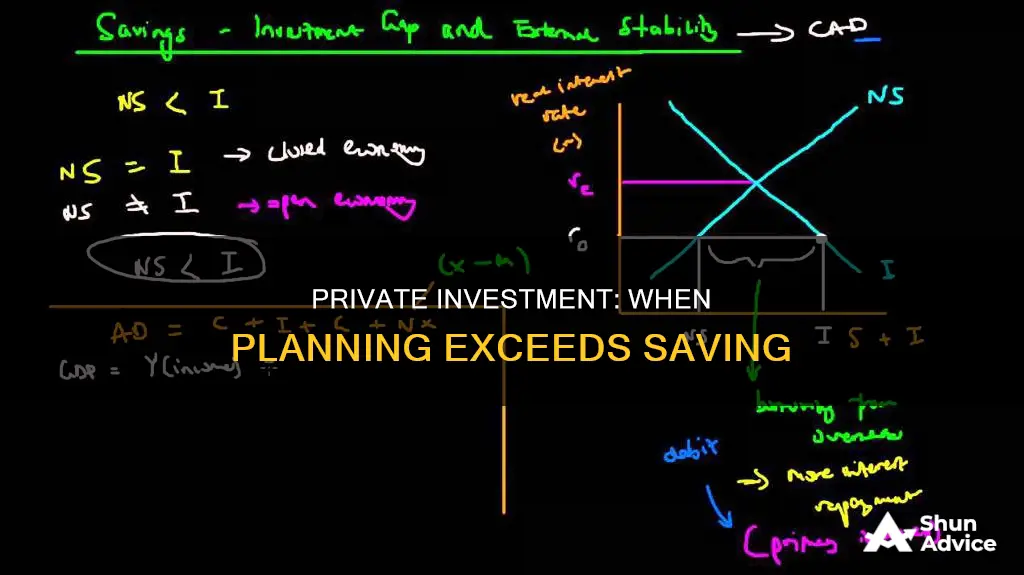

When planned investment exceeds saving in a private economy, the inventory rises above the desired level, indicating that consumption is lower than expected. This suggests that aggregate demand is less than aggregate supply. To restore equilibrium, producers must decrease output to reduce income and, consequently, planned investment. As a result, the economy moves towards a balance where savings equal investment.

What You'll Learn

Producers will expand output to restore inventory levels

When planned savings exceed planned investments, the inventory falls below the desired level. This is because inventories accumulate when planned investment is less than planned saving. To restore inventory levels, producers will expand output. This increased output will result in higher income, which, in turn, will lead to a rise in planned investment and savings. As output increases, income will continue to rise, leading to a further increase in planned savings until savings equal investments, bringing the economy back into equilibrium.

Producers expanding their output is a direct response to the gap between desired inventory levels and the current inventory. By increasing production, they aim to replenish their stock and meet the desired inventory targets. This strategy demonstrates the dynamic nature of economic adjustments, where producers actively contribute to stabilizing the economy by addressing imbalances between planned savings and investments.

The relationship between planned savings, planned investment, and inventory levels is intricate. When planned savings exceed planned investment, it indicates a potential issue with inventory management. The accumulation of inventories due to lower-than-expected consumption and aggregate demand can disrupt the equilibrium of the economy. Therefore, producers take corrective actions, such as expanding output, to rectify the situation and restore balance.

It's important to note that this scenario assumes a closed economic model where the private sector's savings are entirely invested in the same economy. In reality, there are various factors that could influence this relationship, such as government spending, taxes, and interactions with external sectors. However, the basic principle remains that producers will adjust their output to manage inventory levels and maintain economic stability.

In summary, when planned savings surpass planned investments, producers play a pivotal role in restoring equilibrium by expanding output to replenish inventories. This action has a positive impact on income, planned investment, and, ultimately, planned savings. The continuous rise in output and income creates a feedback loop that eventually brings the economy back into balance, highlighting the interconnectedness of various economic factors and the self-correcting nature of market economies.

The Investment Savings Curve: A Guide to Financial Strategy

You may want to see also

Income will increase as a result of higher output

When planned savings exceed planned investment, the inventory falls below the desired level. Producers must then expand output to bring the inventory back to the desired level. This increase in output leads to higher income. As income rises, planned investment also increases, creating a cycle where income and planned investment continue to rise until they reach equilibrium.

This scenario, where planned savings are greater than planned investments, has implications for the economy. It indicates that consumption in the economy is lower than expected, resulting in less aggregate demand compared to aggregate supply. As a result, inventories accumulate, and the stock of goods tends to pile up.

To address this imbalance, producers increase output to bring inventory levels back to the desired state. This increased production leads to higher income levels. The rise in income, in turn, fuels an increase in planned investment. This cycle continues, with income and planned investment rising simultaneously until they eventually reach a point of equality, bringing the economy back into equilibrium.

