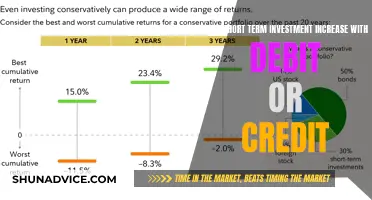

Long-term investments are a crucial aspect of financial planning, but it's important to understand the nuances to make informed decisions. One common misconception is that long-term investments are always a safe haven, offering guaranteed returns. However, this is not true. Long-term investments, such as stocks, bonds, and real estate, carry inherent risks that can fluctuate over time. These risks include market volatility, economic downturns, and changes in interest rates, which can impact the value of the investment. Additionally, while long-term investments often provide higher returns compared to short-term options, they are not immune to losses, especially during periods of market decline. Therefore, it is essential to carefully assess one's risk tolerance, investment goals, and time horizon before committing to long-term investments.

What You'll Learn

Long-term investments are always recorded at historical cost

The statement "Long-term investments are always recorded at historical cost" is not entirely accurate and contains a few misconceptions. Let's break down why:

Firstly, long-term investments are indeed initially recorded at their historical cost, which is the price paid to acquire the investment. This is a fundamental principle in accounting. However, the statement overlooks the fact that the historical cost is not always the only relevant figure. Over time, the value of these investments can change due to various factors. For instance, the market value of the investment might fluctuate, and this change in value needs to be reflected in the financial statements.

Secondly, the term "always" is crucial here. In practice, long-term investments are not always recorded at historical cost indefinitely. If the investment is impaired, meaning its value has declined significantly and is unlikely to recover, the company must adjust the carrying amount to reflect the impairment loss. This means the investment is no longer recorded at its original historical cost but at a lower value that more accurately represents its current worth.

Furthermore, the concept of fair value comes into play. Fair value is the price that would be received to sell the investment in an arm's-length transaction. While historical cost is a starting point, companies are required to revalue their long-term investments periodically and report them at fair value if it is more reliable. This is especially important for investments in volatile markets or those with unique characteristics.

In summary, while the historical cost is a critical initial figure for long-term investments, it is not the sole figure that determines their value. The market value, impairment losses, and fair value assessments are all factors that can influence how these investments are recorded and presented in financial statements. Therefore, the statement should be nuanced to reflect these complexities.

Understanding Long-Term Investment Strategies: Key Factors to Consider

You may want to see also

They are not affected by market fluctuations

The notion that long-term investments are unaffected by market fluctuations is a misconception. In reality, these investments are inherently susceptible to market volatility, which can significantly impact their value and performance over time. Market fluctuations, such as economic downturns, recessions, or shifts in interest rates, can cause the value of long-term investments to rise and fall. For instance, if an investor holds a long-term bond, a decrease in interest rates could lead to a decline in the bond's price, as newer bonds with lower interest rates become more attractive to investors. Similarly, a stock's value can be greatly influenced by market sentiment and economic conditions, causing it to experience rapid price changes during market fluctuations.

Long-term investments, such as stocks, bonds, and real estate, are typically held for extended periods, often years or even decades. While the intention is to benefit from the potential growth and compounding returns over time, market fluctuations can introduce significant risks. During periods of market decline, the value of these investments can drop, potentially eroding the investor's capital. For example, a prolonged market bear phase could result in substantial losses for investors who are unable to sell their holdings at a loss.

The impact of market fluctuations on long-term investments is often more pronounced due to the time horizon involved. Short-term investors may be more agile and able to ride out market volatility, but long-term investors are generally committed to holding their investments for an extended period. This commitment can lead to a higher risk tolerance, as they are willing to withstand temporary losses in the hope of future gains. However, it is essential to recognize that this strategy is not without risks, and market fluctuations can still cause significant short-term volatility in long-term investment portfolios.

To navigate these challenges, investors should adopt a well-diversified approach, spreading their investments across various asset classes and sectors. Diversification helps mitigate the impact of market fluctuations by reducing the correlation between individual investments. Additionally, investors should conduct thorough research and due diligence to identify investments that are less sensitive to market volatility. This may involve selecting investments with strong fundamentals, robust business models, and a history of resilience during economic downturns.

In summary, the statement that long-term investments are not affected by market fluctuations is not true. Market volatility can significantly influence the value and performance of these investments, impacting investors' portfolios and financial goals. Understanding the risks associated with market fluctuations is crucial for investors to make informed decisions and develop strategies that align with their investment objectives and risk tolerance.

These investments are typically held for more than one year

Long-term investments are a crucial component of financial portfolios, and understanding their characteristics is essential for investors. One common misconception is that these investments are always held for more than one year. While it is true that many long-term investments, such as stocks, bonds, and real estate, are indeed held for extended periods, this statement is not universally true.

