Form 1041 is the income tax return form used by trusts and estates to report their income, deductions, gains, and losses. There are several deductible expenses on Form 1041, including:

- Ordinary and necessary expenses, such as professional fees, office expenses, travel expenses, depreciation, and taxes.

- Interest and charitable contributions, subject to certain limitations.

- Taxes and distributions made to beneficiaries in accordance with the terms of the trust or estate's governing documents and applicable law.

- Fees for the services of trustees and executors, provided they are fair and required for the services rendered.

- Losses from the sale or exchange of property, capital gains and losses, and administrative expenses.

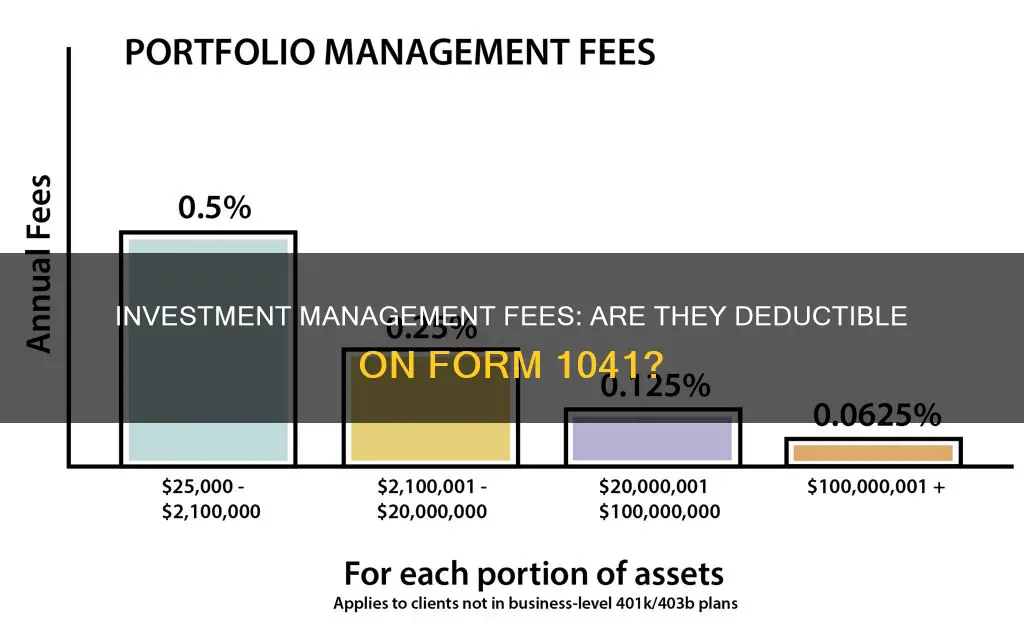

- Investment management costs, state death taxes, and expenses associated with a rental property, if applicable.

| Characteristics | Values |

|---|---|

| Are investment management fees deductible on form 1041? | No |

| When did the TCJA suspend the deduction for miscellaneous itemized deductions for individuals? | Until 2025 |

| What does the TCJA stand for? | Tax Cuts and Jobs Act |

| What does the TCJA do? | Suspends the deduction for miscellaneous itemized deductions for individuals |

| What does the TCJA not do? | Does not suspend the deduction for miscellaneous itemized deductions for estates and trusts |

What You'll Learn

Investment management fees are not deductible on Form 1041

The 2017 tax reform act, commonly known as the Tax Cuts and Jobs Act (TCJA), has resulted in many simple trusts having a tax liability on ordinary income, which was rarely the case prior to the act. This is because the TCJA suspended the deduction for miscellaneous itemized deductions for individuals until 2025.

Investment management fees are a type of miscellaneous itemized deduction. Therefore, under the TCJA, investment management fees are not deductible on Form 1041. This is true even if the fees would not have been incurred if the property were not held in the trust or estate.

The TCJA's impact on the deductibility of investment management fees on Form 1041 can be illustrated through an example. Assume a trust has income and expenses as follows:

- Interest income: $50,000

- Dividend income: $20,000

- Investment management fees: $15,000

- Other deductible expenses: $5,000

Under the TCJA, the trust's taxable income would be calculated as follows:

- Total income: $70,000 ($50,000 + $20,000)

- Deductions: $5,000

- Taxable income: $65,000

The trust's taxable income of $65,000 would be subject to tax at the trust level, even though it is a simple trust that is required to pay out all of its income.

Prior to the TCJA, the investment management fees would have been deductible, resulting in a lower taxable income and potentially no tax liability for the trust.

It is important to note that the suspension of the deduction for miscellaneous itemized deductions only applies to tax years 2018 through 2025. Therefore, investment management fees may become deductible on Form 1041 again starting in tax year 2026.

