Cash App is a financial services platform that allows users to send, receive, save, and invest their money. The app offers brokerage services through Cash App Investing LLC, a subsidiary of Block, Inc., allowing users to buy and sell stocks and exchange-traded funds (ETFs). When users sell stocks or ETFs through Cash App Investing, the proceeds are automatically deposited into their Cash App balance. From there, users can choose to cash out their investments by withdrawing the funds to their linked bank account. This can be done directly through the app or online through the Cash App website.

| Characteristics | Values |

|---|---|

| How to cash out investments | Tap the Money tab on your Cash App home screen, tap on the Stocks Tile, scroll down to Stocks Owned, select the company whose stock you want to sell, select an amount or enter a custom amount, confirm with your PIN or Touch ID |

| Where does the money go? | The amount of your sale will be automatically deposited into your Cash App balance. From there, you can choose to cash out to your linked bank account |

| How long does it take? | Depending on market activity, sales proceeds may take up to 1 or 2 business days to be deposited in your Cash App balance |

| Are there any fees? | Depending on your transfer speed, you may be subject to a fee |

What You'll Learn

Withdrawing money from the Cash App

To withdraw money from your Cash App balance, you can use the app or the Cash App website. In the app, tap the "Money" tab on your home screen, select a transfer speed, and confirm with your PIN or Touch ID. Alternatively, log in to your account on the Cash App website, click "Money" on the left side, then click "Withdraw" under your Cash Balance. Choose or enter an amount, select your bank account and transfer speed, and confirm. Depending on your transfer speed, there may be a fee involved.

It's worth noting that withdrawals to your bank account from your Cash App will appear on your statement with the prefix "Cash App*". Additionally, the Cash App does not charge any fees per trade, but there may be fees assessed by government agencies, which will be disclosed before trade confirmation.

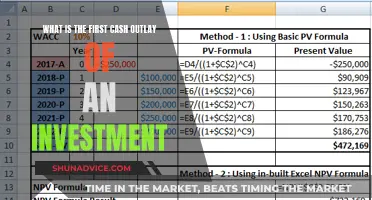

Uncertain Future Cash Flows: Navigating Investment Project Analysis

You may want to see also

Understanding your Cash App Investing Account

When you start investing with Cash App, you create a brokerage account with Cash App Investing LLC. Opening a brokerage account, sometimes referred to as an Investing account, allows you to buy and sell stocks and exchange-traded funds (ETFs).

Your Investing account balance is different from your Cash App balance. The balance associated with your Investing account is called a "stock balance" and represents the total current value of your investments. This balance is shown separately from your general Cash App balance. When you make a purchase, funds are taken from your Cash App balance. If more funds are needed to cover the transaction, they are pulled from your linked debit card.

Any stocks or ETFs bought through Cash App Investing LLC are held by the carrying broker, DriveWealth, LLC. Once you sell your shares, the funds from the sale are automatically transferred to your Cash App balance. These funds are then available to use as you wish, including cashing out to your linked bank account.

Cash App Investing accounts are "zero-balance" accounts. This means that when you buy stocks or ETFs, the purchase amount is transferred from your Cash App balance to your Investing account. When you sell stocks or ETFs, the proceeds are automatically transferred out of your Investing account and into your Cash App balance.

Your Cash App balance is not protected by the Securities Investor Protection Corporation (SIPC), but it may be eligible for other protections, such as FDIC insurance. Securities in your Investing account are protected by the SIPC up to $500,000.

Understanding Cash Flow: Investing Activities Explained

You may want to see also

Selling stock using Cash App Investing

Step 1: Access Your Cash App Account

Begin by logging into your Cash App account on your mobile device. From the home screen of the app, locate and tap the "Money" tab. This will open up various options related to your account.

Step 2: Navigate to Your Stocks

On the "Money" tab, you will find a section called "Stocks Tile." Tap on this to access your stocks portfolio. Here, you can view all the stocks you currently own and manage your investments.

Step 3: Choose the Stock to Sell

Scroll down to the "Stocks Owned" section. Here, you will find a list of all the companies whose stocks you own. Select the specific company whose stock you wish to sell. By selecting the company, you can view the details of your holdings and initiate the selling process.

