Unit Investment Trusts (UITs) are investment companies that offer a fixed portfolio of stocks and bonds to investors for a specific period. They are similar to mutual funds and exchange-traded funds in that they pool investors' money into a single vehicle. However, unlike mutual funds, UITs are not actively managed or traded, meaning that securities are bought and held for the duration of the trust. This passive investment strategy can result in lower fees and greater tax efficiency. While UITs may provide greater diversification and predictability, investors have less control over the investments made and may be locked into an underperforming investment plan.

What You'll Learn

UITs are not actively traded

Unit Investment Trusts (UITs) are not actively traded. This means that, unlike mutual funds, securities are not bought or sold unless there is a change in the underlying investment, such as a corporate merger or bankruptcy.

A UIT is a type of investment vehicle that pools money from multiple investors to purchase a fixed portfolio of securities, such as stocks or bonds. The portfolio remains fixed until the termination of the trust, which usually ranges from 13 months to as much as 30 years, depending on the underlying securities.

The UIT sponsor selects the portfolio of securities, which are then deposited into the trust for a specified period of time. The securities within a UIT portfolio can be actively traded, but only between investors who participate in the fund from the start.

A UIT typically makes a one-time public offering of a specific, fixed number of securities or units, like a closed-end fund. It issues redeemable units, which means that the UIT will buy back an investor's units at their approximate net asset value (NAV).

The UIT sponsor may also maintain a secondary market, which allows investors to buy and sell UIT units at the market price. However, the investment portfolio of a UIT is generally fixed, providing investors with more certainty about what they are investing in for the duration of their investment.

The UIT sponsor may, in limited circumstances, remove a security from the trust. These situations are outlined in the prospectus, which investors should carefully read before investing.

Saving and Investing: Key Factors for Decision-Making

You may want to see also

UITs are bought and sold directly from the issuing company

Unit Investment Trusts (UITs) are bought and sold directly from the issuing company or on the secondary market. They are similar to open-ended and closed-end mutual funds in that they all consist of collective investments where many investors combine their funds to be managed by a portfolio manager.

Like open-ended mutual funds, UITs are bought and sold directly from the company that issues them. However, they can also be bought on the secondary market, like closed-end funds, which are issued via an initial public offering (IPO).

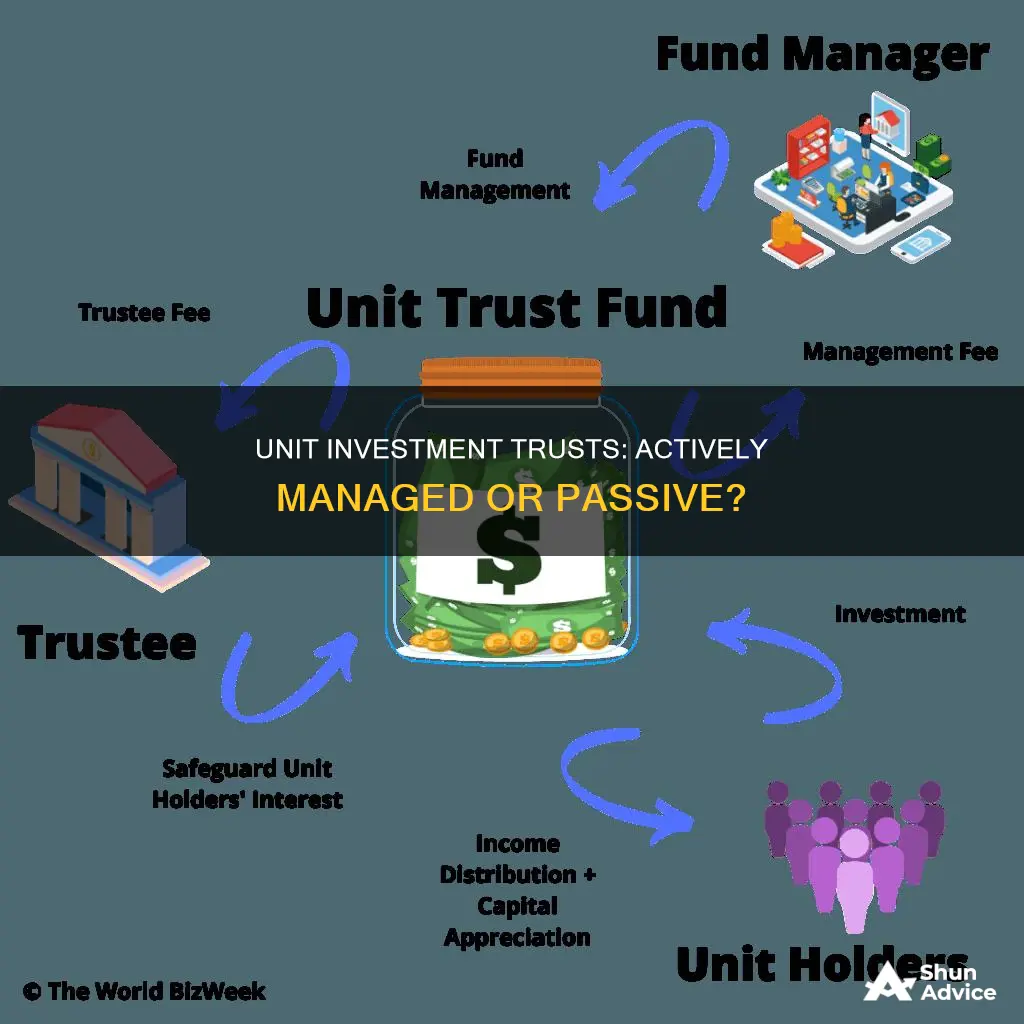

A UIT is a type of investment vehicle that pools money from multiple investors to purchase a fixed portfolio of securities, such as stocks or bonds. Once the trust is created, investors purchase units that represent a proportional ownership interest in the underlying assets. The trust is then managed, and income is distributed over the life of the assets.

