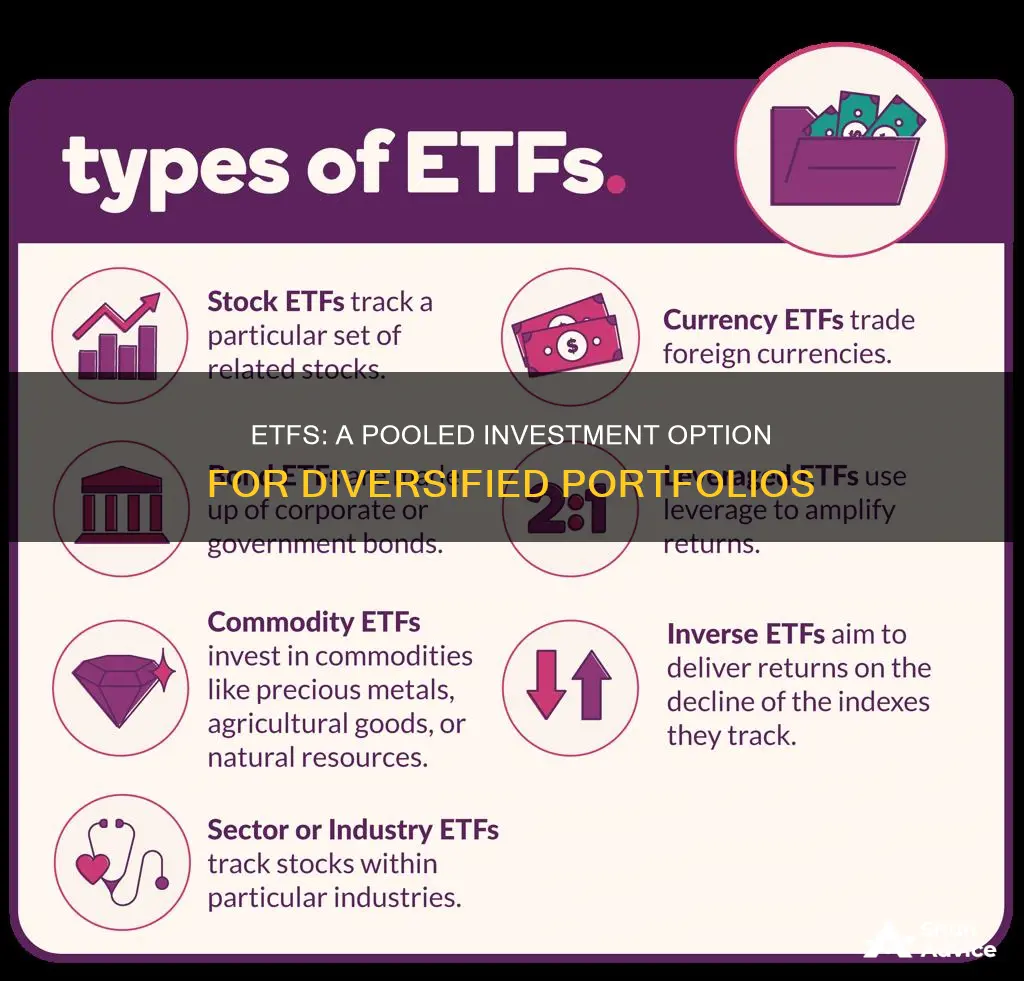

Exchange-traded funds (ETFs) are pooled investment funds that are traded on an exchange like individual stocks. They are professionally managed and allow investors to benefit from economies of scale. ETFs can be structured to track anything from the price of a commodity to a large and diverse collection of securities. They are also known for their low expense ratios and fewer broker commissions compared to buying stocks individually. ETFs are considered more liquid than mutual funds as they can be traded during regular market hours, whereas mutual funds can only be purchased after the market closes.

| Characteristics | Values |

|---|---|

| Definition | Exchange-traded funds (ETFs) are pooled investment funds that aggregate many individual investments into one large investment. |

| Examples | Mutual funds, hedge funds, pension funds, and unit investment trusts (UITs) are all examples of pooled investment funds. |

| Benefits | Investors in ETFs benefit from economies of scale, such as lower transaction costs and wider exposure. |

| Management | ETFs are passively managed, meaning their performance is pegged to a specific market index. |

| Trading | ETFs can be traded on the stock market like shares. |

| Liquidity | ETFs are considered more liquid than mutual funds as they can be traded throughout the trading day. |

| Fees | ETFs have lower fees and expenses than mutual funds due to less active management. |

| Taxes | ETFs offer tax advantages to investors as passively managed portfolios realize fewer capital gains. |

What You'll Learn

ETFs are professionally managed

Exchange-Traded Funds (ETFs) are professionally managed by a portfolio or fund manager. They can be actively or passively managed. Actively managed ETFs are overseen by a manager or team who makes decisions on the underlying investments in the fund. The manager can adjust the investments within the fund as desired and is not subject to the set rules of tracking an index. The active fund manager aims to beat a benchmark using research and strategies. Actively managed ETFs can be further divided into traditional actively managed ETFs and semi-transparent active equity ETFs.

