Investment portfolios are a vital tool for traders, and many traders do indeed post their portfolios online. These portfolios are a collection of all the strategies and financial products that a particular trader has invested in. For example, stockcircle.com allows users to analyse the portfolios of investment gurus by using data from the SEC to track transactions and holdings. Similarly, eToro offers Smart Portfolios, which are curated by eToro analysts and provide a convenient and diversified way to access major market trends. These portfolios are designed to be accessible to all levels of investors and start at a $500 initial investment.

| Characteristics | Values |

|---|---|

| Investment portfolio definition | A collection of all the strategies and financial products that a particular trader has decided to invest in |

| Investment portfolio examples | Real estate, animals, commodities, currencies |

| Importance of a trading portfolio | A vital tool for a trader, showcasing a trader's diversification |

| Benefits of a diversified portfolio | Lower risk, greater balance, reduced investment risk in the long term |

| Aggressive portfolio | Seeks outsized gains and accepts the outsized risks that go with them |

| Defensive portfolio | Focuses on consumer staples that are impervious to downturns |

| Income portfolio | Concentrates on shareholder distributions |

| Speculative portfolio | Entails taking more risk than any other type of portfolio |

| Hybrid portfolio | Diversifies across asset classes |

What You'll Learn

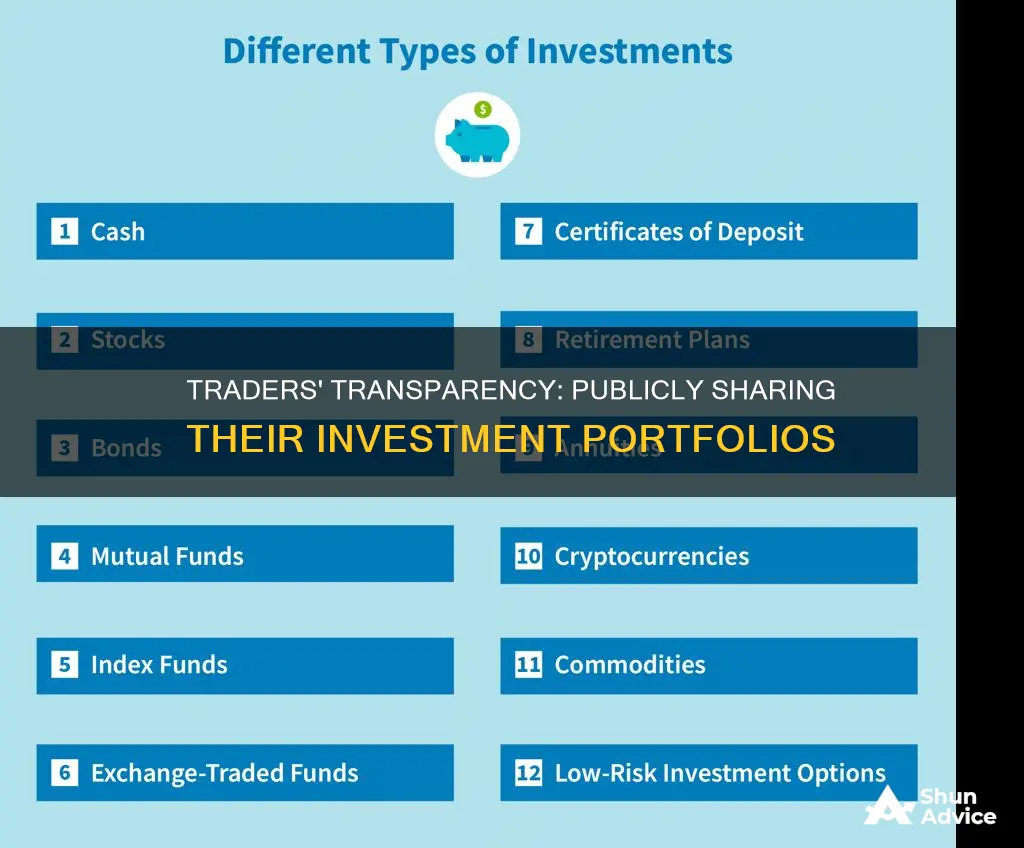

Investment portfolio types

Investment portfolios are a cornerstone of investing in the markets, and there are several types of portfolios to choose from. The type of portfolio an investor chooses depends on their risk tolerance, investment goals, and time horizon. Here is a list of some of the most common types of investment portfolios:

Aggressive Portfolio

Aggressive portfolios seek outsized gains and accept the large risks that come with them. Stocks in this type of portfolio usually have a high beta, meaning they are more sensitive to the overall market and experience greater fluctuations in price. These portfolios are typically made up of companies in the early stages of their growth that are not yet household names. Aggressive portfolios are suitable for younger or more risk-tolerant investors.

