A company's cash flow is the movement of money into and out of its accounts over a certain period of time. A positive cash flow indicates that a company's liquid assets are increasing, enabling it to cover obligations, reinvest in its business, and return money to shareholders. Conversely, a negative cash flow suggests that a company may need to raise money. A company's cash flow statement is one of its key financial statements, alongside the balance sheet and income statement. This statement includes cash flow from operations, investing, and financing activities. This paragraph will discuss investment criteria that disregard cash flow in their formulas.

| Characteristics | Values |

|---|---|

| Type of Investment Criteria | Free Cash Flow (FCF) |

| Definition of FCF | Amount of cash generated by a business after accounting for reinvestment in non-current capital assets |

| FCF Formula | FCF = Cash from Operations – CapEx |

| FCF Calculation | Cash from Operations is net income plus any non-cash expenses, adjusted for changes in non-cash working capital |

| Non-cash expenses include depreciation, amortization, stock-based compensation, impairment charges, and gains/losses on investments | |

| Capital Expenditures (CapEx) refer to the purchase of non-current assets such as property, equipment, and other major investments | |

| FCF Uses | Valuation and determining whether a company can meet its debt obligations |

| Investors use FCF to assess companies for potential investment | |

| Types of FCF | Free Cash Flow to the Firm (FCFF) or "unlevered" free cash flows |

| Free Cash Flow to Equity (FCFE) or "levered" free cash flows | |

| Generic Free Cash Flow (FCF) |

What You'll Learn

Cash Flow from Operations (CFO)

CFO indicates whether a company has enough funds to pay its bills and operating expenses. It is calculated by taking the cash received from sales and subtracting the operating expenses paid in cash for that period. CFO is an important benchmark for determining the financial success of a company's core business activities.

There are two methods for calculating CFO: the indirect method and the direct method. The indirect method begins with net income from the income statement and then adds back non-cash items to arrive at a cash basis figure. The direct method tracks all transactions in a period on a cash basis and uses actual cash inflows and outflows on the cash flow statement.

The cash flow statement is one of the three main financial statements required in standard financial reporting, alongside the income statement and balance sheet. The statement is divided into three sections: cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities.

Transferring Cash to Fidelity Investments: A Step-by-Step Guide

You may want to see also

Cash Flow from Investing (CFI)

CFI includes the cash flow from purchases or sales of physical assets, investments in securities, or the sale of securities or assets. These can be long-term investments in the health and performance of the company, or they may generate income on their own. Examples include property, plant, and equipment (PP&E), acquisitions of other businesses, and investments in marketable securities (stocks, bonds, etc.).

Negative cash flow from CFI does not always indicate poor financial health. It could mean that the company is investing in assets, research, or other long-term development activities that are important for the company's health and continued operations. For example, a company may invest in fixed assets such as property, plant, and equipment to grow its business. While this may show as negative cash flow from CFI in the short term, it could lead to increased cash flow in the long term.

Positive CFI, on the other hand, indicates that a company has retained cash in the business and added to its reserves to handle short-term liabilities and fluctuations. This can be a good sign for investors, as it means the company has the cash to invest in itself and cover future loan expenses.

Overall, CFI is an important aspect of a company's financial statements, providing insights into its investment activities and long-term strategy.

A Beginner's Guide to Investing Cash in Vanguard

You may want to see also

Cash Flow from Financing Activities (CFF)

CFF = CED – (CD + RP)

Where:

- CED = Cash inflows from issuing equity or debt

- CD = Cash paid as dividends

- RP = Repurchase of debt and equity

CFF takes into account transactions related to debt, equity, and dividends. A positive CFF indicates that a company is generating more cash than it is spending, suggesting strong financial health. Conversely, a negative CFF does not always imply financial distress, as it could be a result of the company actively paying off debts or making dividend payments and stock repurchases.

Investors and analysts use CFF to assess a company's financial footing and capital structure management. It is important to note that CFF should be analysed in conjunction with other financial statements, such as the balance sheet and income statement, to gain a comprehensive understanding of the company's performance and financial position.

CFF is an essential tool for evaluating a company's ability to manage its operations and growth, providing key insights into its financial stability and capital allocation.

