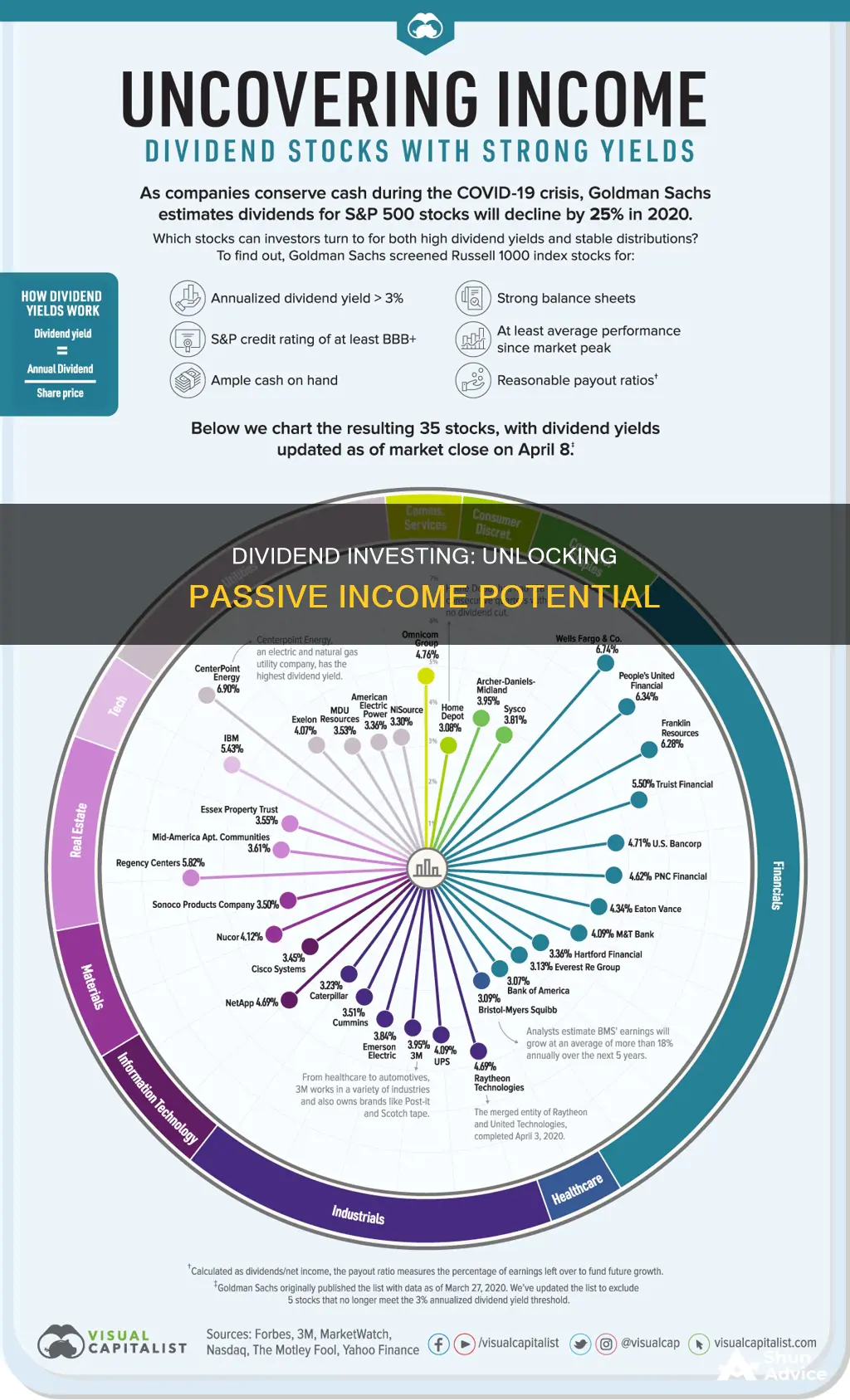

Dividend investing is a strategy that allows investors to generate a steady income stream by investing in companies that pay out a portion of their profits to shareholders. This approach is particularly appealing to those seeking a more passive form of investment, as it provides a regular return without the need for active trading. In this guide, we will explore the mechanics of dividend investing, including how to identify high-yielding dividend stocks, the benefits and risks associated with this strategy, and how to build a well-rounded portfolio that maximizes dividend income over the long term.

What You'll Learn

- Dividend Definition: A portion of a company's profits paid to shareholders

- Dividend Payout Ratio: The percentage of earnings paid out as dividends

- Dividend Reinvestment: Buying additional shares with the dividend received

- Dividend Growth: Companies increasing dividends over time

- Tax Implications: Dividend income is taxable, but rates vary

Dividend Definition: A portion of a company's profits paid to shareholders

Dividend investing is a strategy that focuses on investing in companies that pay out a portion of their profits to shareholders in the form of dividends. This approach is particularly attractive to investors who seek regular income from their investments, as dividends provide a steady stream of cash flow. When a company generates profits, it has the option to reinvest those earnings back into the business or distribute a portion of them to its shareholders. Dividends are essentially a way for companies to share their success with their investors.

