Simple interest is a straightforward way of calculating interest on an investment or loan. It is calculated by multiplying the interest rate by the principal payment, then by the number of years you plan to invest. It is paid on the principal amount of an investment or loan, and can be calculated yearly, monthly, or even daily. This means that the total amount you earn grows over time.

| Characteristics | Values |

|---|---|

| How is simple interest calculated? | By multiplying the interest rate by the principal payment, then by the number of years you plan to invest. |

| How often is simple interest paid? | Yearly, monthly, or even daily. |

| Is simple interest paid annually? | Yes, but only if the payment frequency is annual. |

What You'll Learn

- Simple interest is calculated by multiplying the interest rate by the principal payment, then by the number of years you plan to invest

- Simple interest is better than compound interest when you're borrowing money

- Simple interest is paid annually, semi-annually, monthly or daily

- Simple interest is paid on the principal amount of an investment or loan

- Simple interest is easier to manage for short-term loans

Simple interest is calculated by multiplying the interest rate by the principal payment, then by the number of years you plan to invest

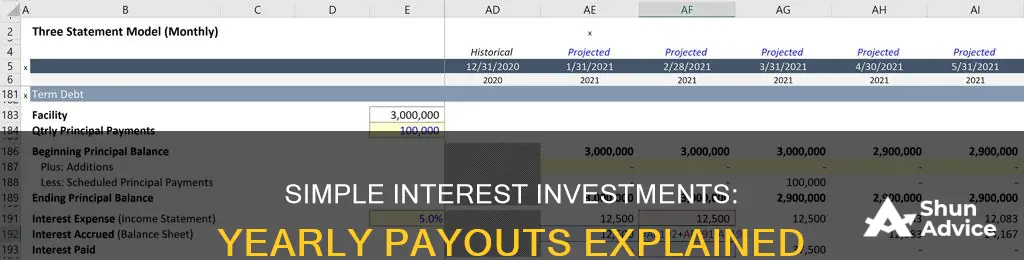

Simple interest is the interest applied only to the original amount of money deposited or borrowed. It is calculated regularly – yearly, monthly, or even daily. This means the total you owe (if interest due isn't paid) or earn grows over time. For example, if you invest $10,000 at 5% simple interest, you'd receive $500 per year, every year, for as long as the investment remained in place.

Simple interest is better than compound interest when you're borrowing money. This is because the amount you owe stays constant. On the other hand, compound interest refers to interest paid on the principal as well as on any interest that has already accumulated.

Interest Rates: Impact on Investment Decisions

You may want to see also

Simple interest is better than compound interest when you're borrowing money

Simple interest is calculated by multiplying the interest rate by the principal payment, then by the number of years you plan to invest. It can be calculated regularly – yearly, monthly, or even daily. This means that if you invest $1,000 at 5% simple interest, you would earn $50 in interest per year. If the payment frequency is anything but annual, divide the annual interest by the number of payments in a year to find out the amount of each interest payment. For example, if payments are made semi-annually, you'll receive $30 every six months.

Interest Rates and Investment: Inverse Relationship?

You may want to see also

Simple interest is paid annually, semi-annually, monthly or daily

Simple interest is calculated by multiplying the interest rate by the principal payment, then by the number of years you plan to invest. It is the interest applied only to the original amount of money deposited or borrowed. Calculating simple interest requires knowing your principal amount, annual interest rate, and time period.

Simple interest is better than compound interest when you're borrowing money. It is also better for short-term loans, as the amount you owe stays constant. However, compound interest can boost your total funds for savings accounts, retirement funds, or long-term investments.

Acorn Investments: Interest Payments and Your Money

You may want to see also

Simple interest is paid on the principal amount of an investment or loan

Simple interest is one of the two main ways that interest can be computed, the other being compound interest. Compound interest refers to interest paid on the principal as well as on any interest that has already accumulated. For example, if you're looking at savings accounts, retirement funds, or long-term investments, compound interest can boost your total funds. Banks can pay customers compound interest for their deposits. On the other hand, simple interest might be easier to manage for short-term loans since the amount you owe stays constant.

How to Spark Interest in Investing

You may want to see also

Simple interest is easier to manage for short-term loans

Simple interest is also easier to manage because it is only paid on the principal amount of an investment or loan. This means that the amount you owe stays constant, and you don't have to worry about interest accumulating over time. This can make it easier to budget and plan for the future, as you know exactly how much you will need to pay back.

In contrast, compound interest can be more complicated to manage as it is paid on the principal as well as on any interest that has already accumulated. This means that the amount you owe can grow over time, and it can be more difficult to keep track of.

Simple interest is often used for short-term loans, such as those with a term of 10 years or less. These loans typically have a fixed interest rate, which means that the interest rate stays the same for the duration of the loan. This can make it easier to calculate and manage the interest payments.

Overall, simple interest is a straightforward and predictable way to calculate interest, which can make it easier to manage for short-term loans.

Interest: Friend or Foe to Your Investment Earnings?

You may want to see also

Frequently asked questions

Simple interest is calculated by multiplying the interest rate by the principal payment, then by the number of years you plan to invest.

Simple interest can be paid yearly, monthly, or even daily.

You would receive $500 per year, every year, for as long as the investment remained in place.

Divide the annual interest by the number of payments in a year to find out the amount of each interest payment.