Passively managed ETFs, on the other hand, attempt to closely track a benchmark such as a broad stock market index like the S&P 500. They are designed to mimic the contents of an index, with the return being nearly identical to the return of the index.

While most ETFs are passive investments, active management offers the possibility of higher returns through the decisions of the fund managers and research analysts. However, the fund might also underperform the benchmark. Actively managed ETFs also tend to be more expensive than passively managed ETFs, with higher expense ratios.

Actively managed ETFs share many characteristics with passive ETFs, but they tend to be more expensive. They often have higher expense ratios than passive ETFs, which puts pressure on fund managers to outperform the market. The potential to outperform the market depends on the manager's abilities. While some managers will regularly beat expectations, most research finds that active management tends to underperform passive strategies.

Actively managed ETFs can be a good choice for investors who want the possibility of higher returns and are comfortable with the higher fees. However, investors who cannot afford the higher fees or do not want to take on the additional risk of underperformance may prefer passively managed ETFs or other investment options.

A Beginner's Guide to Investing in ETFs with Fidelity

You may want to see also

ETFs are traded on the stock market

Exchange-traded funds (ETFs) are a type of investment fund that can be traded on stock exchanges. They are bought and sold in the same way as individual stocks, with prices fluctuating throughout the trading day. ETFs are a pooled investment security, meaning they are a collection of investments aggregated into one large investment fund. This allows investors to benefit from economies of scale and gain exposure to a wide range of securities with a limited budget.

ETFs can be structured in various ways and can track anything from the price of a commodity to a diverse collection of securities. They can also be designed to track specific investment strategies. For example, an ETF might track the performance of an index, such as the S&P 500, by holding the same securities in the same proportions. This is known as passive investing, where investors bet on the "market average" instead of trying to pick the best investments. Passive ETFs aim to replicate the performance of a broader index, and they tend to have lower fees than actively managed funds.

Actively managed ETFs, on the other hand, have portfolio managers who make decisions about which securities to include in the fund. These ETFs can deviate from the benchmark index and may perform better than it. However, the added service of active management comes at a higher cost.

ETFs are traded on exchanges in the secondary market and are negotiable securities. This means that they are bought and sold between investors, rather than directly from the issuer. When investors purchase ETFs, they are buying shares from other investors at the market price, usually with a commission.

ETFs are known for their liquidity, as they can be bought and sold at current market prices at any time during the trading day. They are also transparent, with holdings generally published online daily. The largest ETFs have very strong market liquidity, with high regular trading volume and tight bid-ask spreads.

In summary, ETFs are traded on the stock market and offer investors a flexible, low-cost, and tax-efficient way to gain exposure to a broad range of securities.

Lithium ETF: A Smart Investment Strategy for Beginners

You may want to see also

ETFs are passively managed

Exchange-traded funds (ETFs) can be passively or actively managed. Passively managed ETFs attempt to track a benchmark, such as a broad stock market index like the S&P 500, and are not subject to the set rules of tracking an index. They are designed to mirror the holdings of a designated index—a collection of tradable assets deemed to be representative of a particular market or segment. Passive ETFs are subject to the total market risk and lack flexibility. They are also heavily weighted towards the highest-valued stocks in terms of market cap.

Passive ETFs are a popular strategy among investors who prefer a long-term, buy-and-hold approach. They tend to follow buy-and-hold strategies to try to track a particular benchmark. Passive ETFs tend to be lower-cost and more transparent than actively managed ETFs, but they do not provide any room for outperformance. Passive ETFs will often have lower management fees compared to actively managed ETFs.

Passive ETFs are known for their cost-efficiency and generally have lower management fees. The primary objective of passive ETFs is to replicate the performance of a specific benchmark index or asset class without requiring active decision-making. Since there is no active manager trying to beat a benchmark, there is often a reduced administrative fee. This is because most passive ETFs rely on a rules-based approach that doesn't involve the ongoing costs associated with active research or security selection.

Passive ETFs have seen substantial growth in popularity since their introduction in 1993. The low returns posted by actively managed funds and the endorsement of passive investing vehicles by influential figures such as Warren Buffett have led investor cash to flood into passive management. In August 2019, passive ETFs and mutual funds surpassed their active counterparts in assets under management (AUM), according to Morningstar.

