The Internal Rate of Return (IRR) is a metric used to estimate the profitability of an investment. It is calculated by finding the discount rate that makes the net present value (NPV) of all cash flows equal to zero. In other words, the IRR is the expected compound annual rate of return on an investment. The formula for calculating the IRR involves setting the NPV equal to zero and solving for the discount rate, which is the IRR. This can be done manually through trial and error, or by using software such as Excel.

| Characteristics | Values |

|---|---|

| What is IRR used for? | IRR is used to assess the profitability of potential investments. |

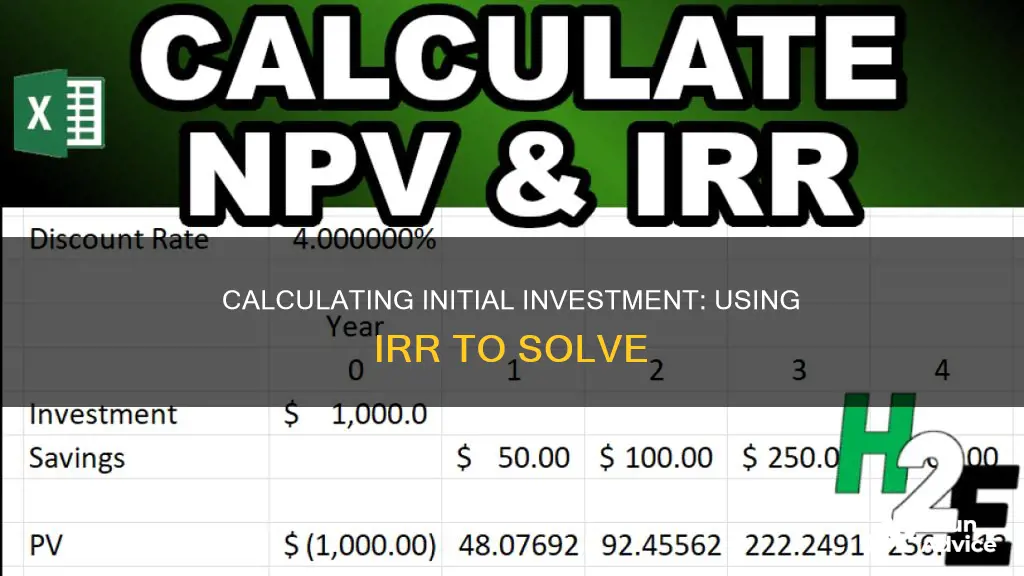

| IRR calculation | IRR is calculated using the same formula as NPV, but with the NPV set to zero. |

| IRR compared to other metrics | IRR is a uniform metric that can be used to rank investments of varying types. |

| IRR and NPV relationship | IRR is the annual rate of growth that an investment is expected to generate. |

| IRR and cash flows | IRR is the discount rate that makes the present value of the sum of annual nominal cash inflows equal to the initial net cash outlay for the investment. |

| IRR and investment decisions | The IRR rule states that a project or investment may be worth pursuing if its IRR exceeds the minimum required rate of return, or hurdle rate. |

| IRR and time value of money | IRR helps companies and investors account for the time value of money by discounting future cash flows to their present value. |

| IRR and actual dollar value | IRR does not give the return on the initial investment in terms of real dollars. |

| IRR and anomalies in cash flows | IRR does not consider any irregular or uncommon forms of cash flow. |

| IRR and reinvestments | IRR assumes that reinvestments are made at the same internal rate of return, which may not be accurate. |

| IRR and compound annual growth rate | IRR is a type of compound annual growth rate, where the annual yield from the investment is reinvested. |

| IRR and investment comparison | IRR allows for easy comparison between different projects and investments. |

| IRR limitations | IRR has limitations and should not be used as the sole criterion for investment decisions. |

| IRR calculation methods | IRR can be calculated using Excel functions (IRR or XIRR), a financial calculator, or an iterative trial-and-error approach. |

