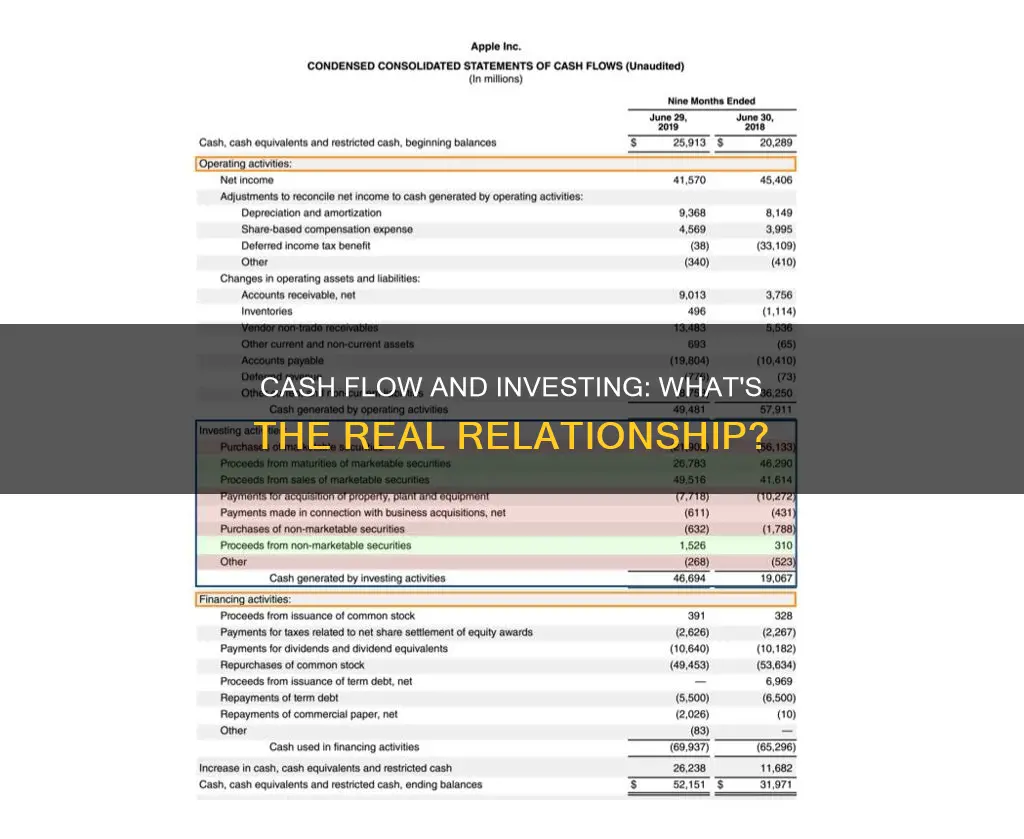

Cash flow from investing activities is a critical component of a company's cash flow statement, offering insights into its investment performance and capital allocation decisions. This section of the cash flow statement details the cash inflows and outflows resulting from investment activities, which primarily involve the acquisition and disposal of long-term assets such as property, plant, equipment, and investments in marketable securities. It is calculated by subtracting total cash outflows from total inflows related to investing activities, revealing the net cash flow. A positive net cash flow indicates effective management of investments, while negative cash flow in investing activities is generally viewed as a worthy short-term investment for long-term business growth.

| Characteristics | Values |

|---|---|

| What is included in cash flow from investing activities? | Capital expenditure involving the acquisition of fixed assets, plant and machinery, proceeds from sales of fixed assets, purchase of investment securities, bonds, debentures, and stock, proceeds from sales of investment securities bonds, debentures, and stock, acquisition of another company, proceeds from sales of other business units, loans made to third parties, and the collection of loans made by the entity. |

| What is not included in cash flow from investing activities? | Short-term investments or cash equivalents, cash received from sales of goods and services, payments made to vendors and suppliers, tax-related payments, payment of dividends, expenses related to asset depreciation, debt and equity financing, and income and expenses related to business operations. |

| How to calculate cash flow from investing activities? | To calculate cash flow from investing activities, add the purchases or sales of property and equipment, other businesses, and marketable securities. |

What You'll Learn

Long-term investments

Cash equivalent investments, such as certificates of deposit and high-interest savings accounts, are also popular among investors due to their stable rate of return and low risk. These investments are often chosen for retirement planning.

The specific method of accounting for a long-term investment is largely governed by the intent of the investment. Companies may acquire investments for their cash flow yields, to establish influence or control, or for other strategic reasons. When a company owns less than 50% of the outstanding stock of another company as a long-term investment, the percentage of ownership determines whether to use the cost method or the equity method for accounting purposes.

Overall, long-term investments offer the potential for higher returns and wealth creation but require a high level of patience and the ability to withstand market fluctuations.

Extra Cash: Smart Investment Strategies for Beginners

You may want to see also

Cash flow statement

A cash flow statement is one of the three main financial statements that a company generates in an accounting period. It provides a detailed picture of what happened to a company's cash during a specified period, known as the accounting period. It demonstrates an organisation's ability to operate in the short and long term, based on how much cash is flowing into and out of the business.

The cash flow statement is typically broken into three sections: operating activities, investing activities, and financing activities.

