Free cash flow (FCF) is a key metric for assessing a company's financial health and strategic potential. It is the cash left after meeting both operational expenses and capital investments, and it offers a clear snapshot of a company's financial well-being. FCF is calculated as the operating cash flow minus capital expenditures, and it reveals a company's strategic objectives, financial stability, and ability to self-finance growth. While it is not listed on financial statements, it is an important indicator for investors, creditors, and shareholders, as it shows a company's ability to produce cash available for discretionary distribution.

What You'll Learn

Calculating Free Cash Flow

Free cash flow (FCF) is an important metric for understanding a company's financial health and performance. It represents the cash a company generates after accounting for all its costs, including operating costs and capital expenditures.

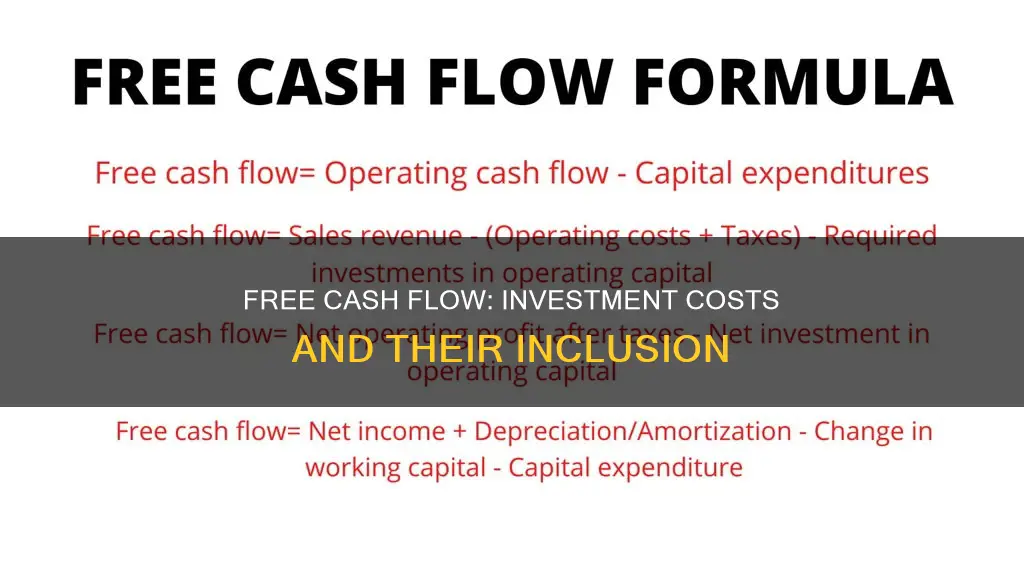

There are several methods for calculating free cash flow, and the specific approach will depend on the financial information available for a given company. Here are the key methods:

Using Operating Cash Flow

This is the most common method as it is the simplest and only requires two numbers readily found in financial statements: operating cash flow and capital expenditures. The formula is:

> FCF = Operating Cash Flow – Capital Expenditures

Using Sales Revenue

This method focuses on the revenue generated by a company and then subtracts the associated costs. It uses the income statement and balance sheet as sources of information. The formula is:

> FCF = Sales Revenue – (Operating Costs + Taxes) – Required Investments in Operating Capital

Using Net Operating Profits

This calculation is similar to using sales revenue but uses operating income instead. The formula is:

> FCF = Net Operating Profit After Taxes – Net Investment in Operating Capital

Using Amortization and Depreciation

This approach starts with the income statement, balance sheet, and cash flow statement. It adds net income, depreciation, and amortization, adjusts for changes in working capital, and then subtracts capital expenditures:

> FCF = Net Income + Depreciation/Amortization – Change in Working Capital – Capital Expenditure

Example Calculation

As an example, consider the department store Macy's. For the fiscal year ending in 2022, Macy's had a cash flow from operating activities of $1.615 billion and capital expenditures of $1.169 billion. To calculate the free cash flow, we subtract the capital expenditures from the operating cash flow:

> $1.615 billion – $1.169 billion = $0.446 billion, or $446 million

So, Macy's has $446 million in free cash flow, which it can use to pay dividends, expand operations, or reduce debt.

Understanding the Relationship Between Cash and Investments

You may want to see also

Free Cash Flow and Net Income

Free cash flow (FCF) is a measure of a company's profitability and financial health. It represents the cash that a company generates after accounting for cash outflows to support its operations and maintain its capital assets. In other words, it is the money left over after a company pays for its operating expenses (OpEx) and capital expenditures (CapEx).

FCF is calculated by subtracting capital expenditures from operating cash flow. Operating cash flow is the cash generated from a company's operations, or revenues, less operating expenses.

FCF is important because it shows how efficient a company is at generating cash. It can also be used to determine if a company is able to expand or restructure, or if it is likely to see a growth in profits. A company with a high FCF is generally seen as a positive sign by investors, as it indicates that the company is able to pay dividends, pay down debt, and contribute to growth.

Net income, also known as the bottom line, is the remaining income or revenues after deducting expenses, taxes, and the cost of goods sold (COGS). It is important for potential investors and creditors but does not always show the company's actual development. For example, net income may be temporarily inflated by a one-time asset sale.

While net income is an important indicator of a company's financial performance, it does not provide a complete picture of the company's financial health. FCF, on the other hand, takes into account both the cash inflows and outflows of a company, providing a more comprehensive understanding of its financial position.

Cashing Out Investments: Using the Cash App to Withdraw Funds

You may want to see also

Free Cash Flow and Net Cash Flow

Free cash flow (FCF) is the money a company generates after accounting for cash outflows to support its operations and maintain its capital assets. It is calculated by subtracting capital expenditures from cash flow from operations. FCF is a measure of a company's profitability and financial health.