Step 4: Decide on the Amount to Sell

After selecting the company, you will be given the option to choose the amount of stock you want to sell. You can either select a preset amount or tap on the "..." option to enter a custom amount. This flexibility allows you to sell a portion of your holdings or all of them, depending on your preferences.

Step 5: Confirm the Transaction

Finally, confirm that you want to proceed with the sale. You may be asked to provide your PIN or Touch ID for security purposes. Once you have confirmed, your request to sell the stock will be placed.

Proceeds Deposited to Cash App Balance

It is important to note that the amount from the sale of your stock will be automatically deposited into your Cash App balance. Depending on market activity, this process can take up to 1 or 2 business days. You can then choose to use these funds for other investments, spend them using your Cash Card, or transfer them to your linked bank account.

Cash App Investment Options: Where to Put Your Money

You may want to see also

Cash App Investing Customer Account Agreement

When you open a Cash App Investing account, you create a brokerage account with Cash App Investing LLC, a subsidiary of Block, Inc. This allows you to buy and sell stocks and exchange-traded funds (ETFs).

The balance associated with your Investing account is different from your Cash App balance. The "stock balance" is the total current value of your investments. The securities in your Investing account are held by a third-party custodian, DriveWealth, LLC. The value of your Investing account is shown separately from your general Cash App balance.

When making a stock or ETF purchase, funds are taken from your Cash App balance. If more funds are needed to cover the remainder of the transaction, they are pulled from your linked debit card to your Cash App balance. Any purchased stock or ETF bought through Cash App Investing LLC is held by their carrying broker, DriveWealth, LLC.

Once your stocks and/or ETFs are officially sold, the funds from the sale(s) will be automatically transferred to your Cash App balance. You can then choose to buy more stocks, spend it on your Cash Card, send money to friends and family, or instantly cash out to your linked bank account.

Cash App Investing accounts are considered "zero-balance" accounts. This means that whenever you choose to buy stocks or ETFs, the purchase amount is transferred from your Cash App balance to your Cash App Investing account. When you sell stocks or ETFs, the proceeds of that sale are automatically transferred out of your Investing account at DriveWealth and to your Cash App balance.

In the Cash App Investing Customer Account Agreement, you authorise Cash App Investing and the Carrying Broker to initiate transfers of funds out of your Cash App Investing account into your Cash App balance whenever there is a free credit balance. Your Cash App balance is not Securities Investor Protection Corporation (SIPC) protected, but it may be subject to other protections, such as FDIC insurance.

Cash App Investing LLC

When you start investing with Cash App, you create a brokerage account with Cash App Investing LLC. This allows you to buy and sell stocks and ETFs. The balance associated with your Investing account, or "stock balance", is separate from your Cash App balance and represents the total current value of your investments. Securities in your Investing account are held by a third-party custodian, DriveWealth, LLC.

To sell stocks using Cash App Investing:

- Tap the Money tab on your Cash App home screen.

- Tap on the Stocks Tile.

- Scroll down to Stocks Owned.

- Select the company whose stock you want to sell.

- Select an amount or tap to enter a custom amount.

- Confirm with your PIN or Touch ID.

Once your stocks are sold, the funds from the sales will be automatically transferred to your Cash App Balance. You can then choose to buy more stocks, spend the money on your Cash Card, send money to friends and family, or cash out to your linked bank account.

It is important to note that selling shares may have tax implications, and you should consult a tax advisor for guidance on your particular situation. Additionally, Cash App Investing LLC does not hold the proceeds from the sale of stocks or ETFs. You authorise the proceeds to be automatically transferred to your Cash balance, which is not SIPC-protected but may be eligible for Federal Deposit Insurance Corporation (FDIC) insurance.

Frequently asked questions

First, you need to tap the Money tab on your Cash App home screen, then tap on the Stocks Tile. Scroll down to Stocks Owned and select the company whose stock you want to sell. Select an amount or enter a custom amount, then confirm with your PIN or Touch ID.

Depending on market activity, the sale proceeds may take up to one or two business days to be deposited into your Cash App balance.

Yes, you can withdraw your Cash App balance to your linked payment method. You can do this in the app or online.

Tap the Money tab on your Cash App home screen, select a transfer speed, and confirm with your PIN or Touch ID.

Yes, log into your Cash App account, click Money, then Withdraw under your Cash Balance. Choose or enter an amount, select your bank account and transfer speed, and confirm.