Schwab is a well-known financial services firm that offers a range of investment products and services. When considering whether your investments are safe at Schwab, it's important to understand the firm's reputation, regulatory compliance, and the various safeguards they have in place to protect investors. This includes comprehensive insurance coverage, robust security measures, and transparent reporting to ensure that your assets are protected and that you have access to your investments as needed. Additionally, Schwab's commitment to investor education and its resources for understanding and managing risk can help you make informed decisions about your investments.

What You'll Learn

- Schwab's Security Measures: How does Schwab protect investor assets

- FDIC and SIPC Coverage: What insurance protects my investments

- Schwab's Fraud Prevention: What steps does Schwab take to prevent fraud

- Market Volatility and Risk: How does market volatility affect my investments

- Schwab's Customer Support: What support is available for investors

Schwab's Security Measures: How does Schwab protect investor assets?

Schwab, a prominent financial services firm, understands the critical importance of safeguarding investor assets. With a vast array of investment options and a large customer base, ensuring the security of funds is paramount. Here's an in-depth look at the security measures employed by Schwab to protect investor assets:

Robust Cybersecurity Infrastructure: Schwab invests heavily in state-of-the-art cybersecurity systems to fortify its digital defenses. This includes advanced encryption protocols, multi-factor authentication, and real-time monitoring systems. By implementing these measures, Schwab aims to prevent unauthorized access to investor accounts, safeguarding sensitive information and financial assets. The company's cybersecurity team works tirelessly to identify and mitigate potential threats, ensuring that investor data remains secure.

Strict Access Controls: Access to investor accounts is tightly controlled, with multiple layers of verification. Schwab employs biometric authentication, such as fingerprint or facial recognition, for secure login processes. Additionally, the firm utilizes role-based access controls, ensuring that employees have access only to the information necessary for their specific roles. This minimizes the risk of internal fraud and unauthorized transactions.

Fraud Detection and Prevention: Schwab has developed sophisticated fraud detection algorithms and systems to identify suspicious activities promptly. These tools analyze transaction patterns, account behavior, and other relevant data to flag potential fraudulent activities. In the event of any anomalies, the system triggers alerts, allowing Schwab's security team to take immediate action. The firm's fraud prevention strategies are continually updated to adapt to evolving fraud techniques.

Secure Fund Transfers and Payments: When it comes to fund transfers and payments, Schwab employs secure protocols to ensure the integrity and confidentiality of such transactions. This includes using secure communication channels, such as SSL/TLS encryption, to protect data during transmission. Additionally, Schwab offers various secure payment methods, including direct deposits and electronic transfers, providing investors with convenient and safe ways to manage their investments.

Regular Security Audits and Training: Regular security audits are conducted to assess the effectiveness of Schwab's security measures. These audits involve comprehensive assessments of the firm's infrastructure, policies, and procedures. By identifying vulnerabilities and addressing them proactively, Schwab ensures that its security protocols remain robust. Moreover, the company provides regular security training to its employees, keeping them informed about the latest threats and best practices in data protection.

In summary, Schwab's commitment to investor security is evident through its comprehensive security measures. By employing advanced cybersecurity technologies, implementing strict access controls, and utilizing fraud detection systems, Schwab strives to create a safe environment for investors. These efforts, combined with regular security audits and employee training, contribute to the overall protection of investor assets, fostering trust and confidence in the firm's services.

Key Objectives of Investment Management Strategies

You may want to see also

FDIC and SIPC Coverage: What insurance protects my investments?

When it comes to safeguarding your investments, understanding the insurance mechanisms in place is crucial, especially when dealing with a brokerage firm like Charles Schwab. Two key insurance programs, the Federal Deposit Insurance Corporation (FDIC) and the Securities Investor Protection Corporation (SIPC), play a vital role in protecting your assets.

The FDIC primarily insures deposits held in banks and savings associations. However, it does not directly protect investments. This insurance ensures that your funds are safe up to a certain amount if the financial institution fails, but it doesn't cover the value of your stocks, bonds, or other securities. For investment protection, you need to look at SIPC.

SIPC is a non-profit corporation that safeguards individual securities accounts. It provides protection against the loss of your securities and cash held in a brokerage account due to the failure of the brokerage firm. SIPC coverage ensures that in the event of a brokerage firm's insolvency, your investments up to certain limits are protected. This coverage is designed to prevent the loss of principal due to the firm's inability to meet its financial obligations.

