Atram investment is a unique and innovative approach to investing that has gained significant attention in recent years. This method involves a strategic investment strategy that focuses on long-term growth and stability, offering investors a way to build wealth over time. By utilizing a combination of careful research, risk management, and a forward-thinking mindset, atram investment aims to provide consistent returns while minimizing potential losses. This investment strategy is particularly appealing to those seeking a more sustainable and patient approach to financial growth, allowing investors to build a robust portfolio that can weather market fluctuations and economic shifts.

What You'll Learn

- Investment Vehicles: Understanding different types of investments, such as stocks, bonds, and mutual funds

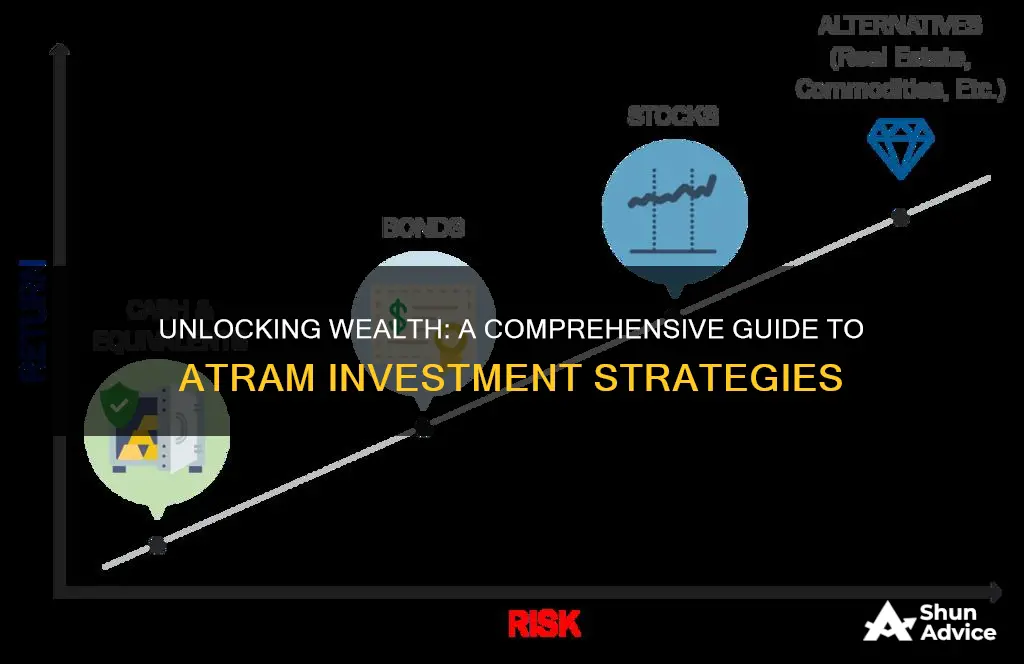

- Risk and Return: Exploring the relationship between risk and potential returns in investment strategies

- Diversification: Strategies to spread investments across various assets to minimize risk

- Long-Term vs. Short-Term: The pros and cons of holding investments for extended periods

- Tax Implications: How taxes affect investment returns and strategies to minimize tax liabilities

Investment Vehicles: Understanding different types of investments, such as stocks, bonds, and mutual funds

When it comes to investing, understanding the various investment vehicles available is crucial for making informed financial decisions. Here's an overview of some common investment types:

Stocks: Stocks, also known as shares or equity, represent ownership in a company. When you buy a stock, you become a shareholder and have a claim on a portion of the company's assets and profits. Stocks are typically traded on stock exchanges, and their prices fluctuate based on market conditions, company performance, and investor sentiment. Investing in stocks offers the potential for significant returns over the long term, but it also carries higher risks. Investors can choose from various types of stocks, including common stock, preferred stock, and different classes of stock within a single company.