ETFs: Are Investment Expenses Deductible from Your Taxes?

You may want to see also

ETFs are more liquid than mutual funds

Exchange-Traded Funds (ETFs) are indeed pooled investments. They are open-ended funds that can be created or redeemed based on investor demand. ETFs are professionally managed by experienced financial professionals who aim to deliver the highest potential returns for their investors.

Trading Mechanisms

ETFs can be traded on the stock market like shares, whereas mutual funds can only be purchased after the market closes, based on the calculated price. This makes ETFs more accessible and easier to trade, contributing to their higher liquidity.

Trading Frequency

ETFs trade throughout the day on an exchange, similar to stocks. In contrast, mutual funds only allow transactions once daily, making them less flexible and less liquid than ETFs.

Management Style

ETFs are passively managed, meaning their performance is tied to a specific market index. They only trade securities when the composition of the underlying index changes, resulting in minimal buying and selling within the fund. On the other hand, mutual funds are actively managed, and their fund managers buy and sell securities as deemed necessary, leading to more frequent trading.

Tax Implications

The passive management style of ETFs results in fewer taxable events. Actively managed mutual funds tend to generate more capital gains, which can lead to higher taxes for investors.

Fees and Expenses

Mutual funds are known for having higher fees and expenses than ETFs due to the higher costs associated with managing an active fund, including manpower and trading fees. The higher fees and expenses of mutual funds can deter investors, making ETFs relatively more liquid.

Trading Volume

While trading volume is not the sole determinant of liquidity, it can impact market makers' ability to create or redeem ETF units. ETFs that invest in securities with limited supply or difficult trading conditions may experience reduced liquidity. However, most well-diversified ETFs invest in liquid securities traded on major exchanges, ensuring sufficient trading volume.

In summary, ETFs are more liquid than mutual funds due to their trading mechanisms, frequency, management style, tax implications, and fee structures. These factors collectively contribute to the higher liquidity of ETFs compared to mutual funds.

ETFs: A Smart Investment Strategy for Your Money

You may want to see also

ETFs offer tax advantages

Exchange-traded funds (ETFs) are known for their tax efficiency. This is due to their unique structure and the way they are traded, which results in fewer capital gains than mutual funds. This tax efficiency is a significant part of their appeal to investors. Here are some reasons why ETFs offer tax advantages:

- Low Portfolio Turnover: ETFs tend to have low turnover, which reduces the realized gains that need to be distributed. However, it's important to note that different ETFs have different levels of internal turnover, so investors should review a fund's prospectus.

- More Long-term Capital Gains: The low turnover in ETFs often means a longer holding period for the underlying investments. Generally, ETFs hold underlying securities for longer than 12 months, which qualifies any gains realized for favourable long-term capital gains tax rates.

- Secondary Market Transactions: When an ETF investor sells their shares on the stock exchange to another investor, the ETF portfolio manager doesn't need to buy or sell any of the ETF's underlying investments. As a result, one investor's decision to sell doesn't impact others, helping to keep capital gains distributions low.

- Primary Market Transactions: ETFs have a unique creation and redemption mechanism that allows authorized participants (APs) to build or disassemble baskets of ETF shares based on demand. These transactions typically happen "in-kind", exchanging securities for ETF shares instead of cash. Since these transactions are not considered sales, they don't trigger taxable events for the fund, improving the tax efficiency of ETFs.

- Tax-loss Harvesting: ETFs lend themselves to tax-planning strategies such as tax-loss harvesting. Investors can sell ETFs with losses before their one-year anniversary and then hold ETFs with gains past this point to take advantage of the lower long-term capital gains tax rates.

While ETFs offer tax advantages, it's important to note that they can still have tax consequences. Distributions from ETFs, such as dividends, capital gains, or interest, may trigger taxable events. Additionally, the type of ETF and the jurisdiction of the investor can also impact the tax treatment of gains or losses. Therefore, it's crucial for investors to understand the tax implications of their ETF investments and consult with tax professionals before making investment decisions.

A Beginner's Guide to S&P 500 ETF Investing

You may want to see also

Frequently asked questions

Pooled investment funds aggregate capital from a number of individuals, investing as one giant portfolio. This allows investors to benefit from economies of scale, such as lower trading costs per dollar of investment and diversification.

An exchange-traded fund (ETF) is a pooled investment security that can be bought and sold like an individual stock. ETFs can be structured to track anything from the price of a commodity to a large and diverse collection of securities.

Yes, ETFs are pooled investment funds that offer investors an interest in a professionally managed, diversified portfolio of investments.

ETFs offer investors low expense ratios and fewer broker commissions than buying the stocks individually. They are also more tax-efficient than mutual funds.