Depreciation is a non-cash expense that represents the systematic allocation of the cost of a tangible asset over its useful life. It is a type of expense that is used to reduce the carrying value of an asset. It is found on the income statement, balance sheet, and cash flow statement. While depreciation does not directly impact cash flow, it does have an indirect effect on it, specifically on the cash flow from operating activities. This is because depreciation is tax-deductible, reducing the amount of cash a business must pay in income taxes.

| Characteristics | Values |

|---|---|

| Depreciation's impact on cash flow | Indirect |

| Depreciation's impact on taxable income | Reduces taxable income |

| Depreciation's impact on tax liabilities | Reduces cash outflows from income taxes |

| Depreciation's impact on net income | Reduces net income on the income statement |

| Depreciation's impact on cash | Does not reduce the company's cash that is reported on the balance sheet |

| Depreciation's impact on cash flow statement | Listed as an add-back to net income within the cash flows from operating activities section |

| Depreciation's impact on fixed assets | Reduces the carrying value of an asset |

What You'll Learn

Depreciation is a non-cash expense

Although depreciation is a non-cash expense, it does influence a company's cash flow in an indirect way. This is because depreciation is tax-deductible, so it reduces a company's taxable income and, therefore, the amount of tax they have to pay. This has a positive impact on cash flow.

Depreciation is added to the cash flow statement in the operating activities section, along with other non-cash expenses such as amortization and depletion. This is because depreciation is added back to net income in the cash flow statement, to reflect that it does not use up cash.

Overall, depreciation is a non-cash expense that can have a significant impact on a company's financial performance. It is important for business owners to understand how to calculate depreciation to accurately determine the true cost of doing business.

Extra Cash? Here's How to Invest Wisely

You may want to see also

Depreciation reduces taxable income, reducing taxes paid

Depreciation is a non-cash expense that can be used to reduce a company's tax bill. It is a type of expense that is used to reduce the carrying value of an asset. This is done by spreading the cost of a tangible asset over its "useful life".

When a company prepares its income tax return, depreciation is listed as an expense. This reduces the amount of taxable income that needs to be reported to the government, which in turn reduces the amount of cash that goes out of the business. The larger the depreciation expense, the lower the taxable income, and the lower the company's tax bill.

For example, if a company buys a vehicle for $30,000 and plans to use it for the next five years, the depreciation expense would be divided over five years at $6,000 per year. Each year, depreciation expense is debited for $6,000 and the fixed asset accumulation account is credited for $6,000. After five years, the expense of the vehicle has been fully accounted for, and the vehicle is worth $0 on the books.

Depreciation is entered as a debit on the income statement as an expense and a credit to asset value, so actual cash flows are not exchanged. It is found on the income statement, balance sheet, and cash flow statement.

Depreciation does not negatively affect the operating cash flow (OCF) of a business. Instead, it has an indirectly positive impact on cash flow. However, it is important to remember that depreciation is connected to a fixed asset, and the original purchase of the asset would have resulted in a cash outflow. Therefore, the positive impact of depreciation on cash flow is cancelled out by the original payment.

Restricted Cash: A Viable Investment Option?

You may want to see also

Depreciation is listed as an expense on the income statement

Depreciation is a non-cash expense that is listed as an expense on the income statement. It is a type of expense that is used to reduce the carrying value of an asset. It is an estimated expense that is scheduled, rather than an explicit expense.

Depreciation is entered as a debit on the income statement as an expense and a credit to asset value. This means that there is no actual cash flow exchanged. It is a non-cash expense, and so needs to be added back to the cash flow statement in the operating activities section.

Depreciation is an accounting method for allocating the cost of a tangible asset over time. It is used to spread the cost of an asset over its useful life. This means that the cost of an asset is spread out over its useful lifetime, instead of recording the entire loss at the time of purchase.

Depreciation is important as it allows companies to avoid taking a huge expense deduction on the income statement in the year the asset is purchased. It also helps to reduce a company's tax burden. Depreciation is tax-deductible, which can have a major impact on a company's bottom line.

Depreciation is found on the income statement, balance sheet, and cash flow statement. It can have a big impact on a company's financial performance overall.

Cash Advance Investment Strategies: A Guide to Getting Started

You may want to see also

Depreciation is added back to net income in the cash flow statement

Depreciation is a non-cash expense that is used to reduce the carrying value of an asset. It is an estimated expense that is scheduled rather than an explicit expense. It is entered as a debit on the income statement and a credit to the asset value. This means that no actual cash flows are exchanged.

