The perception of investment bankers as workaholics is well-established, but it's important to consider whether this stereotype is entirely accurate. While the high-pressure nature of the job often demands long hours and intense focus, it's not uncommon for investment bankers to take breaks and engage in less demanding tasks during the day. This practice, often referred to as slacking off, is a natural part of the workday and can actually enhance productivity and creativity. However, it's crucial to maintain a balance to avoid burnout and ensure long-term success in this demanding profession.

What You'll Learn

- Compensation and Incentives: Investment bankers' motivation and performance tied to bonuses and rewards

- Work Culture and Hours: Long hours and high-pressure environment may lead to burnout

- Technology and Automation: Digital tools and automation impact job roles and workload

- Regulatory and Compliance Challenges: Navigating complex regulations can be demanding and time-consuming

- Client Demands and Expectations: High client expectations and demands can lead to increased workload

Compensation and Incentives: Investment bankers' motivation and performance tied to bonuses and rewards

The concept of motivation and performance in investment banking is deeply intertwined with the structure of compensation and incentives. Investment bankers, known for their high-pressure environment and demanding work culture, are often driven by a unique set of rewards and penalties. The primary motivator for many in this field is financial compensation, which is typically structured in a way that directly correlates to performance.

Bonuses and rewards are a significant part of the investment banking industry's compensation strategy. These incentives are designed to motivate bankers to achieve specific targets and deliver exceptional results. Annual bonuses, for instance, are a common practice, with a significant portion of an investment banker's income tied to the performance of their firm and individual contributions. The structure of these bonuses can vary, with some firms offering a fixed percentage of annual income, while others may provide a variable percentage based on factors like revenue growth, profit margins, or client satisfaction.

Incentive programs often go beyond financial rewards. Many investment banks implement comprehensive incentive structures that include non-financial perks and benefits. These may include additional vacation days, flexible work arrangements, enhanced health and wellness programs, and even personal development opportunities. For instance, a successful deal or project might earn an individual banker extra days off, a luxury hotel stay, or a high-end gadget as a reward. Such incentives aim to create a positive work environment and foster a sense of loyalty and commitment.

The impact of these compensation and incentive structures is significant. When performance is directly linked to financial rewards, investment bankers are motivated to go above and beyond. They strive to meet and exceed targets, knowing that their efforts can lead to substantial financial gains. This performance-based culture encourages a high level of productivity and often results in a dedicated and driven workforce. However, it's important to note that this system can also lead to a culture of overwork and potential burnout, as the pressure to perform and secure bonuses can be intense.

In summary, the compensation and incentive structures in investment banking play a crucial role in motivating bankers and driving performance. While financial bonuses are a primary motivator, non-financial incentives also contribute to a positive work environment. Understanding these structures and their impact is essential in addressing the perception of investment bankers 'slacking off,' as it highlights the complex interplay between compensation, motivation, and performance in this high-stakes industry.

Who Watches Survival Shows?

You may want to see also

Work Culture and Hours: Long hours and high-pressure environment may lead to burnout

