Savings refer to the money left over after subtracting consumer spending from disposable income. It is the amount of money, expressed as a percentage or ratio, that a person deducts from their disposable personal income to set aside as a nest egg or for retirement. The savings rate reflects the rate of time preference for an individual or the average time preference for a group. It is influenced by economic conditions, social institutions, and individual or population characteristics. Savings can be kept in various forms, such as cash, bank deposits, or investments.

On the other hand, investing is putting money into financial schemes, real estate, or the stock market with the intention of growing one's wealth. It carries a certain level of risk as the returns can fluctuate, and there may be penalties or taxes for early withdrawal.

While savings and investments are distinct concepts, they are often lumped together as alternatives to spending money. The decision to save or invest depends on individual financial goals and time horizons. Short-term goals are usually better suited for savings, while long-term goals, such as retirement planning, are more appropriate for investing.

| Characteristics | Values |

|---|---|

| Definition of savings | The amount of money left over after spending and other obligations are deducted from earnings |

| Purpose of savings | People may save for various life goals or aspirations such as retirement, a child's college education, the down payment for a home, a car or vacation, or another future event |

| Savings vs. investments | Savings are kept in the form of cash or cash equivalents, which are exposed to no risk of loss but also come with minimal returns. Investments, on the other hand, require money to be put at risk with the possibility of higher returns |

| Savings accounts | Banks and credit unions offer several types of savings accounts, including standard deposit accounts, checking and money market accounts, and CDs |

| Calculating savings rate | Your savings rate is the percentage of disposable personal income that you keep rather than spend on consumption or obligations |

What You'll Learn

Savings vs. investing

Savings and investments are often lumped together as the sole alternative to spending money, but each strategy has its own advantages and disadvantages. Saving typically involves putting money aside gradually, usually into a bank account, for a particular goal, like paying for a car or a house, or to cover emergencies. On the other hand, investing involves using your money to buy assets that might increase in value, such as stocks, property, or shares in a mutual fund.

Advantages and Disadvantages of Saving

Saving is generally considered safer than investing, though it may not result in the most wealth accumulated over the long run. Savings accounts are very safe but tend to offer very low rates of return as a result. Here are some advantages and disadvantages of saving:

Advantages

- Savings accounts tell you upfront how much interest you'll earn on your balance.

- The Federal Deposit Insurance Corporation (FDIC) guarantees bank accounts up to $250,000 per depositor, per FDIC-insured bank, per ownership category.

- Bank products are generally very liquid, meaning you can access your money quickly when you need it.

- There are minimal fees associated with savings accounts.

- Saving is generally straightforward and easy to do.

Disadvantages

- Returns on savings accounts are low, meaning you could earn more by investing (but higher returns are not guaranteed).

- Because returns are low, you may lose purchasing power over time due to inflation.

Advantages and Disadvantages of Investing

Investing offers the potential for higher returns than saving, but it also comes with greater risk. Here are some advantages and disadvantages of investing:

Advantages

- Investing products such as stocks can have much higher returns than savings accounts.

- Investing products are generally very liquid and can easily be converted into cash.

- If you own a diversified collection of stocks, you're likely to beat inflation over the long term and increase your purchasing power.

Disadvantages

- Returns on investments are not guaranteed, and there's a risk of losing money, at least in the short term, as the value of assets fluctuates.

- Depending on when you sell and the health of the economy, you may not get back what you initially invested.

- Investing can be complex and may require some research before getting started.

- Fees can be higher in brokerage accounts.

When to Save vs. When to Invest

Whether to save or invest depends on your financial goals and time horizon. Saving is generally better for shorter-term goals and money that you may need access to in the next few years, such as an emergency fund or a down payment on a house or car. Investing is generally better for longer-term goals, such as retirement or funding a child's education, as it provides the potential for higher returns over time.

Car-eful" Considerations: Unraveling the Myth of New Cars as Investment

You may want to see also

Savings accounts

There are several types of savings accounts to choose from:

- Standard savings accounts: These are the most common type of savings account, offering easy access to your money through online banking, phone, mail, or in-person at a physical branch or ATM. While interest rates tend to be low, they are often higher than those offered by checking accounts.

- Checking accounts: These accounts offer the ability to write checks or use a debit card, but they pay lower interest rates than other types of savings accounts, and many don't pay interest at all. In exchange, account holders get highly liquid and accessible funds, often with low or no monthly fees.

- Money market accounts (MMAs): MMAs are interest-bearing accounts that often pay higher interest rates than standard savings accounts. They also come with check-writing and debit card privileges, but they may have restrictions that make them less flexible than checking accounts.

