Are AFS investments long-term? This question delves into the nature of Alternative Financial Services (AFS) investments and their potential for long-term growth and stability. AFS encompasses a wide range of financial products and services, including peer-to-peer lending, crowdfunding, and alternative asset classes. Understanding the long-term viability of these investments is crucial for investors seeking to diversify their portfolios and achieve their financial goals. This exploration will analyze the factors that influence the long-term performance of AFS investments, including market trends, regulatory environments, and the unique characteristics of these alternative financial instruments.

What You'll Learn

- Market Volatility: AFS investments may face short-term price swings, requiring long-term commitment

- Risk Management: Diversification and risk assessment are crucial for long-term AFS success

- Regulatory Changes: AFS investments are subject to evolving regulations, impacting long-term strategies

- Economic Cycles: Understanding economic cycles helps navigate AFS investments over extended periods

- Tax Implications: Long-term AFS investments may have tax benefits, but rules vary by jurisdiction

Market Volatility: AFS investments may face short-term price swings, requiring long-term commitment

When considering whether Alternative Financial Services (AFS) investments are suitable for the long term, it's important to acknowledge the inherent volatility of these markets. AFS investments, which encompass a range of non-traditional financial instruments and strategies, often experience more significant price fluctuations compared to traditional assets like stocks and bonds. This volatility can be attributed to several factors, including the relatively smaller size of the AFS market, the limited liquidity of certain assets, and the influence of external factors such as economic policies, geopolitical events, and market sentiment.

For investors, this volatility means that AFS investments may not be suitable for those seeking stable, predictable returns in the short term. Instead, a long-term investment horizon is often recommended to smooth out the price swings and allow the underlying assets to demonstrate their true potential. This approach is particularly important for AFS investments, which often involve innovative and sometimes niche strategies that may not be immediately recognized or valued by the market.

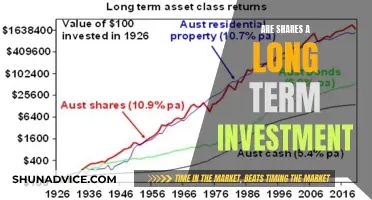

A long-term commitment to AFS investments can be a strategic move for several reasons. Firstly, it allows investors to benefit from the compounding effect of these investments over time. Many AFS strategies are designed to generate returns that grow exponentially, and this growth can be significantly enhanced over extended periods. Secondly, a long-term perspective enables investors to weather the short-term price volatility. While individual investments may experience significant price drops, a diversified AFS portfolio, held for an extended duration, can provide a more stable and potentially rewarding outcome.

However, it's crucial to understand that a long-term commitment does not imply a passive approach. Investors should actively monitor their AFS investments, staying informed about market trends, regulatory changes, and the performance of their holdings. This proactive management ensures that the investment strategy remains aligned with the investor's goals and risk tolerance. Additionally, investors should be prepared to make adjustments to their portfolio as market conditions evolve, allowing them to capitalize on opportunities and mitigate risks effectively.

In summary, while AFS investments may exhibit short-term price volatility, a long-term commitment can be a strategic decision for investors. This approach leverages the potential for significant returns over time, mitigates the impact of short-term fluctuations, and allows investors to actively manage their portfolio, ensuring it remains on track to meet their financial objectives. Understanding the market dynamics and adopting a patient, informed investment strategy is key to navigating the world of AFS investments successfully.

Mastering Short-Term Investing: Strategies for Quick Profits

You may want to see also

Risk Management: Diversification and risk assessment are crucial for long-term AFS success

In the realm of Alternative Financial Services (AFS) investments, risk management is a cornerstone of long-term success. Diversification and risk assessment are essential strategies that investors can employ to navigate the complex and often volatile world of AFS. These practices are particularly important given the unique characteristics of AFS investments, which often involve non-traditional assets and strategies that can carry higher risks.

Diversification is a fundamental principle in investment management, and it becomes even more critical in the context of AFS. By spreading investments across various AFS products, sectors, and strategies, investors can reduce the impact of any single investment's performance on their overall portfolio. For instance, an investor might choose to allocate a portion of their portfolio to private equity, another to real estate investment trusts (REITs), and a third to structured products. This approach ensures that the portfolio is not overly exposed to any one type of risk, such as market volatility or liquidity issues associated with specific AFS vehicles.

