Long-term investments are a fundamental aspect of investing, representing a strategic approach to building wealth over time. This activity involves committing funds to assets with the expectation of holding them for an extended period, often years or even decades. The goal is to benefit from the potential growth and compounding effects of these investments, allowing for the accumulation of significant wealth over the long haul. Understanding the principles and strategies of long-term investing is crucial for anyone looking to secure their financial future and achieve their investment goals.

What You'll Learn

- Risk and Reward: Understanding the trade-off between long-term gains and short-term risks

- Diversification: Spreading investments across various assets to mitigate risk

- Compounding: How long-term investments can grow exponentially over time

- Market Volatility: The impact of short-term market fluctuations on long-term strategies

- Patience and Discipline: The importance of long-term commitment in investment success

Risk and Reward: Understanding the trade-off between long-term gains and short-term risks

Long-term investments are indeed a crucial aspect of investing, offering a strategic approach to building wealth over time. This strategy involves a careful consideration of the trade-off between risk and reward, which is fundamental to understanding the very nature of investing. The concept of long-term gains is often associated with the idea of patience and a commitment to a well-thought-out financial plan. It requires individuals to look beyond the immediate fluctuations in the market and focus on the potential for sustained growth.

When engaging in long-term investments, one must be prepared to weather the short-term market volatility. This is where the risk comes into play. Short-term risks are inherent in any investment, as markets can experience rapid changes due to various economic, political, or even global events. These risks can cause short-term losses, which may deter investors who prefer a more conservative approach. However, it is essential to recognize that short-term volatility is often a necessary step towards achieving long-term financial goals.

The reward, in this context, refers to the potential for significant gains over an extended period. Long-term investments are typically made in assets with a proven track record of growth, such as stocks, bonds, or real estate. By holding these investments for an extended duration, investors can benefit from compounding returns, where earnings are reinvested to generate additional income. This compounding effect can lead to substantial growth, especially when compared to short-term trading strategies. For instance, investing in a well-diversified portfolio of stocks for a decade or more has historically shown the potential to outperform more aggressive, short-term trading approaches.

Understanding the risk and reward dynamic is crucial for investors to make informed decisions. It involves a careful assessment of one's financial goals, risk tolerance, and investment horizon. Investors who are comfortable with the potential short-term losses may be better suited for long-term strategies, as they can ride out the market's ups and downs. On the other hand, those seeking more immediate returns might prefer short-term trading or alternative investment vehicles.

In summary, long-term investments are a strategic approach to building wealth, offering the potential for substantial gains over time. While short-term risks are an inevitable part of the journey, they can be managed through careful planning and a long-term perspective. By embracing the trade-off between risk and reward, investors can make informed choices that align with their financial objectives and risk tolerance, ultimately contributing to a more secure and prosperous financial future.

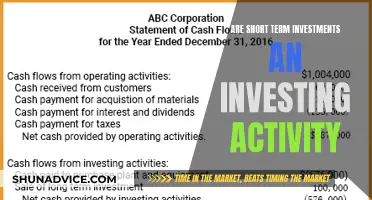

Unveiling the Potential: Is Short-Term Investment an Asset?

You may want to see also

Diversification: Spreading investments across various assets to mitigate risk

Diversification is a fundamental strategy in investing that involves allocating your investment portfolio across a variety of assets to reduce risk and potentially increase returns. The core principle is to avoid putting all your eggs in one basket, as this can lead to significant losses if a particular asset or market experiences a downturn. By diversifying, investors aim to create a balanced and well-rounded portfolio that can weather various economic conditions.

The idea behind diversification is to spread your investments so that the impact of any single asset's performance is minimized. For example, if you own stocks from multiple sectors, a decline in the tech sector might be offset by the strong performance of healthcare or consumer staples stocks. Similarly, investing in different types of securities, such as bonds, real estate, and commodities, can provide a hedge against market volatility. This approach is particularly crucial for long-term investors, as it allows them to focus on their investment goals without being overly concerned about short-term market fluctuations.

One common method of diversification is asset allocation, which involves dividing your portfolio into different asset classes. Typically, this includes a mix of stocks, bonds, and cash equivalents. Stocks offer the potential for higher returns but come with higher risk, while bonds provide a more stable income stream. Cash equivalents, such as money market funds, offer liquidity and minimal risk. By allocating your investments across these asset classes, you can create a diversified portfolio that aligns with your risk tolerance and investment objectives.

