The quick ratio is a financial metric used to determine a company's ability to pay off its short-term debts and meet its short-term obligations. It is calculated by dividing a company's liquid assets (cash, cash equivalents, marketable securities, and accounts receivable) by its current liabilities. This ratio provides insight into a company's financial health and liquidity position, indicating whether it has enough liquid assets to cover its short-term debts. A quick ratio above 1 is considered favourable, while a ratio below 1 may indicate potential liquidity issues. While the quick ratio is a valuable tool, it is important to consider other financial metrics and contextual factors for a comprehensive assessment of a company's financial health.

What You'll Learn

Quick ratio vs current ratio

The quick ratio and the current ratio are both measures of a company's short-term liquidity and financial health. However, they differ in terms of the timeframe considered and the types of assets included in their calculations.

Quick Ratio

Also known as the acid-test ratio, the quick ratio is a conservative measure of a company's liquidity. It focuses on the company's most liquid assets, which can be converted to cash within 90 days or less. The formula for the quick ratio is:

> Quick Ratio = (Cash + Cash Equivalents + Liquid Securities + Receivables) / Current Liabilities

The quick ratio only includes highly liquid assets or cash equivalents, such as cash, marketable securities, and accounts receivable. It excludes inventory and prepaid expenses, as these may take longer than 90 days to convert into cash. A quick ratio above one is considered excellent, as it indicates that the company's assets and liabilities are evenly matched.

Current Ratio

The current ratio measures a company's ability to offset its current liabilities or short-term debts with its short-term or current assets. The formula for the current ratio is:

> Current Ratio = Current Assets / Current Liabilities

The current ratio includes all current assets, even those that may take longer than 90 days to convert into cash. These assets include cash and cash equivalents, securities, inventory, and prepaid expenses. A current ratio of 2:1 or greater is considered ideal, indicating that the company has sufficient assets to cover its short-term liabilities.

Key Differences

The main difference between the quick ratio and the current ratio is the timeframe considered and the types of assets included. The quick ratio offers a more conservative, short-term view of a company's liquidity, while the current ratio provides a longer-term perspective. The quick ratio includes only liquid assets, while the current ratio considers all current assets. Additionally, the ideal quick ratio is 1:1 or greater, while the ideal current ratio is 2:1 or greater.

Both ratios are useful for financial analysis, but the choice between them depends on the specific needs and context. The quick ratio is more suitable for assessing short-term liquidity and covering debts within the next 90 days. On the other hand, the current ratio provides a longer-term view of a company's liquidity position and is better suited for scenarios where capital constraints are not imminent.