Defensive Portfolio

Defensive portfolios focus on consumer staples that are less susceptible to economic downturns. Defensive stocks are relatively isolated from broad market movements and tend to perform well in both good and bad economic times. These portfolios are commonly used by older investors who are retired or nearing retirement and want to preserve their capital.

Income Portfolio

Income portfolios concentrate on investments that generate income through dividends or other types of distributions to stakeholders. Some of the stocks in this type of portfolio may also be found in defensive portfolios, but they are primarily chosen for their high yields. Income portfolios should produce positive cash flow and can include investments such as real estate investment trusts (REITs) and master limited partnerships (MLPs).

Speculative Portfolio

Speculative portfolios entail taking on more risk than the other types. Speculative investments may include initial public offerings (IPOs) or stocks that are rumoured to be takeover targets. They often involve companies in the technology or healthcare sectors that are developing a single breakthrough product. Speculative portfolios are not recommended for more than 10% of an individual's assets.

Hybrid Portfolio

Hybrid portfolios diversify across multiple asset classes, including stocks, bonds, commodities, real estate, and even art. They typically include a mix of blue-chip stocks, high-grade government or corporate bonds, and alternative investments. This approach offers the benefit of negative correlation, as equities and fixed-income securities tend to move in opposite directions.

Socially Responsible Portfolio

Socially responsible and environmental, social, and governance (ESG) portfolios allow investors to support societal causes while also pursuing financial gains. These portfolios can be structured for growth or asset preservation and can be tailored to any risk level or investment goal. They favour stocks and bonds that aim to minimise environmental impact or promote diversity and equality.

Graph Savings: A Smart Investment Strategy?

You may want to see also

Benefits of diversification

Diversification is a common investing technique used to reduce the chances of experiencing large losses. Here are some of the benefits of diversification:

Protects Against Losses

Diversification is an attempt to protect against losses, which is especially important for older investors who need to preserve wealth toward the end of their careers. It is also crucial for retirees or individuals approaching retirement, who may no longer have a stable income. If they are relying on their portfolio to cover living expenses, it is vital to consider risk over returns.

Increases Risk-Adjusted Returns

Diversification is thought to increase the risk-adjusted returns of a portfolio. This means investors earn greater returns when factoring in the risk they are taking.

Creates Better Opportunities

Diversifying can lead to better opportunities. For example, let's say you invest in a streaming service to diversify away from transportation companies. That streaming company then announces a major partnership and investment in content. Had you not diversified across industries, you would have missed out on the benefits of positive changes across sectors.

Makes Investing More Fun

For some, diversifying can make investing more fun and enjoyable. Instead of holding all your investment within a narrow group, diversifying means researching new industries, comparing companies, and emotionally buying into different industries.

Reduces Volatility

Diversification helps to reduce the volatility of a portfolio over time. It can help to mitigate the risk and volatility in your portfolio, potentially reducing the number and severity of ups and downs.

Limits Impact of Market Volatility

The primary goal of diversification is not to maximise returns, but to limit the impact of volatility on a portfolio.

Reduces Risk

Diversification reduces asset-specific risk, which is the risk of owning too much of one stock or stocks in general, relative to other investments.

Investing: A Smarter Option Than Saving for Your Future

You may want to see also

How to diversify

There are websites that allow you to view the portfolios of top investors, such as Stockcircle. However, it is unclear how up-to-date this information is.

The basic objective of diversification is to reduce risk. As the saying goes, "Don't put all your eggs in one basket". Diversification restricts damage to your financial well-being in case one asset or instrument performs poorly. For example, in 2008-2009, equities crashed by 39%. If an investor had spread their investments across equity, debt, cash, and gold, their portfolio would have given an average return of 0.68%. This is because of the strong performance by gold (up 24%) and stable returns from debt and cash.

- Diversify across asset classes: Asset classes such as stocks, bonds, and cash generally behave differently under similar market and economic circumstances. Within stocks, there are sub-asset classes, including large, small, and mid-cap stocks, as well as different styles like growth, value, and a blend of the two. There are also domestic and international stocks, with the latter including stocks from developed countries and emerging markets.

- Diversify across industries and sectors: The performance of stocks is often influenced by the industries and sectors they belong to. For example, the factors impacting stocks in the technology sector could be very different from those in the energy sector.

- Diversify across bond types: The price of a bond usually moves in the opposite direction of interest rates. Bonds with a longer time until maturity and lower credit quality will generally be more sensitive to interest rate changes. Bonds issued outside the US may also be impacted by the relative value of the US dollar.

