling products.

Inventory management has a direct impact on cash flow. By optimizing inventory management, a business can improve its cash flow and overall financial health.

Best ETFs to Invest in Now

You may want to see also

Inventory control improves cash flow

Inventory management and cash flow are closely linked. A business owner needs to ensure they have the necessary cash flow to pay all expenses, and one of the major factors in this is inventory management.

How Inventory Affects Cash Flow

Inventory is a huge asset for a product-based business. You need enough stock to fulfil orders, but if you buy too much inventory, your company may tie up cash in products that sit on the shelf and may even need to be discounted to sell.

How to Improve Cash Flow with Inventory Management

One of the first steps to smart inventory management is understanding how much product you’re currently selling. Use your inventory management software to create a report covering how much of each product SKU you’ve sold.

You can use different timeframes to gather further insights—daily and monthly reports can help you see how effective your current advertising tactics are. Yearly reports will help you see trends over time and historical order volume during different points in the year.

Your goal is to determine how much inventory you sell each month. This number will help you determine how much inventory you need to order from suppliers and how frequently you need to place orders.

Track this data regularly and keep an eye on the reports to see trends and make smart decisions based on those changes. This will keep you from overstocking and understocking items that have changed in popularity.

How to Calculate Inventory Turnover Ratio

While there are many ways to look at inventory, one great way to get an overall look at your inventory management is to calculate your inventory turnover ratio. Essentially, this ratio tells you how often you turn over your total inventory, on average, during a certain period.

Tips for Optimizing Inventory Management

- Revisit your levels of safety stock

- Stop making or buying items that don’t sell

- Implement internal controls to avoid inventory shrinkage

- Break down and report your inventory into three categories: safety stock, replenish stock, and obsolete stock

- Develop a company policy to deal with dead stock

- Reconsider bulk purchase discounts

- Pay attention to your supplier accounts

- Try dropshipping

- Try financing your inventory

Investing in Startups: Where to Begin?

You may want to see also

Inventory turnover and cash flow

Inventory management and cash flow are closely linked. A business owner must ensure they have the necessary cash flow to pay all expenses, and one of the major factors impacting this is inventory management.

Inventory turnover is a key measure of a business's performance. It is calculated by dividing net sales by the average inventory over a given period of time, typically a year. A high inventory turnover ratio is generally better, indicating strong sales and high demand.

A low inventory turnover ratio may be a sign of weak sales or excess inventory, while a high ratio could indicate insufficient inventory stocking. A low ratio can be advantageous during periods of inflation or supply chain disruptions if it reflects an inventory increase ahead of higher demand or supplier price hikes.

The inventory turnover ratio is a useful metric for businesses to make better decisions on pricing, manufacturing, marketing, and purchasing. It is also a measure of a company's liquidity, with a higher ratio equalling higher liquidity and more cash on hand to pay expenses.

A business can improve its inventory turnover ratio by implementing proper stock control, which will help reduce the cost of goods sold (COGS) and positively impact cash flow.

- Forecast demand and stock an adequate amount of inventory to meet that demand.

- Implement internal controls to avoid inventory shrinkage due to damage, employee carelessness, or theft.

- Categorise inventory into safety stock, replenish stock, and obsolete stock to stay organised and make smarter purchasing decisions.

- Develop a company policy to deal with dead stock and regularly evaluate products with low turnover ratios to see if the stock is obsolete.

- Reconsider bulk purchase discounts and only take advantage of them once cash flow is under control.

- Monitor supplier accounts closely if they are ordering and stocking inventory for you.

- Consider dropshipping or financing your inventory to free up cash flow if it suits your business model.

- Invest in an inventory management system to gain accurate insights into what to order and what is not selling.

In summary, a business can improve its cash flow by minimising investment in inventory and focusing on good inventory management practices, including proper planning, accurate tracking, and understanding demand to ensure the right amount of inventory is stocked to meet sales.

Investing and Paying Off Debt: Strategies for Financial Freedom

You may want to see also

Inventory financing

Who Uses It?

Advantages and Disadvantages

There are a variety of reasons why businesses may want to turn to inventory financing. However, while there are plenty of positives, there are also some downsides.

Advantages

- Companies don't have to rely on their business or personal credit ratings or their financial history.

- Smaller business owners don't have to put up their personal or business assets to secure financing.

- Being able to access credit allows companies to sell more products to their consumers over a longer stretch of time.

- Newer businesses are eligible and can access credit quickly.

Disadvantages

- Repayment may be problematic for new and struggling companies.

- Lenders may not advance the full amount requested.

