When considering whether CDs (Certificates of Deposit) are suitable for short-term investments, it's important to understand the nature of these financial instruments. CDs are time deposits offered by banks, typically with a fixed maturity date and a predetermined interest rate. While CDs can provide a secure and predictable return, they are generally designed for longer-term commitments, often ranging from a few months to several years. However, there are certain scenarios where short-term CDs can be advantageous, such as when an investor needs a liquid asset for a specific, short-term goal or when they prefer a low-risk investment with a guaranteed return. In this paragraph, we will explore the factors that determine the suitability of CDs for short-term investments and discuss the potential benefits and considerations for investors.

What You'll Learn

- Market Volatility: CDs offer stable returns, contrasting with volatile stock markets

- Liquidity: CDs typically have penalties for early withdrawal, limiting short-term liquidity

- Interest Rates: Rising rates may reduce CD attractiveness for long-term investors

- Tax Implications: Tax treatment varies, impacting short-term investment strategies

- Risk Management: CDs are generally low-risk, making them less suitable for short-term, high-risk tolerance

Market Volatility: CDs offer stable returns, contrasting with volatile stock markets

The concept of market volatility is a critical aspect of investing, and it's especially relevant when considering the nature of Certificate of Deposits (CDs) and their suitability as short-term investments. Market volatility refers to the rapid and significant fluctuations in asset prices, which can be influenced by various economic, political, and global events. In contrast to the unpredictable nature of stock markets, CDs provide a stable and predictable investment option.

CDs are time-bound deposits offered by banks, typically with fixed interest rates. When you invest in a CD, you agree to keep your money in the account for a specified period, often ranging from a few months to several years. During this time, the bank guarantees a fixed rate of return, ensuring that your investment remains stable and secure. This stability is a stark contrast to the volatile stock market, where prices can fluctuate dramatically in a short period.

In volatile stock markets, investors often face uncertainty and risk. Stock prices can drop significantly in a matter of days or weeks, leading to potential financial losses. This volatility is primarily driven by market sentiment, economic news, and global events, which can be challenging to predict. As a result, short-term investments in stocks may not provide the stability and security that investors seek.

CDs, on the other hand, offer a safe haven for investors who prefer a more conservative approach. By locking in a fixed interest rate for a predetermined period, CDs provide a predictable return, shielding investors from the immediate impact of market volatility. This stability is particularly appealing to risk-averse investors who want to preserve their capital while still earning a reasonable return.

In summary, market volatility highlights the importance of stable investment options like CDs. While stock markets can be unpredictable and volatile, CDs offer a secure and predictable return, making them an attractive choice for short-term investments. Understanding the contrast between these two investment vehicles can help investors make informed decisions, especially those seeking a more conservative and stable approach to growing their wealth.

Afs Investments: Long-Term Strategy or Short-Term Gamble?

You may want to see also

Liquidity: CDs typically have penalties for early withdrawal, limiting short-term liquidity

When considering whether CDs (Certificate of Deposits) are suitable for short-term investments, it's crucial to understand the concept of liquidity. Liquidity refers to how easily an investment can be converted into cash without significant loss of value. In the context of CDs, liquidity is an important factor to consider, especially for those seeking access to their funds in the short term.

CDs are time-bound investments where you deposit a fixed amount of money for a predetermined period, often ranging from a few months to several years. During this term, the funds are typically locked in, and early withdrawal can result in penalties. These penalties are designed to discourage investors from withdrawing their money before the agreed-upon maturity date, as it can impact the financial institution's ability to manage its own liquidity needs. The penalties for early withdrawal can vary, but they often include a fee based on the remaining term of the CD or a percentage of the principal amount.

The lack of short-term liquidity in CDs means that if you need access to your funds before the maturity date, you may face financial consequences. This can be a significant drawback for investors who require flexibility and quick access to their money. For instance, if an emergency arises, and you need to withdraw funds early, the penalty could be substantial, potentially eroding the potential gains from the CD.

Additionally, the fixed-term nature of CDs means that you must commit to a specific investment period, which may not align with your short-term financial goals. While CDs can offer higher interest rates compared to traditional savings accounts, the trade-off is the reduced liquidity and the potential financial penalty for early withdrawal.

