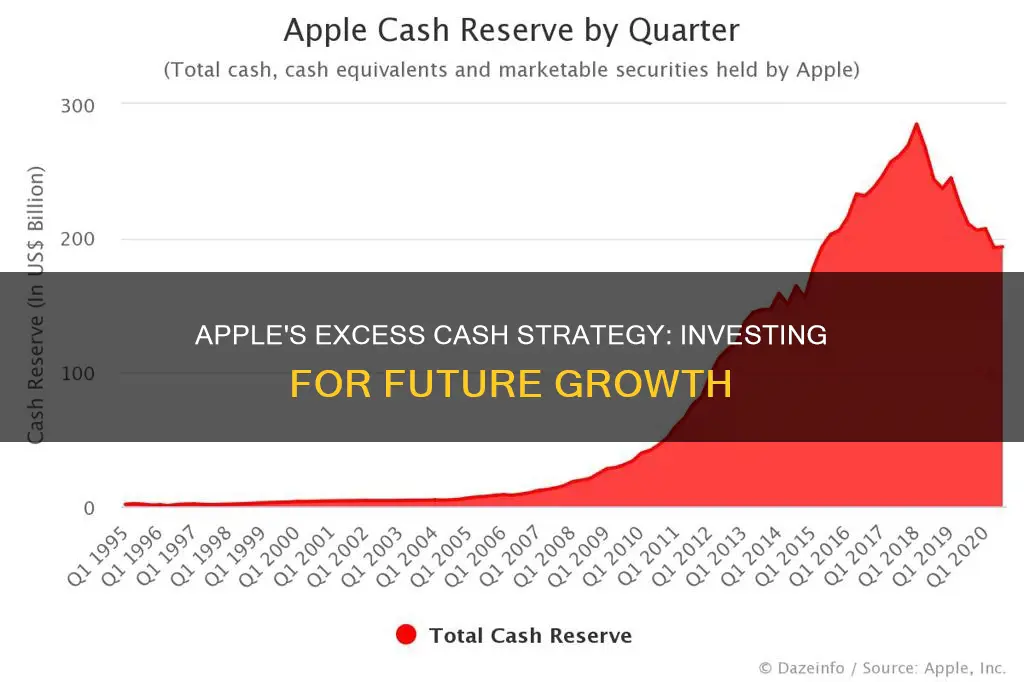

Apple's cash management has been a topic of interest for many years. As of 2022, the company had $23.7 billion in cash and $24.7 billion in short-term investments that could be quickly converted into cash. Apple's excess cash has primarily accumulated due to its substantial international earnings, which, if repatriated to the United States, would be subject to significant taxation. This has led to large amounts of cash accumulating on Apple's balance sheet. However, in recent years, Apple has started to bring foreign cash back to the US, accepting the tax implications. Apple's cash management strategy has evolved to include various initiatives, such as increasing dividends, investing in research and development, and repurchasing its shares.

| Characteristics | Values |

|---|---|

| Excess Cash | US$40-US$50 billion dollars in profit every year |

| Taxation Reasons | Subject to significant taxation if funds are 'repatriated' to the United States |

| Low Cost of Capital | Able to obtain money at 1-2% interest rates |

| Research & Development Intensive Industry | Strong cash position allows for R&D funding |

| Lack of Intelligent Investment Opportunities | Insufficient 'short-term' investment opportunities |

What You'll Learn

To avoid repatriation taxes

Apple has historically preferred to hold its cash overseas rather than bring it back to the United States to avoid repatriation taxes. This has resulted in huge piles of cash accumulating on its balance sheet.

In a 2018 press release, Apple announced that it would pay an estimated $38 billion in repatriation taxes on its overseas cash and investments. This would allow the company to bring back an estimated $207 billion of the $252.3 billion that was overseas as of September 2017.

Apple's cash management practices have since included bringing foreign cash back to the U.S. and taking the 15.5% repatriation tax hit. According to Apple's balance sheet, cash and equivalents have declined in the past five years from a high of $49 billion in 2019 to the current level of $24 billion.

Apple's overseas sales have grown, and so has its cash pile. The company's preference for holding cash overseas rather than repatriating it has been driven by the desire to avoid the significant taxation that would be incurred if the funds were brought back to the United States.

Cash Repayments: A Smart Investment Strategy?

You may want to see also

To fund research and development

Apple's success as a company is largely due to its ability to innovate. As such, it operates in an industry where research and development are crucial. Apple's large cash reserves have allowed it to constantly explore new opportunities and be the first to market.

Apple has used its excess cash to fund research and development activities, with R&D expenses more than quadrupling in the past decade and more than doubling in the past five years. This reflects a productive use of cash and a good opportunity to expand its breadth into new industries and its depth into existing ones.

Apple's management of its cash reserves has been a topic of curiosity for years, especially since the passing of Steve Jobs in 2011. The company has been criticised for not deploying its cash in a way that continues to innovate and produce above-average returns. However, Apple's excess cash has piled up largely because a lot of that cash is generated internationally. Repatriating that cash to the United States would subject it to taxation, which would adversely affect returns. Rather than take the tax hit, Apple has historically preferred to hold the cash, resulting in huge piles accumulating on its balance sheet.