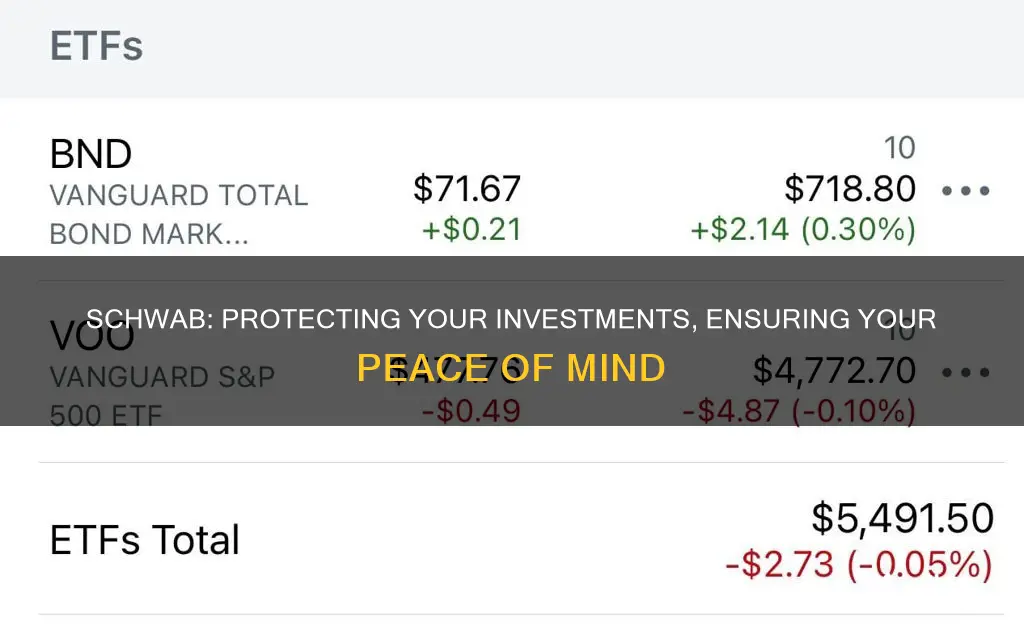

It's important to note that SIPC coverage has limits. As of 2023, the standard coverage is up to $500,000 per customer, per brokerage firm, for each type of account (e.g., cash, securities). This means that if you have multiple accounts with the same firm, the total protection is $500,000 per firm. Additionally, SIPC does not protect against market fluctuations or losses in the value of your investments.

Understanding these insurance mechanisms is essential for investors to feel confident in their decision to invest with a particular brokerage. While Schwab, like other firms, relies on these insurance programs, it's also crucial to diversify your investments and regularly review your portfolio to manage risk effectively.

A Guide to Investing in Nasdaq 100 from India

You may want to see also

Schwab's Fraud Prevention: What steps does Schwab take to prevent fraud?

Schwab, a prominent financial services firm, employs a comprehensive set of measures to safeguard its clients' investments and prevent fraudulent activities. Their fraud prevention strategies are designed to protect both the company and its investors, ensuring a secure and trustworthy environment for financial transactions. Here's an overview of the steps taken by Schwab to maintain a robust fraud prevention system:

Advanced Security Protocols: Schwab has invested heavily in cutting-edge technology to fortify its security infrastructure. They utilize sophisticated algorithms and machine learning models to detect and analyze potential fraudulent patterns. These tools can identify suspicious activities in real-time, allowing for immediate intervention. The firm's security protocols are constantly evolving to stay ahead of emerging fraud techniques, ensuring that clients' assets remain protected.

Multi-Factor Authentication: To enhance security, Schwab implements multi-factor authentication (MFA) for all user accounts. This means that when a client logs in to their account, they are required to provide multiple forms of verification, such as a password and a unique code sent to their mobile device. MFA significantly reduces the risk of unauthorized access, making it harder for fraudsters to gain control of accounts.

Regular Security Audits: Regular security audits and assessments are conducted by Schwab's internal teams and external cybersecurity experts. These audits involve thorough examinations of the company's systems, networks, and processes to identify vulnerabilities and potential weaknesses. By proactively addressing these issues, Schwab can strengthen its defenses against fraud and ensure compliance with industry standards.

Employee Training and Awareness: Schwab recognizes that preventing fraud starts with its employees. They provide comprehensive training programs to educate staff about fraud identification, reporting, and prevention. Employees are taught to recognize suspicious activities, such as unusual account behavior or potential security breaches. Regular awareness campaigns and workshops keep the team informed about the latest fraud trends and best practices, fostering a culture of security within the organization.

Fraud Reporting and Response: Schwab has established a dedicated fraud response team that is available 24/7 to handle potential security incidents. When a suspicious activity is detected, the team takes immediate action, which may include freezing accounts, conducting further investigations, and notifying the appropriate authorities. The firm's efficient response system ensures that any potential fraud is addressed swiftly, minimizing the impact on clients' investments.

By implementing these robust fraud prevention measures, Schwab demonstrates its commitment to protecting its clients' interests and maintaining a secure investment environment. These steps not only safeguard the company's reputation but also provide investors with peace of mind, knowing that their assets are protected by industry-leading security practices.

Investing vs Saving: Understanding the Key Differences

You may want to see also

Market Volatility and Risk: How does market volatility affect my investments?

Market volatility can significantly impact your investments, especially when it comes to your holdings at a brokerage like Charles Schwab. Volatility refers to the rapid and significant price fluctuations in the financial markets, which can create both opportunities and risks for investors. Understanding how market volatility affects your investments is crucial for making informed decisions and managing your portfolio effectively.

