Long-term investments are a crucial aspect of a company's financial strategy, and understanding their classification as non-current assets is essential for investors and analysts alike. These investments, which are typically held for more than a year, play a significant role in a company's financial health and growth prospects. In this paragraph, we will explore the concept of long-term investments and their classification as non-current assets, shedding light on their importance and how they contribute to a company's overall financial stability and future success.

What You'll Learn

- Definition: Non-current assets are long-term investments, like property, plant, and equipment, not expected to be converted to cash within a year

- Classification: These assets are classified as non-current on the balance sheet due to their long-term nature

- Examples: Long-term investments include stocks, bonds, and other financial instruments held for more than a year

- Impact on Cash Flow: Non-current assets affect cash flow less frequently compared to current assets

- Tax Implications: Long-term investments may have different tax treatments, offering potential benefits for investors

Definition: Non-current assets are long-term investments, like property, plant, and equipment, not expected to be converted to cash within a year

Non-current assets are a crucial component of a company's financial health and represent long-term investments that a business holds for extended periods. These assets are not intended to be sold or converted into cash within the next fiscal year and are typically associated with the company's operations and long-term growth. The term "non-current" is used to distinguish these assets from current assets, which are expected to be converted into cash or used up within one year.

One of the key characteristics of non-current assets is their long-term nature. These assets are often referred to as fixed assets or long-term investments and are essential for the company's ongoing operations and future prospects. Examples of non-current assets include property, plant, and equipment, such as real estate, buildings, machinery, and vehicles. These items are substantial and have a useful life that extends beyond the standard operating cycle of a business. For instance, a company might invest in a new manufacturing plant that will be used for production over several years, or a retail business may purchase a fleet of delivery trucks to support its logistics operations.

The classification of non-current assets is important for financial reporting and analysis. These assets are typically recorded on a company's balance sheet at their historical cost, which may differ from their current market value. This historical cost is then depreciated over the asset's useful life to reflect its decreasing value over time. Depreciation is a critical concept in accounting, as it allocates the cost of the asset over multiple periods, providing a more accurate representation of the company's financial performance and the value of its assets.

Non-current assets play a significant role in assessing a company's financial stability and long-term viability. Investors and creditors closely examine these assets to understand the company's ability to generate future cash flows and maintain its operations. A robust and diverse non-current asset portfolio can indicate a company's commitment to long-term growth and its capacity to manage risks associated with these investments. For instance, a company with a well-maintained fleet of vehicles can ensure efficient transportation and delivery, while a well-leased commercial property can provide a steady income stream.

In summary, non-current assets are long-term investments that are integral to a company's operations and future prospects. These assets, such as property, plant, and equipment, are not expected to be converted into cash within a year and are subject to depreciation over their useful lives. Understanding the nature and classification of non-current assets is essential for financial reporting, analysis, and assessing a company's overall financial health and long-term sustainability.

Maximizing Affiliate Investments: Strategies for Long-Term Success

You may want to see also

Classification: These assets are classified as non-current on the balance sheet due to their long-term nature

The classification of long-term investments as non-current assets on a company's balance sheet is a fundamental aspect of financial reporting. This classification is primarily based on the long-term nature of these investments, which are typically held for more than one year. Non-current assets are those that are not expected to be converted into cash or used up within a normal operating cycle, which is usually one year or less.

Long-term investments, such as equity securities, bonds, and other financial instruments, are considered non-current because they are not intended for short-term use. These investments are often part of a company's long-term financial strategy, providing a source of capital growth, income, or both. For example, a company might invest in stocks or bonds with a maturity date far in the future, expecting to hold these investments for an extended period.

The classification of these assets as non-current is crucial for several reasons. Firstly, it provides a clear picture of a company's financial position and its ability to meet long-term obligations. Investors and creditors can assess the company's financial health by understanding the nature and duration of its investments. Secondly, this classification allows for a more accurate representation of the company's cash flow and liquidity. Non-current assets are not expected to generate immediate cash, so they do not impact the company's short-term financial flexibility.

On a balance sheet, non-current assets are typically reported in the order of their liquidity, with the most liquid assets first. Long-term investments are usually listed after current assets, such as accounts receivable and inventory, as they are not readily convertible into cash within the next year. This arrangement provides a clear distinction between assets that are available for immediate use and those that are tied up in long-term investments.