Net cash flow, on the other hand, is a broader concept that looks at the net amount of cash and cash equivalents transferred into and out of a company, including cash from operating, investing, and financing activities. Net cash flow can be positive or negative, depending on whether the company has more cash inflows or outflows.

Free cash flow is more specific and focuses on the cash generated through operating activities after accounting for operating expenses and capital expenditures. It is an important metric for investors to analyse a company's financial health, as it represents the actual amount of cash at the company's disposal. A company with a consistently low or negative FCF may struggle to remain solvent and may be forced to raise additional funds.

FCF is also crucial for understanding the sustainability of dividend payments and the likelihood of future dividend increases. While a high FCF is generally positive, it should be considered alongside other financial indicators. For example, a company with a high FCF may be postponing necessary capital expenditures, which could cause issues in the future.

Calculating FCF can be complex and time-consuming, as it requires manually deriving the number from other data. However, it is a valuable tool for investors to assess a company's financial health and make informed investment decisions.

Cash Investment: Revenue or Asset?

You may want to see also

Free Cash Flow as a Financial Indicator

Free cash flow (FCF) is a financial indicator that represents the cash a company generates after accounting for cash outflows to support its operations and maintain its capital assets. It is calculated by subtracting capital expenditures from operating cash flow. FCF is an important metric for assessing a company's financial health, ability to generate cash, and ability to meet its financial obligations.

FCF is the money that remains after a company pays for operating expenses (OpEx) and capital expenditures (CapEx). It is the cash available for the company to use at its discretion, such as paying dividends to shareholders, investing in growth initiatives, or paying off debts. A positive FCF indicates that a company is generating more cash than is needed to run and reinvest in the business, while a negative FCF suggests that a company may be spending more on investments than it generates from operations.

FCF is a valuable tool for investors, creditors, and analysts. Investors use FCF to assess a company's financial health and potential for future growth. It helps them determine whether a company is a good investment opportunity and whether it can sustain dividend payments. Creditors can use FCF analysis to assess a company's ability to meet its debt obligations. Analysts employ FCF in financial modelling and valuation to estimate a company's intrinsic value.

FCF has some limitations. It can be challenging to calculate due to varying accounting practices and non-recurring items that can distort the results. Additionally, capital expenditures can vary significantly from year to year and across different industries, making comparisons difficult. Despite these limitations, FCF is a powerful metric that provides valuable insights into a company's financial health and prospects.

Investing: Negative Cash Flow's Impact and Insights

You may want to see also

Improving Free Cash Flow

Free cash flow (FCF) is a measure of a company's profitability and financial health. It is the money a company has left over after paying its operating expenses and capital expenditures. It is calculated as:

> FCF = Cash from Operations – CapEx

- Lease, don't buy: Leasing equipment and real estate helps improve cash flow as you pay in small increments and lease payments are a business expense that can be written off in taxes.

- Offer discounts for early payment: This incentivizes customers to pay their bills ahead of time, improving your cash flow.

- Conduct customer credit checks: Performing credit checks on customers who don't want to pay in cash can help ensure you receive payments on time.

- Form a buying cooperative: Pooling cash with other businesses can help you negotiate lower prices with suppliers, who usually offer discounts for bulk purchases.

- Improve your inventory: Get rid of products that aren't selling, even if at a discount. This frees up cash that would otherwise be tied up in slow-moving inventory.

- Send invoices out immediately: This helps improve cash flow by ensuring that receivables come in more quickly.

- Use electronic payments: Paying electronically allows you to wait until the morning of the day a bill is due, improving your cash flow.

- Pay suppliers less: Maintaining friendly communication with suppliers can help you negotiate better terms and discounts in exchange for early payments.

- Use high-interest savings accounts: This provides liquidity while growing your cash position, with some accounts offering interest rates much higher than the national average.

- Increase pricing: Experimenting with pricing can help you find the optimal price point and increase cash flow.

- Improve accounts receivable: Encourage customers to pay early by offering slight discounts. Also, provide a variety of payment options, such as ACH or credit card payments, to make it easier for customers to pay.

- Manage accounts payable: Use software to help manage accounts payable and communicate with your team to prioritize which invoices are most important to pay first.

- Put idle cash to work: Move idle cash to interest-bearing accounts or invest it back into the business to reduce debts and lower interest payments.

- Utilize a sweep account: Commercial banks offer sweep accounts that automatically transfer money from your business checking account to your savings account, helping you maximize earnings.

- Utilize cheap/free financing options: Take advantage of low to medium-cost purchases and financing options with low or no interest for the initial period of the loan.

- Control access to bank accounts: Implement safeguards to protect your assets and eliminate fraud and unauthorized use of company bank accounts.

- Outsource certain business functions: Evaluate your business needs and consider outsourcing functions such as IT management, human resources, accounting, and marketing to save money and increase efficiency.

- Renegotiate existing service contracts: Regularly review service plans and contracts to identify opportunities to save money by shopping around for better deals.

Uncertain Future Cash Flows: Navigating Investment Project Analysis

You may want to see also

Frequently asked questions

Free cash flow (FCF) is the money a company generates after accounting for cash outflows to support its operations and maintain its capital assets. It is a definitive measure of a company's financial health.

There are several ways to calculate free cash flow, but the most common formula is:

> Free Cash Flow (FCF) = Operating Cash Flow − Capital Expenditures

Free cash flow indicates the amount of cash a company has left over after meeting its operational and capital expenses. This cash can be used to invest in growth, pay down debt, or provide returns to shareholders.

Free cash flow is important because it represents the actual amount of cash a company has at its disposal. It is a reliable measure of a company's financial performance and can indicate its ability to pay dividends, service debt, and fund growth opportunities.