- Diversify using mutual funds and ETFs: Mutual funds and exchange-traded funds (ETFs) are excellent tools for diversifying your portfolio. Most of these funds are invested in specific asset classes, such as stocks, bonds, or cash, while some are a mix of different asset classes. Diversification can be achieved by holding several of these funds, which also hold a variety of stocks, bonds, or other securities, providing another level of diversification. Additionally, investing in mutual funds and ETFs can be a more cost-effective way for investors with limited funds to diversify.

- Diversify across geographies: Diversification among stocks and bonds of companies headquartered in the US and those located abroad provides another level of diversification. The relative value of the US dollar to other currencies will impact the return on these securities for US investors. Additionally, the differences in the economies of other countries will further diversify your portfolio.

It is important to note that there is no one-size-fits-all approach to diversification. The level of diversification that is right for you will depend on your unique situation, including factors such as your age, risk tolerance, investment goals, and time horizon.

Saving and Investing: Economy's Growth Engine

You may want to see also

Risks of an undiversified portfolio

There are websites that allow you to view the investment portfolios of top investors. These sites use data reported to the SEC to track the transactions and holdings of these investors. However, they do not provide investment advice, and you are solely responsible for your investment decisions.

Now, here are some risks associated with an undiversified portfolio:

Increased Volatility

An undiversified portfolio is heavily concentrated in a single asset class, industry, or stock. If the value of that particular asset or stock drops, your entire portfolio will be significantly impacted. On the other hand, a diversified portfolio reduces the impact of any single investment's poor performance by spreading the risk across different assets. For example, if you invest all your money in a tech company and unforeseen circumstances negatively affect the tech industry, the value of your investment can plummet. In contrast, a diversified portfolio with investments in sectors like healthcare, real estate, and consumer goods would be better equipped to handle such market fluctuations.

Lack of Capital Preservation

An undiversified portfolio can pose a risk to capital preservation. If your investments are concentrated in a single asset class or industry, you are vulnerable to specific risks associated with that sector. For instance, if all your investments are in the real estate market and there is an economic downturn or a housing market crash, your portfolio could suffer significant losses, potentially jeopardizing your capital. By diversifying across different asset classes such as stocks, bonds, and commodities, you can protect your capital from being wiped out by a single market event.

Missed Opportunities

An undiversified portfolio may limit your exposure to other potentially lucrative assets, causing you to miss out on growth opportunities. For example, if you invest solely in large-cap stocks, you might overlook the growth potential of small-cap or international stocks. Diversification allows you to tap into various investment opportunities, increasing the chances of benefiting from different market conditions and economic cycles. By allocating your investments across different asset classes, you can enhance your overall return on investment.

Case Study: Enron Corporation

The collapse of Enron Corporation serves as a stark reminder of the dangers of an undiversified portfolio. Many employees and investors had a significant portion of their retirement savings tied up in Enron stock, believing it to be a safe and lucrative investment. However, when Enron's fraudulent accounting practices were exposed, the stock plummeted, wiping out billions of dollars of wealth. Had they diversified their investments across multiple stocks and sectors, the impact of Enron's collapse would have been mitigated.

Savings vs Investments: When Does Saving Trump Spending?

You may want to see also

How to view other people's portfolios

There are several ways to view other people's portfolios. Firstly, many online platforms and apps allow users to share their portfolios and showcase their work. For example, the subreddit r/IndianStockMarket is a community where people often share their portfolios. Similarly, Stockcircle is a website that allows users to explore the investment portfolios of the world's best investors. These platforms can provide inspiration and insights into different investment strategies.

Another way to view other people's portfolios is through the use of portfolio management apps. These apps can sync with your existing accounts and provide real-time information on your investments. Some popular options include Empower (formerly Personal Capital), SigFig Wealth Management, Sharesight, and Yahoo Finance. These apps offer features such as performance tracking, fee monitoring, and retirement planning tools.

Additionally, significant transactions and holdings in publicly traded companies are required to be reported to the SEC by investors and funds. This data is available to the public and can be used to track the transactions and holdings of specific investors. However, it's important to note that smaller transactions and holdings might not be included in these reports.

Lastly, some individuals may choose to share their portfolios directly with others, such as through personal websites, blogs, or social media platforms. This can provide a more detailed and personalised look into someone else's investment strategies and portfolio composition.

Private Investment: When Planning Exceeds Saving

You may want to see also

Frequently asked questions

An investment portfolio is a collection of all the strategies and financial products that a particular trader has decided to invest in. This could include real estate, animals, commodities, or currencies.

There are several types of investment portfolios, including aggressive, defensive, income, speculative, and hybrid. Each type carries its own level of risk and return and caters to different goals, risk appetites, and personalities.

A diversified portfolio reduces risk and generally leads to better returns. It involves a mix of complementary tools, instruments, and trading strategies that operate differently from one another. This allows for lower related risks and a reduction in the risk of investment in the long term.