In summary, the classification of long-term investments as non-current assets is a standard practice in financial reporting, reflecting the long-term nature of these investments. This classification is essential for providing a comprehensive view of a company's financial position, cash flow, and liquidity, ensuring that stakeholders have the necessary information to make informed decisions.

Debt Securities: Unlocking the Investment-Finance Connection

You may want to see also

Examples: Long-term investments include stocks, bonds, and other financial instruments held for more than a year

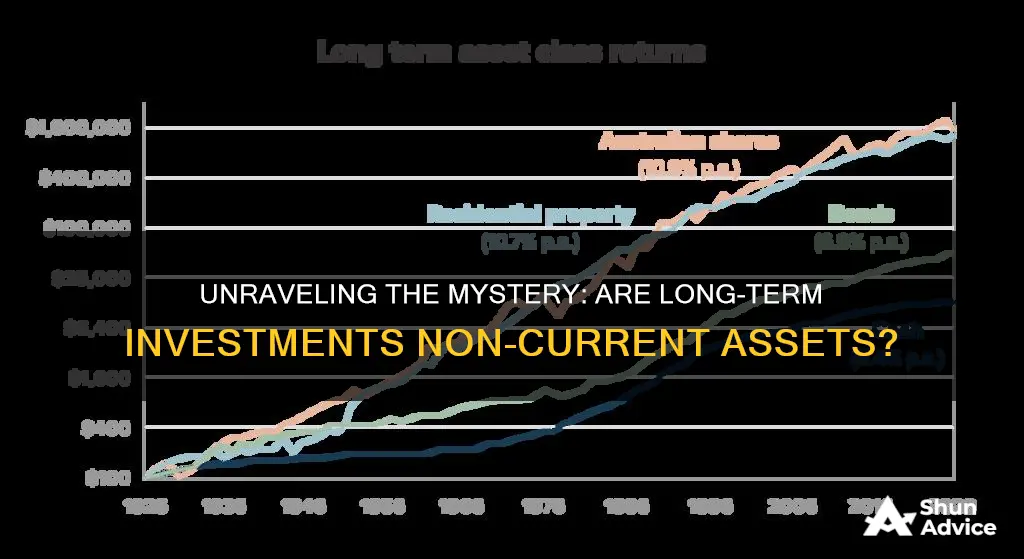

Long-term investments are a crucial component of a company's financial portfolio, and they play a significant role in its overall financial health. These investments are typically held for an extended period, often more than a year, and are considered non-current assets on a company's balance sheet. The primary purpose of long-term investments is to generate returns over time, providing a steady income stream for the company.

One of the most common examples of long-term investments is stocks. When a company purchases shares of another corporation, it becomes a long-term investor. These stocks are bought with the expectation that the company's value will increase over time, and the investment can be sold at a higher price in the future. Stocks offer the potential for capital appreciation and dividend income, making them an attractive option for long-term financial growth.

Bonds are another essential type of long-term investment. Companies issue bonds to raise capital, and investors purchase these bonds, essentially lending money to the company. Bonds typically have a maturity date, meaning they are held for a specific period, often several years. Investors receive regular interest payments during the bond's life and can redeem the principal amount at maturity. Bonds are considered a more stable investment compared to stocks, making them a preferred choice for risk-averse investors.

In addition to stocks and bonds, long-term investments can also include other financial instruments. These may include mutual funds, which are pools of money invested in a diversified portfolio of stocks, bonds, or other securities. Companies may also invest in derivatives, such as options and futures contracts, which are derived from underlying assets like stocks or commodities. These derivatives are often used for hedging purposes or to speculate on price movements.

The classification of long-term investments as non-current assets is essential for financial reporting and analysis. Non-current assets are those that are not expected to be converted into cash or sold within a year. By holding these investments for the long term, companies can benefit from potential capital gains and regular income, contributing to their overall financial stability and growth.

Unraveling the True Nature of Short-Term vs. Long-Term Investments

You may want to see also

Impact on Cash Flow: Non-current assets affect cash flow less frequently compared to current assets

Non-current assets, also known as long-term assets, have a significant impact on a company's financial health and operations, but their effect on cash flow is distinct from that of current assets. Current assets, such as cash, accounts receivable, and inventory, are more closely tied to a company's short-term financial activities and are expected to be converted into cash within one year or less. In contrast, non-current assets are long-term investments and resources that are not readily convertible into cash in the short term. These assets include property, plant, and equipment, as well as long-term investments, intangible assets, and other long-term financial instruments.

