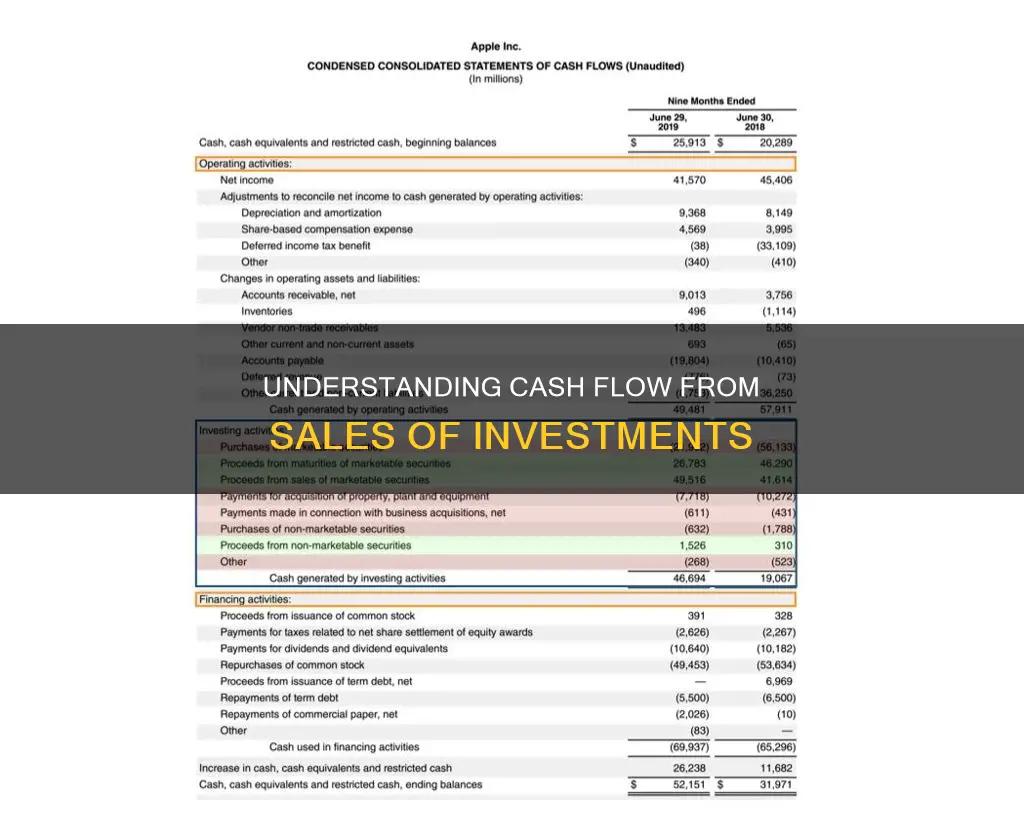

Cash flow from investing activities is a crucial aspect of a company's financial reporting, reflecting the cash inflows and outflows from long-term investments and their impact on overall cash flow. This section of the cash flow statement provides insights into how effectively a company manages its cash, including day-to-day operations and financing activities. Investing activities encompass a range of transactions, such as the purchase or sale of physical assets, investments in securities, acquisitions, and divestitures. These activities are essential for the growth and capital development of a company, and understanding the cash flow from investing activities helps pinpoint areas of cash flow management and provides a comprehensive view of the company's financial health.

| Characteristics | Values |

|---|---|

| Part of a company's financial statement | Cash flow statement |

| Type of activity | Investing activity |

| Involves | Inflow or outflow of cash |

| Nature of the investment | Long-term |

| Examples of inflows | Proceeds from the sale of a division, sale of fixed assets, sale of investment securities, collection of loans and insurance proceeds |

| Examples of outflows | Purchase of fixed assets, purchase of investments, acquisition of other businesses |

What You'll Learn

Cash flow from investing activities

Investing activities include the purchase or sale of physical assets, investments in securities, or the sale of securities or assets. These can be long-term investments in the health or performance of the company, or they can be made to generate income on their own.

Some examples of investing activities are:

- Purchase of fixed assets

- Purchase of investments such as stocks or securities

- Sale of fixed assets

- Sale of investment securities

- Collection of loans and insurance proceeds

- Proceeds from the sale of a division or cash out as a result of a merger or acquisition

Negative cash flow from investing activities does not always indicate poor financial health. It is often a sign that the company is investing in assets, research, or other long-term development activities that are important to the health and continued operations of the company.

Investing: Negative Cash Flow's Impact and Insights

You may want to see also

Long-term investments

Another example of a long-term investment is the acquisition of other businesses or companies. This type of investment can also result in negative cash flow in the short term, but it can have a positive impact on the company's future operations and growth prospects. It's important for investors and analysts to monitor these investments and their impact on cash flow to assess the financial health of a company.