Another strategy is to invest in a wide range of individual securities within each asset class. For instance, instead of buying just one tech stock, you could invest in a mix of large-cap and small-cap tech companies, as well as those in different sectors like healthcare, energy, and finance. This approach ensures that your portfolio is not overly exposed to any single company or industry, reducing the impact of specific risks. Additionally, considering international markets and diverse industries can further enhance diversification, providing exposure to different economic cycles and market conditions.

Diversification also extends to the use of derivatives and alternative investments. Options, futures, and swaps can be used to gain exposure to various assets without directly purchasing them. Alternative investments, such as private equity, real estate investment trusts (REITs), and commodities, offer unique opportunities to diversify further. These strategies can provide investors with a more comprehensive approach to managing risk and potentially enhancing returns over the long term.

Maximizing Profits: A Beginner's Guide to Short-Term Rental Investing

You may want to see also

Compounding: How long-term investments can grow exponentially over time

Compounding is a powerful concept that highlights the significant growth potential of long-term investments. It is a process where the earnings generated from an investment are reinvested, and over time, these earnings themselves earn returns, leading to exponential growth. This phenomenon is particularly advantageous for long-term investors as it allows their wealth to accumulate at an accelerating rate.

The key to understanding compounding lies in the idea of time and the power of reinvesting returns. When you invest in assets like stocks, bonds, or real estate, you initially contribute a certain amount of capital. As these investments generate income or appreciate in value, the returns are often reinvested, meaning they are used to purchase additional assets. This reinvestment process is crucial because it allows the initial investment to grow faster than if the returns were simply spent or withdrawn.

Over time, as the reinvested earnings continue to earn returns, the investment portfolio grows exponentially. This is because the returns are added to the principal amount, and subsequent returns are calculated based on this larger base. For example, if you invest $10,000 and it generates an annual return of 10%, the first year's return is $1,000. In the second year, this $1,000 is added to the initial investment, making the new base $11,000, and the return for the second year is $1,100. This process repeats, with each year's return becoming larger due to the compounding effect.

Compounding is a key reason why long-term investments are considered a vital strategy for wealth accumulation. It allows investors to benefit from the power of time, where their money works harder over extended periods. The longer the investment horizon, the more significant the impact of compounding can be. This is especially true for investments with consistent growth or income potential, such as dividend-paying stocks or assets with a history of appreciation.

In summary, compounding is a mechanism that accelerates the growth of long-term investments. By reinvesting returns, investors can watch their wealth grow exponentially, making it a powerful tool for building substantial financial assets over time. Understanding and embracing this concept can be a game-changer for anyone looking to maximize their investment returns.

Understanding Inventory's Role in Short-Term Investment Strategies

You may want to see also

Market Volatility: The impact of short-term market fluctuations on long-term strategies

Market volatility refers to the rapid and significant price fluctuations in financial markets, often driven by short-term factors such as news, economic data, or investor sentiment. While short-term market movements can be unpredictable and may cause anxiety for investors, it is essential to understand their impact on long-term investment strategies. Long-term investments are typically made with a horizon of several years or more, focusing on the fundamental value of an asset or business rather than short-term price movements.

In the context of long-term investing, market volatility can present both challenges and opportunities. On the one hand, short-term fluctuations can lead to temporary losses, which may deter investors from their long-term goals. For instance, a sudden market downturn could result in a decline in the value of long-term investments, causing investors to question their strategy. However, history has shown that markets tend to recover over the long term, and short-term volatility is often a natural part of the investment journey.

One key aspect of managing market volatility is maintaining a disciplined and patient approach. Long-term investors should focus on their investment objectives and avoid making impulsive decisions based on short-term market swings. This may involve regularly reviewing and rebalancing portfolios to ensure they align with the investor's risk tolerance and goals. By staying committed to a well-defined strategy, investors can weather the storms of market volatility and benefit from the power of compounding returns over time.

Additionally, diversifying investments across different asset classes and sectors can help mitigate the impact of market volatility. A well-diversified portfolio can provide a buffer against short-term market fluctuations, as different assets may react differently to various economic conditions. For example, a portfolio that includes a mix of stocks, bonds, and alternative investments can offer a more stable and balanced approach, reducing the overall risk exposure.