- Fees and interest rates are higher for new and struggling businesses.

- Lenders may require regular check-ins to monitor inventory levels and sales.

Types of Inventory Financing

There are two different kinds of inventory financing:

- Inventory Loan: Also referred to as term loans, this kind of financing is based on the total value of the company's inventory. The lender issues a specific amount of money, and the company agrees to make fixed payments every month or to pay off the loan in full once the inventory is sold.

- Line of Credit: This form of financing provides businesses with revolving credit. It gives them regular access to credit as long as they make regular monthly payments to satisfy the terms and conditions of the contract.

Congress' Stock Secrets

You may want to see also

Inventory planning and risk mitigation

Understanding Inventory Risk

Inventory risk is the probability that a business will be unable to sell its goods or that its inventory stock will decrease in value. There are several types of inventory risk, including inaccurate inventory forecasting, unreliable suppliers, storage risk, process risk, and financial risk. These risks can lead to financial losses, customer dissatisfaction, damage to reputation, and operational disruptions.

Strategies for Risk Mitigation

To mitigate these risks, businesses can implement various strategies, including:

- Using forecasting tools and demand planning: By analyzing historical sales data, tracking market trends, and using forecasting tools, businesses can make more informed purchasing decisions and avoid stockouts or excess inventory.

- Diversifying product offerings and supply sources: Offering a range of products and sourcing from multiple suppliers can help reduce the impact of fluctuations in customer demand and supply chain disruptions.

- Implementing safety stock buffers: Building a buffer of inventory can help protect against unexpected demand fluctuations or supply disruptions.

- Improving storage conditions: Proper storage practices, climate-controlled facilities, and robust security measures can help prevent damage or spoilage of inventory.

- Streamlining inventory management processes: Efficient and accurate inventory management procedures, such as regular cycle counts and barcode scanning systems, can reduce discrepancies, lost items, and operational costs.

- Exploring hedging strategies and alternative financing options: Optimizing the inventory turnover ratio and exploring alternative financing options can help manage financial risks associated with holding inventory.

Benefits of Effective Inventory Risk Management

Effective inventory risk management offers several benefits, including:

- Avoiding financial losses: By mitigating inventory risks, businesses can avoid financial losses due to lost sales, overstocking, damaged or spoiled inventory, and product recalls.

- Maintaining customer satisfaction: Effective inventory management ensures that businesses have enough inventory to meet customer demand, reducing the risk of stockouts and frustrated customers.

- Protecting reputation: Inventory risk management helps prevent inventory-related problems, such as product recalls and quality issues, which can damage a company's reputation and make it difficult to attract and retain customers.

- Maintaining efficient operations: By minimizing disruptions and ensuring continuity of operations, businesses can maintain efficient supply chain operations and reduce delays.

Case Studies

Several well-known companies have successfully implemented inventory risk management strategies:

- Amazon: Amazon uses algorithms and data analytics to optimize inventory levels and reduce the risk of stockouts. They also work closely with suppliers to minimize lead times and improve inventory management.

- Walmart: Walmart combines demand forecasting, safety stock management, and inventory control systems to reduce inventory risk. They use RFID technology to improve inventory visibility and accuracy.

- Zara: Zara has a unique inventory management system that allows them to quickly respond to changing customer demand. They produce small batches of clothing and frequently introduce new styles, collaborating closely with suppliers and emphasizing supply chain efficiency.

- Apple: Apple uses a just-in-time inventory management system to minimize excess inventory. They work closely with suppliers to ensure timely deliveries and maintain accurate inventory control systems.

- Toyota: Toyota employs a lean inventory management system, focusing on minimizing waste and optimizing supply chain efficiency. They use a pull system, where inventory is produced only when needed, and work closely with suppliers to improve inventory management.

Retirement Planning: Navigating TD Ameritrade's Investment Options

You may want to see also

Frequently asked questions

Inventory management and cash flow are closely linked. "Cash flow" refers to the amount of money made and paid out. Inventory management refers to how a product is ordered, stored, and tracked. When you know exactly how much product you need to manufacture, you avoid overspending in production and warehousing costs.

Inventory turnover is a key measure of a business's performance. A high inventory turnover ratio indicates strong sales, while a low ratio means you are buying more inventory than you are selling.

Poor inventory control can lead to reduced sales, dissatisfied customers, and obsolete stock. For example, if a company cannot stock enough inventory to meet demand, customers may turn to competitors.

You can improve cash flow by implementing strategies such as investing in an inventory management system, maintaining safety stock, and focusing on popular products.