The process begins with a company's board of directors making a decision to pay dividends. This decision is often based on the company's financial health, growth prospects, and the desire to retain a portion of its profits for future expansion. Once approved, the company announces the dividend amount, the payment date, and the record date, which is the date by which an investor must own the stock to be eligible to receive the dividend. Shareholders who own the company's stock before the record date will receive the dividend payment.

Dividend payments can vary in amount and frequency. Some companies pay dividends quarterly, providing investors with a consistent income stream. Others may pay annually or even semi-annually. The dividend amount is typically a percentage of the stock's price or a fixed amount per share. For example, a company might declare a dividend of $0.50 per share, meaning shareholders will receive $0.50 for each share they own.

Investing in dividend-paying stocks offers several advantages. Firstly, dividends provide a regular income, which can be particularly beneficial for long-term investors seeking a steady cash flow. Secondly, companies that consistently pay dividends often have a strong financial position and a history of profitability, indicating a more stable and mature business. Additionally, dividend-focused investments can provide a hedge against market volatility, as dividends tend to increase during economic downturns, offering a source of income when other investments may be suffering.

It's important to note that not all companies pay dividends, and the decision to invest in dividend-paying stocks should be based on thorough research. Investors should consider factors such as the company's dividend history, payout ratio, and the overall market conditions. Building a diversified portfolio of dividend-paying stocks can be a powerful strategy for long-term wealth accumulation, providing both capital appreciation and a steady income stream.

Investing vs. Buying Shares: Understanding the Fundamental Distinction

You may want to see also

Dividend Payout Ratio: The percentage of earnings paid out as dividends

The Dividend Payout Ratio is a crucial metric for investors interested in understanding how companies distribute their profits to shareholders through dividends. This ratio provides insight into the portion of a company's earnings that are paid out to investors as dividends, offering a clear picture of the company's dividend policy and financial health.

Calculating the Dividend Payout Ratio is straightforward. It is determined by dividing the total dividends paid by the company during a specific period (often a fiscal year) by the company's net income or earnings for the same period. The formula is: Dividend Payout Ratio = Total Dividends Paid / Net Income. For example, if a company pays out $500,000 in dividends and its net income for the year is $1,000,000, the payout ratio would be 50%.

This ratio is an essential indicator for investors as it helps them assess the sustainability of a company's dividend payments. A high payout ratio might suggest that a company is distributing a significant portion of its earnings to shareholders, which could be a sign of financial stability and a well-established dividend policy. However, it's important to consider that a very high payout ratio might also indicate that the company is not reinvesting enough in its own growth, which could be a cause for concern in the long term.

On the other hand, a low payout ratio could mean that the company is retaining more of its earnings, which it can use for future expansion, research, or other strategic initiatives. This can be attractive to investors seeking long-term growth potential, as it suggests that the company is in a strong financial position to invest in its own development while still providing a return to shareholders.

Understanding the Dividend Payout Ratio is a key step in evaluating the attractiveness of a dividend-paying stock. It allows investors to make informed decisions about the sustainability and potential growth of their dividend investments. By analyzing this ratio alongside other financial metrics, investors can build a well-rounded understanding of a company's dividend policy and its overall financial health.

Retirement Planning: Navigating Investment Strategies as the Finish Line Approaches

You may want to see also

Dividend Reinvestment: Buying additional shares with the dividend received

Dividend reinvestment is a powerful strategy for long-term investors who want to maximize their returns from dividend-paying stocks. When you receive a dividend, instead of taking the cash payout, you can choose to reinvest it by purchasing additional shares of the same stock. This process allows your investment to grow exponentially over time, as the reinvested dividends generate more dividends, and so on.

The concept is simple: when a company pays dividends, it provides an opportunity to buy more of that company's stock at a lower cost per share. By reinvesting these dividends, investors can compound their wealth, benefiting from the power of compounding returns. For example, if you own 100 shares of a company and receive a $2 dividend, you can choose to reinvest that $2 by buying 1 additional share, increasing your total holdings to 101 shares. Over time, this strategy can lead to a substantial increase in the number of shares you own.

This method is particularly advantageous for investors who want to build a substantial position in a company without having to make frequent large investments. By consistently reinvesting dividends, you can accumulate a larger number of shares, which can then generate even more dividends in the future. This creates a positive feedback loop, allowing your investment to grow exponentially.

It's important to note that dividend reinvestment is a long-term strategy and may not be suitable for short-term traders. The key to success with this approach is patience and a long-term investment horizon. Investors should also consider the potential risks associated with individual stocks and diversify their portfolio to manage risk effectively.

In summary, dividend reinvestment is a powerful tool for investors who want to benefit from the power of compounding returns. By reinvesting dividends, you can purchase additional shares, increasing your holdings and potentially generating even more dividends in the future. This strategy requires a long-term perspective and a willingness to let your investments grow over time.