Bonds: Bonds are debt instruments issued by governments, municipalities, or corporations to raise capital. When you invest in a bond, you are essentially lending money to the issuer in exchange for a promise to repay the principal amount (face value) plus interest at a specified date. Bonds are generally considered less risky than stocks but offer lower potential returns. The interest rate (coupon rate) and maturity date are key factors in bond investments. Government bonds are often seen as a safe haven, while corporate bonds may offer higher yields but carry more risk.

Mutual Funds: Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. A professional fund manager makes investment decisions on behalf of the fund's shareholders. Mutual funds offer instant diversification, as they hold a basket of securities, reducing individual investment risk. Investors can choose from various types of mutual funds, including equity funds, bond funds, money market funds, and specialized funds focused on specific sectors or strategies. This investment vehicle is suitable for those who prefer a hands-off approach and want professional management.

Understanding the characteristics and risks associated with each investment type is essential for building a well-rounded investment portfolio. Stocks offer ownership and potential for high returns but come with higher volatility. Bonds provide a steady income stream and are generally more stable. Mutual funds offer diversification and professional management, making them accessible to a wide range of investors. It's important to assess your risk tolerance, investment goals, and time horizon before deciding on an investment strategy.

Investing: Why the Fear?

You may want to see also

Risk and Return: Exploring the relationship between risk and potential returns in investment strategies

The relationship between risk and return is a fundamental concept in investment, and understanding this dynamic is crucial for investors seeking to optimize their portfolios. At its core, this concept posits that as the potential for higher returns increases, so does the level of risk associated with an investment. This trade-off is a key consideration for investors, as it influences their decision-making process and the overall strategy they adopt.

In the context of investment strategies, risk can be categorized into various types, including market risk, credit risk, and liquidity risk. Market risk, for instance, pertains to the volatility of an investment's performance relative to the broader market. It is often associated with investments in stocks, where the potential for significant gains is accompanied by the possibility of substantial losses during market downturns. On the other hand, credit risk is relevant to debt instruments and refers to the likelihood of default by the borrower, which can impact the value of the investment.

Return, in this context, refers to the profit or gain generated from an investment. It is typically measured as a percentage of the initial investment and can be influenced by various factors, including the investment's performance, market conditions, and economic trends. Higher returns are often sought after by investors, but they are generally pursued through investments that carry a higher degree of risk. For example, investing in small-cap stocks or emerging market bonds may offer the potential for substantial returns but also entails a higher level of market and credit risk.

The relationship between risk and return is not linear but rather a complex interplay. Investors often use risk assessment tools and models to quantify and manage risk. These tools help in identifying the potential risks associated with different investments and allow investors to make informed decisions. Diversification is a common strategy to manage risk, where investors spread their investments across various asset classes, sectors, or geographic regions to reduce the impact of any single risk factor.

In summary, the concept of risk and return is integral to investment strategies, as it highlights the inherent trade-off between the potential for higher returns and the increased risk involved. Investors must carefully consider their risk tolerance, investment goals, and the potential impact of various risks on their portfolios. By understanding this relationship, investors can make more informed choices, ensuring their investment strategies are aligned with their financial objectives and risk preferences.

Invest Your Thrift Savings Plan: Strategies for Success

You may want to see also

Diversification: Strategies to spread investments across various assets to minimize risk

Diversification is a fundamental strategy in investing, aiming to spread your investments across a variety of assets to reduce risk and potentially increase returns over the long term. This approach is based on the idea that different assets perform differently at various times, and by allocating your capital across these assets, you can smooth out the volatility of your portfolio. Here's a detailed look at how diversification works and some strategies to implement it effectively:

Understanding the Concept:

Diversification involves dividing your investment portfolio among various asset classes such as stocks, bonds, real estate, commodities, and even different sectors within the stock market. The primary goal is to ensure that your portfolio is not overly exposed to the performance of any single asset or sector. By doing so, you can reduce the impact of any one investment's poor performance on your overall portfolio. For instance, if you invest solely in tech stocks, a downturn in the tech sector could significantly affect your portfolio. However, by diversifying into other sectors like healthcare or consumer goods, you mitigate this risk.