Cashing Out Investments: When and How to Do It

You may want to see also

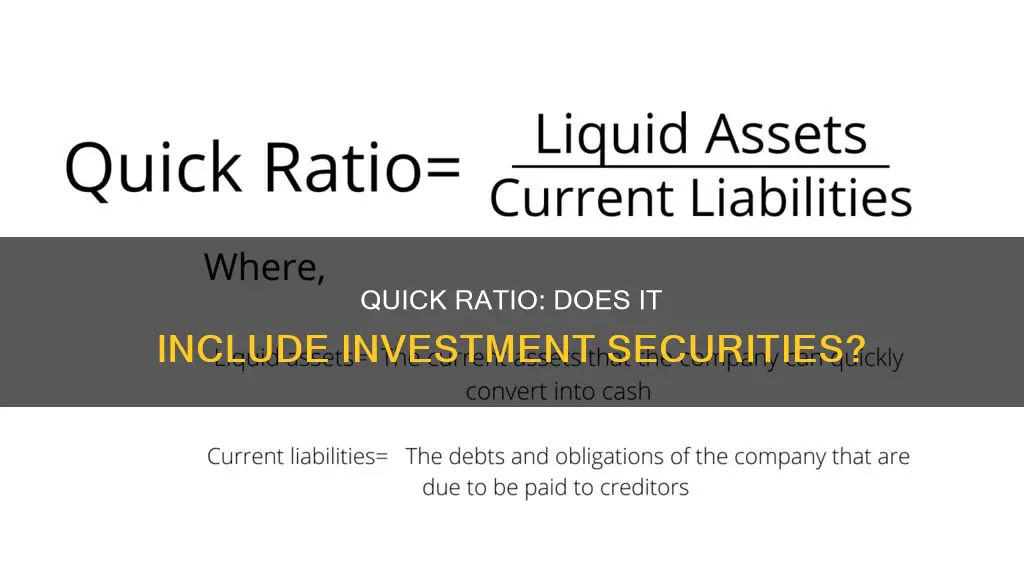

Quick ratio formula

The quick ratio is a financial metric used to assess a company's short-term liquidity position and its ability to meet its short-term financial obligations. It is also known as the "acid-test" or "liquidity ratio". The quick ratio is calculated by dividing a company's most liquid assets, or "quick assets", by its current liabilities:

> Quick Ratio = [Cash & equivalents + marketable securities + accounts receivable] / Current liabilities

Quick assets are defined as the most liquid current assets that can be easily converted into cash. They typically include cash, cash equivalents, marketable securities, and net accounts receivable.

The quick ratio is considered a more conservative measure than the current ratio, which includes all current assets as coverage for current liabilities. The quick ratio excludes specific current assets such as prepaid expenses and inventory, as these may not be as easily convertible to cash and may require substantial discounts to liquidate.

A company with a quick ratio of more than one is generally considered financially healthy and less of a financial risk. A higher quick ratio indicates better liquidity and financial health, but it is important to consider other financial metrics to assess the complete picture of a company's financial health.

Depreciation's Role in Investment Cash Flows Explored

You may want to see also

Quick ratio analysis

The quick ratio is considered a more conservative measure than the current ratio as it excludes inventory and prepaid expenses, which may be more difficult to convert to cash. A company with a quick ratio of more than one is generally considered financially stable and less of a financial risk. On the other hand, a company with a quick ratio of less than one may struggle to pay off its current liabilities and could face a liquidity crisis.

The quick ratio is an essential tool for investors, suppliers, lenders, and accountants to assess a company's financial health and make informed decisions. However, it is important to consider other financial metrics as well, as the quick ratio does not provide a complete picture of a company's financial health.

The formula for calculating the quick ratio is:

Quick Ratio = (Cash + Cash Equivalents + Marketable Securities + Accounts Receivable) / Current Liabilities

This ratio can be used to compare companies across different time periods or sectors to gauge their liquidity and financial stability. It is a relatively straightforward calculation that provides valuable insights into a company's ability to manage its short-term debts.

Cash Flow Analysis: Key to Investment Decision-Making

You may want to see also

Quick ratio limitations

The quick ratio is a useful metric for assessing a company's short-term liquidity and financial health. However, it has some limitations that should be considered when interpreting the results:

- Industry Comparisons: The quick ratio is not suitable for comparing companies across different industries. It is designed for assessing companies where short-term liquidity is a critical factor and is most meaningful when used to compare similar companies within the same sector.

- Context of Assets and Liabilities: The quick ratio is a mathematical value that provides no context about the specific assets and liabilities included in the calculation. It does not consider the nature or quality of these items, which may be important in understanding the true liquidity position of a company.

- Payment Timeframes: The quick ratio does not take into account the timeframe of payments. Some accounts receivable may become bad debts that are never recovered, or they may be received after a longer period, negatively impacting liquidity. Conversely, a high proportion of inventories compared to current assets can skew the ratio and lead to incorrect interpretations.

- Inventory Exclusion: While excluding inventory is beneficial for industries with low inventories, it can be a limitation for industries with high inventories, such as supermarkets. In such cases, the exclusion of inventory may result in an extremely low quick ratio that does not accurately reflect the company's liquidity position.

- True Liquidity of Accounts Receivable: The quick ratio assumes that accounts receivable are readily available for conversion into cash. However, it does not account for the financial situation of debtors, who may not be able to pay as requested, leading to potential bad debts.

- Overstatement of Liquidity: The quick ratio may overstate the true collectability of accounts receivable and the true liquidity of marketable securities, especially during economic downturns when asset liquidation may be more challenging.

