Artificial intelligence (AI) investing is a relatively new concept that has gained traction in recent years, with many investors curious about its potential. The idea is to leverage AI algorithms and machine learning to identify investment opportunities and make trading decisions. While the concept is intriguing, it's important to understand the intricacies and potential challenges of AI investing to determine if it's a viable strategy. This paragraph will explore the effectiveness of AI in the investment world, examining its benefits, limitations, and the ongoing debate surrounding its success.

What You'll Learn

- AI Investment Strategies: Exploring various approaches to investing in AI-related companies

- Market Trends: Analyzing the impact of AI on market dynamics and investment opportunities

- Risk Assessment: Identifying and managing risks associated with AI investments

- Ethical Considerations: Examining ethical implications of AI in finance and investment practices

- Performance Metrics: Evaluating the success of AI-driven investment portfolios and strategies

AI Investment Strategies: Exploring various approaches to investing in AI-related companies

The field of artificial intelligence (AI) has opened up exciting opportunities for investors, with the potential to revolutionize numerous industries. As AI continues to advance, it is becoming increasingly important for investors to understand the various strategies and approaches to investing in AI-related companies. Here, we delve into some of the key strategies that investors can consider when navigating this rapidly evolving landscape.

One popular approach is to invest in AI-focused funds or exchange-traded funds (ETFs). These funds are designed to provide broad exposure to companies involved in AI, machine learning, and related technologies. By investing in these funds, investors can gain access to a diverse portfolio of AI-related companies, reducing the risk associated with individual stock picks. ETFs often track specific indices, allowing investors to benefit from the overall growth of the AI sector. This strategy is particularly suitable for those who prefer a more passive investment approach or lack the time and expertise to research individual stocks.

Another strategy is to focus on specific sectors or industries that are heavily reliant on AI technologies. For example, healthcare, finance, transportation, and robotics are sectors where AI has already made significant inroads. Investors can identify companies leading the way in these industries and assess their AI capabilities, market position, and growth prospects. This sector-specific approach allows investors to capitalize on the unique advantages of AI in different fields. For instance, investing in medical AI startups working on personalized treatment plans or autonomous vehicle manufacturers can offer significant returns as these technologies disrupt traditional industries.

Additionally, investors can explore the concept of venture capital (VC) investing in AI startups. This strategy involves backing early-stage companies with high growth potential. VC investors often seek to identify groundbreaking AI technologies, assess their market fit, and provide the necessary funding and expertise for growth. By investing in AI startups, investors can gain exposure to cutting-edge innovations and potentially benefit from substantial returns if these companies succeed. However, this approach requires a deep understanding of the AI landscape, thorough due diligence, and a high tolerance for risk.

Lastly, some investors opt for a more diversified approach by investing in a mix of AI-related companies and traditional technology stocks. This strategy allows investors to benefit from the overall growth of the tech sector while also capturing the specific opportunities presented by AI. By combining AI-focused investments with more established tech companies, investors can create a well-rounded portfolio that leverages the strengths of both approaches.

In conclusion, investing in AI-related companies offers a range of strategies for investors to consider. From AI-focused funds and sector-specific investments to VC backing and diversified portfolios, each approach has its own set of advantages and considerations. As the AI landscape continues to evolve, investors who stay informed and adapt their strategies accordingly will be well-positioned to capitalize on the opportunities presented by this transformative technology.

Investing: Choosing Companies Wisely

You may want to see also

Market Trends: Analyzing the impact of AI on market dynamics and investment opportunities

The integration of artificial intelligence (AI) into financial markets is reshaping investment strategies and market dynamics, presenting both opportunities and challenges for investors. As AI continues to advance, its impact on the investment landscape is becoming increasingly significant, offering new avenues for analysis and decision-making.