What You'll Learn

- IRR is the annual rate of return that makes the NPV equal to zero

- IRR is a metric used to estimate the profitability of potential investments

- IRR is a discount rate that makes the net present value of all cash flows equal to zero

- IRR is the potential rate of return on an investment, expressed annually

- IRR is used to compare and rank projects based on their projected yield

IRR is the annual rate of return that makes the NPV equal to zero

The Internal Rate of Return (IRR) is a metric used in financial analysis to estimate the profitability of potential investments. It is the discount rate that makes the net present value (NPV) of all cash flows equal to zero in a discounted cash flow analysis.

IRR is calculated using the same formula as NPV, but it sets the NPV equal to zero. The formula for calculating the IRR is:

Net cash inflow during period t

Total initial investment costs

The internal rate of return

The number of time periods

$$\displaylines{ \text{0}=\text{NPV}=\sum_{t=1}^{T}\frac{C_t}{\left(1+IRR\right)^t}-C_0} }$$

Where:

- $$C_t$$ = Net cash inflow during period t

- $$C_0$$ = Total initial investment costs

- IRR = The internal rate of return

- T = The number of time periods

The manual calculation of the IRR metric involves setting the NPV equal to zero and solving for the discount rate, which is the IRR. This can be done through trial and error or by using software such as Excel.

The IRR is the annual rate of return that makes the NPV equal to zero. It is the expected compound annual rate of return that will be earned on a project or investment. The initial cash investment for the beginning period will be equal to the present value of the future cash flows of that investment.

A higher IRR indicates a more desirable investment. It is used to rank multiple prospective investments or projects on a relatively even basis. The investment with the highest IRR is generally considered the best option.

Investing with Probability: Making Informed Decisions

You may want to see also

IRR is a metric used to estimate the profitability of potential investments

IRR, or internal rate of return, is a metric used in financial analysis to estimate the profitability of potential investments. It is a discount rate that makes the net present value (NPV) of all cash flows equal to zero in a discounted cash flow analysis.

The IRR is calculated using the same formula as NPV but is not the actual dollar value of the project. Instead, it is the annual return that makes the NPV equal to zero. The higher the internal rate of return, the more desirable an investment becomes.

The IRR is used to identify the rate of discount that makes the present value of the sum of annual nominal cash inflows equal to the initial net cash outlay for the investment. It is particularly useful for analyzing capital budgeting projects and comparing potential rates of annual return over time.

The manual calculation of the IRR metric involves setting the NPV equal to zero and solving for the discount rate, which is the IRR. The initial investment is always negative as it represents an outflow, and subsequent cash flows can be positive or negative depending on the estimates of the project's future performance.

The IRR can be calculated using Excel, a financial calculator, or an iterative process of trying different discount rates until the NPV equals zero.

In summary, IRR is a valuable tool for companies and investors to assess the potential profitability of investments and make informed decisions about capital allocation.

Strategies to Maximize Cash Investments in Just One Year

You may want to see also

IRR is a discount rate that makes the net present value of all cash flows equal to zero

IRR, or internal rate of return, is a metric used in financial analysis to estimate the profitability of potential investments. It is a discount rate that makes the net present value (NPV) of all cash flows equal to zero in a discounted cash flow analysis.

The IRR is calculated using the same formula as NPV, but instead sets the NPV equal to zero. This is done to identify the rate of discount that makes the present value of the sum of annual nominal cash inflows equal to the initial net cash outlay for the investment. In other words, it is the expected compound annual rate of return that will be earned on a project or investment.

The IRR is particularly useful for companies in capital budgeting, allowing senior leaders to compare and rank projects based on their projected yield. It is also used to determine where to invest their capital, by showing which options will have the best return.

The IRR is calculated using the following formula:

Net cash inflow during period t

Total initial investment costs

The internal rate of return

The number of time periods

Manually calculating the IRR involves setting the NPV equal to zero and then solving for the discount rate. Due to the nature of the formula, this is typically done through trial and error or by using software such as Excel.