The TCJA's suspension of the deduction for miscellaneous itemized deductions has had a significant impact on the taxation of trusts and estates. Investment management fees, which were previously deductible on Form 1041, are no longer deductible for tax years 2018 through 2025. This change has resulted in many simple trusts having a tax liability on ordinary income, which was rare prior to the TCJA. It is important for taxpayers to be aware of this change to ensure accurate reporting and compliance with tax laws.

Building a Portfolio: Investing Strategies for Beginners

You may want to see also

Fiduciary fees are deductible on Form 1041

Fiduciary fees are generally fully deductible. However, if a portion of the income for the estate or trust comes from municipal bonds or other tax-exempt vehicles, you must allocate the fiduciary fees between taxable and tax-exempt income. You can only deduct the amount allocable to taxable income.

Fiduciary fees are not considered "miscellaneous itemized deductions", and therefore are not subject to the 2% floor. This means that you can deduct the full amount of the fiduciary fees, as long as they are not more than the total taxable income.

Fiduciary fees are considered administration costs and are deductible in arriving at adjusted gross income (AGI). This means that you can deduct these fees even if you do not itemize your deductions.

Fiduciary fees are deductible for estates and non-grantor trusts. For grantor trusts, the fees are considered the income of the grantor/owner and are not deductible for the trust.

Warren Buffett's Portfolio: A Guide to Investing Like Him

You may want to see also

Investment advisory fees are deductible on Form 1041

The 2017 Tax Cuts and Jobs Act (TCJA) eliminated the deduction for miscellaneous itemized deductions for individuals until 2025. This includes investment advisory fees for individuals. However, this does not apply to estates and trusts, which are allowed to deduct these fees as fiduciary fees.

Investment advisory fees are deductible for estates and trusts because they are considered costs that are paid or incurred in connection with the administration of the estate or trust and would not have been incurred if the property were not held in the trust or estate. These fees are deductible even if they are not directly related to a specific business or activity.

It is important to note that there are limitations to deducting investment advisory fees. Only the incremental costs of investment advice beyond the amount that would normally be charged to an individual investor are deductible. This includes costs for services that would be provided to any individual investor as part of an investment advisory fee, such as balancing the interests of current beneficiaries and remaindermen.

When preparing Form 1041, it is crucial to keep accurate records of all fees paid and the services provided to properly substantiate the deduction.

Strategies for Allocating Your Investment Portfolio Wisely

You may want to see also

Attorney and accountant fees are deductible on Form 1041

Attorney and accountant fees as administrative expenses

Attorney and accountant fees are considered administrative expenses and are deductible on Line 14 of Form 1041.

Other deductible expenses on Form 1041

In addition to attorney and accountant fees, there are other deductible expenses on Form 1041. These include:

- Ordinary and necessary expenses, such as professional fees, office expenses, travel expenses, depreciation, and taxes

- Interest and charitable contributions

- Taxes and distributions

- Fees for the services of trustees and executors

- Losses from the sale or exchange of property, capital gains and losses, and administrative expenses

- Investment management costs

- State death taxes

Spending, Saving, and Investing: What's the Difference?

You may want to see also

Tax return preparation fees are deductible on Form 1041

- Tax return preparation fees can include the cost of preparing not only the federal income tax return but also state and local tax returns.

- If the estate or trust uses tax preparation software to prepare its own return, the cost of the software is not deductible as a tax return preparation fee.

- If the estate or trust pays a flat fee that includes tax return preparation and other services, only the portion of the fee that is specifically for tax return preparation is deductible.

- Tax return preparation fees are deductible in the year they are paid or incurred.

- If the estate or trust uses an enrolled agent or a tax attorney to prepare its return, the fee may be deductible as a miscellaneous itemized deduction or may be deductible as a business expense, depending on the specific circumstances.

Invest Your Savings: Safe Strategies for Beginners

You may want to see also

Frequently asked questions

No. The TCJA suspended the deduction for miscellaneous itemized deductions for individuals until 2025. Tax rules for estates and trusts say that fiduciary tax laws follow individual tax law, unless they are explicitly exempted. Therefore, estates and trusts can no longer deduct investment advisor fees either.

Ordinary and necessary expenses, interest and charitable contributions, taxes and distributions, fees for the services of trustees and executors, capital gains and losses, administrative expenses, investment management costs, and state death taxes.

TAI is the trust's income as calculated by the terms of the trust's governing document and the applicable local law. DNI is the amount of income for the year that, if distributed, is taxable to the beneficiary.

The 2% itemized deduction is a rule that only allows deductions for miscellaneous itemized deductions to the extent that the total of the deductions exceed 2% of adjusted gross income.