Strategies for Diversification:

- Asset Allocation: This is the process of deciding how much of your portfolio should be allocated to different asset classes. A common strategy is the 60/40 model, where 60% of your portfolio is in stocks and 40% in bonds. This allocation provides a balance between growth potential and capital preservation. You can adjust these percentages based on your risk tolerance and investment goals.

- Geographical Diversification: Investing in companies or funds from different countries and regions can reduce the impact of country-specific risks. For example, if a particular country's economy faces a recession, a diversified international portfolio might be less affected.

- Sector Allocation: Diversifying across various economic sectors is crucial. Sectors like technology, healthcare, energy, and consumer goods often perform differently, and including a range of sectors can help smooth out portfolio performance.

- Correlations and Beta: Consider the correlation between assets. Assets with low correlation (not moving in the same direction) are good candidates for diversification. For instance, real estate and stocks often have a low correlation, making them a good pair for diversification.

- Index Funds and ETFs: Exchange-Traded Funds (ETFs) and Index Funds offer an easy way to diversify. These funds track a specific market index, providing instant diversification across multiple companies or sectors.

Benefits of Diversification:

- Risk Reduction: The primary advantage is the reduction of risk. By not concentrating your investments, you minimize the potential negative impact of any single asset's performance.

- Long-Term Growth: Diversification can lead to more consistent returns over time, as different asset classes may perform well in various economic conditions.

- Capital Preservation: During market downturns, a well-diversified portfolio can help protect capital, as not all assets will suffer simultaneously.

In summary, diversification is a powerful tool for investors to manage risk and build a robust portfolio. It involves a strategic approach to asset allocation, ensuring that your investments are spread across various options, thereby reducing the potential for significant losses and promoting long-term growth.

Earnin App and Fidelity Investments: A Match Made in Finance?

You may want to see also

Long-Term vs. Short-Term: The pros and cons of holding investments for extended periods

When it comes to investing, the duration for which you hold an investment can significantly impact your financial journey. This concept is often referred to as the investment horizon or time horizon. It's crucial to understand the differences between long-term and short-term investments to make informed decisions that align with your financial goals.

Long-Term Investing:

Long-term investing is a strategy where you hold your investments for an extended period, typically years or even decades. This approach is often associated with a buy-and-hold strategy, where the focus is on long-term growth and compounding returns. Here are some advantages:

- Compounding Growth: Over time, long-term investments can benefit from compounding, where your returns earn additional returns, leading to exponential growth. This is particularly effective for investments in stocks, real estate, or certain mutual funds.

- Risk Mitigation: Long-term holding allows investors to weather short-term market fluctuations. Historically, markets tend to trend upwards over the long term, and short-term dips are often followed by rebounds. This strategy is less stressful for investors who can afford to wait out temporary market volatility.

- Diversification: Long-term investors often have the opportunity to diversify their portfolios across various assets, sectors, and industries. Diversification helps reduce risk by not concentrating investments in a single area.

Short-Term Investing:

In contrast, short-term investing involves holding assets for a brief period, often weeks, months, or a few years. This strategy is more reactive and focuses on capitalizing on short-term market opportunities or trends. Here are some considerations:

- Quick Profits: Short-term traders aim to profit from price movements within a short duration. This can be achieved through day trading, swing trading, or trading based on news and market events. The potential for quick gains is a significant attraction.

- Higher Risk: Short-term investments often carry higher risks. Market conditions can change rapidly, and short-term traders must be prepared to act quickly, potentially leading to higher transaction costs and emotional stress.

- Market Timing: Successful short-term investing requires a keen understanding of market trends and the ability to time the market. Predicting market turns accurately is challenging and often requires constant monitoring of financial news and market indicators.

In the world of investing, the choice between long-term and short-term strategies depends on your financial goals, risk tolerance, and investment timeframe. Long-term investing is generally recommended for building wealth over time, while short-term strategies might be more suitable for active traders seeking quick profits. Understanding these concepts is essential for making informed investment decisions and navigating the complex world of finance.

