Building a strong investment portfolio can be a challenging task, but it is an essential step towards achieving your financial goals. A well-diversified portfolio is vital to any investor's success, and there are several steps you can take to ensure you're on the right track. Firstly, it's important to establish clear investment goals and understand your risk tolerance and time horizon. This will help you determine your investment strategy and the optimal portfolio mix. Next, you should decide on the types of assets you want to include in your portfolio, such as stocks, bonds, mutual funds, exchange-traded funds (ETFs), and alternative investments. It's crucial to consider your risk tolerance and financial profile when selecting investments. Once you've chosen your investments, you need to monitor your portfolio regularly and rebalance it when necessary. This might involve buying or selling certain assets to ensure your portfolio aligns with your investment strategy and goals. Building an investment portfolio can be a complex process, and it's always a good idea to seek advice from a financial advisor who can guide you through the steps and help you make informed decisions.

| Characteristics | Values |

|---|---|

| Investment goals | Retirement, children's education, large purchases, starting a business, leaving a financial legacy |

| Time horizon | Short-term, medium-term, long-term |

| Risk tolerance | Aggressive, moderate, conservative |

| Investment types | Stocks, bonds, mutual funds, exchange-traded funds (ETFs), commodities, precious metals, real estate, cryptocurrencies, hedge funds, cash alternatives |

| Asset allocation | Equities, fixed-income securities, bonds, cash investments |

| Diversification | Sector, industry, security, market value, growth stocks, value stocks, international diversification |

| Taxes | Tax-deferred accounts, taxable accounts |

| Monitoring and rebalancing | Regularly review and adjust portfolio, rebalancing, tax-loss selling |

What You'll Learn

Define your investment goals and risk tolerance

Before you start choosing how to invest, it's important to define your investment goals and risk tolerance. Ask yourself: what matters most to you? What are your aspirations? What are your short-term and long-term financial goals?

Your financial goals might include retirement, saving for your child's college tuition, buying a home or car, starting a business, or leaving a financial legacy to your children or heirs.

Once you've established your goals, you need to determine your time horizon for each one. For example, if you're saving for retirement, think about when you want to retire. If another goal is saving for college, your time horizon will be based on when your children will reach college age.

Your risk tolerance is your ability to accept investment losses in exchange for the possibility of higher investment returns. It's tied to how much time you have before reaching your financial goals, as well as how comfortable you are with the ups and downs of the market. If your goal is many years away, you have more time to ride out the highs and lows. A longer time horizon might support a more aggressive portfolio, while a shorter time horizon may require a more conservative approach.

Your risk tolerance will also depend on your personality and how you mentally handle market volatility. Are you willing to risk losing some money for the possibility of greater returns? Could you sleep at night if your investments took a short-term drop?

An unmarried 22-year-old college graduate just beginning their career will have a different risk tolerance and investment strategy than a 55-year-old married person expecting to help pay for a child's college education and retire in the next decade.

Clarifying your goals, time horizon, and risk tolerance will help you choose an appropriate investment strategy and build a portfolio that aligns with your unique financial objectives.

Creating a Diversified Investment Portfolio: Strategies for Success

You may want to see also

Understand your investment time horizon

Understanding your investment time horizon is a critical step in building a strong investment portfolio. This refers to how long you plan to hold your investments before needing to access the money. Defining your time horizon will help you determine the appropriate investment strategies and asset allocation for your goals.

Investment time horizons can generally be categorised into three types: short-term, medium-term, and long-term. Short-term goals are those where you need the money within the next 12 months. Medium-term goals typically have a time horizon of one to five years, while long-term goals are those that will take more than five years to achieve. For example, saving for a new car in the next year would be a short-term goal, whereas saving for retirement in 30 years would be a long-term goal.

Your investment time horizon is important because it helps you assess your risk tolerance and determine the level of risk you are comfortable with. If you have a longer time horizon, you may be able to tolerate more risk as you have more time to recover from potential market downturns. On the other hand, if your goal is approaching and you have a shorter time horizon, you may need to adopt a more conservative strategy to ensure you don't lose money.

Let's consider an example. Suppose you are saving for a down payment on a house, and you plan to buy a house in three years. In this case, your time horizon is three years, making it a medium-term goal. Now, let's say you have $50,000 saved up, and you're considering investing it in stocks or bonds. Since your goal is only three years away, investing in stocks may be too risky because their values can fluctuate significantly in the short term. Instead, you might opt for more conservative investments, such as bonds or fixed-income securities, which offer steadier returns with lower risk.

On the other hand, if your goal is to save for retirement in 30 years, you have a much longer time horizon. In this case, you can afford to take on more risk because you have time to ride out any market volatility. You might choose to invest a larger portion of your portfolio in stocks, which have the potential for higher returns over the long term.