Boat Blues: Navigating the Murky Waters of Marine Investment

You may want to see also

Dividend Growth: Companies increasing dividends over time

Dividend growth investing is a strategy that focuses on companies that consistently increase their dividend payments over time. This approach is particularly attractive to investors seeking a steady income stream and long-term wealth accumulation. When a company increases its dividends, it demonstrates financial stability and a commitment to rewarding its shareholders. This is often a sign of a well-managed business with a strong cash flow and a positive outlook for future growth.

The concept is simple: investors look for companies that have a history of raising dividends, indicating a consistent and improving financial performance. These companies often have a solid track record of increasing dividends annually, which can provide a reliable source of income for investors. Over time, as the dividends grow, so does the investor's wealth, making this a powerful strategy for long-term investors.

One of the key benefits of dividend growth investing is the potential for compound growth. As the dividends are reinvested, they earn additional income, and this process repeats, leading to exponential growth. For example, if an investor purchases shares of a company that pays a $2 dividend and the dividend is increased by 5% annually, the dividend income will grow. After the first year, the dividend will be $2.10, and after the second year, it will be $2.205, and so on. This compounding effect can significantly boost the overall return on investment.

Identifying such companies requires research and analysis. Investors should look for businesses with a consistent dividend payment history, a strong balance sheet, and a management team that demonstrates a commitment to long-term value creation. Sectors like utilities, consumer staples, and real estate investment trusts (REITs) often have a higher propensity for dividend growth due to their stable cash flows and regulated environments.

Additionally, investors can benefit from a long-term perspective, as dividend growth companies tend to outperform over extended periods. These companies often have a competitive advantage, efficient operations, and a strong market position, which contributes to their ability to consistently increase dividends. By focusing on dividend growth, investors can build a robust portfolio that provides a steady income and potential capital appreciation.

AI's Future: What to Buy to Get Started with Artificial Intelligence

You may want to see also

Tax Implications: Dividend income is taxable, but rates vary

Dividend income is a significant aspect of investing, and understanding its tax implications is crucial for investors. When you receive dividends from your investments, it's essential to know that this income is taxable, and the tax rates can vary depending on several factors. The tax treatment of dividends is a complex topic, and investors should be aware of the potential financial impact.

In many countries, dividend income is taxed at different rates compared to other types of income. For instance, in the United States, dividends are generally taxed at lower rates than ordinary income. This preferential treatment is often due to the belief that dividends represent a return on invested capital rather than active income. However, the specific tax rate applied to dividends can vary based on the investor's income level and the holding period of the investment. Long-term capital gains, for example, may be taxed at a lower rate than short-term gains, and qualified dividends might be taxed at even lower rates, especially for lower-income earners.

The tax rate on dividends can also change over time, depending on the tax laws and regulations in your jurisdiction. These laws often have specific rules and brackets for dividend income, which means that the tax rate can vary significantly depending on the amount of dividend income received. For instance, in some countries, a flat tax rate might be applied to all dividend income, while in others, a progressive system could see higher tax rates applied to higher dividend amounts.

Additionally, investors should consider the impact of tax-efficient strategies. Some investors may choose to reinvest dividends to benefit from compound growth, which can defer taxes until the dividends are eventually withdrawn. Others might opt for tax-efficient accounts, such as retirement accounts, which can provide tax advantages. Understanding these strategies can help investors manage their tax liabilities effectively.

It is essential to consult with a tax professional or financial advisor to ensure compliance with tax laws and to develop a strategy that aligns with your investment goals and tax situation. They can provide personalized advice on how to optimize your dividend income and manage the associated tax implications. Being aware of these tax considerations is a vital step in making informed decisions about dividend investing.

Seeking Investors for Your Farm?

You may want to see also

Frequently asked questions

Dividend investing is a strategy where investors focus on companies that pay regular dividends to their shareholders. It involves buying shares of these companies, which then generate a steady income stream through the distribution of a portion of the company's profits.

When a company generates profits, it can choose to reinvest them into the business or distribute a portion of those profits to shareholders as dividends. Investors who own shares of dividend-paying companies receive these dividends at regular intervals, typically quarterly or annually.

Not all companies are created equal when it comes to dividend investing. It's important to look for companies with a strong financial position, a history of consistent dividend payments, and a commitment to maintaining or growing their dividend over time. These companies are often considered more reliable dividend investors.

To maximize dividend income, investors can consider the following strategies: diversifying their portfolio across multiple dividend-paying stocks, investing in exchange-traded funds (ETFs) that focus on dividends, and regularly reviewing and rebalancing their portfolio to ensure it aligns with their investment goals and risk tolerance.

Dividend income is typically taxable, and the tax treatment varies depending on the jurisdiction and the type of dividend. In some countries, dividends are taxed at the ordinary income tax rate, while in others, they may be eligible for reduced tax rates or special dividend tax credits. It's essential to understand the tax laws in your region to manage the tax impact of dividend income effectively.