REITs: Why Aren't More People Investing?

You may want to see also

Tax Implications: How taxes affect investment returns and strategies to minimize tax liabilities

Understanding the tax implications of investments is crucial for investors as it directly impacts their overall returns and long-term financial success. Taxes can significantly reduce the net gains from investment activities, and being aware of these tax effects is essential for making informed decisions. When an investor sells an asset, such as stocks or real estate, they may incur capital gains taxes, which are typically levied on the profit made from the sale. The tax rate can vary depending on the holding period of the investment and the investor's income level. For example, short-term capital gains, often associated with holding assets for less than a year, are usually taxed at ordinary income rates, which can be quite high. In contrast, long-term capital gains, from assets held for more than a year, often benefit from lower tax rates, providing an incentive for investors to adopt a long-term investment strategy.

Taxes also come into play when investing in certain types of accounts, such as retirement plans. Traditional Individual Retirement Accounts (IRAs) allow for tax-deductible contributions, reducing taxable income in the year of contribution. However, withdrawals from traditional IRAs in retirement are taxed as ordinary income. On the other hand, Roth IRAs offer tax-free growth and withdrawals in retirement, but contributions are made with after-tax dollars, providing no immediate tax benefit. Understanding these differences is vital for investors to optimize their retirement savings strategy.

To minimize tax liabilities, investors can employ various strategies. One approach is to take advantage of tax-efficient investment vehicles. For instance, investing in tax-free municipal bonds can provide income without federal income tax, while also offering an escape from state and local taxes. Additionally, investors can consider tax-loss harvesting, a strategy where they sell investments that have decreased in value to offset capital gains and reduce overall tax obligations. This technique is particularly useful for investors with a mix of winning and losing positions.

Another strategy is to be mindful of the timing of investments and withdrawals. Investors can time their investments to take advantage of lower tax rates or tax credits. For example, investing in the early stages of a business or startup might offer tax incentives, such as the ability to claim a portion of the investment as a deduction. Furthermore, understanding the tax treatment of different investment types is essential. Some investments, like mutual funds or exchange-traded funds (ETFs), may have unique tax considerations, and investors should be aware of any distributions or capital gains they may trigger.

In summary, taxes play a significant role in investment returns and should be carefully considered. Investors can benefit from understanding the tax implications of various investment strategies and accounts. By employing tax-efficient investment vehicles, utilizing tax-loss harvesting techniques, and being mindful of timing, investors can effectively minimize their tax liabilities and maximize their overall investment gains. Staying informed about tax laws and seeking professional advice can further enhance an investor's ability to navigate the complex world of taxation and make optimal investment choices.

Buy-to-Let: Unlocking the World of Property Investment

You may want to see also

Frequently asked questions

ATRAM stands for Automated Trading and Risk Management, and it refers to a sophisticated investment strategy that utilizes advanced algorithms and machine learning techniques to automate the trading process. This approach aims to optimize risk management, improve trading efficiency, and potentially generate higher returns by leveraging cutting-edge technology.

The ATRAM investment strategy involves a multi-step process. Firstly, it employs a comprehensive data analysis of various financial markets, historical trends, and market indicators to identify potential trading opportunities. Secondly, it utilizes machine learning algorithms to develop trading models and strategies, which can adapt and learn from market dynamics. These models then execute trades automatically based on predefined rules and risk parameters. The system continuously monitors and adjusts positions to manage risk effectively, ensuring that investments are made with a strategic and disciplined approach.

ATRAM offers several advantages in the investment landscape. Firstly, it reduces the impact of human emotions and biases, leading to more disciplined and consistent trading decisions. This automation can help investors stay focused on their long-term goals and avoid impulsive actions. Secondly, the use of advanced algorithms allows for rapid analysis of vast amounts of data, enabling quicker identification of market trends and potential opportunities. Additionally, ATRAM can enhance risk management by implementing real-time monitoring and adjustments, helping investors navigate volatile markets with greater confidence.