In summary, when evaluating CDs as short-term investments, it's essential to consider the impact of penalties for early withdrawal on your liquidity needs. CDs are best suited for investors who can commit to a fixed term and are comfortable with the lack of immediate access to their funds. Understanding the liquidity constraints of CDs will help investors make informed decisions and choose the right investment vehicles that align with their financial objectives and risk tolerance.

Understanding Short-Term Investments: Are They Cash Equivalents?

You may want to see also

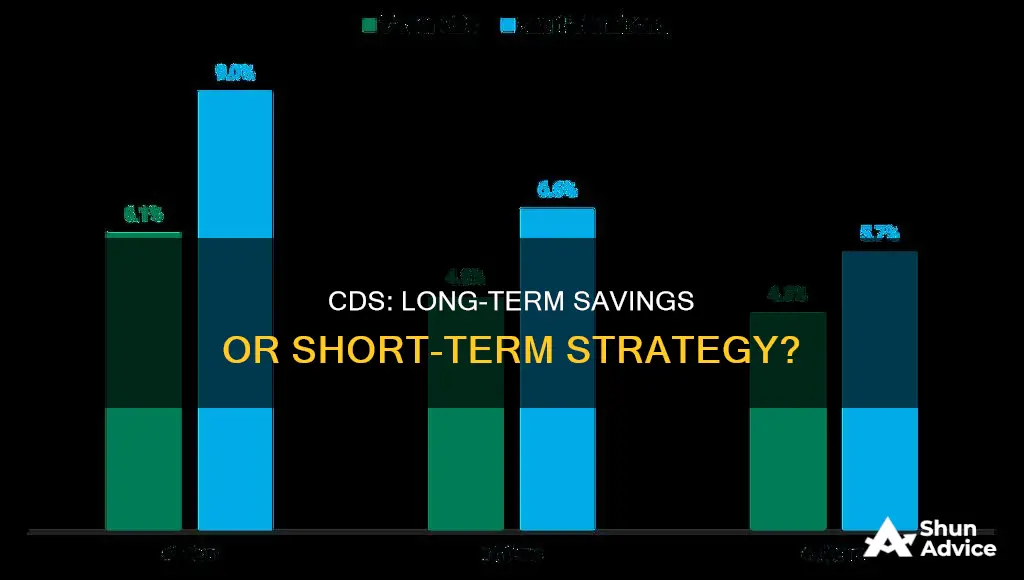

Interest Rates: Rising rates may reduce CD attractiveness for long-term investors

As interest rates rise, the appeal of certificates of deposit (CDs) for long-term investors may diminish. CDs are typically considered low-risk, fixed-income investments with a predetermined maturity date and a fixed interest rate. When interest rates increase, the allure of CDs for investors seeking stable returns over the long term can be significantly impacted.

Long-term investors often seek investments that offer consistent returns over an extended period. CDs, with their fixed interest rates, can provide a sense of security and predictability in an uncertain economic environment. However, as interest rates rise, the fixed rate of a CD may become less attractive compared to other investment options. For instance, if the market interest rate for similar-term investments has increased, investors might be enticed to switch to these newer options, leaving CDs less competitive.

The impact of rising interest rates on CDs is particularly notable for those with longer-term investment horizons. When rates are low, long-term CDs can offer substantial returns, but as rates rise, the potential for higher returns elsewhere may outweigh the benefits of a CD's fixed rate. This is especially true for investors who are risk-averse and prefer the stability of a fixed income.

Additionally, the term length of CDs can play a crucial role in their attractiveness during periods of rising interest rates. Longer-term CDs may offer higher interest rates, but as rates increase, the longer duration could mean that investors miss out on even higher returns available in the short term. This trade-off between higher rates and longer durations can make it challenging for investors to decide whether to commit to a CD with a longer maturity.

In summary, while CDs have traditionally been a reliable investment option, particularly for risk-averse investors, rising interest rates can reduce their appeal for long-term investors. The potential for higher returns in other markets may encourage investors to seek alternatives, making it essential for individuals to carefully consider their investment strategies in a dynamic interest rate environment.

Mastering Short-Term Investing: Strategies for Quick Profits

You may want to see also

Tax Implications: Tax treatment varies, impacting short-term investment strategies

The tax implications of short-term investments, including those in Commercial Papers (CPs) or Commercial Debt Securities (CDS), can significantly impact an investor's overall financial strategy. Understanding the tax treatment of these investments is crucial for making informed decisions, especially for those with a focus on short-term gains.