In summary, market volatility is an inherent feature of short-term market dynamics, but it should not deter investors from pursuing long-term strategies. By understanding the nature of volatility, maintaining a disciplined approach, and diversifying investments, investors can navigate market fluctuations with confidence. Long-term investing is a journey that requires patience and a focus on the underlying fundamentals, allowing investors to build wealth over time despite the occasional short-term market challenges.

Unlocking Long-Term Wealth: A Comprehensive Guide to Smart Investing

You may want to see also

Patience and Discipline: The importance of long-term commitment in investment success

The concept of long-term investments is often associated with a particular mindset and set of strategies that require patience and discipline. It is a strategy that involves a commitment to hold investments for an extended period, typically years or even decades, rather than seeking short-term gains. This approach is particularly relevant in today's fast-paced financial markets, where the allure of quick profits can sometimes overshadow the benefits of a patient, long-term strategy.

Patience is a virtue in the investment world, especially when it comes to long-term commitments. It requires an individual to trust their investment decisions and maintain a consistent approach over time. This is not an easy feat, as the financial markets can be volatile, and short-term fluctuations can be discouraging. However, historical data and market trends consistently show that long-term investors, who remain committed to their strategy, often reap significant rewards. For instance, a study of the S&P 500 index over several decades revealed that annualized returns averaged around 10%, demonstrating the power of long-term investing.

Discipline is another critical aspect of this investment philosophy. It involves adhering to a well-defined investment plan, making informed decisions based on research and analysis, and avoiding impulsive reactions to market volatility. Long-term investors must resist the temptation to make frequent changes to their portfolio, as this can lead to higher transaction costs and potentially undermine the strategy's effectiveness. Discipline also entails regularly reviewing and rebalancing the investment portfolio to ensure it aligns with the investor's goals and risk tolerance.

The benefits of long-term commitment are twofold. Firstly, it allows investors to ride out the short-term market noise and focus on the underlying value of their investments. Over time, companies tend to grow and mature, and their true value becomes more apparent. Secondly, it provides an opportunity to benefit from compounding returns. As investments grow, the earnings generate additional income, which, when reinvested, can lead to exponential growth over the years. This effect is particularly powerful in tax-advantaged retirement accounts, where compound growth can significantly boost savings.

In conclusion, long-term investments are indeed an investing activity that requires patience and discipline. It is a strategy that enables investors to weather market storms, benefit from compounding returns, and ultimately achieve their financial goals. While it may not provide quick riches, it offers a more stable and rewarding path to financial success, making it an attractive approach for those seeking a sustainable and patient investment journey.

Debt Securities: Unlocking the Investment-Finance Connection

You may want to see also

Frequently asked questions

Long-term investments are financial assets that are purchased with the intention of holding them for an extended period, typically several years or more. These investments are often made with the goal of capital appreciation, where the value of the asset increases over time, or to generate regular income through dividends or interest payments. Examples of long-term investments include stocks, bonds, real estate, and certain mutual funds or exchange-traded funds (ETFs).

Long-term investments are a fundamental part of a well-rounded investment strategy for several reasons. Firstly, they provide an opportunity to benefit from the power of compounding, where the earnings from an investment are reinvested to generate additional returns over time. This can lead to significant growth in the value of the investment. Secondly, long-term holdings often offer lower risk compared to short-term trades, as they are less susceptible to market volatility and short-term price fluctuations. This makes them an attractive option for risk-averse investors.

Long-term investments and short-term trades represent two distinct approaches to investing. Long-term investments are typically held for an extended period, allowing investors to ride out market fluctuations and benefit from the potential for capital growth. In contrast, short-term trades involve buying and selling assets quickly, often within a matter of days or weeks, to capitalize on short-term price movements or market trends. Short-term trading strategies may require more frequent monitoring and can be riskier due to higher transaction costs and potential tax implications.

Adopting a long-term investment approach offers several advantages. Firstly, it allows investors to smooth out the impact of market volatility, as short-term fluctuations are averaged out over time. This can result in more consistent returns. Secondly, long-term investments often provide access to a wider range of assets and investment opportunities, including international markets and less-liquid securities. Additionally, long-term holdings can be more tax-efficient, as capital gains taxes may be lower or deferred for extended periods, depending on the jurisdiction and investment type.