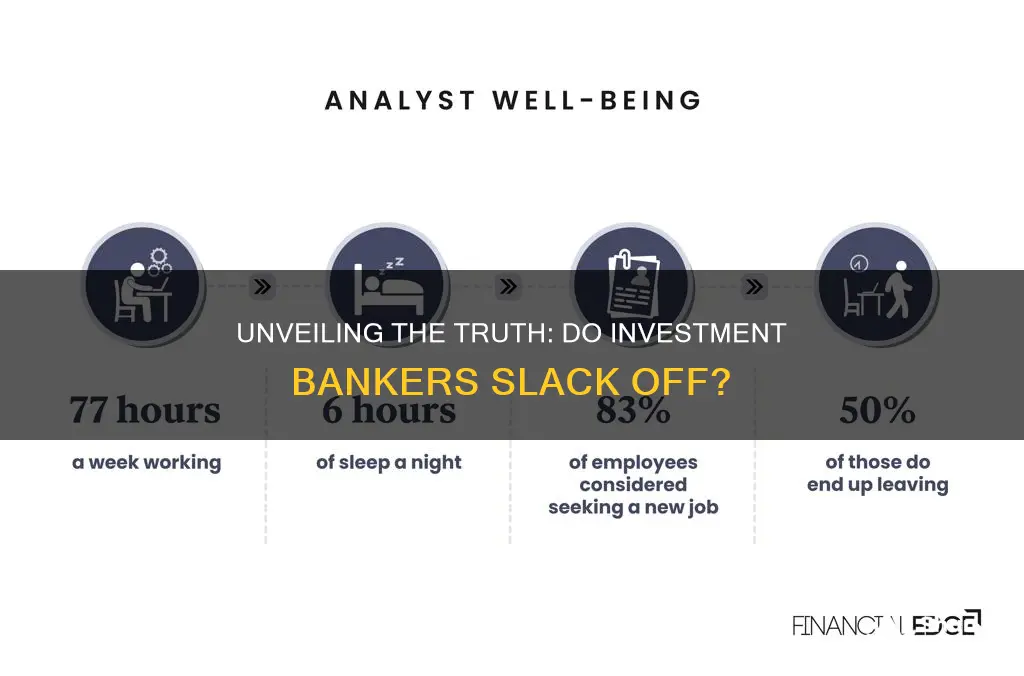

The demanding nature of investment banking has long been associated with long work hours and a high-pressure environment, which can significantly impact the well-being of employees. While it is a common perception that investment bankers often work tirelessly, the reality is that this culture can lead to burnout and other serious health issues. The fast-paced and competitive nature of the industry often requires bankers to work extended hours, sometimes well into the night, to meet deadlines, close deals, and stay ahead of the competition. This relentless work schedule can take a toll on both physical and mental health.

Burnout is a very real and serious consequence of this work culture. It is characterized by emotional exhaustion, cynicism, and a sense of reduced personal accomplishment. Investment bankers, driven by the desire to succeed and maintain their reputation, may find themselves caught in a cycle of overworking. They might feel compelled to put in extra hours to demonstrate their dedication and commitment to the firm and their clients. However, this can lead to a constant state of fatigue, where individuals feel drained and unable to perform at their best.

The high-pressure environment in investment banking can also contribute to burnout. The constant need to meet targets, secure new business, and manage client expectations can create a stressful atmosphere. This stress can manifest in various ways, such as increased anxiety, difficulty concentrating, and a decline in overall productivity. Over time, these pressures can lead to physical and mental health issues, including insomnia, depression, and even cardiovascular problems.

To address this issue, it is crucial for investment banking firms to foster a healthier work culture. This can be achieved by implementing policies that promote work-life balance. For instance, offering flexible work arrangements, such as remote work options or adjusted schedules, can help employees manage their personal and professional lives more effectively. Additionally, providing access to wellness programs, counseling services, and regular health check-ups can support the mental and physical well-being of the workforce.

In conclusion, while the investment banking industry demands dedication and long hours, it is essential to recognize the potential consequences of this work culture. By prioritizing employee well-being and implementing supportive measures, firms can create a more sustainable and healthy environment, reducing the risk of burnout and promoting long-term success for both the employees and the organization. It is a delicate balance, but one that is crucial for the industry's future and the well-being of its professionals.

Retirement Strategies of the Rich

You may want to see also

Technology and Automation: Digital tools and automation impact job roles and workload

The integration of digital tools and automation has significantly transformed the investment banking industry, impacting job roles and the overall workload. As technology advances, it is essential to understand how these changes affect the profession and the individuals within it. Investment banking, traditionally a labor-intensive field, has witnessed a shift towards a more automated landscape, which brings both opportunities and challenges.

One of the most noticeable impacts is the automation of routine tasks, which were once time-consuming and prone to human error. For instance, digital platforms now handle data entry, report generation, and basic financial modeling, allowing investment bankers to focus on more complex and strategic responsibilities. This automation streamlines processes, reduces operational costs, and enhances overall efficiency. However, it also raises concerns about job security and the need for continuous skill development. Investment bankers must adapt to these changes, ensuring they possess the technical skills to work alongside automated systems effectively.

The role of an investment banker has evolved to include more analytical and advisory functions. With automation handling repetitive tasks, bankers now have the opportunity to delve deeper into market research, client interactions, and complex financial analysis. This shift enables them to provide more valuable insights and strategic recommendations to clients. For example, automated data analysis tools can quickly process vast amounts of financial data, identifying trends and patterns that may not be apparent through manual methods. This capability empowers investment bankers to make more informed decisions and offer innovative solutions to their clients' needs.

However, the increased reliance on technology also brings challenges. As automation takes over certain tasks, there is a risk of over-specialization, where investment bankers may become too focused on specific automated processes, potentially leading to a lack of broad understanding. To mitigate this, organizations should encourage cross-training and knowledge-sharing among teams. Additionally, the industry must address the potential ethical and legal implications of automation, ensuring that the use of digital tools adheres to regulatory standards and maintains the integrity of financial services.

In conclusion, technology and automation have undoubtedly reshaped the investment banking industry. While they offer numerous benefits, such as improved efficiency and enhanced analytical capabilities, they also require a thoughtful approach to ensure a smooth transition. Investment bankers must embrace these changes, continuously update their skill sets, and adapt to a more automated work environment. By doing so, they can leverage the power of digital tools to deliver exceptional services and maintain a competitive edge in the market.

Retirees: How to Navigate Today's Markets with Your Investments

You may want to see also

Regulatory and Compliance Challenges: Navigating complex regulations can be demanding and time-consuming

The world of investment banking is a complex and highly regulated environment, where professionals must navigate a myriad of rules and regulations to ensure compliance and maintain the integrity of the financial markets. Navigating this intricate web of regulations can indeed be a challenging and time-consuming task, often demanding a significant amount of effort and attention from investment bankers.

