A mortgage is a loan provided by a lender to finance a home purchase. The money from the mortgage is typically repaid to the lender at an agreed-upon interest rate. The home acts as collateral, meaning that the lender has the right to foreclose on the property if the borrower fails to make their payments. The monthly payments made by the borrower are split into at least four categories: principal, interest, taxes, and insurance. The principal refers to the amount borrowed, while the interest is the fee charged by the lender for lending the money. In addition to traditional mortgages, there are also alternative options such as investor cash flow loans and purchase-money mortgages, where the seller acts as the lender.

| Characteristics | Values |

|---|---|

| Mortgage definition | A loan used to finance a home purchase |

| Lender | A bank or credit union |

| Collateral | The home |

| Documents | A promissory note, and in many states, a deed of trust |

| Interest | The fee the lender charges for using their money |

| Property taxes | Paid along with the mortgage in some localities |

| Homeowner's insurance | Paid along with the mortgage in some cases |

| Private mortgage insurance (PMI) | Required if the down payment is less than 20% |

| Mortgage cash flow obligation (MCFO) | A type of mortgage pass-through unsecured general obligation bond that uses cash flow from a pool of mortgages to repay investors their principal plus interest |

| Investor cash flow loan | A mortgage program that lets real estate investors use projected cash flow on property to qualify for a loan |

| Asset Qualifier Home Loans | A type of loan that allows borrowers to use their assets instead of income to qualify for a mortgage |

What You'll Learn

Mortgage cash flow obligation (MCFO)

A mortgage is a loan used to finance a home purchase. When an individual takes out a mortgage, they are promising to repay the money they've borrowed at an agreed-upon interest rate. The home is used as collateral, meaning that if the borrower breaks their promise to repay the mortgage, the bank has the right to foreclose on the property.

A Mortgage Cash Flow Obligation (MCFO) is a type of mortgage pass-through unsecured general obligation bond that has several classes or tranches. MCFOs use cash flow from a pool of mortgages that generate revenue to repay investors their principal plus interest. Payments are received from mortgages in the pool and passed on to holders of the MCFO security.

MCFOs resemble Collateralized Mortgage Obligations (CMOs) in some respects, but they are not the same. MCFOs do not hold a lien on the mortgages held by the security. They are merely obligated by contract to use the income from the mortgages to pay their investors. MCFO owners have no legal rights to the actual underlying mortgages, thus MCFOs are riskier than CMOs.

The stated maturities of MCFO tranches are determined based on the date when the final principal from a pool of mortgages is expected to be paid off. However, maturity dates for these types of MBS may not be an accurate representation of MBS risks because they do not take into account prepayments of the underlying mortgage loans.

Mortgage-Backed Securities: Boosting Economy Through Homeownership

You may want to see also

Investor cash flow loan

A mortgage is a loan from a lender, typically a bank, used to finance a home purchase. The home is used as collateral, meaning that if the borrower fails to repay the loan, the bank has the right to foreclose on the property.