Risk assessment is another critical component of effective risk management. It involves a thorough analysis of the potential risks associated with each AFS investment. This includes understanding the investment's historical performance, its underlying assets, and the strategies employed by the AFS provider. For example, an investor might assess the risk of a private equity fund by examining its historical returns, the quality of its portfolio companies, and the fund's liquidity provisions. This due diligence can help investors make informed decisions and adjust their portfolio allocations accordingly.

Furthermore, risk assessment should also consider the broader market and economic environment. External factors such as interest rate changes, economic cycles, and geopolitical events can significantly impact AFS investments. For instance, a rise in interest rates might affect the performance of certain AFS products, while a global economic downturn could lead to increased volatility in markets where AFS is prevalent. By staying informed about these external risks, investors can make more strategic decisions to protect their capital and achieve their long-term financial goals.

In summary, for AFS investments to be considered long-term, investors must prioritize risk management through diversification and thorough risk assessment. These practices enable investors to build robust portfolios that can weather the inherent risks of AFS, ensuring that their investments remain aligned with their financial objectives. By adopting a disciplined approach to risk management, investors can navigate the complex AFS landscape with greater confidence and potentially achieve more stable, long-term returns.

Unlock Short-Term Gains: A Beginner's Guide to Treasury Bills

You may want to see also

Regulatory Changes: AFS investments are subject to evolving regulations, impacting long-term strategies

The world of Alternative Financial Services (AFS) investments is a dynamic and ever-changing landscape, and one of the key factors that investors should be aware of is the impact of regulatory changes. These regulations are designed to ensure fair practices and protect investors, but they can also significantly influence the long-term strategies of AFS investments. As such, staying informed about these changes is crucial for investors looking to navigate this complex market.

Regulatory bodies around the world are constantly updating and modifying rules to keep up with the evolving nature of the financial industry. For AFS investments, which often involve non-traditional financial products and services, these regulations can be particularly challenging to navigate. One of the primary concerns is the potential for regulatory changes to disrupt long-term investment strategies. For instance, a sudden shift in regulations might require AFS firms to adjust their business models, which could impact the availability and performance of certain investment products.

Long-term investors in AFS often seek stable and consistent returns, and any regulatory change that introduces uncertainty can be detrimental. For example, a new regulation might impose stricter reporting requirements, which could increase operational costs for AFS firms, potentially leading to reduced investment opportunities or lower returns for investors. Additionally, changes in tax laws or accounting standards can affect the overall profitability and attractiveness of AFS investments.

To mitigate these risks, investors should closely monitor regulatory developments and their potential impact on their AFS portfolios. This includes staying informed about industry associations' and regulatory bodies' announcements, attending relevant conferences, and subscribing to newsletters or reports that provide insights into regulatory changes. By proactively managing the regulatory environment, investors can make more informed decisions and adjust their strategies accordingly.

In summary, the regulatory landscape for AFS investments is subject to frequent changes, which can have a direct impact on long-term investment strategies. Investors must remain vigilant and adaptable, ensuring they are well-prepared to adjust their approaches as regulations evolve. This proactive stance will enable them to navigate the complexities of the AFS market and potentially identify new opportunities that arise from regulatory adjustments.

Understanding Short-Term Investments: A Balance Sheet Guide

You may want to see also

Economic Cycles: Understanding economic cycles helps navigate AFS investments over extended periods

Understanding economic cycles is a crucial aspect of navigating AFS (Asset-Backed Securities) investments over the long term. These cycles, which are recurring patterns of expansion and contraction in the economy, significantly influence the performance of various financial instruments, including AFS. By grasping the dynamics of economic cycles, investors can make more informed decisions, ensuring their AFS investments are aligned with the market's trajectory.

Economic cycles are characterized by distinct phases. The expansion phase, often referred to as economic growth, is marked by rising output, low unemployment, and increasing consumer and business spending. This period typically leads to higher demand for goods and services, driving up prices and potentially impacting the value of AFS investments. Conversely, the contraction phase, or recession, involves a decline in economic activity, with falling output, rising unemployment, and reduced spending. This phase often results in lower prices and can present challenges for AFS investments.

During economic expansions, AFS investments may benefit from the overall market growth. For instance, in a thriving economy, businesses might expand their operations, leading to increased demand for loans and, consequently, higher demand for AFS securities. This could result in improved credit quality and potentially higher returns for investors. However, it's essential to recognize that not all AFS investments will perform equally during this phase, as some sectors or specific securities might be more sensitive to economic conditions.