However, in 2018, Apple's cash management practice began to change. The company started bringing foreign cash back to the U.S. and taking the repatriation tax hit. As a result, cash and equivalents have declined in the past five years, from a high of $49 billion in 2019 to $24 billion today.

Apple's R&D spending is already fully funded on a yearly basis, and the company does not need excess cash for this purpose. However, some investors want the company to increase its R&D spending even more, and Apple could handle any increase from its yearly profits.

Unlocking Investment Strategies: Determining Cash Availability

You may want to see also

To buy back stocks

Apple has been buying back its own stock since 2012, and this has been the largest use of its cash. In the past 10 years, Apple has spent an average of $50 billion per year and a total of $582 billion on share repurchases. In 2023, Apple announced a $90 billion stock buyback program, which was in addition to another $90 billion share buyback program announced in 2022. This brings the total spent on share repurchases to over $572 billion.

Share buyback programs are often performed to reduce the number of outstanding shares in a company. Increased scarcity typically results in an increase in the stock's price, or supporting a desired target. For investors, the firm's buybacks have come to act as "a sign of their confidence in the business".

Apple's revenue has more than doubled in the past 10 years, from $171 billion in 2013 to $394 billion in 2022. This has resulted in increasing levels of cash dividends paid out to shareholders, with the average Dividend Payout Ratio for the last 10 years being about 22.7%.

Marijuana Money: Investing the Green Rush

You may want to see also

To pay dividends

Apple's large cash holdings have raised questions about how the company manages its cash and what it does with the excess. One of the key uses of Apple's cash is to pay dividends to shareholders.

Apple has been paying dividends to its shareholders, and the amount paid out has been increasing over the years. Between 2013 and 2022, the total dividends paid out to shareholders grew from $10.6 billion to $14.8 billion. The average Dividend Payout Ratio over the last 10 years has been about 22.7%. This means that Apple has been consistently returning a portion of its profits to its investors in the form of dividends.

In addition to dividends, Apple has also been using its cash for other purposes. The company has been investing in research and development, making acquisitions, and repurchasing its own shares. These activities are all part of Apple's overall cash management strategy and are aimed at enhancing shareholder value.

Apple's cash management practices have evolved over time, and the company has made efforts to bring back some of its foreign cash holdings to the U.S., despite the associated tax implications. As of 2018, Apple started to repatriate its foreign cash reserves, taking a 15.5% tax hit on the repatriated amount. This has resulted in a decline in Apple's cash and cash equivalents over the past few years.

While Apple's dividend payments have increased over the last decade, they have remained relatively flat in the last five years, with only a slight increase of about $800 million. This suggests that Apple may be prioritising other uses of its cash, such as share repurchases, which have been a significant part of the company's cash management strategy.

Overall, Apple's dividend payments are an important aspect of its cash management and investor relations. By consistently paying dividends and increasing the amounts over time, Apple demonstrates its commitment to returning value to its shareholders. However, the company also balances this with other strategic investments and initiatives to drive long-term growth and enhance shareholder value.

Retirement Investing: Strategies for Your Cash Reserves

You may want to see also

To pay down debt

Paying off debt is usually the first option considered when deciding what to do with excess cash. It is generally a good idea to pay off debt with excess cash, as short-term investments are unlikely to yield a return that is equal to or greater than the rate of interest charged on debt. For example, it doesn't make sense to invest a cash surplus at 5% when a loan charges 12% interest.

However, automatically paying off debt with excess cash is not always the best strategy. For example, if interest rates are low and expected to rise, it may be better to temporarily invest the cash surplus and avoid taking out a loan with a higher interest rate in the future.

Apple's cash management has been a topic of interest for years, especially since the death of Steve Jobs in 2011. Apple's excess cash has accumulated largely due to its international operations. Repatriating this cash to the US would subject it to taxation, which would reduce returns. To avoid this tax hit, Apple has historically preferred to hold onto this cash, resulting in large amounts of cash on its balance sheet. However, in 2018, Apple began bringing foreign cash back to the US and taking the repatriation tax hit. As a result, the cash and equivalents on Apple's balance sheet have declined in recent years.

Apple's debt ratio, which evaluates its long-term solvency, is 58.6%. This indicates that Apple is highly leveraged in debt but still able to meet its long-term obligations. Apple's current ratio, which evaluates its ability to meet short-term obligations, is 1.3x, indicating that Apple has sufficient liquidity to meet its short-term debts.

Apple's long-term debt is $98.9 billion, which it could easily pay off with its annual net earnings of $99 billion. Apple's ability to pay off its long-term debt within a year or less indicates effective cash management and a durable competitive advantage.

Strategies for Investing in Cash ATMs: A Guide

You may want to see also

Frequently asked questions

Apple's excess cash is invested in marketable securities to hedge against currency-related risks and to keep up with inflation.

Apple holds so much cash because, as a business, it is a cash-generating machine. The company has generated around US$40-US$50 billion in profit every year, resulting in massive sums of free cash flow.

Apple's excess cash is used in several ways, including share repurchases, dividend payments, acquisitions, and research and development.