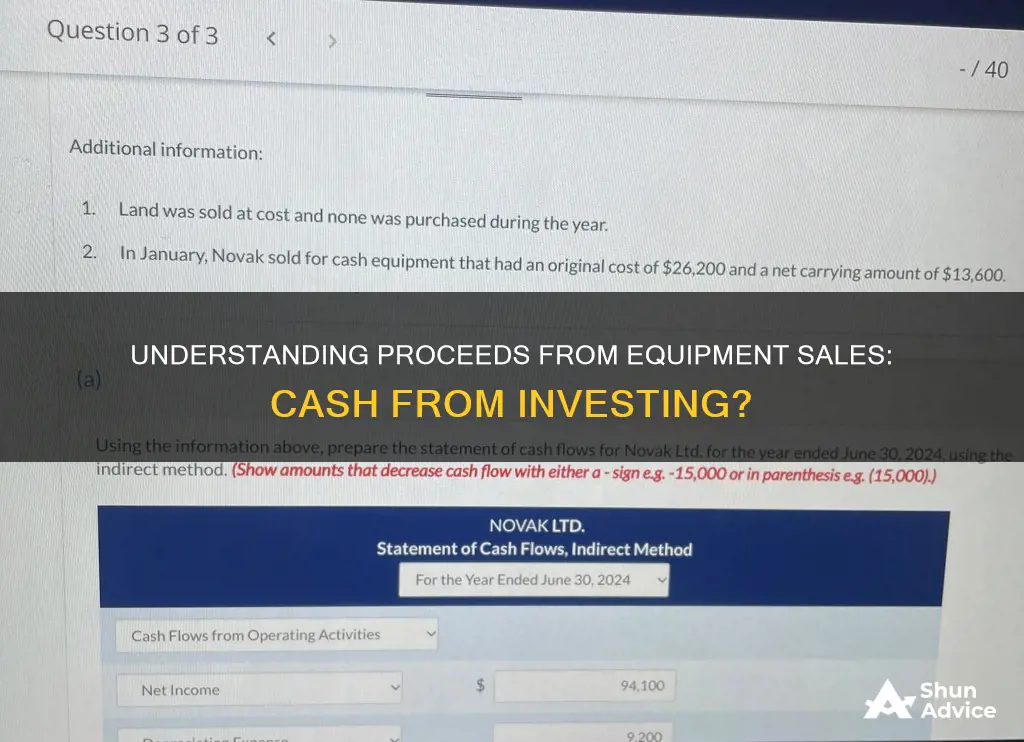

A company's cash flow statement is divided into three sections: cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities. Cash flow from investing activities includes any cash inflows or outflows from the sale or purchase of long-term investments, such as physical assets, securities, or other business investments. This can include the sale of equipment, which would be recorded as a cash inflow in the investing section of the cash flow statement. Therefore, the proceeds from selling equipment are part of the cash flow from investing activities.

| Characteristics | Values |

|---|---|

| Part of cash flow statement | Yes |

| Section of cash flow statement | Cash flow from investing activities |

| Type of cash flow | Positive |

| Impact on cash flow | Increase |

| Type of asset | Long-term |

| Examples | Proceeds from the sale of PP&E, proceeds from the sale of a division, cash from a merger or acquisition |

| Accounting treatment | Gain/loss on sale is a reconciling item between net income and cash flow in the operating section |

What You'll Learn

- Proceeds from equipment sale are a cash inflow in the investing section

- Gain/loss on equipment sale is a reconciling item between net income and cash flow

- Cash purchase of equipment is a cash outflow for investing activities

- Partially/fully financed equipment purchase is a non-cash transaction

- Equipment sale proceeds are added as a cash inflow

Proceeds from equipment sale are a cash inflow in the investing section

The proceeds from the sale of equipment are indeed a cash inflow in the investing section of a company's cash flow statement. This is because the sale of equipment is considered an investing activity, which involves the disposal of long-term assets.

The cash flow statement is one of the three main financial statements that a business uses, the other two being the balance sheet and the income statement. The cash flow statement is divided into three sections: cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities.

Cash flow from investing activities includes any inflows or outflows of cash from a company's long-term investments, such as physical assets, securities, or other business investments. This can include the purchase or sale of fixed assets like property, plant, or equipment. The sale of equipment, therefore, falls under investing activities and is reported as a cash inflow in the investing section of the cash flow statement.

It is important to note that the gain or loss on the sale of equipment is treated separately and is reported in the operating section of the cash flow statement as a reconciling item between net income and cash flow from operations. This treatment only applies when using the indirect method of preparing the operating activities section of the cash flow statement. Under the direct method, gains and losses are ignored.

Overall, the cash flow statement provides valuable insights into a company's financial health and performance, helping business owners, investors, and analysts make informed decisions.

Understanding the Investing Activities on a Cash Flow Statement

You may want to see also

Gain/loss on equipment sale is a reconciling item between net income and cash flow

The sale of equipment is not an operating activity, but rather an investing activity. The proceeds from the sale of equipment are added to the investing activities section of the cash flow statement. However, the gain or loss on the sale of equipment is a reconciling item between net income and cash flow in the operating section. This is because the gain or loss on the sale affects net income but not cash flow.