Building a Robust Investment Portfolio: Where to Start?

You may want to see also

Choose your asset allocation

Choosing your asset allocation is a crucial step in building a strong investment portfolio. Here are some detailed guidelines to help you make this decision:

Understand Your Risk Tolerance:

Before deciding on your asset allocation, it is essential to assess your comfort with investment risk. Be honest with yourself about how you handle market volatility. If you are comfortable with high-risk investments and can tolerate market swings, you may lean towards a more aggressive portfolio. On the other hand, if market downturns give you "ulcers," you may prefer a more conservative approach with lower-risk investments. Your risk tolerance will influence the mix of equities and fixed-income investments in your portfolio.

Time Horizon:

Consider your investment time horizon, or how long you plan to invest for each goal. For example, if you're saving for retirement, think about your expected retirement age. If you're saving for a child's college education, consider their age and how many years of schooling you plan to cover. Generally, a longer time horizon allows for a more aggressive portfolio, while a shorter time horizon calls for a more conservative approach.

Investment Goals:

Clarify your investment goals and what you hope to achieve. Are you investing for retirement, saving for a down payment on a house, or funding a child's education? Each goal may have a different time horizon and risk tolerance. Prioritize your goals and tailor your asset allocation accordingly.

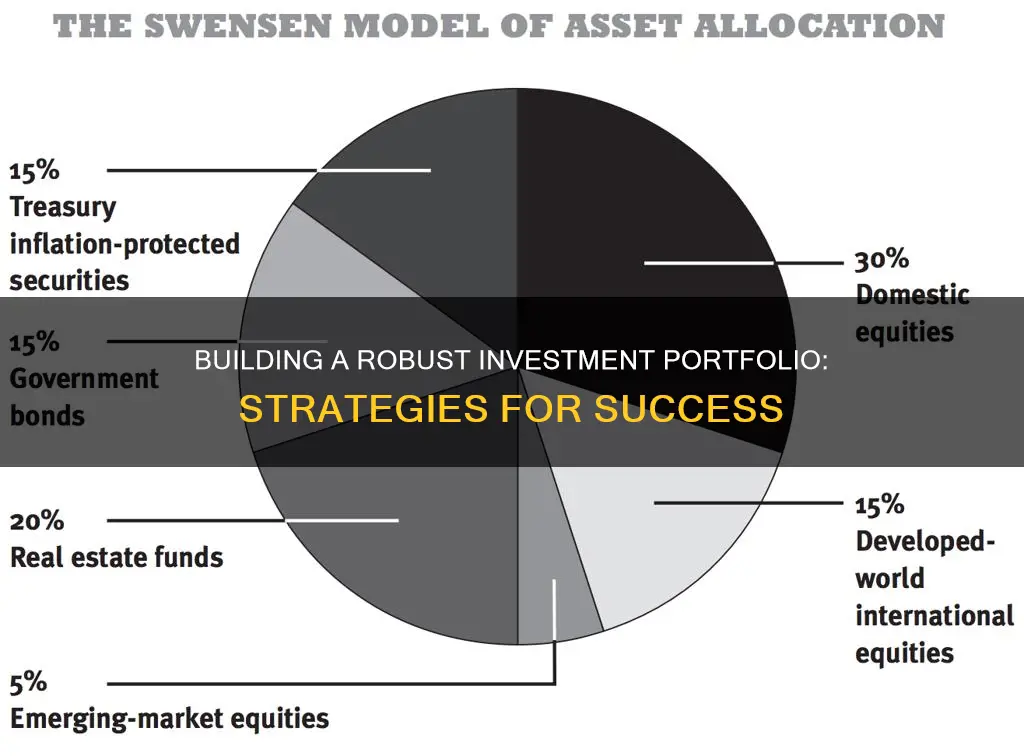

Asset Allocation Strategies:

Once you understand your risk tolerance, time horizon, and goals, you can start determining your asset allocation strategy. A conservative portfolio typically focuses on protecting its value, with a larger allocation to bonds and less to equities. Aggressive portfolios, on the other hand, tend to devote a larger portion to equities and seek higher returns. Your portfolio can also be somewhere in between—a moderate or balanced portfolio might allocate 60% to stocks and 40% to bonds, for instance.

Diversification:

Diversification is a key component of a strong investment portfolio. Diversify across different asset classes, such as stocks, bonds, mutual funds, exchange-traded funds (ETFs), and alternative investments. You can further diversify within each asset class. For example, with stocks, you can invest in different sectors, market capitalizations, and domestic and foreign stocks. With bonds, you can diversify by maturity, government vs corporate debt, credit rating, and interest rates. Remember that diversification helps manage risk but does not guarantee against losses.