Depreciation is a way to spread the cost of a tangible asset over its "useful life". It is a way to account for the value an asset loses over time due to wear and tear and expected obsolescence. This helps companies avoid taking a huge expense deduction on the income statement in the year the asset is purchased.

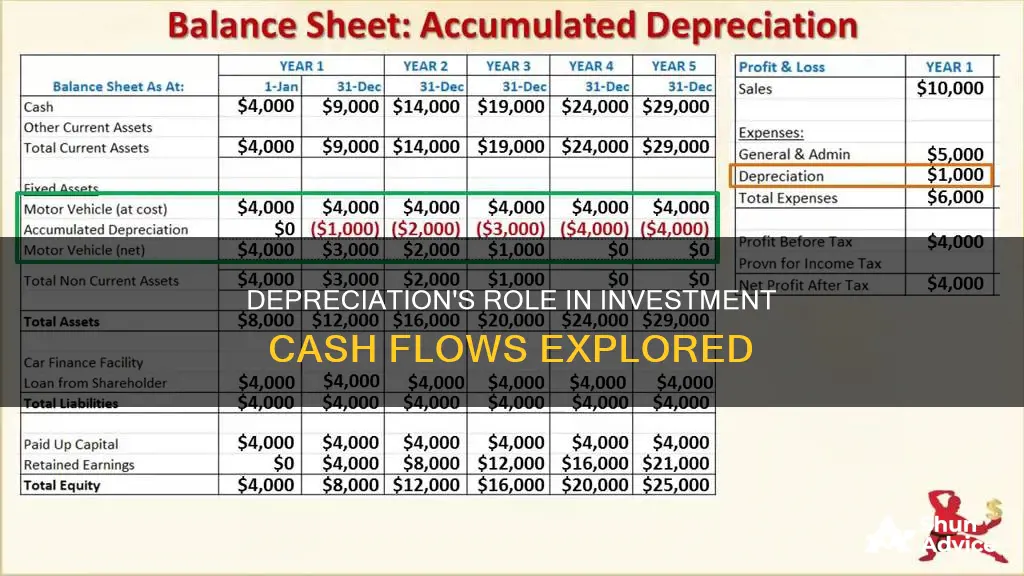

Since depreciation is a non-cash expense, it needs to be added back to the cash flow statement in the operating activities section, along with other expenses such as amortization and depletion. This is because depreciation reduces net income on the income statement, but it does not reduce the company's cash that is reported on the balance sheet.

The operating cash flow (OCF) starts with net income, to which depreciation is added back, along with amortization, net change in operating working capital, and other operating cash flow adjustments. This results in a higher amount of cash on the cash flow statement.

Overall, depreciation does not negatively affect the operating cash flow of a business. In fact, it can help increase net income by reducing tax liabilities and, therefore, cash outflows from income taxes.

Cashing Out Investments: Using the Cash App to Withdraw Funds

You may want to see also

Depreciation is associated with a fixed asset

Depreciation is a type of expense that is used to reduce the carrying value of an asset. It is an estimated, scheduled expense, rather than an explicit one. It is an accounting method for allocating the cost of a tangible asset over time.

The reason for using depreciation is to match the cost of a fixed asset to the revenue it generates. This is known as the matching principle, where revenues are recorded with their associated expenses in the same reporting period. The net effect is a gradual decline in the reported carrying amount of fixed assets on the balance sheet.

Depreciation is calculated based on the asset cost, less any estimated salvage value. The useful life of an asset is the time period over which it is expected to be productive. It is recognised over this useful life, and the useful life may be revised as the asset ages.

Depreciation is entered as a debit on the income statement as an expense and a credit to asset value. It is a non-cash expense, so it does not negatively affect the operating cash flow of a business. However, it does have an indirect effect on cash flow by changing a company's tax liabilities, which reduces cash outflows from income taxes.

Cashing Out Putnam Investments: A Step-by-Step Guide

You may want to see also

Frequently asked questions

Depreciation is a non-cash expense that represents the systematic allocation of the cost of a tangible asset over its useful life.

No, depreciation does not directly impact the amount of cash flow generated by a business.

Yes, depreciation has an indirect impact on cash flow because it changes the company’s tax liabilities, reducing cash outflows from income taxes.

Depreciation appears in the statement of cash flows as an add-back to net income within the cash flows from operating activities section.

Although depreciation has an indirectly positive impact on cash flow, it is important to remember that depreciation only exists because it is connected to a fixed asset. The original purchase of the asset would have resulted in a cash outflow, which means that the positive impact of depreciation on cash flow is cancelled out by the original payment.