- Certificates of deposit (CDs): CDs offer a higher interest rate than a standard savings account in exchange for limiting access to your cash for a certain period, typically ranging from three months to five years. The longer the term, the higher the interest rate. Early withdrawal may result in penalties, so it's best to keep the money in the account for the full term.

When deciding between saving and investing, it's important to consider your financial goals and time horizon. Savings accounts are ideal for short-term needs, such as emergency funds or expenses you anticipate within the next three to five years, such as a down payment on a home or car. They are also a good option if you want to preserve your capital and avoid the risk of losing money, as the principal amount you deposit is protected by FDIC insurance.

On the other hand, investing is generally better suited for long-term goals, such as retirement or building generational wealth. Investing involves putting your money at risk with the potential for higher returns. It's important to note that investments may fluctuate in value and are not as easily accessible as savings accounts, as you may need to sell them to access your cash.

The Spectacle of Snapchat: Why Investors Keep Faith Despite Lack of Profit

You may want to see also

Savings rate calculations

Savings rates are important for determining how long it will take to reach financial independence. The higher your savings rate, the faster you will achieve financial independence.

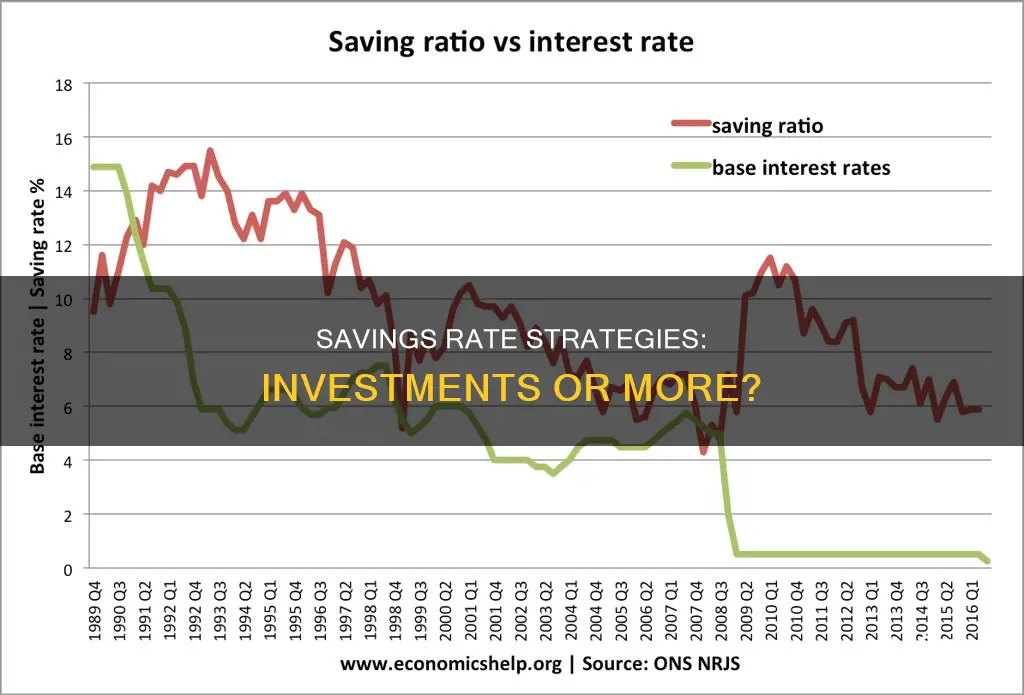

The savings rate is the percentage of disposable personal income that a person or group of people save rather than spend on consumption. It is a measurement of the amount of money that a person deducts from their disposable personal income to set aside for the future. Disposable income is defined as all sources of income minus the tax paid on that income.

To calculate your savings rate, take your total income and subtract your expenses. Then, divide that figure by your income, which will give you a percentage. This is your savings rate.

For example, if your net income is $25,000 a year after taxes (i.e. your disposable income) and you spend $24,000 in consumption, bills, and other expenditures over the course of the year, your total savings are $1,000. Dividing $1,000 by $25,000 gives you a savings rate of 4%.

It is important to note that savings are kept in the form of cash or cash equivalents, such as bank deposits, which offer minimal returns but are also risk-free. On the other hand, investing involves seeking to grow wealth by putting money at risk, with the potential for higher returns.

Yuan Investment: Worth the Risk?

You may want to see also

When to save vs. invest

Saving and investing are often lumped together as the sole alternative to spending money, but each strategy has its own advantages and disadvantages. In general, you should save to preserve your money and invest to grow your money.

When to Save

- You don't have an emergency fund: Financial advisors say that having a financial cushion for emergencies should always be your first priority. It's recommended to save at least three to six months' worth of living expenses before investing.

- You need the cash within five years: Shorter-term savings should stay in a savings account, where returns are guaranteed.