In contrast, economic contractions can have a more negative impact on AFS investments. During recessions, businesses may struggle, leading to higher default rates on loans and, subsequently, reduced performance of AFS securities. This could result in lower prices for these investments. Investors should be prepared for potential losses during economic downturns and consider strategies to mitigate risk, such as diversifying their AFS portfolio across different sectors and credit ratings.

To navigate these cycles effectively, investors should adopt a long-term perspective. Economic cycles are inevitable, and attempting to time the market by predicting the exact peak or trough can be challenging. Instead, investors should focus on understanding the underlying factors driving economic cycles and how they affect AFS investments. This includes studying historical data, analyzing market trends, and staying informed about economic indicators that signal shifts in the business cycle.

In summary, economic cycles play a pivotal role in the long-term performance of AFS investments. By recognizing the different phases of the economic cycle and their impact on AFS securities, investors can make more strategic decisions. A comprehensive understanding of economic dynamics enables investors to position their AFS portfolios to benefit from economic expansions while implementing risk management strategies during contractions, ultimately contributing to more stable and successful long-term investment outcomes.

Unlocking the Power of Long-Term Investments: Are They Assets?

You may want to see also

Tax Implications: Long-term AFS investments may have tax benefits, but rules vary by jurisdiction

When it comes to Alternative Investment Funds (AIFs) and their tax treatment, the concept of "long-term" is crucial, especially for those looking to optimize their investment strategies. Long-term AFS investments, which are typically held for an extended period, can offer significant tax advantages, but these benefits are subject to varying rules and regulations across different jurisdictions. Understanding these tax implications is essential for investors to make informed decisions and structure their portfolios effectively.

In many countries, long-term investments in AFS are often treated favorably in tax laws. For instance, in some jurisdictions, long-term capital gains taxes may be lower or even exempt for such investments. This is because holding investments for an extended period is generally seen as a sign of long-term commitment and risk mitigation. As a result, investors can benefit from reduced tax liabilities on any gains realized from these investments. Additionally, the tax rules for AFS may also include provisions for tax deferral or exemption on dividends received, further enhancing the tax efficiency of these long-term holdings.

However, it's important to note that the specific tax treatment of long-term AFS investments can vary significantly from one country to another. Tax authorities often have different criteria to determine what constitutes a long-term investment. Some jurisdictions may require investments to be held for a minimum number of years, while others might consider factors like the investment's nature, the investor's intent, and the overall market conditions. For example, in certain countries, long-term AFS investments might be defined as those held for more than 12 months, while in others, it could be a 24-month threshold or even longer.

Investors should also be aware of the potential tax traps and complexities associated with AFS. In some cases, short-term trading activities within an AFS might be subject to higher tax rates, even if the overall holding period is long. This is because tax laws often differentiate between long-term and short-term capital gains, with the latter being taxed at a higher rate. Furthermore, the tax rules for AFS can become even more intricate when dealing with international investments, as double taxation agreements and transfer pricing regulations come into play.

To navigate these tax implications effectively, investors should seek professional advice tailored to their specific jurisdiction. Tax advisors can provide valuable insights into the local tax laws and help structure AFS investments to maximize tax benefits. Additionally, staying informed about any changes in tax legislation is crucial, as these changes can significantly impact the tax treatment of AFS investments. By understanding the tax rules and taking advantage of the favorable treatment for long-term AFS investments, investors can potentially enhance their overall returns and minimize their tax liabilities.

Navigating the Duality: Short-Term and Long-Term Investments Demystified

You may want to see also

Frequently asked questions

AFS investments are typically designed with a long-term investment horizon, often spanning several years or even decades. The focus is on building a diversified portfolio that can weather short-term market fluctuations and provide consistent returns over an extended period.

AFS strategies emphasize a buy-and-hold approach, aiming to hold investments for the long haul. This contrasts with short-term trading, which involves frequent buying and selling to capitalize on short-term market movements. AFS investors seek to minimize transaction costs and taxes associated with frequent trading.

Yes, AFS investments can be tailored to suit various risk appetites. While some AFS funds may have a more aggressive approach, others are designed to be more conservative, focusing on long-term capital preservation. Investors can choose funds that align with their risk tolerance and long-term financial goals.

Long-term AFS investments offer several advantages, including reduced impact of market volatility, lower transaction costs, and the potential for higher average returns over time. This strategy allows investors to benefit from compounding growth and can be particularly effective in building wealth over an extended period.