The operating section of the cash flow statement does not directly report cash inflows and outflows. Instead, it starts with net income from operations, which must match the profit and loss statement, and then shows the adjustments necessary to arrive at the cash flow from operations. When a company sells equipment for a gain, the gain increases net income but not cash. Therefore, the gain is recorded as a negative adjustment in the operating section of the cash flow statement. Conversely, when a company sells equipment at a loss, the loss reduces net income but not cash flow. In this case, the loss is recorded as a positive adjustment in the operating section of the cash flow statement.

It is important to note that the special treatment for gain or loss on the sale of equipment only applies when using the indirect method of preparing the operating activities section of the cash flow statement. Under the direct method, gains and losses are ignored.

In summary, the gain or loss on the sale of equipment is a reconciling item between net income and cash flow in the operating section of the cash flow statement when using the indirect method. This adjustment is necessary because the gain or loss affects net income but not cash flow.

Extra Cash: Smart Investment Strategies for Beginners

You may want to see also

Cash purchase of equipment is a cash outflow for investing activities

A cash purchase of equipment is indeed a cash outflow for investing activities. This is because the purchase of equipment is considered a long-term investment in the company's operations.

The cash flow statement is one of the three main financial statements that a business uses, alongside the balance sheet and income statement. The cash flow statement is divided into three sections: operating activities, investing activities, and financing activities. Investing activities include purchases of physical assets, investments in securities, or the sale of securities or assets.

A cash purchase of equipment is a cash outflow because it involves spending money, which generates negative cash flow. This negative cash flow is not necessarily a bad sign, as it can indicate that management is investing in the long-term health of the company. For example, a company might be investing heavily in equipment to grow the business. While this would be cash-flow negative in the short term, it could be positive in the long term.

The cash flow statement provides an account of the cash used in operations, including working capital, financing, and investing. It bridges the gap between the income statement and the balance sheet by showing how much cash is generated or spent on operating, investing, and financing activities for a specific period.

Cashing Out Investments: Using the Cash App to Withdraw Funds

You may want to see also

Partially/fully financed equipment purchase is a non-cash transaction

Partially or fully financed equipment purchases are non-cash transactions. This means that they are not reported in the cash flow statement. Instead, they are disclosed in the notes to the financial statements or a footnote.

The cash flow statement is one of the three financial reports that a company generates in an accounting period. It bridges the gap between the income statement and the balance sheet by showing how much cash is generated or spent on operating, investing, and financing activities for a specific period.

The cash flow statement has three sections: cash from operating activities, cash from investing activities, and cash from financing activities. Investing activities include the purchase of physical assets, investments in securities, or the sale of securities or assets.

When a company purchases equipment with the intention of keeping it for more than a year, it needs to make journal entries to reflect depreciation. It also needs to make an equipment journal entry when it disposes of the asset.

In the case of a partially or fully financed equipment purchase, the cash flow statement is not affected until the loan or installment amount is paid. The down payment is considered a cash outflow in the investing activities section, while the remaining financed amount is disclosed in the notes to the financial statements.

For example, consider a company that purchases a car for $10,000 by paying cash of $4,000 and signing a promissory note for $6,000. The accounting entry would be to debit the asset account Automobiles for the cost of $10,000, credit the asset account Cash for the $4,000 that was paid, and credit the liability account Notes Payable for $6,000.

In summary, partially or fully financed equipment purchases are non-cash transactions that are disclosed in the notes or footnotes of financial statements. The cash flow statement is impacted only when loan or installment payments are made, with the down payment being considered a cash outflow in the investing activities section.

CDs: Cash or Investment?

You may want to see also

Equipment sale proceeds are added as a cash inflow

The cash flow statement is one of the three main financial statements that a business uses, the other two being the balance sheet and the income statement. The cash flow statement is divided into three sections: cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities.

The investing activities section includes any inflows or outflows of cash from a company's long-term investments, such as the purchase or sale of fixed assets like property, plant, or equipment. The sale of equipment, therefore, falls under this category and is added as a cash inflow.

It is important to note that the cash flow statement only considers the cash aspect of the transaction. The gain or loss on the sale of equipment is reflected in the operating section of the cash flow statement as a reconciling item between net income and cash flow from operations. This is only the case when using the indirect method of preparing the operating activities section. Under the direct method, gains and losses are ignored.

Overall, the cash flow statement provides valuable insights into a company's financial health and performance, helping business owners, investors, and analysts make informed decisions.

Positive Cash Flows: A Smart Investment Strategy?

You may want to see also

Frequently asked questions

Cash flow from investing activities is part of a company's cash flow statement and is used to display investing activities and their impact on cash flow.

Investing activities include the purchase of physical assets, investments in securities, or the sale of securities and assets.

Cash flow from operating activities includes any spending or sources of cash that are part of a company's day-to-day business operations. Cash flow from investing activities, on the other hand, involves long-term uses of cash, such as the purchase or sale of fixed assets.

The proceeds from the sale of equipment are added to the investing activities section of the cash flow statement as a cash inflow.

Yes, proceeds from selling equipment are considered cash from investing activities.