- You're saving for a down payment: If you're planning to buy a house or a car within the next three years, it's best to keep your money in a savings account, rather than risking losing it in an investment.

- You're saving for travel: An upcoming vacation where you'll be spending more than usual is a good reason to build a cash cushion in a savings account.

- You have high-interest debt: When it comes to credit card balances and other high-interest debt, it doesn't make sense to invest when you're paying a high rate of interest.

When to Invest

- You have an emergency fund: Once you've saved at least one month's worth of living expenses, you can start investing while continuing to build your emergency fund.

- You're eligible for a 401(k) match: If your employer offers a 401(k) match, it's usually a good idea to contribute enough to get the full match, as this is essentially free money.

- You have long-term goals: Investing is a good option for funding expensive future goals that are at least five years away, such as retirement or a college fund for younger children.

- You've paid off high-interest debt: If you've cleared high-interest debt and have low-interest debt such as student loans or a mortgage, you can feel more comfortable paying the minimums and investing any extra money.

- You have excess cash: If your savings accounts are flush and your income covers your expenses, consider investing to protect your purchasing power against inflation.

Savings vs. Investments

It's important to understand the differences between saving and investing. Saving means putting money away for later use in a secure place, such as a bank account. Investing means taking some risk and buying assets that will ideally increase in value over the long term. While saving offers a guaranteed return (interest on your balance), investing includes the potential to lose money.

Choosing a Savings Account

When choosing a savings account, look for one that has FDIC insurance, a high annual percentage yield (APY), and no monthly fee. Online banks tend to offer higher interest rates than traditional banks.

Choosing a Brokerage Account

When choosing a brokerage account, consider how hands-on you want to be. Robo-advisors use algorithms to manage your investments based on your risk tolerance and goals, and they're a good option for beginners. Traditional brokerages offer similar services, and you can find companies that offer low-cost index funds with no fees.

Salary and Investment: A Correlation

You may want to see also

Savings and investments for different goals

Savings and investments are important for achieving your financial goals. Here are some strategies for different types of goals:

Short-term goals

Short-term goals are those you aim to achieve within a couple of years. Examples include an emergency fund, a rental deposit, or a major purchase. For these goals, you'll want to keep your savings protected and easily accessible. Consider the following options:

- High-yield savings accounts

- Money market accounts

- Short-term certificates of deposit (CDs)

- Short-term guaranteed investment certificates (GICs)

- Cashable savings bonds

Medium-term goals

Medium-term goals typically take a few years to achieve, and they may be more expensive than short-term goals. Examples include saving for a down payment on a house, pursuing higher education, or planning a wedding. For these goals, you'll want an account with some liquidity, and you may want to consider different strategies such as savings buckets or laddering CDs. Suitable options include:

- High-yield savings accounts

- Money market accounts

- Certificates of deposit (CDs)

- Registered education savings plans (RESPs)

- Tax-free savings accounts (TFSAs)

Long-term goals

Long-term goals usually take at least five years to achieve, and retirement is often the biggest one. For these goals, you may need to look beyond standard banking products to earn higher rates of return. Here are some options:

- Employer-sponsored retirement accounts (e.g. 401(k))

- Traditional or Roth IRAs

- High-yield savings accounts

- Registered retirement savings plans (RRSPs)

- Registered disability savings plans (RDSPs)

General tips

When saving and investing for different goals, it's important to keep the following in mind:

- Prioritize debt repayment: It's generally better to pay down debt first, as the interest you pay on debt is usually more than what you can earn by investing.

- Figure out your risk tolerance: Many investments offer higher potential returns but also come with risks. You need to assess your emotional willingness to accept risk and your financial ability to absorb losses.

- Consider working with a financial advisor: They can help you plan and achieve your financial goals based on your risk tolerance and time horizon.

- Automate your savings: Split your direct deposit or set up recurring transfers from your checking account to your savings account.

- Use multiple savings accounts: This can help you keep track of your progress for each goal and ensure that money meant for one goal isn't accidentally used for another.

Solar Energy: Invest or Not?

You may want to see also

Frequently asked questions

The savings rate is the percentage of disposable personal income that a person or group of people save rather than spend on consumption.

Take your total income and subtract your expenses. Now, divide that figure by your income, and you have your savings rate as a percentage.

The higher your savings rate, the faster your path to financial independence. The basic idea is that the more of your income that you can save, the sooner you'll be able to retire.

Saving is for preserving your money, while investing is for growing it. When you save money in a bank account or CD, you earn a steady amount of interest and keep your principal intact. When you invest, your money is at risk of loss but can grow beyond what you'd get from a savings account.

You should save when you have immediate or near-term expenses that your monthly income wouldn't cover. You should invest when you have enough savings to cover short-term needs and want to maximise the amount of money you can earn.