Monitor and Rebalance:

Your asset allocation may get out of alignment over time due to market fluctuations. Regularly monitor your portfolio to ensure it still aligns with your goals and risk tolerance. Rebalancing involves buying or selling assets to return your portfolio to its intended allocation. You can do this at set intervals or when certain asset classes deviate significantly from your desired allocation.

Savings, Investment, and Productivity: The Interplay for Economic Growth

You may want to see also

Diversify your portfolio

Diversifying your portfolio is a key step in building a strong investment portfolio. Diversification is about spreading your money across multiple types of investments, and it's important because different investments tend to perform well at different times. This means that having a mix of investments can help smooth out returns over the long run.

There are several ways to diversify your portfolio:

- Stocks: You can choose to invest in a mix of large, medium, and small companies across different sectors and styles. For example, you can invest in growth stocks, which have better-than-average growth prospects but may seem expensive relative to their earnings, or value stocks, which some investors believe are undervalued. You can also diversify by investing in both domestic and international stocks.

- Bonds: You can diversify your bond investments by considering factors such as coupon, maturity, bond type, credit rating, and the interest rate environment.

- Mutual Funds: Mutual funds allow you to hold a diverse range of stocks and bonds that are professionally researched and picked by fund managers. While they charge fees, they can be useful for investors with relatively small amounts of money as they provide the benefits of diversification and economies of scale.

- Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds but trade like stocks and track a chosen index or basket of stocks. They are passively managed, which means they have lower fees than mutual funds. Like mutual funds, they cover a wide range of asset classes and can be useful for rounding out your portfolio.

- Other Investments: You can also consider alternative investments such as commodities, precious metals, real estate, cryptocurrencies, and hedge funds. These can add further diversification to your portfolio as they sometimes outperform stocks. However, they can be riskier and more volatile.

When diversifying your portfolio, it's important to consider your risk tolerance and investment goals. Different investments carry different levels of risk, so you should choose a mix of investments that aligns with your comfort level and financial objectives. Additionally, remember to periodically reassess and rebalance your portfolio to maintain your desired level of diversification.

Investment Philosophy: Portfolio Diversification Strategies Explained

You may want to see also

Monitor and rebalance your portfolio

Monitoring and rebalancing your portfolio is essential for keeping it strong and healthy. Here are some detailed guidelines on how to do this:

Monitoring Your Portfolio

Life and financial markets are ever-changing, so it's important to regularly review your portfolio to ensure it aligns with your goals and risk tolerance. Check in on your portfolio at least once a year, and possibly more often if there are significant market fluctuations or changes in your personal circumstances.

Rebalancing Your Portfolio

Over time, your chosen asset allocation may get out of balance. For example, if one of your stocks rises in value, it can disrupt the proportions of your portfolio. Rebalancing involves adjusting your portfolio to restore it to its original makeup or target allocation. This can mean buying more of underweighted securities with the proceeds from selling overweighted ones.

Some advisors recommend rebalancing at set intervals, such as every six or 12 months, or when the allocation of one of your asset classes shifts by a certain percentage, such as 5%. For instance, if your original allocation was 60% stocks and it increased to 65%, you would sell some stocks or invest in other asset classes to bring the stock allocation back to 60%.

When rebalancing, consider the tax implications of selling assets, as well as the outlook for your securities. If you suspect that overweighted stocks are due for a fall, you may want to sell despite potential capital gains taxes. On the other hand, if selling would incur significant taxes, you could avoid this by simply not contributing any new funds to that asset class in the future, allowing its weighting to decrease over time.

Adjusting Your Investment Strategy

In addition to regular rebalancing, you may also need to adjust your overall investment strategy as your life changes. Getting married or divorced, becoming a parent, receiving an inheritance, or nearing retirement are all significant life events that could require rethinking your investment approach.

Tools for Monitoring and Rebalancing

Robo-advisors can be a helpful tool for monitoring and rebalancing your portfolio. They can automatically make adjustments to keep your portfolio in line with your target allocations. Additionally, mutual funds and exchange-traded funds (ETFs) can provide instant diversification and help maintain a balanced portfolio.

Saving and Investment: Synergistic Strategies for Financial Growth

You may want to see also

Frequently asked questions

An investment portfolio is a collection of assets that you buy or deposit money into to generate income or capital appreciation. These assets can include stocks, bonds, mutual funds, exchange-traded funds (ETFs), real estate, and more.

The first step is to establish clear investment goals and understand your risk tolerance and time horizon. Ask yourself: What are my financial goals? How much risk am I comfortable with? How long do I plan to invest for?

The specific mix of assets will depend on your goals, time horizon, and risk tolerance. A well-diversified portfolio typically includes a mix of stocks, bonds, mutual funds, ETFs, and alternative investments.

It's important to regularly monitor and rebalance your portfolio. This may involve buying or selling assets to return to your target asset allocation. You should also reassess your portfolio when your financial situation, goals, or risk tolerance change.