A UIT typically issues redeemable units, which means that the UIT will buy back an investor's units at their approximate net asset value (NAV). Many UIT sponsors will also maintain a secondary market, allowing investors to buy and sell UIT units at the market price.

Investors can redeem UIT units at net asset value (NAV) to the fund or trust either directly or with the help of an investment advisor. The NAV is defined as the total value of the portfolio divided by the number of shares or units outstanding and is calculated each business day.

Accessing Your ENT Investment Portfolio: A Step-by-Step Guide

You may want to see also

UITs are not the same as investment trusts

Unit Investment Trusts (UITs) are not the same as investment trusts. An investment trust is a public limited company, predominantly found in Japan and the United Kingdom, that aims to make money by investing in other companies.

A UIT, on the other hand, is an investment company that offers a fixed portfolio of stocks and bonds to investors for a specific period. UITs are similar to open-ended and closed-end mutual funds in that they consist of collective investments where multiple investors combine their funds to be managed by a portfolio manager.

One of the key differences between UITs and investment trusts is that UITs are not actively managed. Assets are purchased upfront and held for the duration of the UIT without frequent buying or selling. In rare cases, trust sponsors may be allowed to exchange underperforming trust assets.

Another distinction is that UITs have a stated expiration date based on the investments held in their portfolio. When the portfolio terminates, investors receive their share of the UIT's net assets.

Furthermore, UITs are typically structured as pass-through entities for tax purposes. This means that UITs don't pay taxes at the trust level; instead, income, gains, and losses are passed through to the investors, who are responsible for paying taxes on their share.

While UITs and investment trusts share some similarities as investment vehicles, they differ in their structure, management, taxation, and other features.

Stable Investment Portfolios: Strategies for Long-Term Success

You may want to see also

UITs are similar to mutual funds and exchange-traded funds

Unit Investment Trusts (UITs) are similar to mutual funds and exchange-traded funds in that they are a basket of investments that pool many investors' contributions into a single vehicle. UITs, mutual funds, and exchange-traded funds are all defined as investment companies. They are all collective investment vehicles where investors combine their funds to be managed by a portfolio manager.

UITs are similar to mutual funds in that they are both baskets of stocks, bonds, and other securities. Both UITs and mutual funds are designed to hold a diverse array of assets. They do not set limits on types of holdings, and each may consist of stocks, bonds, or other investments, though certain funds may have their own rules. Both UITs and mutual funds are also regulated by the U.S. Securities and Exchange Commission (SEC).

UITs are similar to open-ended and closed-end mutual funds in that they are bought and sold directly from the company that issues them. Like closed-end funds, UITs are issued via an initial public offering (IPO). Like open-ended mutual funds, UITs can sometimes be bought on the secondary market.

UITs and mutual funds are also similar in that they both allow investors to redeem shares from the sponsor. In the case of UITs, these are redeemable units, which means that the UIT will buy back an investor's units at their approximate net asset value (NAV). Mutual fund shares can also be redeemed at NAV to the fund or trust either directly or with the help of an investment advisor.

Finally, both UITs and mutual funds are required to distribute capital gains and dividends to their shareholders.

Strategies to Optimize Your Investment Portfolio's Performance

You may want to see also

UITs are not actively managed

Unit Investment Trusts (UITs) are not actively managed. They are a type of investment company that offers a fixed portfolio of stocks and bonds to investors for a specific period. UITs are bought and sold directly from the company that issues them and have a stated expiration date. Unlike mutual funds, they are not actively traded, meaning securities are not bought or sold unless there is a change in the underlying investment, such as a corporate merger or bankruptcy.

The portfolio of a UIT is selected by the sponsor and deposited into the trust for a specified period, and this portfolio is not actively traded. It follows a buy-and-hold strategy, meaning that assets are purchased upfront and then held for the duration of the UIT. In rare cases, trust sponsors may be allowed to exchange the trust assets.

The UIT is designed to follow an investment objective over a specified time period, and the portfolio remains fixed until the termination of the trust. The termination date is specified at the time the UIT is created and, in the case of a UIT investing in bonds, for example, the termination date is determined by the maturity date of the bond investments.

The UIT sponsor may remove a security from the trust under limited circumstances, which are outlined in the prospectus. However, unlike actively managed funds, the securities in the portfolio remain fixed over the life of the investment, and there is no manager-driven style drift.

The benefits of UITs not being actively managed include lower fees and expenses compared to actively managed funds, greater tax efficiency, and more predictable performance. However, this also means that investors have little control over the investments made by the trust, and poor performers may be retained.

Strategies to Expand Your Investment Portfolio Wisely

You may want to see also

Frequently asked questions

No, UITs are not actively managed. They are designed to follow an investment objective over a specified time period, and the assets are purchased upfront and then held for the duration of the UIT. In rare cases, trust sponsors may be allowed to exchange the trust assets.

A unit investment trust (UIT) is an investment company that offers a fixed portfolio, generally of stocks and bonds, as redeemable units to investors for a specific period of time. It is designed to provide capital appreciation and/or dividend income.

Mutual funds are open-ended and actively managed, with shares being offered to the public. UITs, on the other hand, have a termination date, a set number of shares, and no active management.

UITs offer several benefits, including greater diversification, daily liquidity, rebalancing opportunities, and discipline. They are also registered with the SEC and are subject to regulation, providing greater transparency and security for investors.