When the market is volatile, it means that asset prices can experience rapid and unpredictable changes. This volatility can be influenced by various factors such as economic news, geopolitical events, company-specific developments, or even investor sentiment. During volatile periods, stock prices may rise and fall dramatically within a short time frame, which can have both positive and negative consequences for your investments. On the one hand, volatility can lead to potential gains if you make well-timed investment decisions. On the other hand, it can also result in significant losses if you're not prepared or if your investments are not well-diversified.

One of the primary effects of market volatility is the increased risk associated with your investments. Volatile markets often lead to higher price swings, which can cause your portfolio's value to fluctuate more rapidly. For example, if you hold a stock that is highly sensitive to market volatility, its price might drop significantly during a downturn, potentially eroding your investment's value. Similarly, if you have a significant portion of your portfolio invested in volatile assets, the overall risk of your investment strategy increases. This heightened risk can be particularly concerning for investors who are risk-averse or have long-term financial goals that require stable and consistent growth.

To mitigate the impact of market volatility, investors often focus on diversification. Diversification involves spreading your investments across different asset classes, sectors, and geographic regions. By diversifying your portfolio, you reduce the risk associated with any single investment. For instance, if you invest in a mix of stocks, bonds, and alternative assets, a downturn in one area might be offset by gains in another. This strategy helps to smooth out the volatility impact and provides a more stable investment experience. Additionally, investors can consider implementing risk management techniques such as setting stop-loss orders or regularly reviewing and rebalancing their portfolios to maintain their desired risk exposure.

In the context of your investments at Schwab, it's essential to monitor your portfolio's performance and adjust your strategy accordingly. Schwab provides various tools and resources to help investors navigate market volatility. These may include real-time market data, research reports, and educational materials to guide your investment decisions. By staying informed and actively managing your portfolio, you can better position yourself to handle market fluctuations and potentially protect your investments. Remember, while market volatility is an inherent part of investing, proper risk management and a long-term perspective can help you weather these challenges and achieve your financial goals.

Recording Debt-Equity Investments: Balance Sheet Strategies

You may want to see also

Schwab's Customer Support: What support is available for investors?

Schwab, a well-known financial services firm, offers a range of investment products and services, and ensuring the safety of investors' assets is a top priority for the company. Here's an overview of the customer support and resources available to investors regarding the safety of their investments:

Schwab provides a comprehensive support system to address investor concerns and queries. Their customer support channels include a dedicated phone line, online chat, and email services. Investors can reach out to the support team via these methods to discuss any investment-related matters, including the security of their holdings. The company's representatives are trained to handle various investment topics, ensuring that investors receive accurate and reliable information.

One of the key resources for investors is the 'Investor Center' on the Schwab website. This section offers a wealth of educational materials and tools to help investors make informed decisions. It includes articles, guides, and videos covering various investment strategies, risk management, and portfolio management techniques. By providing these resources, Schwab empowers investors to take control of their financial journey and make choices that align with their risk tolerance and goals.

Additionally, Schwab offers a feature called 'Portfolio Analysis' within their online platform. This tool allows investors to review and analyze their investment performance over time. It provides insights into the composition of their portfolio, including asset allocation, performance metrics, and risk assessments. By utilizing this feature, investors can make data-driven decisions and adjust their strategies accordingly, ensuring they stay on track with their investment plans.

For more personalized assistance, Schwab's financial advisors are available to provide one-on-one guidance. These advisors can offer tailored investment advice, helping investors navigate market complexities and make strategic choices. They can also assist in reviewing and optimizing investment portfolios, ensuring that the investor's assets are well-protected and aligned with their financial objectives.

In summary, Schwab offers a multi-faceted approach to customer support, providing investors with the tools and resources they need to make informed decisions. From comprehensive online resources to dedicated support channels and personalized advice, investors can feel confident in their investment choices, knowing that Schwab is committed to their financial well-being.

Investing at 60: Strategies for Late-Start Retirement Planning

You may want to see also

Frequently asked questions

Yes, Charles Schwab is a well-established and trusted financial services company with a strong reputation for security and customer protection. They have been in the industry for over 40 years and are known for their comprehensive range of investment products and services.

Schwab employs robust security measures to safeguard your investments. They utilize advanced encryption technologies to secure your account information and transactions. Additionally, they offer two-factor authentication, fraud monitoring, and regular security audits to ensure the safety of your assets.

Withdrawing funds from your Schwab account is a straightforward process. You can initiate a withdrawal online through their website or mobile app. Simply log in to your account, select the investment you want to withdraw, and follow the prompts to complete the transaction. Funds are typically available in your bank account within a few days.

Yes, Charles Schwab provides various insurance and protection options for investors. They offer up to $1 million in insurance coverage for eligible accounts through the Securities Investor Protection Corporation (SIPC). This means that in the unlikely event of a firm failure, your investments up to the SIPC limit are protected.

Absolutely! Schwab allows investors to transfer their existing investments from other brokers. The process is relatively simple and involves providing necessary documentation and account information. Once the transfer is initiated, Schwab will handle the process, and your investments will be accessible through your new Schwab account.