Short-term investments are a crucial aspect of financial planning and can be an essential component of an investor's strategy. These investments typically involve assets that are expected to be converted into cash or sold within a year or less. While they may not generate the same level of returns as long-term holdings, short-term investments play a vital role in an investor's portfolio by providing liquidity, managing risk, and offering opportunities to capitalize on market fluctuations. Understanding the nature of these investments and their impact on an investor's financial goals is essential for making informed decisions and optimizing one's investment approach.

What You'll Learn

- Liquidity and Marketability: Short-term investments are easily convertible into cash within a year

- Risk and Volatility: These investments offer low risk and stable returns

- Tax Implications: Short-term gains are taxed at higher rates than long-term gains

- Diversification: They provide a balanced portfolio with a mix of assets

- Strategic Allocation: Short-term investments are used for emergency funds and short-term goals

Liquidity and Marketability: Short-term investments are easily convertible into cash within a year

Liquidity and marketability are crucial aspects of short-term investments, as they directly impact an investor's ability to access their funds when needed. Short-term investments are typically defined as assets that can be quickly converted into cash within a short period, often a year or less. This characteristic is essential for investors who prioritize flexibility and the ability to respond to changing financial circumstances.

The high liquidity of short-term investments allows investors to take advantage of immediate opportunities or address unexpected financial needs. For instance, if an investor needs to cover an emergency expense, they can quickly sell their short-term investments and have the funds readily available. This level of liquidity is particularly attractive to risk-averse investors who prefer to have a safety net in place.

Marketability is another critical factor, ensuring that short-term investments can be easily bought or sold in the market. This aspect is vital for investors who seek to diversify their portfolios or rebalance their asset allocation. With highly marketable short-term investments, investors can efficiently adjust their holdings without incurring significant transaction costs or delays.

In the context of financial reporting, the liquidity and marketability of short-term investments are essential for accurate financial statements. Companies must classify their investments accordingly to provide a clear picture of their financial health and stability. Proper classification ensures that investors and stakeholders can make informed decisions based on the liquidity and marketability of the company's assets.

Furthermore, understanding the liquidity and marketability of short-term investments is crucial for risk management. Investors can assess the potential impact of market fluctuations or economic changes on their holdings. By recognizing the short-term nature of these investments, investors can make more informed decisions, ensuring their portfolios remain aligned with their financial goals and risk tolerance.

Prepaid Expenses: Are They a Short-Term Investment?

You may want to see also

Risk and Volatility: These investments offer low risk and stable returns

Short-term investments are indeed a crucial aspect of an investment strategy, particularly for those seeking a more conservative approach. These investments are characterized by their low-risk nature and the potential for stable returns, making them an attractive option for investors who prioritize capital preservation and income generation.

The primary appeal of short-term investments lies in their ability to provide a safe haven for investors' capital. These investments typically include assets that are highly liquid and easily convertible into cash, such as money market funds, treasury bills, and short-term corporate bonds. By holding these assets for a brief period, investors can minimize the risk of loss, especially in volatile markets. This is especially relevant for risk-averse investors who want to avoid the potential downsides of long-term equity investments.

Volatility is a key consideration in the world of investing, and short-term investments often provide a shield against market fluctuations. These investments are designed to maintain the value of the principal amount, ensuring that investors' capital remains relatively stable. For instance, money market funds invest in short-term, high-quality debt instruments, offering a secure environment for investors' funds. This stability is particularly beneficial for those approaching retirement or managing a fixed income, as it provides a reliable source of income without exposing their capital to significant risk.

The low-risk nature of short-term investments is further emphasized by their short duration. These investments are typically held for a few days to a few months, allowing investors to take advantage of market opportunities quickly without long-term commitments. This flexibility enables investors to adapt to changing market conditions and adjust their portfolios accordingly, ensuring that their investments remain aligned with their risk tolerance and financial goals.

In summary, short-term investments are an essential component of a well-rounded investment strategy, offering low risk and stable returns. They provide investors with a sense of security and control over their capital, making them an ideal choice for those seeking a more conservative approach. By understanding the characteristics of these investments, investors can make informed decisions to meet their financial objectives while managing risk effectively.

Unraveling the True Nature of Short-Term vs. Long-Term Investments

You may want to see also

Tax Implications: Short-term gains are taxed at higher rates than long-term gains

Understanding the tax implications of short-term investments is crucial for investors, as it can significantly impact their overall financial strategy. When it comes to short-term gains, the tax treatment is quite different from that of long-term gains, and this distinction is essential to grasp for effective financial planning.

In many jurisdictions, short-term capital gains are typically taxed at a higher rate compared to long-term gains. This is because short-term gains are generally considered ordinary income and are often taxed at the investor's regular income tax rate. The tax rate for short-term gains can vary depending on the country and the investor's tax bracket. For instance, in the United States, short-term capital gains are usually taxed at the same rate as ordinary income, which can range from 10% to 37%, depending on the individual's income level. This means that if an investor sells a short-term investment for a profit, they may face a higher tax burden compared to long-term gains, which are often taxed at a more favorable rate.

The difference in tax rates between short-term and long-term gains is a critical factor in investment decision-making. Investors should be aware that holding investments for a shorter duration might result in higher tax liabilities. This consideration is especially relevant for those who frequently buy and sell assets, as it can impact their overall profitability. By understanding these tax implications, investors can make more informed choices about their investment strategies and potentially optimize their tax situation.

Long-term capital gains, on the other hand, often enjoy more favorable tax treatment. Many countries provide reduced tax rates for long-term gains, encouraging investors to hold their assets for an extended period. For example, in some countries, long-term capital gains may be taxed at a lower rate, such as 0%, 15%, or 20%, depending on the investment period and the investor's status. This lower tax rate can significantly benefit investors who adopt a long-term investment approach, allowing them to retain a larger portion of their profits.