The duration for which an investment is held can vary significantly depending on the investor's strategy and goals. Some investors may opt for a buy-and-hold approach, where they purchase long-term investments and hold them for several years or even decades. This strategy is often associated with long-term capital appreciation and is common in index funds and retirement accounts. However, others may take a more active approach, buying and selling investments more frequently to capitalize on short-term market opportunities or to manage risk. In this case, the holding period can be much shorter, sometimes even just a few days or weeks.

Additionally, certain types of investments are inherently more long-term in nature. For example, real estate investments, such as buying and renting out properties, typically require a long-term commitment. The process of finding tenants, managing properties, and potentially renovating them can take time and is not suited for short-term gains. Similarly, some alternative investments, like private equity or venture capital funds, are designed to be held for extended periods to allow for the maturation of the underlying assets.

It is important to note that the term "long-term" can be subjective and depends on the context. What constitutes a long-term investment for one individual or institution may be different for another. For instance, a long-term investment strategy for a young investor building a retirement nest egg might involve holding assets for decades, while a more conservative investor might prefer a shorter holding period to preserve capital.

In summary, while many long-term investments are indeed held for more than one year, this is not a universal rule. The holding period can vary based on investment strategies, goals, and the specific characteristics of the investment itself. Investors should carefully consider their risk tolerance, time horizon, and financial objectives to determine the most suitable holding period for their long-term investments.

They are not intended for sale in the near future

Long-term investments are typically made with the expectation that they will be held for an extended period, often several years or more. These investments are not intended for short-term trading or quick profit-taking. The primary goal of long-term investments is to generate steady returns over time, allowing investors to benefit from the growth and compounding effects of their investments.

One common misconception is that long-term investments are always intended for sale in the near future. This is not true. Long-term investments are a strategic approach to building wealth, and investors often hold these assets for extended periods to realize their full potential. For example, an investor might purchase shares of a well-established company with a strong track record of growth and dividends. The intention is to hold these shares for years, allowing the company's value to appreciate and the dividends to accumulate, rather than selling them shortly after purchase for a quick profit.

The key advantage of long-term investments is the ability to weather short-term market fluctuations and economic cycles. By maintaining a long-term perspective, investors can avoid the temptation to make impulsive decisions based on temporary market volatility. This approach often leads to better risk-adjusted returns over time, as short-term market swings tend to even out in the long run.

Additionally, long-term investments often provide investors with a sense of financial security and stability. By holding assets for an extended period, investors can benefit from the power of compounding, where their returns generate additional returns, leading to significant growth over time. This strategy is particularly effective for retirement planning, education funds, or any investment goal that requires a long-term commitment.

In summary, the statement "They are not intended for sale in the near future" is not true for long-term investments. This misconception can lead investors to make suboptimal decisions, such as selling profitable investments prematurely or missing out on the long-term benefits of holding quality assets. Understanding the true nature of long-term investments is essential for building a robust investment strategy and achieving financial goals.

Long-term investments are not always reported at fair value

Long-term investments are a crucial component of a company's financial portfolio, representing assets held for an extended period with the expectation of generating returns over time. These investments can include a variety of financial instruments such as bonds, stocks, and other securities. However, it is important to understand that long-term investments are not always reported at fair value, contrary to what one might assume.

The concept of fair value is a fundamental principle in financial reporting, where assets and liabilities are valued based on their current market price or the price they would fetch in an arm's-length transaction. This approach ensures transparency and comparability in financial statements. However, for long-term investments, the fair value principle is not always applicable. This is primarily because the market for certain long-term investments may be less liquid, making it challenging to obtain accurate and timely market prices.

In such cases, companies often rely on alternative valuation methods, such as the cost basis or the present value of future cash flows. The cost basis method values the investment at its original purchase price, which may not reflect the current market conditions. This approach is particularly common for investments in private companies or illiquid markets, where a fair market price is difficult to determine. The present value method, on the other hand, estimates the fair value by discounting the future cash flows of the investment to its current value, taking into account factors like interest rates and the time value of money.

Furthermore, the decision to report long-term investments at fair value or using alternative methods depends on the specific investment and the company's accounting policies. Some companies may choose to report long-term investments at fair value only when there is a significant change in market conditions or when the investment is sold. This approach provides a more conservative representation of the investment's value, especially if the market is volatile or the investment is held for a substantial period.

In summary, while fair value reporting is a standard practice in financial accounting, it is not always applicable to long-term investments. Companies must consider the liquidity of the investment, the availability of market data, and their specific accounting policies when determining the appropriate valuation method. Understanding these nuances is essential for investors and financial analysts to interpret financial statements accurately and make informed decisions regarding long-term investments.

Frequently asked questions

Long-term investments are typically held for an extended period, often years, and are not intended for frequent trading.

These investments provide a stable and reliable source of returns over time, offering a hedge against market volatility and potential long-term growth.

Stocks, bonds, real estate, and mutual funds are often considered long-term investment options.

Not necessarily. While long-term investments may offer more stable returns, they can still be subject to market fluctuations and economic downturns, especially in the short term.