The relationship between higher output, increased income, and subsequent rises in planned investment and savings is crucial for understanding the dynamics of an economy. This cycle demonstrates how changes in one area can have a ripple effect, ultimately influencing the overall equilibrium of the economy.

It's important to note that this scenario assumes a closed economy, where the private sector's savings are invested back into the economy. In an open economy, where capital can flow in and out, the impact of changes in planned savings and investments may be influenced by external factors as well.

The Cycle of Savings, Borrowing, and Investing: Understanding the Trio

You may want to see also

This will lead to a rise in planned investment

When planned investment exceeds saving in a private economy, the inventory rises above the desired level. This indicates that consumption in the economy is lower than expected, and there is less aggregate demand compared to aggregate supply.

To bring the inventory back to the desired level, producers must take action. They will expand output, which will lead to a rise in income. As income rises, planned savings will also increase. This rise in output and income will continue until there is an equilibrium, where savings are equal to investment.

This process of restoring equilibrium can lead to a positive cycle of increasing investment and savings. As output increases, there may be further incentives to invest in the hope of higher returns. This additional investment will further boost output and income, creating a virtuous cycle of growth.

Therefore, when planned investment exceeds savings, it can initiate a cycle of rising investment, output, income, and savings. This process will continue until the desired inventory level is achieved and equilibrium is reached.

Social Security Investment Strategies: Maximizing Your Savings

You may want to see also

Higher income means higher planned savings

When planned savings exceed planned investments, the inventory falls below the desired level. To increase inventory to the desired level, producers must expand output. This increase in output leads to a rise in income, which, in turn, results in a rise in planned savings.

This dynamic illustrates the relationship between income and planned savings, demonstrating that higher income indeed leads to higher planned savings. As income rises, individuals or businesses have more disposable income, allowing for increased savings. This is particularly evident in the context of private savings, where individuals have greater financial flexibility to allocate a larger portion of their income towards savings.

The relationship between income and savings is further influenced by the marginal propensity to save (MPS). The MPS represents the additional amount an entity plans to save out of an extra unit of income. A higher MPS indicates that a larger proportion of increased income will be saved. For example, if an individual's income rises by $100 and their MPS is 0.4, they will save $40 of that additional income.

It is important to note that while a higher income generally leads to higher planned savings, this relationship can be influenced by various factors, such as an individual's financial goals, expenses, and overall economic conditions. For instance, an individual with high income may also have higher expenses, reducing their ability to save. Additionally, economic downturns or uncertainties may prompt individuals to save more, even if their income remains constant.

Understanding the concept of higher income leading to higher planned savings is crucial for economic planning and policy formulation. It helps governments and central banks make informed decisions regarding fiscal and monetary policies, particularly those aimed at encouraging savings and investments. Additionally, this understanding can guide the development of incentives and initiatives to promote financial literacy and savings culture among the populace.

Investment Options for College Savings: What Are Your Choices?

You may want to see also

The economy will reach equilibrium when savings = investment

When planned savings exceed planned investment, the inventory falls below the desired level. Producers must then expand output to bring the inventory back to the desired level. This increase in output leads to higher incomes, which in turn stimulates a rise in planned investment. As income rises, planned savings also increase. This cycle continues until the economy reaches equilibrium, where savings are equal to investment.

This equilibrium, where savings (S) equal investment (I), represents a balance in the economy. It indicates that the desired level of inventory is achieved, and there is no excess accumulation of goods. This equilibrium ensures that consumption in the economy meets expectations, and there is a healthy balance between aggregate demand and aggregate supply.

However, if planned savings are consistently less than planned investment, it indicates a different economic scenario. In this case, the inventory rises above the desired level, suggesting that consumption in the economy is lower than anticipated. This situation reflects a decrease in aggregate demand relative to aggregate supply.

To restore equilibrium when planned savings are less than planned investment, adjustments are necessary. Producers may reduce output to prevent an excess accumulation of goods, which could lead to an inventory surplus. This reduction in output may result in decreased income, causing a decline in planned savings. As planned savings decrease, the gap between savings and investment narrows, bringing the economy closer to equilibrium.

In summary, the economy strives for a state of equilibrium where savings equal investment. Deviations from this equilibrium, whether due to excess savings or insufficient savings, trigger adjustments in output, income, and subsequent savings and investment levels. These adjustments continue until the economy stabilizes at the point where savings match investment, ensuring a balanced and efficient economic system.

Maximizing Savings: Strategies to Double Your Money

You may want to see also

Frequently asked questions

When planned investment exceeds savings, the planned inventory rises above the desired level, indicating that consumption in the economy was less than expected. This suggests a lower aggregate demand in comparison to aggregate supply.

The economy will adjust to reach equilibrium. Producers will expand output to bring the inventory back to the desired level. This increased output leads to higher income, which in turn raises savings. As savings increase, they will eventually match or exceed planned investments.

The rise in output and income can stimulate the economy and lead to a new equilibrium where savings match investments. However, if planned investment consistently falls short of planned savings, inventories may accumulate, and a stock of goods may pile up.