The impact of non-current assets on cash flow is less frequent and more delayed compared to current assets. Non-current assets are typically acquired and utilized over an extended period, often several years or more. For example, a company might invest in a new manufacturing plant, which is a non-current asset, and it will take time to depreciate and utilize this asset fully. During the initial investment phase, cash outflow is significant, but as the asset is used and depreciated over time, it generates cash flow through its operational activities. This process is gradual and may not result in immediate cash inflows or outflows.

In contrast, current assets are more directly linked to a company's day-to-day operations and short-term financial management. For instance, accounts receivable represents money owed by customers for goods or services sold on credit. This asset is expected to be converted into cash within a short period, often within a month or a quarter. Similarly, inventory is a current asset that represents goods available for sale, and its value is expected to be realized through sales and cash collections in the near future. Therefore, changes in current assets have a more immediate and frequent impact on a company's cash flow.

The less frequent and delayed impact of non-current assets on cash flow is a critical aspect of financial analysis and management. Investors and creditors need to understand how these long-term investments and resources contribute to a company's financial stability and growth. Non-current assets provide a foundation for a company's long-term operations and may not directly influence short-term cash flow needs. However, they are essential for maintaining a company's competitive advantage, market position, and overall financial health.

In summary, non-current assets have a unique relationship with cash flow, as they are long-term investments that generate value over time. While they may not directly impact short-term cash flow, they are vital for a company's sustainability and growth. Understanding this distinction is crucial for financial analysts, investors, and management to make informed decisions regarding asset allocation, investment strategies, and overall financial planning.

CDs: Long-Term Savings or Short-Term Strategy?

You may want to see also

Tax Implications: Long-term investments may have different tax treatments, offering potential benefits for investors

Long-term investments can have significant tax implications for investors, and understanding these can be crucial for optimizing financial strategies. When an investor holds an asset for an extended period, typically more than a year, it often falls under the category of long-term investments. These investments are subject to specific tax rules that can provide advantages compared to short-term holdings.

One key tax benefit is the potential for lower tax rates. In many jurisdictions, long-term capital gains are taxed at a reduced rate compared to ordinary income. This lower rate is often applied to the profit realized from selling the investment after a certain holding period, usually one year or more. For example, in the United States, long-term capital gains are taxed at 0%, 15%, or 20%, depending on the investor's income, whereas short-term gains are taxed as ordinary income, which can be significantly higher. This tax advantage can result in substantial savings for investors, especially those with substantial long-term gains.

Additionally, the tax treatment of long-term investments can vary depending on the type of asset. For instance, in some countries, dividends received from long-term holdings of stocks or mutual funds may be eligible for reduced tax rates or even tax-free status, provided certain conditions are met. This can be particularly beneficial for investors in dividend-paying companies, as it allows them to reinvest the savings back into the portfolio or use them for other financial goals.

Furthermore, the tax rules surrounding long-term investments can also impact the overall investment strategy. Investors may consider the tax implications when deciding whether to hold an asset for the long term or to recognize gains and rotate their portfolios. By understanding the tax benefits, investors can make more informed decisions, potentially maximizing their returns while minimizing tax liabilities.

In summary, long-term investments often come with distinct tax advantages, such as reduced capital gains tax rates and potential tax-free treatment of certain income sources. These benefits can significantly impact an investor's overall financial strategy, encouraging a long-term perspective and potentially enhancing investment returns. It is essential for investors to be aware of these tax implications to make well-informed choices in their investment journey.

Unraveling ETFs: Are They Short-Term Investments?

You may want to see also

Frequently asked questions

Long-term investments are typically classified as non-current assets on a company's balance sheet. These investments are expected to be held for more than one year and are not intended for immediate sale or conversion into cash. Examples include investments in bonds, stocks, and other financial instruments that the company plans to keep for the long term.

Long-term investments significantly influence a company's financial reporting. They are reported at their fair value, which may fluctuate over time. These investments generate income, such as interest or dividends, which is recognized as interest income in the income statement. Additionally, any changes in the fair value of these investments are recorded in the other comprehensive income section of the balance sheet.

Yes, there are certain criteria to classify an investment as a non-current asset. Firstly, the investment must have a maturity or expected holding period of more than one year. Secondly, it should not be intended for sale in the near future. Lastly, the company should have the intent and ability to hold the investment for the long term, and it should not be a trading security or a current asset.