Whether to invest or pay off debt is a common financial dilemma. While there is no one-size-fits-all answer, understanding the factors involved can help you make informed choices.

Prioritising debt repayment can lay the groundwork for long-term financial stability. It acknowledges the urgency of addressing existing debts, especially high-interest ones, as they can be a substantial drain on your resources. By allocating your money towards paying off these debts, you can reduce the burden of interest payments.

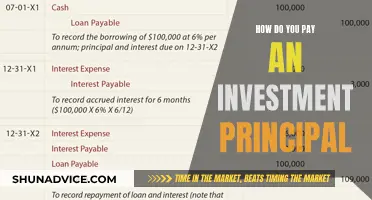

On the other hand, investing can be a way to set money aside for the future, ideally in an investment vehicle that will grow in value over time. If you can earn more interest on your money by investing than your debts are costing you, then investing may be a good option.

Ultimately, finding a balance that supports your goals is crucial. It is possible to pay down debt and invest simultaneously, ensuring you are building your financial security and working towards your future goals.

| Characteristics | Values |

|---|---|

| Interest rates | Compare the interest rates on your debts to the interest rates on your investments. If your debt has a higher interest rate, focus on paying it off first. |

| Credit score | Paying off debt can improve your credit score, which can lead to better loan terms and financial opportunities in the future. |

| Emergency fund | It is important to have an emergency fund to prepare for unexpected expenses. Consider setting aside three to six months' worth of living expenses. |

| Risk tolerance | Consider your risk tolerance when deciding whether to invest or pay off debt. Investing involves more risk and volatility, while paying off debt provides a guaranteed return. |

| Psychological factors | Paying off debt can provide psychological and emotional benefits, such as a sense of financial freedom and reduced stress. |

| Long-term goals | Consider your long-term financial goals when deciding whether to invest or pay off debt. Investing early can impact your retirement success, while carrying debt into retirement can be detrimental. |

What You'll Learn

Pay off high-interest debt first

Paying off high-interest debt first is a common strategy for managing your finances. This approach is known as the "avalanche method" and it involves making the minimum monthly payments on all your credit cards and loans, while putting any extra money towards the debt with the highest interest rate.

This strategy is a smart move as it helps you tackle the costliest debt first. Credit card debt and high-interest loans can accumulate interest at rates that far exceed what you can earn through savings or investments. By prioritising the repayment of these debts, you reduce the burden of interest payments and free up financial resources for other goals.

However, it's important to note that this strategy may not be the best option for everyone. If you have multiple accounts with similar interest rates, or if the debt with the highest interest rate also has a large balance, it could take a while to pay it down, which may be discouraging.

Additionally, it's crucial to consider your unique circumstances and goals when deciding how to manage your debt. While paying off high-interest debt first can be a prudent financial strategy, it's important to also prioritise building an emergency fund and saving for retirement, especially if you have access to an employer match in a retirement plan.

Furthermore, don't forget the psychological and emotional benefits of paying off certain debts. For example, becoming the true owner of a property, free and clear of any mortgage responsibility, can bring peace of mind and a sense of security.

In conclusion, while paying off high-interest debt first can be a financially savvy move, it's important to consider your specific situation, stay motivated, and seek advice from a financial advisor to create a comprehensive plan that aligns with your short-term and long-term goals.

TSP Investments: Understanding the Distribution Dynamics

You may want to see also

Build an emergency fund

Building an emergency fund is a crucial step in achieving financial security. An emergency fund is a dedicated savings account for unexpected expenses or financial emergencies, such as car repairs, medical bills, or unemployment. Here are some detailed tips to help you build a robust emergency fund:

Understand the Importance of an Emergency Fund:

Unexpected expenses can arise at any time, and having an emergency fund will help you stay financially secure and avoid taking on high-interest debt. It provides a safety net that can cover surprise costs, giving you peace of mind and helping you stay on track with your long-term financial goals.

Set Clear Goals:

Start by setting a clear and achievable goal for your emergency fund. Generally, it is recommended to save anywhere from three to six months' worth of living expenses. However, this may vary depending on your personal circumstances. Consider your essential monthly expenses, such as rent, utilities, groceries, and any other necessary costs. Aim to save enough to cover these expenses for at at least three months as your initial target.

Create a Budget and Save Consistently:

Creating a budget is essential to building your emergency fund. Analyze your income and expenses to determine how much you can realistically set aside each month. Make saving a habit by setting up automatic transfers from your checking account to your emergency fund. Even small, regular contributions can add up over time. Consistency is key—try to save a fixed amount each month and gradually increase it if possible.

Choose the Right Account:

Select a safe and easily accessible account for your emergency fund. A high-yield savings account is a popular option, as it allows your savings to grow through interest accumulation while remaining liquid. Look for accounts with competitive annual percentage yields (APY) to maximize the interest earned on your savings.

Explore Other Options:

In addition to a high-yield savings account, there are other options to consider for your emergency fund. These include certificates of deposit (CDs), U.S. Treasury bills, and money market mutual funds. Each of these options has its own advantages and maturity periods, so be sure to research them thoroughly before deciding.

Prioritize and Stay Disciplined:

Balancing your emergency fund with other financial goals, such as paying off debt, can be challenging. It is crucial to prioritize and stay disciplined. While paying off high-interest debt is important, having a small emergency fund can provide a crucial cushion. Work towards both goals simultaneously, ensuring you don't neglect one at the expense of the other.

Remember, building an emergency fund takes time and discipline. Start with small steps, stay consistent, and gradually work towards your financial goals.

Young Investors: Why the Reluctance?