When used in conjunction with NPV, the IRR can help to determine the best investment or use of capital. If relying solely on the IRR, the opportunity with the highest IRR would usually be selected.

Cash App Investing: Not for Everyone

You may want to see also

IRR is the potential rate of return on an investment, expressed annually

The Internal Rate of Return (IRR) is a metric used in financial analysis to estimate the profitability of potential investments. It is the annual rate of return that an investment is expected to generate. The IRR is expressed as a percentage and is calculated by taking the initial investment and dividing it by the future value, raised to the inverse of the number of periods, and then subtracting one.

The formula for calculating the IRR is as follows:

Internal Rate of Return (IRR) = (Future Value / Present Value)^(1 / Number of Periods) - 1

The IRR is an important tool for companies when deciding where to invest their capital. It helps determine which option will provide the best return on investment by ranking investments based on their projected yield. The investment with the highest IRR is generally considered the best option.

The IRR can be calculated manually or by using software such as Excel, which has built-in functions specifically for calculating the IRR.

While the IRR is a useful metric, it does have some limitations. It does not provide the return on the initial investment in real dollar terms, and it assumes that all positive cash flows will be reinvested at the same rate as the project, which may not always be accurate. Additionally, the IRR should not be used as the sole metric for making investment decisions, as it does not consider all relevant factors.

Bloomberg Terminals: Investment Bankers' Best Friend

You may want to see also

IRR is used to compare and rank projects based on their projected yield

The internal rate of return (IRR) is a metric used to estimate the profitability of potential investments. It is a discount rate that makes the net present value (NPV) of all cash flows equal to zero in a discounted cash flow analysis. The higher the IRR, the better the return on an investment. As the same calculation applies to varying investments, it can be used to compare and rank projects based on their projected yield. The investment with the highest IRR is generally the best investment choice.

The IRR is calculated using the same formula as NPV, but it sets the NPV equal to zero. The formula for determining IRR is:

Net cash inflow during period t

Total initial investment costs

The internal rate of return

The number of time periods

Calculating IRR manually involves setting the NPV equal to zero and solving for the discount rate, which is the IRR. The initial investment is always negative because it represents an outflow. Each subsequent cash flow can be positive or negative, depending on the estimates of what the project delivers or requires as a capital injection in the future. Due to the nature of the formula, IRR is typically calculated iteratively through trial and error or by using software like Excel.

IRR is widely used in capital budgeting to help companies evaluate and rank projects based on their projected yield. It is also used in private equity and venture capital investments, which involve multiple cash infusions over the life of a business. When making investment decisions, analysts consider both the NPV and IRR, along with other indicators such as the payback period.

While IRR is a valuable tool, it has some limitations. It does not provide the return on the initial investment in real dollars and can lead to poor investment decisions when used exclusively, especially when comparing projects of different durations. Additionally, it assumes that all positive cash flows will be reinvested at the same rate as the project, which may not always be accurate.

Cash App Investing: Free or Fee-Based?

You may want to see also

Frequently asked questions

The formula for calculating the initial investment using the IRR method is:

Initial Investment = Net Present Value / (1 + IRR) ^ number of years

To calculate the NPV, you need to sum up all the future cash flows (inflows and outflows) and discount them back to their present value. The formula for NPV is:

NPV = Summation of (Cash Flow x (1 + discount rate)^number of years)

The IRR method is a way to calculate the internal rate of return for an investment. It is used to estimate the profitability of potential investments and is calculated by finding the discount rate that makes the NPV equal to zero.

The IRR method is relatively easy to understand and calculate, especially with the use of spreadsheets. It allows for comparisons between different projects and investments and takes into account the time value of money.

The IRR method does not account for the actual dollar value of the project and does not consider any anomalies in cash flows. It also assumes that reinvestments are made at the same internal rate of return, which may not always be accurate.