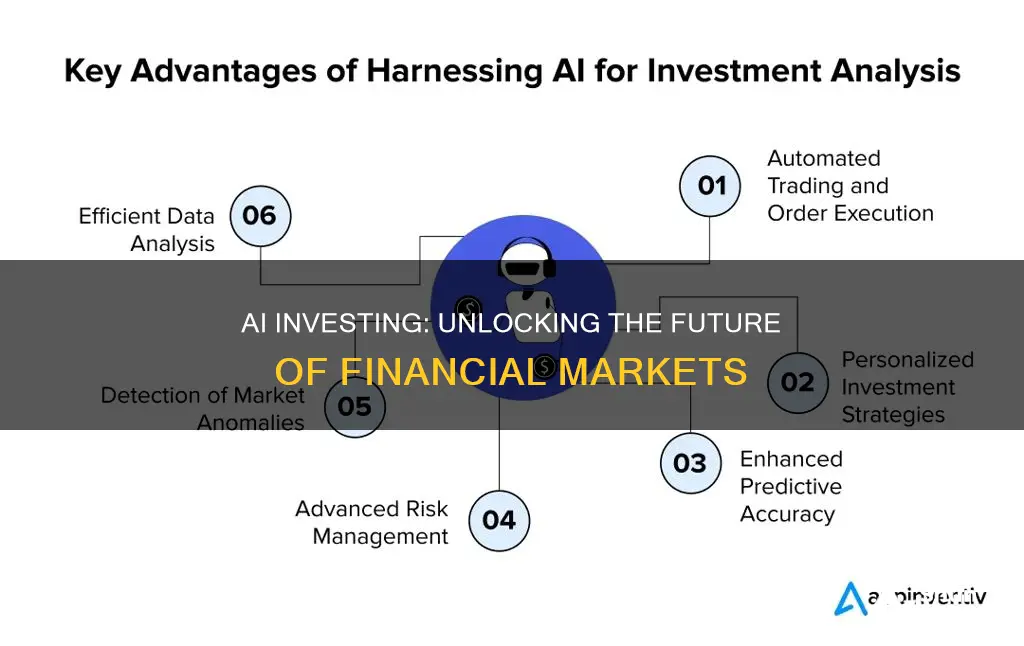

One of the most notable impacts of AI on markets is its ability to process vast amounts of data quickly and accurately. AI algorithms can analyze historical market trends, news sentiment, social media, and real-time financial data, providing investors with comprehensive insights. This enables investors to make more informed decisions, identify patterns, and predict market movements with greater precision. For example, AI-powered sentiment analysis can gauge market sentiment towards specific companies or industries, helping investors anticipate potential shifts in stock prices.

AI-driven automation has also revolutionized trading processes. Algorithmic trading, powered by machine learning, allows for rapid execution of trades based on predefined strategies. These algorithms can adapt to changing market conditions, execute trades at optimal prices, and minimize human error. As a result, high-frequency trading (HFT) has become more prevalent, contributing to increased market liquidity and reduced transaction costs. However, this trend also raises concerns about market volatility and potential disruptions, especially during periods of rapid AI-driven trading.

Moreover, AI is transforming investment management by enabling more sophisticated portfolio management and risk assessment. AI models can analyze individual investor risk profiles, market conditions, and historical performance to optimize asset allocation. These models can also identify potential investment opportunities by evaluating a vast array of data points, including company-specific factors, industry trends, and macroeconomic indicators. As a result, investors can construct more diversified portfolios and make strategic decisions aligned with their risk tolerance and financial goals.

Despite the benefits, the widespread adoption of AI in investing also brings challenges. One concern is the potential for over-optimization, where AI models become too focused on historical patterns, failing to adapt to unforeseen events. Additionally, the complexity of AI algorithms and the lack of transparency in their decision-making processes can make it difficult for investors to understand and explain their investment choices. Regulatory bodies are also grappling with the ethical and legal implications of AI-driven investing, particularly regarding data privacy, algorithmic bias, and market manipulation.

In conclusion, AI is significantly influencing market trends and investment opportunities. Its ability to process vast data, automate trading, and enhance portfolio management offers investors powerful tools for analysis and decision-making. However, investors must navigate the challenges associated with AI, including over-optimization risks and regulatory considerations, to ensure that AI-driven investing remains a reliable and ethical approach in the ever-evolving financial markets. Staying informed about the latest advancements in AI and its applications in finance is crucial for investors to leverage this technology effectively.

Savings vs Investment: What's the Difference?

You may want to see also

Risk Assessment: Identifying and managing risks associated with AI investments

When it comes to AI investing, risk assessment is a critical component that can make or break your investment strategy. The field of AI is rapidly evolving, and with it, the potential risks and challenges associated with these investments. Here's a breakdown of how to identify and manage these risks effectively:

Identifying Risks:

- Technical Risks: AI investments often involve cutting-edge technology, which inherently carries risks. These include the potential for algorithm failures, data quality issues, or unexpected technical challenges. For instance, an AI system might struggle with edge cases or require more data than initially anticipated, leading to delays and increased costs.

- Market and Competitive Risks: The AI market is highly competitive, with numerous players vying for dominance. Assess the competitive landscape to identify potential threats. This includes analyzing competitors' strategies, market share, and the uniqueness of your investment's offering. A thorough understanding of the market dynamics can help anticipate challenges and position your investment for success.

