Trusts and estates are complex financial arrangements that often require careful tax planning to ensure compliance with regulations. One of the critical considerations in this regard is the deductibility of various expenses, including investment management fees. The Tax Cuts and Jobs Act (TCJA) of 2017 introduced significant changes to the tax treatment of trusts and estates, including the elimination of certain deductions for tax years 2018 through 2025. This has led to uncertainty regarding the deductibility of investment management fees by trusts. The TCJA's impact is particularly notable for simple trusts, which, unlike complex trusts, are required to distribute all their income and cannot make charitable contributions. The evolving regulatory landscape underscores the importance of seeking professional advice to ensure compliance and optimize tax strategies for trusts and estates.

What You'll Learn

- Investment management fees are not deductible for income tax purposes

- Tax Cuts and Jobs Act (TCJA) suspends miscellaneous itemized deductions

- Trusts can deduct administrative expenses

- Trusts can deduct personal exemption and distribution deduction

- Investment management fees are subject to the 2% limitation

Investment management fees are not deductible for income tax purposes

However, it is important to distinguish between the types of fees being charged. Investment management fees are typically charged as part of a bundled fee, which includes other costs such as fiduciary, attorney, or accounting fees. These other fees are not subject to the 2% floor and are therefore still deductible. As a result, it is necessary to "unbundle" these fees to distinguish which portion is subject to the 2% floor and which is not.

The distinction between deductible and non-deductible fees lies in whether the expense is "commonly and customarily" incurred by an individual. For example, legal fees for a court case involving a trust asset could be incurred by an individual and are therefore non-deductible. Conversely, legal fees incurred in the decanting of a trust are trust-specific and are allowed as a deduction.

Other costs that are not deductible for trusts include ownership costs such as repairs, maintenance, condo fees, and insurance costs. These are considered costs that could be incurred by an individual owner of a property and are therefore not specific to an estate or trust.

It is worth noting that there is some ambiguity in the new section, and fiduciaries and financial institutions have expressed concern. While waiting for further guidance from the IRS, it is worth considering the support for the assertion that these fees are still deductible. For example, above-the-line trust and estate administration expenses, such as fiduciary fees, are not considered 'miscellaneous itemized deductions' and are therefore not subject to the 2% floor.

Saving Precedes Investing: The Foundation of Financial Planning

You may want to see also

Tax Cuts and Jobs Act (TCJA) suspends miscellaneous itemized deductions

The Tax Cuts and Jobs Act (TCJA) was signed on December 22, 2017, and came into effect on January 1, 2018. The Act introduced a new Section 67(g), which eliminated all "miscellaneous itemized deductions" for trusts and estates for tax years 2018 through 2025. This change has caused some ambiguity and concern among fiduciaries and financial institutions.

Before the TCJA, there were certain deductions that were considered "miscellaneous itemized deductions" and were limited to the amount exceeding 2% of adjusted gross income (AGI) for individual taxpayers. These included employee business expenses, investment expenses, educator expenses above the line, tax preparation fees, employees' home office expenses, and rural mail carrier vehicle expenses. The TCJA's suspension of these deductions means that, for tax years 2018 to 2025, there is no tax benefit for either income tax or net investment income tax. However, these expenses may still be deductible for state income tax purposes.

The TCJA also introduced changes to deductions, depreciation, and expensing, which may impact a taxpayer's business taxes. For example, the Act introduced a new provision, Section 199A, which allows a deduction of up to 20% of qualified business income for owners of some businesses, with limits based on income and type of business. Additionally, the TCJA generally eliminated the deduction for any expenses related to entertainment, amusement, or recreation activities. However, taxpayers can still deduct 50% of the cost of business meals if they meet certain conditions.

The Act also introduced new limits on the deduction for business interest expenses. The deduction for net interest is now limited to 50% of adjusted taxable income for firms with a debt-equity ratio above 1.5. Any disallowed interest above the limit can be carried forward indefinitely. There are some exceptions to this limit, and certain businesses can opt out of it.