In many jurisdictions, short-term investments are typically taxed differently from long-term holdings. For instance, in the United States, short-term capital gains are generally taxed at ordinary income tax rates, which can be higher than the long-term capital gains rate. This is an important consideration for investors, as it directly affects their net returns. When investing in CDS, which are often considered short-term instruments, the tax treatment can vary depending on the specific type of CDS and the investor's tax residency.

One key aspect is the distinction between tax-free and taxable CDS. Tax-free CDS, also known as tax-free municipal bonds, are issued by state or local governments and are exempt from federal income tax. These investments can be attractive for short-term strategies as they provide a steady stream of interest income without the immediate tax burden. However, it's essential to note that tax laws can change, and what was once considered tax-free may become taxable, impacting the overall strategy.

On the other hand, taxable CDS are subject to income tax on the interest earned. This type of investment may be more suitable for investors who are looking to defer taxes or those in a lower tax bracket. The tax treatment of taxable CDS can vary based on the investor's tax status and the holding period. Short-term holdings might be taxed at a higher rate, while longer-term investments could benefit from more favorable tax rates.

Additionally, investors should be aware of the potential impact of tax laws on their overall investment performance. Tax-efficient strategies may involve careful selection of investment vehicles, including CDS, and a well-planned investment timeline. For instance, investors might choose to hold CDS for a short period to benefit from lower tax rates on short-term gains, especially if they anticipate selling the investment soon after purchase. Understanding these nuances can help investors optimize their tax position and overall investment returns.

Long-Term Investment Strategies: Navigating the Market's Future

You may want to see also

Risk Management: CDs are generally low-risk, making them less suitable for short-term, high-risk tolerance

When considering whether CDs (Certificate of Deposits) are suitable for short-term investments, it's important to understand the nature of these financial instruments and their associated risks. CDs are typically low-risk investments, which means they are not well-suited for those seeking high-risk tolerance in the short term. This is primarily due to the fixed nature of CDs, which offer a predetermined interest rate and maturity date.

In the context of risk management, CDs are considered a safe haven for investors. They provide a secure and predictable return, especially when compared to more volatile short-term investments. The low-risk profile of CDs is a result of their issuance by banks and credit unions, which are highly regulated financial institutions. These institutions are required to maintain certain levels of liquidity and financial stability, ensuring that investors' funds are protected.

However, the very nature of CDs being low-risk also makes them less attractive for short-term, high-risk tolerance investors. Short-term investors often seek flexibility and the potential for higher returns, which CDs may not provide. CDs typically have a fixed term, ranging from a few months to several years, during which the investor is committed to the investment. This lack of flexibility can be a drawback for those who prefer a more dynamic approach to their investments.

For short-term investors, the low-risk nature of CDs can be seen as a double-edged sword. While it ensures capital preservation, it may also result in lower potential returns compared to riskier alternatives. CDs are designed to provide a stable and secure investment, but this stability might not align with the goals of short-term investors who aim to maximize returns in a short period.

In summary, while CDs are generally considered low-risk investments, this characteristic makes them less ideal for short-term, high-risk tolerance investors. Understanding the trade-off between risk and return is essential for investors to make informed decisions about their short-term investment strategies.

The Long-Term Value of Real Estate: A Smart Investment Strategy

You may want to see also

Frequently asked questions

CDs are time deposits offered by banks or credit unions. They are a type of fixed-income security where you lend your money to the bank for a specified period, typically ranging from a few months to several years. In return, the bank agrees to pay you a fixed rate of interest at maturity.

No, CDs are generally not classified as short-term investments. They are typically considered medium to long-term investments due to their fixed maturity dates and the time commitment required. The term length can vary widely, and some CDs may have early withdrawal penalties if redeemed before maturity.

CDs offer several advantages for investors seeking stable, predictable returns. They provide a higher interest rate compared to regular savings accounts, especially for longer-term deposits. CDs are also FDIC-insured, ensuring the safety of your principal investment. Additionally, they offer discipline in saving, as early withdrawal can result in penalties, encouraging investors to keep their money invested for the agreed-upon term.