You may want to see also

Weigh up investing vs paying off debt

Weighing up investing against paying off debt is a common financial dilemma. There is no one-size-fits-all answer, but understanding the factors involved can help you make informed choices. Here are some key considerations to help you evaluate which option is best for your situation:

Interest Rates and Returns

A crucial factor in deciding whether to invest or pay off debt is comparing the interest rates on your debts with the potential returns on your investments. If you can earn a higher return on your investments than the interest you are paying on your debts, investing may be the better option. However, it's important to remember that investment returns can be volatile and are not guaranteed, whereas paying off debt provides a certain return in the form of interest savings.

High-Interest Debt

High-interest credit card debt should be a priority for repayment. Credit cards often have high interest rates, and the average rate tracked by Investopedia's credit card database was 24.37% as of April 2024. By paying off this type of debt first, you can save significant money on interest and prevent it from accumulating further.

Emergency and Retirement Funds

Building an emergency fund is essential before investing or paying off low-interest debt. Aim to save at least three to six months' worth of living expenses to protect yourself from unforeseen financial challenges. Additionally, consider your retirement timeline and the impact of debt on your retirement plans. It is generally advisable to avoid bringing debt into retirement, especially high-interest credit card debt, which can eat away at your cash flow and net worth.

Credit Score and Psychological Factors

Paying off debt can improve your credit score, making it easier to borrow money in the future and potentially resulting in better loan terms and financial opportunities. Additionally, the psychological and emotional benefits of being debt-free can provide peace of mind and reduce financial stress. On the other hand, investing may offer a sense of financial security and the excitement of growing your wealth.

Balancing Act

Remember that you don't necessarily have to choose between investing and paying off debt. It is often possible to do both simultaneously. Establish a balanced approach that addresses your short-term needs and long-term financial goals. Work with a financial advisor to create a strategy that fits your unique circumstances and goals.

Warehouses: An Overlooked Investment Haven

You may want to see also

Prioritise paying off credit card debt

Credit card debt can quickly spiral out of control, with interest rates that can far exceed what you earn in your savings account. Therefore, prioritising paying off credit card debt is a prudent financial strategy.

Credit card debt is considered high-interest debt, and the longer you hold onto it, the more money you will owe. The average credit card interest rate in the US hit 20.09% in February 2023, a significant increase from 14.56% in the first quarter of 2022. This large jump means that reducing credit card debt should be a top priority.

The two most popular debt repayment strategies are the debt avalanche and snowball methods. The debt avalanche method focuses on paying off the highest-interest debt first, which saves the most money in the long run. On the other hand, the snowball method targets the smallest debt first to provide quick wins and build motivation.

The debt avalanche method is particularly effective for credit card debt because it saves you the most time and money. Credit card debt often has high interest rates, and by paying it off first, you can prevent the debt from growing larger. Additionally, credit card debt can negatively impact your credit score, which can affect your ability to secure loans or favourable loan terms in the future.

While it is essential to pay off credit card debt, it is also crucial to have an emergency fund. Building an emergency fund ensures that you have a financial cushion for unexpected expenses, such as car repairs or medical bills. This fund can help prevent you from relying on credit cards to cover these costs, reducing the risk of increasing your debt load.

In conclusion, prioritising paying off credit card debt is essential due to the high interest rates associated with this type of debt. By using strategies like the debt avalanche or snowball method and maintaining an emergency fund, you can effectively manage and reduce your credit card debt.

When Investors Stop Investing

You may want to see also

Consider debt consolidation

Debt consolidation refers to taking out a new loan or credit card to pay off other existing loans or credit cards. It involves combining multiple debts into a single, larger loan, which may offer more favourable payoff terms, such as a lower interest rate, lower monthly payments, or both.

There are two primary ways to consolidate debt:

- Get a 0% interest, balance-transfer credit card: Transfer debt onto this card and then be sure to pay it off during the promotional period to get the interest-rate break. You will likely need good or excellent credit (690 or higher) to qualify.

- Get a fixed-rate debt consolidation loan: Use the money from the loan to pay off your debt, then pay back the loan in instalments over a set term. You can qualify for a loan if you have bad or fair credit (689 or below), but borrowers with higher scores will likely qualify for the lowest interest rates.

Two additional ways to consolidate debt are taking out a home equity loan or borrowing from your retirement savings with a 401(k) loan. However, these options come with risks—you could lose your home or your retirement savings if you're unable to make the payments.

Debt consolidation can be a good idea if:

- Your monthly debt payments (including mortgage or rent) don't exceed 50% of your monthly gross income.

- You have enough cash flow to cover debt payments.

- You can pay off the consolidation loan within five years.

- You can get a lower interest rate than you're currently paying, which will help you reduce your total debt.

However, debt consolidation is not a cure-all for severe debt problems. It may not be worth it if:

- Your debt load is small, and you can pay it off within six months to a year at your current pace.

- The total of your debts is more than half your income, and debt consolidation is not your best option according to a debt calculator.

- You're overwhelmed by debt and have no hope of paying it off even with reduced payments.

Hotel Investments: The Road to Returns

You may want to see also

Frequently asked questions

It depends on your circumstances. If you have high-interest debt, such as credit card debt, it's generally recommended to prioritise paying that off first. However, if you have the opportunity to invest with a higher rate of return than the interest rate on your debt, then investing may be the better option.

Paying off high-interest debt can free up your financial resources, alleviate emotional stress, and improve your credit score. It can also reduce the burden of interest payments, as credit card debt and high-interest loans can accumulate interest at rates that exceed what you earn in a savings account.

Investing can be a way to secure your financial future and build a financial safety net. It can also be more "fun" than simply saving or reducing interest expenses. Additionally, if your after-tax return on investments is greater than your after-tax cost of debt, investing may be the wiser financial decision.