- Future Cash Flow: The quick ratio does not consider a company's future cash flow capabilities or its ability to meet long-term liabilities that may be due within the next 12 months. It focuses solely on the current assets and liabilities.

- Limited Applicability: The quick ratio is not appropriate for companies that primarily use operating cash flow to fulfil their obligations. It is designed to assess a company's ability to survive a liquidity constraint and does not reflect how a company will meet its obligations with regular cash flow.

Cash App Investing: Why You Can't Invest on the Platform

You may want to see also

Quick ratio in different industries

The quick ratio is a key liquidity ratio used by analysts to assess a company's ability to meet its short-term obligations using its most liquid assets. It is considered a more conservative measure than the current ratio, which includes all current assets as coverage for current liabilities.

The quick ratio is calculated by dividing a company's most liquid assets, such as cash, cash equivalents, marketable securities, and accounts receivables, by its total current liabilities. It is a simple and widely used measure to analyse a company's liquidity and financial health.

While there is no one-size-fits-all answer for what constitutes a "good" quick ratio, as it varies by industry and company size, a ratio above 1 is generally considered reasonable. A higher quick ratio indicates stronger liquidity and financial health, while a lower ratio suggests potential challenges in paying debts.

Consumer Discretionary Industry

The consumer discretionary industry includes companies that sell non-essential goods and services, such as automobiles, luxury goods, and entertainment. These companies often have higher quick ratios due to the nature of their business. For instance, a luxury car manufacturer may have a quick ratio of 1.5, indicating that it has $1.50 of liquid assets available to cover every $1 of its current liabilities. This suggests strong liquidity and financial stability.

Retail Industry

In contrast, the retail industry, which includes companies that sell goods directly to consumers, often has lower quick ratios. This is because retailers tend to stock up on inventory, especially during peak seasons, which can result in a higher current ratio. However, once the season is over, the current ratio decreases significantly. As a result, retailers may have a quick ratio below 1, indicating more current liabilities than current assets. This does not necessarily depict an alarming situation, as they may have strong sales and efficient inventory management.

Financial Services Industry

Companies in the financial services industry, such as banks and investment firms, typically have higher quick ratios. This is because their business model relies heavily on having liquid assets readily available to meet customer demands and regulatory requirements. A quick ratio above 1 is common in this industry, indicating that these companies have more current assets than current liabilities.

Manufacturing Industry

The manufacturing industry encompasses a wide range of businesses, from automotive to electronics. Their quick ratios can vary significantly depending on the nature of their operations. For example, a company that produces high-end electronics with long production cycles may have a lower quick ratio due to the time lag between producing inventory and receiving payments. On the other hand, a company that manufactures fast-moving consumer goods with shorter production cycles may have a higher quick ratio, as they can quickly convert inventory into cash.

Healthcare Industry

Healthcare providers, including hospitals, clinics, and pharmaceutical companies, often have varying quick ratios. Hospitals, for instance, may have a lower quick ratio due to the high cost of equipment and facilities, which are considered long-term assets. On the other hand, pharmaceutical companies with strong sales and efficient inventory management may have a higher quick ratio, as they can quickly convert inventory into cash.

In summary, the quick ratio is a valuable tool for assessing a company's liquidity and financial health, but it should be considered alongside other financial metrics and industry-specific factors to gain a comprehensive understanding of a company's performance and stability.

Investing a Large Cash Gift: Strategies for Long-Term Growth

You may want to see also

Frequently asked questions

The quick ratio, also known as the acid-test ratio or liquidity ratio, is a formula and financial metric that determines how well a company can pay off its current debts. It measures a company's short-term liquidity against its short-term obligations.

The quick ratio includes a company's "quick" assets, which are assets that can be converted to cash in a short time, typically within 90 days. These include cash and cash equivalents, marketable securities, and accounts receivable.

The quick ratio does not include inventory or prepaid expenses. This is because inventory may take too long to convert into cash, and prepaid expenses cannot be used to pay other liabilities.

The quick ratio is calculated by dividing a company's quick assets by its current liabilities. The formula is: Quick Ratio = Quick Assets / Current Liabilities.