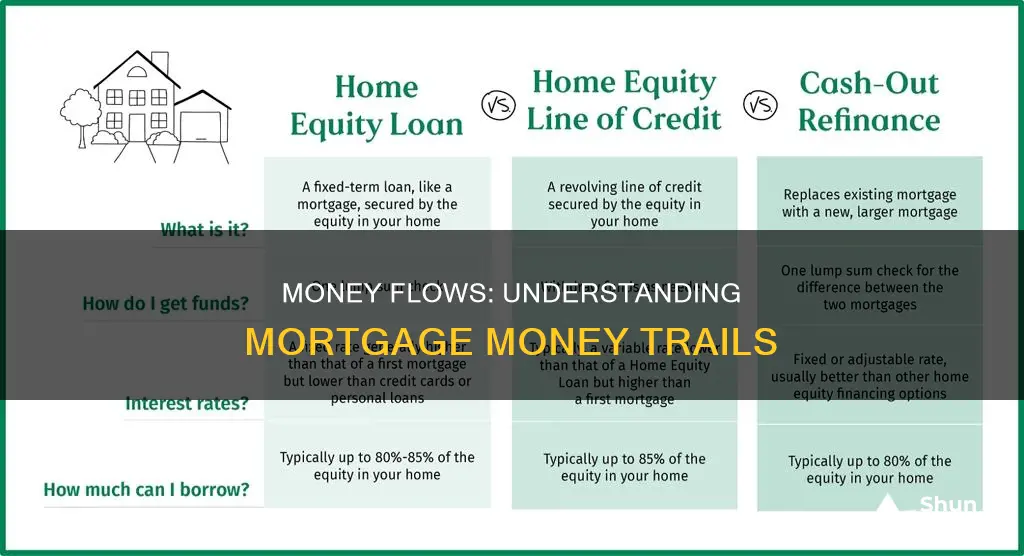

To be eligible for an Investor Cash Flow Loan, borrowers typically need a credit score of at least 680 and a minimum of $500,000 in assets. The loan-to-value ratio (LTV) for these loans is usually capped at 80%. This means that if a property is worth $400,000, the maximum loan amount would be $320,000, resulting in an LTV of 80%. Additionally, a down payment of at least 20% is generally required.

Freedom From Mortgage: A Dream Come True

You may want to see also

Property taxes

If your mortgage agreement does not include property tax payments, you will need to pay them directly to your local government. In this case, fluctuations in property taxes will not affect your monthly mortgage payments. However, you will need to budget accordingly to cover any tax increases, as you will be responsible for paying the full amount directly to your local government when they are due.

Escrow accounts are important in real estate transactions and are used to collect and manage property taxes and insurance payments. These payments are then paid out when they are due. It is important to note that the money in your escrow account does not earn interest, so you may miss out on potential earnings.

Mortgage CRM and LOS Integration: A Powerful Combination

You may want to see also

Interest

The interest rate on a mortgage depends on various factors, including the type of loan (fixed or adjustable) and the loan term. A fixed-rate mortgage has an interest rate that remains the same for the duration of the loan, while an adjustable-rate mortgage may have a variable interest rate that can change over time. Shorter-term loans, such as those with a duration of 10, 15, or 20 years, typically have lower total interest costs over time, even though they require larger monthly payments.

The interest rate on a mortgage can also be influenced by factors such as the borrower's credit score and the size of the down payment. A higher credit score and a larger down payment can lead to a lower interest rate, while a lower credit score or a smaller down payment may result in a higher interest rate. Additionally, the prevailing interest rates in the market can also impact the mortgage interest rate offered by lenders.

When making monthly mortgage payments, part of the money goes towards paying the principal, which is the original amount borrowed, and the remaining portion is applied to the interest. This is how lenders make a profit from lending money. It is important for prospective homeowners to compare interest rates from multiple lenders to ensure they get the best rate and choose the loan that best suits their financial needs and capabilities.

Mortgage Rates: Impacting Your Monthly Payment Costs

You may want to see also

Discount points

The decision to purchase discount points depends on two primary factors: the duration of your stay in the home and your ability to afford the upfront cost. If you plan to stay in the home for an extended period, the money spent on points is more likely to pay off. Additionally, if your credit score is not high enough to qualify for a lower rate, discount points can make your monthly interest payments more affordable.

It is important to consider the breakeven point, which is the amount of time it takes to offset the cost of the points with the savings from lower monthly payments. For instance, if you have a $250,000 mortgage with a 3.5% fixed interest rate over 30 years, your monthly payment would be approximately $1,123. By purchasing one discount point for $2,500, your interest rate would drop to 3.25%, resulting in a monthly payment of about $1,088, a savings of $35 per month. In this case, it would take 72 months to recoup the cost of the discount point.

In some cases, it may be more advantageous to allocate additional funds towards the down payment instead of purchasing discount points, especially if it brings your down payment up to the 20% threshold that eliminates the need for mortgage insurance. Ultimately, the decision to buy discount points should be made after careful consideration of your unique financial situation and goals, and consulting with a mortgage expert can provide tailored advice.

Jared Vennett's Guide to Modern Mortgages Explained

You may want to see also

Frequently asked questions

A mortgage is a loan you get from a lender to finance a home purchase. The home is used as collateral. That means if you break the promise to repay your mortgage, the bank has the right to foreclose on your property.

An MCFO is a type of mortgage pass-through unsecured general obligation bond. MCFOs use cash flow from a pool of mortgages that generate revenue to repay investors their principal plus interest. Payments are received from mortgages in the pool and passed on to holders of the MCFO security.

An investor cash flow loan is a mortgage program that lets real estate investors use projected cash flow on property to qualify for a loan. The lender determines how much loan you can afford by analyzing the projected cash flow on the property you’re looking to purchase.