- Regulatory and Ethical Risks: As AI becomes more prevalent, regulatory frameworks are evolving to address concerns related to privacy, data protection, and ethical AI practices. Stay updated on relevant regulations and industry standards. Non-compliance can result in legal issues and reputational damage. Additionally, consider ethical implications, such as bias in algorithms or the impact of AI on employment, which could lead to public backlash.

Risk Management Strategies:

- Thorough Due Diligence: Conduct extensive research and due diligence before making any AI investment. Analyze the technology, team, and business model. Evaluate the team's expertise, track record, and ability to execute their vision. A robust due diligence process can help uncover potential risks and ensure a more informed investment decision.

- Diversification: Diversifying your AI investments can mitigate risks. Spread your investments across different sectors, technologies, and stages of development. This approach reduces the impact of any single risk and provides a more balanced portfolio.

- Regular Monitoring and Adaptation: AI investments require ongoing monitoring and adaptability. Stay updated on industry trends, competitor moves, and regulatory changes. Regularly review your investments' performance and be prepared to adjust your strategy. This proactive approach allows you to capitalize on opportunities while minimizing potential pitfalls.

- Risk Mitigation Techniques: Implement risk mitigation strategies tailored to each investment. This may include insurance coverage for specific technical risks, contingency plans for market shifts, or partnerships to address regulatory concerns. For instance, consider insurance for data breaches or collaborate with legal experts to navigate complex regulatory environments.

By adopting a comprehensive risk assessment approach, investors can navigate the AI landscape with greater confidence. It enables them to make informed decisions, adapt to changing circumstances, and ultimately increase the chances of success in the AI investment space. Remember, a well-managed risk strategy is essential for long-term success in any investment endeavor.

Cola-Cola Investors: Who's Involved?

You may want to see also

Ethical Considerations: Examining ethical implications of AI in finance and investment practices

The integration of artificial intelligence (AI) in finance and investment practices has sparked both excitement and ethical debates. As AI algorithms become increasingly sophisticated, it is crucial to examine the ethical implications surrounding their use in the financial sector. One of the primary concerns is the potential for bias and discrimination. AI models are trained on historical data, which may contain inherent biases and stereotypes. If these biases are not carefully addressed, AI-driven investment decisions could perpetuate and even exacerbate existing inequalities. For instance, if a model is trained on historical data that reflects gender or racial biases, it might make investment choices that disadvantage certain groups, leading to unfair outcomes. Ensuring fairness and mitigating bias should be a top priority when implementing AI in finance to promote an equitable and just financial system.

Another ethical consideration is the impact of AI on employment and the future of work. The automation capabilities of AI have raised concerns about job displacement and the potential loss of human expertise in the financial industry. As AI algorithms take on more complex tasks, there is a risk of reducing the need for human financial advisors and analysts. This shift could lead to significant job losses and societal disruptions. It is essential for policymakers and industry leaders to consider the ethical implications of automation and develop strategies to reskill and support affected workers. Additionally, ensuring transparency and accountability in AI-driven investment processes is vital. The 'black box' nature of some AI models, where the decision-making process is not fully understood, can lead to a lack of trust and potential misuse. Financial institutions should strive to provide clear explanations of how AI algorithms arrive at investment recommendations to maintain investor confidence and ensure ethical practices.

Privacy and data security are also critical ethical issues in AI-driven finance. As AI systems rely on vast amounts of data, including sensitive financial information, there is a heightened risk of data breaches and unauthorized access. Protecting client data and ensuring the confidentiality of investment strategies are essential to maintaining trust. Financial institutions must implement robust data protection measures and adhere to strict privacy regulations to safeguard the interests of investors and the public. Furthermore, the potential for AI to manipulate markets and engage in fraudulent activities is a significant ethical concern. Advanced algorithms can be used to identify and exploit market inefficiencies, potentially leading to unfair advantages and market distortions. Regulators need to stay vigilant and adapt existing frameworks to address these challenges, ensuring that AI-driven investment practices are fair, transparent, and compliant with legal standards.

In conclusion, while AI has the potential to revolutionize finance and investment, it is imperative to approach its implementation with careful ethical consideration. Addressing bias, ensuring fairness, protecting employment, maintaining transparency, safeguarding privacy, and preventing market manipulation are all essential aspects that require attention. By navigating these ethical challenges, the financial industry can harness the power of AI while upholding integrity, trust, and societal well-being. It is through a thoughtful and responsible approach that AI investing can truly work in the best interest of investors and the financial ecosystem as a whole.