One of the primary challenges is the ever-changing nature of financial regulations. New laws and amendments are frequently introduced, requiring bankers to stay abreast of the latest developments and adapt their practices accordingly. This constant evolution can be demanding, as it requires a dedicated team to monitor and interpret these changes, ensuring that the firm's operations remain compliant. The pressure to keep up with regulatory updates can be intense, especially for smaller firms with limited resources, who may struggle to allocate sufficient time and expertise to this critical task.

Additionally, the complexity of regulations themselves poses a significant challenge. Financial regulations often involve intricate details, technical jargon, and multiple layers of rules, making it difficult for investment bankers to fully comprehend and apply them. Understanding the nuances of these regulations is essential to avoid unintentional breaches, which could result in severe legal and financial consequences. As such, investment bankers must dedicate substantial time to studying and interpreting these rules, ensuring they are applied consistently across all operations.

The time and resource-intensive nature of regulatory compliance can indeed impact productivity and, ironically, the very efficiency that investment bankers strive for. The process of ensuring compliance may involve extensive documentation, reporting, and internal audits, all of which require significant time and effort. While it is essential to maintain high standards of compliance, the potential for burnout among investment bankers is a real concern, as the constant pressure to meet regulatory demands can lead to fatigue and decreased productivity.

To address these challenges, investment banking firms often invest in robust compliance programs and dedicated teams. These programs provide the necessary infrastructure and expertise to navigate the complex regulatory landscape. By allocating resources effectively and implementing comprehensive training programs, firms can ensure that their employees are well-equipped to handle regulatory demands. Moreover, fostering a culture of compliance, where employees understand the importance of their role in maintaining regulatory standards, can significantly contribute to a more efficient and effective work environment.

Rhodium's Radiance: Shine or Shadow for Investors?

You may want to see also

Client Demands and Expectations: High client expectations and demands can lead to increased workload

High client expectations and demands are an inherent part of the investment banking industry, and they can significantly impact the workload and stress levels of professionals in this field. Investment bankers often juggle multiple client projects simultaneously, each with its own unique set of requirements and deadlines. When clients demand frequent updates, rapid decision-making, and comprehensive solutions, it can lead to a challenging work environment.

The pressure to meet these demands can result in increased hours worked, with bankers often dedicating long days and nights to client projects. This high-pressure culture may contribute to a perception that investment bankers are constantly busy and rarely 'slack off'. However, it is important to recognize that this intense work environment can also lead to burnout and fatigue, affecting the quality of work and overall productivity.

To manage this situation, investment banking firms often implement strategies to ensure client satisfaction while maintaining a healthy work-life balance for their employees. This includes setting clear expectations and communication channels with clients, providing regular project updates, and establishing realistic timelines. By doing so, bankers can ensure that clients' demands are met without compromising their own well-being.

Additionally, effective time management and prioritization skills become crucial in this context. Investment bankers must learn to allocate their time efficiently, focusing on critical tasks and deadlines while ensuring that client demands are addressed promptly. This may involve delegating tasks, seeking assistance from colleagues, or implementing structured workflows to streamline the process.

In summary, while high client expectations and demands are a reality in investment banking, it is essential to maintain a balanced approach. By setting clear boundaries, managing time effectively, and prioritizing self-care, investment bankers can navigate the challenges of meeting client demands without sacrificing their own health and productivity. This ensures that the industry can continue to thrive while providing exceptional service to clients.

The Bucket List: Unraveling the Bucket Approach for Retirement Planning

You may want to see also

Frequently asked questions

While investment banking is a high-pressure environment, it's important to maintain a healthy work-life balance. Investment bankers do take breaks throughout the day to recharge and maintain productivity. These breaks can include short walks, quick stretches, or even a quick chat with colleagues to discuss non-work-related topics. It's a common practice to step away from the desk for a few minutes to prevent burnout and maintain focus during long workdays.

Investment banking professionals often have a structured approach to managing their workload. They prioritize tasks based on urgency and importance, ensuring that critical projects are given the necessary attention. Effective time management techniques, such as creating to-do lists, setting deadlines, and breaking down large projects into smaller tasks, help them stay organized. Additionally, many investment banks promote a culture of open communication, allowing bankers to discuss their workload and seek support when needed, which can prevent slacking off due to overwhelming stress.

Long work hours are not uncommon in the investment banking industry, especially during busy periods or when dealing with tight deadlines. While dedication and long hours are often valued, excessive work can lead to fatigue and decreased productivity. Investment banks are increasingly focusing on employee well-being and implementing initiatives to promote a healthier work environment. This includes offering flexible work arrangements, providing access to wellness programs, and encouraging a culture of reasonable work hours. Balancing long work hours with adequate rest and personal time is essential to maintain focus and prevent slacking off due to exhaustion.