Operating Activities

The operating activities on the cash flow statement include any sources and uses of cash from business activities. It reflects how much cash is generated from a company's products or services. These include:

- Receipts from sales of goods and services

- Payments made to suppliers of goods and services used in production

- Salary and wage payments to employees

- Any other type of operating expenses

Investing Activities

Investing activities include any sources and uses of cash from a company's investments. It includes purchases or sales of assets, loans made to vendors or received from customers, or any payments related to mergers and acquisitions. In short, changes in equipment, assets, or investments relate to cash from investing activities.

Financing Activities

Financing activities include the sources of cash from investors and banks, as well as the way cash is paid to shareholders. This includes any dividends, payments for stock repurchases, and repayment of debt principal (loans) that are made by the company.

The two methods of calculating cash flow are the direct method and the indirect method. The direct method involves listing all cash receipts and payments during the reporting period, while the indirect method starts with net income and adjusts for changes in non-cash transactions.

Cash Investments: What Are They?

You may want to see also

Capital allocation

- Entering a new line of business: Requires higher initial outlays of cash but could be the most profitable in the long run.

- Increasing the capacity of the core business: Can be done until growth rates begin to decline.

- Issuing or increasing dividends: A tried and true method.

- Retiring debt: Increases financial efficiency as equity financing is usually cheaper.

- Investing in or acquiring other companies or ventures: Should be done cautiously, sticking to core competencies.

- Buying back company stock: Can increase the percentage ownership of shareholders and signal management's belief in the company's future.

When evaluating a company's capital allocation abilities, investors should consider the history of and expectations for the company's capital allocation abilities, in addition to valuation and growth.

A company's cash flow statement provides substantial information on its financial health and includes three sections:

- Cash Flow from Operations (CFO)

- Cash Flow from Investing (CFI)

- Cash Flow from Financing Activities (CFF)

The CFI section of the cash flow statement reveals a company's investment performance and capital allocation decisions. It includes transactions such as acquiring and disposing of assets, investing in securities, and acquiring other companies.

Overall, the cash flow statement provides an account of the cash used in operations, including working capital, financing, and investing activities. It bridges the gap between the income statement and the balance sheet by showing how much cash is generated or spent on operating, investing, and financing activities for a specific period.

Temporary Investments: Are They Really Cash?

You may want to see also

Acquisition and disposal of assets

The acquisition and disposal of assets are integral components of a company's cash flow statement, providing valuable insights into its investment performance and capital allocation decisions. This section of the statement, known as Cash Flow from Investing Activities (CFI), encompasses transactions such as purchasing and selling long-term assets, including property, plant, and equipment.

When a company acquires assets, it results in a cash outflow from investing activities. For instance, if a business owner invests in a new factory building to expand its operations, this purchase would be categorised as a cash outflow. On the other hand, if the company disposes of assets it no longer needs, such as outdated or unused machinery, the cash received from the sale would be recorded as a cash inflow from investing activities.

The acquisition and disposal of assets also involve investments in securities, such as stocks, bonds, or other financial instruments. If a company purchases investment securities, it leads to a cash outflow, while proceeds from the sale of these securities generate a cash inflow.

It is important to note that the acquisition and disposal of assets are just one aspect of CFI. This section of the cash flow statement also includes other investment-related activities, such as lending money, mergers and acquisitions, and research and development expenditures.

By analysing the CFI section, investors and analysts can gain a deeper understanding of a company's financial health, capital allocation strategies, and long-term growth prospects. It provides valuable insights into how effectively a company is managing its cash and investing in its future operations.

Understanding E-Trade Cash Calls: What Investors Need to Know

You may want to see also

Company growth

A positive net cash flow from investing activities indicates that a company is generating more cash from its investing activities than it is spending. This suggests that the company is effectively managing its investments and may be acquiring assets or making strategic investments to enhance future growth and profitability. For example, a company with a positive net cash flow from investing activities may be investing in fixed assets such as property, plant, and equipment to expand its operations and grow its business.

On the other hand, negative cash flow from investing activities does not always indicate poor financial health. It is often a sign that the company is investing in assets, research, or other long-term development activities that are important for its health and continued operations. For instance, a company might be investing heavily in plant and equipment to grow its business, resulting in cash-flow negative activities that could lead to positive long-term gains.

Overall, investing activities are an important aspect of company growth as they provide insights into a company's capital expenditure and investment strategies. They help stakeholders assess the company's ability to invest in growth opportunities, acquire assets, and manage its long-term financial health.

Cash Investment Strategies: Your Guide to Profitable Opportunities

You may want to see also

Frequently asked questions

A cash flow statement is a financial report that tracks the inflow and outflow of cash, providing insights into a company's financial health and operational efficiency. It is one of the three main financial statements used by companies, alongside the balance sheet and the income statement.

Cash flow from investing activities includes any transactions that involve the acquisition or disposal of long-term assets, such as property, plant, and equipment. It also includes investments in securities, mergers, and acquisitions.

Separating cash flow from investing activities from operating and financing activities provides a clearer picture of how each part of the company is performing. It allows business owners and investors to identify specific areas where cash flow may be an issue and make informed decisions.

To calculate cash flow from investing activities, you need to identify all cash transactions related to investments. This includes cash inflows from sales of long-term assets or investments and cash outflows from purchases of long-term assets or investments. You then subtract the total cash outflows from the total cash inflows to determine the net cash flow from investing activities.