Proceeds from the sale of long-term investments, such as PP&E or marketable securities, can also impact a company's cash flow statement. These sales can generate positive cash flow and indicate effective management of finances. However, negative cash flow from investing activities is not always a bad sign and can indicate that a company is investing in its long-term health and growth.

Investments and Cash Equivalents: What's the Real Difference?

You may want to see also

Business acquisitions

When a company acquires another business, it becomes the owner of the acquired company's assets, including cash, property, equipment, and more. The cash flow statement will show the net amount of cash spent on these acquisitions, often listed as "Acquisitions, Net of Cash Acquired," "Business Acquisitions," or similar variations. This figure represents the cash outflow from the acquiring company to purchase the target company.

For example, if Company A's cash flow statement shows $500 million for "Acquisitions, Net of Cash Acquired," it means Company A used $500 million in cash to acquire one or more other companies. This acquisition will likely lead to significant jumps in values on the income statement, cash flow statement, and balance sheet.

It's important to note that negative cash flow from investing activities, including acquisitions, is not always a negative indicator of a company's financial health. It could signal that the company is investing in its long-term growth and development, which may lead to significant gains in the future.

In summary, business acquisitions are a crucial aspect of a company's investing activities, and the cash flow statement provides transparency into the financial implications of these acquisitions.

Uncertain Future Cash Flows: Navigating Investment Project Analysis

You may want to see also

Proceeds from the sale of assets

When a company sells a physical asset, such as property, plant, or equipment, the proceeds are recorded as a positive cash flow in the investing activities section of the cash flow statement. For example, if a company sells an old piece of equipment for $50,000, the cash inflow of $50,000 is recorded in the investing activities section.

Similarly, if a company sells investments or securities, such as stocks, bonds, or marketable securities, the proceeds are also recorded as a positive cash flow in the investing activities section. For instance, if a company sells stocks for $10,000, the cash inflow of $10,000 is included in the investing activities section of the cash flow statement.

The sale of assets can also include the sale of a division or cash out as a result of a merger or acquisition, which would fall under investing activities. Proceeds from these types of transactions would be recorded as positive cash flows in the investing activities section as well.

It is important to note that the cash flow statement only considers the cash inflows and outflows from these transactions and is separate from the adjusted asset totals reported on the non-current part of a balance sheet. The total income reported on the company's income statement will also impact the cash flow statement, but the cash flow statement specifically focuses on the cash movements related to investing activities.

Overall, proceeds from the sale of assets are a critical component of a company's cash flow statement, providing insight into the cash generated from investing activities and helping to assess the financial health and performance of the company.

Investing Activities: Do Cash Flows Stay Positive?

You may want to see also

Capital expenditures

CapEx is listed under "investing activities" on a company's cash flow statement. It is a popular measure of capital investment used in the valuation of stocks. An increase in capital expenditures means the company is investing in future operations. However, capital expenditures are a reduction in cash flow. Typically, companies with significant capital expenditures are in a state of growth.

The decision of whether to expense or capitalise an expenditure is based on how long the benefit of that spending is expected to last. If the benefit is less than one year, it must be expensed directly on the income statement. If the benefit is greater than one year, it must be capitalised as an asset on the balance sheet. For example, the purchase of a building would provide a benefit of more than one year and would thus be deemed a capital expenditure. On the other hand, the purchase of office supplies like printer ink and paper would not fall under investing activities on the cash flow statement but would instead be an operating expense on the income statement.

The CF/CapEX ratio is a useful metric that measures a company's ability to acquire long-term assets using free cash flow. It is calculated as:

> Cash Flow to Capital Expenditures = Cash Flow from Operations / Capital Expenditures

A higher CF/CapEX ratio generally indicates that a company has sufficient capital to fund investments in new capital expenditures.

Extra Cash: Where to Invest for Maximum Returns

You may want to see also

Frequently asked questions

Cash flow from investing activities is a section of a company's cash flow statement that shows the cash generated by or spent on investment activities.

Cash flow from investing activities includes purchases of physical assets, investments in securities, or the sale of securities or assets.

Cash flow from investing activities is important because it shows how a company is allocating cash for the long term. For example, a company may invest in fixed assets such as property, plant, and equipment to grow the business.

A positive cash flow from investing activities means that the company is divesting its assets, which increases the cash balance of the company. A negative cash flow from investing activities means that the company is likely investing heavily in its fixed asset base to generate revenue growth in the coming years.

The formula for calculating cash flow from investing activities is: Cash Flow from Investing Activities = (Capital Expenditures) + (Purchase of Long-Term Investments) + (Business Acquisitions) – Divestitures.