To summarize, the tax implications of short-term investments are an essential aspect of the investing activity. Short-term gains are often taxed at higher rates than long-term gains, which can impact an investor's overall financial strategy. Understanding these tax differences enables investors to make informed decisions, potentially optimizing their tax efficiency and overall investment returns. It is always advisable to consult with tax professionals to ensure compliance with relevant tax laws and to develop a tailored investment strategy.

Rights as Long-Term Assets: A Wise Investment Strategy

You may want to see also

Diversification: They provide a balanced portfolio with a mix of assets

Short-term investments, often referred to as liquid assets or cash equivalents, play a crucial role in portfolio diversification. Diversification is a fundamental strategy in investing, aiming to reduce risk by spreading investments across various assets, sectors, and geographic regions. By incorporating short-term investments, investors can achieve a balanced portfolio that offers both stability and potential for growth.

The primary benefit of short-term investments is their liquidity, allowing investors to access their funds quickly without significant loss of value. These investments typically include money market funds, certificates of deposit (CDs), treasury bills, and high-yield savings accounts. They provide a safe haven for capital, especially during volatile market conditions, as they are generally considered low-risk assets. For instance, money market funds invest in short-term, high-quality debt instruments, ensuring a stable and secure investment environment.

In a diversified portfolio, short-term investments act as a buffer, providing a steady stream of income and preserving capital. They offer a more conservative approach compared to long-term investments, making them ideal for risk-averse investors or those seeking a more balanced strategy. By holding a mix of short-term and long-term assets, investors can create a well-rounded investment strategy that caters to various financial goals and risk tolerances.

Additionally, short-term investments can serve as a strategic tool for investors to take advantage of market opportunities. When the market is expected to be volatile or uncertain, short-term investments can provide a temporary home for capital, allowing investors to rebalance their portfolios or wait for more favorable conditions. This tactical approach enables investors to maintain a diversified position while adapting to changing market dynamics.

In summary, short-term investments are an essential component of a diversified investment portfolio. They offer liquidity, stability, and a balanced approach to investing. By incorporating these assets, investors can create a robust financial strategy that caters to their specific needs, whether it's preserving capital, generating income, or adapting to market fluctuations. Diversification through short-term investments is a powerful tool for long-term wealth creation and risk management.

Understanding Short-Term Debt Investments: Are They Current Assets?

You may want to see also

Strategic Allocation: Short-term investments are used for emergency funds and short-term goals

Short-term investments play a crucial role in financial planning, particularly when it comes to strategic allocation for emergency funds and short-term goals. These investments are designed to be highly liquid and easily convertible into cash, making them ideal for meeting immediate financial needs. The primary purpose of holding short-term investments is to ensure that individuals and businesses have a safety net during unforeseen circumstances or when short-term financial obligations arise.

In the context of emergency funds, short-term investments provide a critical layer of protection. These funds are typically set aside to cover unexpected expenses, such as medical emergencies, car repairs, or home maintenance. By keeping a portion of their assets in short-term investments, individuals can quickly access the necessary funds without having to liquidate long-term holdings or disrupt their investment strategy. This approach ensures that emergency situations can be managed promptly, providing financial security and peace of mind.

For short-term goals, strategic allocation of investments becomes even more important. This includes milestones like purchasing a new car, funding education expenses, or saving for a down payment on a house. Short-term investments can be tailored to meet these goals by offering a balance between liquidity and potential returns. For instance, a person saving for a car might invest in money market funds or short-term corporate bonds, which provide a higher yield than traditional savings accounts while still allowing for easy access to funds when needed.

The key to successful strategic allocation is diversification and careful consideration of risk. Investors should assess their risk tolerance and create a portfolio that aligns with their short-term objectives. This may involve a mix of low-risk assets like treasury bills and high-quality short-term bonds, ensuring both safety and potential growth. Regular reviews of this allocation are essential to ensure it remains aligned with changing financial circumstances and goals.

In summary, short-term investments are a vital component of a comprehensive financial strategy. They provide a means to address emergency needs and short-term goals, offering liquidity and potential returns. By strategically allocating these investments, individuals can build a robust financial foundation, ensuring they are prepared for various financial scenarios and able to achieve their short-term objectives. This approach demonstrates how short-term investments can be an integral part of an overall investing strategy, contributing to long-term financial success.

CDs: Long-Term Savings or Short-Term Strategy?

You may want to see also

Frequently asked questions

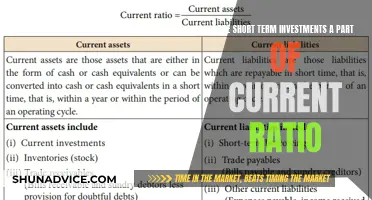

Short-term investments are typically assets that are expected to be converted into cash or sold within a short period, usually one year or less. These can include money market funds, certificates of deposit (CDs), treasury bills, and highly liquid investments that can be quickly bought or sold without significant loss of value.

Yes, short-term investments are generally classified as investing activities in the context of a company's financial statements. Investing activities encompass the purchase and sale of long-term investments, as well as short-term investments, and can include buying and selling of marketable securities, loans to others, and acquisitions of businesses. These activities are crucial for a company's financial management and can impact its cash flow and overall financial health.

Short-term investments are reported on the balance sheet at fair value, and any changes in value are reflected in the income statement as part of net income or loss. When a company sells a short-term investment, it recognizes the gain or loss on the sale, which can impact the company's profitability. Additionally, short-term investments can provide a source of liquidity and are often used to manage cash flow and meet short-term financial obligations.