Understanding Investment Portfolio Beta: A Beginner's Guide

You may want to see also

Trusts can deduct administrative expenses

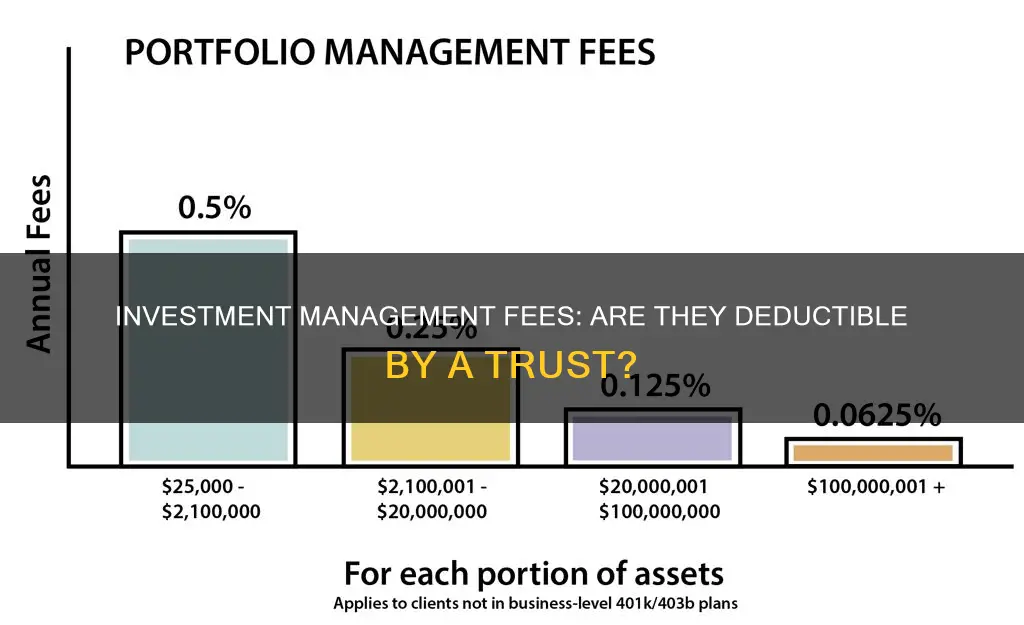

It is important to note that investment management fees and other expenses related to investment income have generally not been considered unique to a trust or estate and have been subject to the 2% limitation. The TCJA took effect in January 2018 and eliminated deductions on most investment-related expenses. Prior to this, investment management fees were considered miscellaneous deductions if they exceeded 2% of a taxpayer's AGI. For example, if a client had an AGI of $250,000 and spent more than $5,000 (2% of their AGI) on investment management fees, the excess amount could be deducted from their tax returns.

While the TCJA removed deductions for most investment-related expenses, a few remain tax-deductible. These include investment interest expenses, qualified dividends, tax-loss harvesting, and financial advisory fees paid directly from an IRA account.

Trusts and estates can also still deduct the personal exemption allowed for estates and non-grantor trusts, as well as the distribution deduction for income distributed to beneficiaries. These deductions are outlined in the proposed regulations and are generally in line with previous IRS guidance.

Visualizing Your Investment Portfolio: A Graphical Guide

You may want to see also

Trusts can deduct personal exemption and distribution deduction

Trusts and estates can deduct administrative expenses that would not have been incurred if the property was not held by a trust or estate. This includes the personal exemption allowed for estates and non-grantor trusts, and the distribution deduction for income distributed to beneficiaries.

The personal exemption allowed for estates and non-grantor trusts is an important aspect of trust taxation. It refers to a deduction that is allowed when calculating the adjusted gross income (AGI) of an estate or trust. This means that certain expenses, such as fiduciary fees, are deductible from the total income of the trust before calculating any taxes owed. This is significant because it reduces the taxable income of the trust, which can result in lower tax liability.

The distribution deduction, on the other hand, is a deduction that is allowed for income that is distributed to the beneficiaries of the trust or estate. This is based on the concept that income distributed to the beneficiaries is no longer considered income of the trust and, therefore, should not be taxed to the trust. This deduction is essential in ensuring that the trust is not taxed on income that it does not retain but rather distributes to the beneficiaries.

It is worth noting that the ability to deduct these expenses is outlined in specific sections of the tax code. For example, Section 67(e) of the Internal Revenue Code allows for the deduction of certain administrative expenses, while Sections 642(b), 651, and 661 address the distribution deduction. These sections provide clear guidelines for trusts and estates to ensure they are complying with the tax regulations.

In conclusion, trusts and estates can deduct the personal exemption and distribution deduction, which are crucial components of trust taxation. These deductions help reduce the taxable income of the trust and ensure that income distributed to beneficiaries is not taxed at the trust level. By understanding and utilizing these deductions, trusts can effectively manage their tax liabilities and ensure compliance with the applicable regulations.

Structuring an Investment Portfolio: Strategies for Success

You may want to see also

Investment management fees are subject to the 2% limitation

Prior to the TCJA, investment management fees were considered deductible administrative expenses unique to trusts or estates and could be deducted in full. However, the TCJA's introduction of a 2% limitation on miscellaneous itemized deductions created confusion as to whether these fees would still be deductible. The IRS addressed this concern in Notice 2018-61, clarifying that investment management fees are subject to the 2% limitation.

It's important to note that not all expenses related to trusts or estates are subject to this limitation. Certain expenses, such as fiduciary fees, tax preparation fees, and costs related to fiduciary accounts, are considered separate from miscellaneous itemized deductions and are fully deductible. These expenses are unique to the administration of a trust or estate and would not typically be incurred by an individual.

The distinction between expenses subject to the 2% limitation and those that are fully deductible can be complex, and it is always recommended to consult with tax professionals or experts in estate and trust taxation for specific guidance.

Viewing Your Acorns Investment Portfolio: A Simple Guide

You may want to see also

Frequently asked questions

The TCJA added a new section, Sec. 67(g), which eliminates all "miscellaneous itemized deductions" for trusts for tax years 2018 through 2025. Investment management fees have generally not been considered unique to a trust and, therefore, have been subject to the 2% limitation. As a result, investment management fees are no longer deductible in computing taxable income and distributable net income (DNI) for trusts.

Yes, there are certain circumstances where investment management fees may be deductible. If the costs incurred by the trust exceed those that would be charged to an individual, and this is solely due to the investment services being provided specifically to a trust, then the additional costs would be deductible.

If the investment services provided to the trust are specialized or require balancing the interests of various parties, the resulting additional costs would not be considered common to an individual investor and, therefore, may be deductible.

The non-deductibility of investment management fees for trusts can result in unexpected tax bills, as it increases the taxable income of the trust. This means that ordinary income may be taxed at the trust level, in addition to any capital gains, leading to a higher tax liability for the trust.