Residential Investment Dividends: Unlocking the Payout Frequency Mystery

You may want to see also

Performance Metrics: Evaluating the success of AI-driven investment portfolios and strategies

When it comes to assessing the effectiveness of AI-driven investment strategies, performance metrics play a pivotal role in providing a comprehensive evaluation. These metrics are essential tools for investors and fund managers to gauge the success and efficiency of their AI-powered portfolios. Here's an in-depth look at how these metrics can be utilized:

Risk-Adjusted Returns: One of the primary performance metrics is the calculation of risk-adjusted returns. This involves assessing the excess return generated by the AI strategy over a risk-free rate, often measured by the Sharpe Ratio. The Sharpe Ratio evaluates the risk-adjusted return of an investment by comparing its excess return to its volatility. A higher Sharpe Ratio indicates better risk-adjusted performance, suggesting that the AI strategy has effectively balanced risk and return. For instance, if an AI-driven portfolio yields a Sharpe Ratio of 0.5, it means that for every one-unit increase in volatility, the portfolio returns 0.5 units more than the risk-free rate.

Alpha and Beta: Alpha and Beta are statistical measures that provide insights into a strategy's performance relative to a benchmark index. Alpha represents the excess return generated by the AI strategy compared to the benchmark, controlling for market risk. A positive alpha indicates that the AI strategy has outperformed the market. Beta, on the other hand, measures the volatility of the AI portfolio relative to the benchmark. A beta of 1 means the portfolio moves in line with the market, while a beta greater than 1 indicates higher volatility. Investors can use these metrics to understand if the AI strategy is adding value beyond market performance.

Information Ratio: This metric is an extension of the Sharpe Ratio, focusing on the consistency of outperformance. The Information Ratio (IR) measures the excess return relative to the standard deviation of excess return. It provides a more nuanced view by assessing how well the AI strategy has performed compared to the market's volatility. A higher Information Ratio suggests that the strategy has consistently generated excess returns, even during volatile market conditions. For example, if an AI strategy has an Information Ratio of 2, it means that for every 1% increase in market volatility, the strategy still generates a 2% excess return.

Backtesting and Stress Testing: Performance metrics also involve rigorous backtesting and stress testing of AI investment strategies. Backtesting involves simulating the strategy's performance over historical data to evaluate its effectiveness under various market conditions. Stress testing, on the other hand, assesses the strategy's resilience during extreme market events, such as financial crises or rapid market shifts. These tests provide valuable insights into the strategy's robustness and its ability to withstand adverse scenarios. By analyzing the performance metrics derived from backtesting and stress testing, investors can make informed decisions about the suitability and potential risks associated with AI-driven investment approaches.

In summary, evaluating the success of AI-driven investment portfolios requires a comprehensive set of performance metrics. These metrics, including risk-adjusted returns, alpha and beta, information ratio, and backtesting/stress testing, provide investors with the necessary tools to assess the effectiveness, risk, and consistency of AI strategies. By employing these metrics, investors can make data-driven decisions, optimize their portfolios, and potentially enhance their overall investment outcomes.

Conservative Investing in Retirement: The Edward Jones Approach

You may want to see also

Frequently asked questions

AI investing refers to the use of artificial intelligence and machine learning algorithms to analyze and make investment decisions in financial markets. It involves training AI models on vast amounts of data to identify patterns, predict market trends, and suggest investment opportunities.

Traditional investment methods often rely on human analysis and experience, while AI investing automates the process by employing algorithms to process and interpret data. AI can analyze a large number of factors simultaneously, including historical prices, news sentiment, social media trends, and more, to make investment choices at a speed and scale that humans cannot match.

AI investing has the potential to offer several advantages. Firstly, it can reduce the impact of human emotions and biases, which are common in traditional investing. AI models can make data-driven decisions without the influence of fear or greed. Secondly, AI can process vast amounts of data quickly, identifying complex patterns and trends that might be missed by human analysts. This can lead to more accurate predictions and faster response times in dynamic markets.

While AI investing has the potential to enhance performance, it also comes with certain risks. One concern is the possibility of overfitting, where the AI model performs exceptionally well on historical data but fails to generalize to new, unseen data. Additionally, the reliance on historical data may not always capture the impact of unforeseen events or market disruptions. Another risk is the potential for algorithmic errors or bugs, which could lead to significant financial losses if not properly managed and tested.

AI investing is not intended to replace human investors but rather to augment their capabilities. AI can handle routine tasks, data analysis, and rapid decision-making, allowing human investors to focus on strategic thinking, risk management, and long-term planning. A collaborative approach between AI and human expertise is often considered the most effective way to leverage the benefits of both while mitigating potential risks.