A Guide to Investing in Cash-Flow Websites

You may want to see also

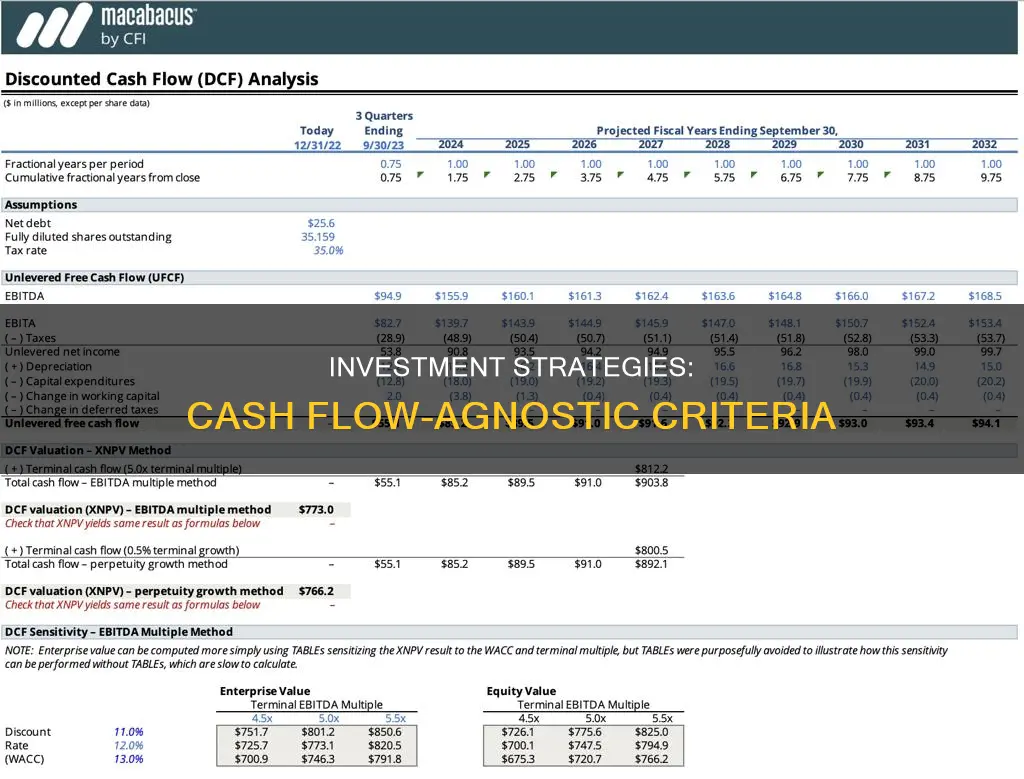

Free Cash Flow (FCF)

FCF is calculated using the formula:

FCF = Cash from Operations – Capital Expenditures

FCF can be defined and calculated in various ways, but in its most generic form, it is calculated as cash from operations minus capital expenditures. This figure represents the cash that a company can produce after deducting purchases of assets such as property, equipment, and other major investments from its operating cash flow.

FCF is an important metric for several reasons. Firstly, it indicates a company's ability to produce cash, which is often what investors care about most. Secondly, it is used for valuation purposes and to determine whether a company can meet its debt obligations. Finally, it can help identify problems in a company's financial fundamentals before they become apparent on its income statement.

While a positive FCF is generally considered favourable, it does not always indicate a strong stock trend. Additionally, FCF has some limitations. For example, purchases that depreciate over time will be subtracted from FCF in the year they are purchased, rather than across multiple years, which can distort short-term financial trends.

UK Cash Investment: Strategies for Success

You may want to see also

Positive vs Negative Cash Flow

Positive cash flow is when a company has more money coming in than going out. This means that the company's liquid assets are increasing, enabling it to cover obligations, reinvest in its business, return money to shareholders, pay expenses, and build a buffer against future financial challenges. Positive cash flow is crucial for business growth and expansion.

Negative cash flow, on the other hand, indicates that a company has more money going out than coming in. This results in the depletion of bank accounts and a decrease in cash reserves over time. Negative cash flow is not always a bad sign, especially if a company is investing in its long-term health, such as research and development. Additionally, young companies often experience negative cash flow as they incur initial expenses and work to attract customers.

Both positive and negative cash flow can impact a company's financial health and decision-making. Positive cash flow can provide opportunities for reinvestment and growth, while negative cash flow may require careful planning to ensure the company's survival and a return to positive cash flow.

Overall, understanding positive and negative cash flow is essential for effective business management and financial strategy.

Liquidating US Investments: A Country's Cash Out Strategy

You may want to see also