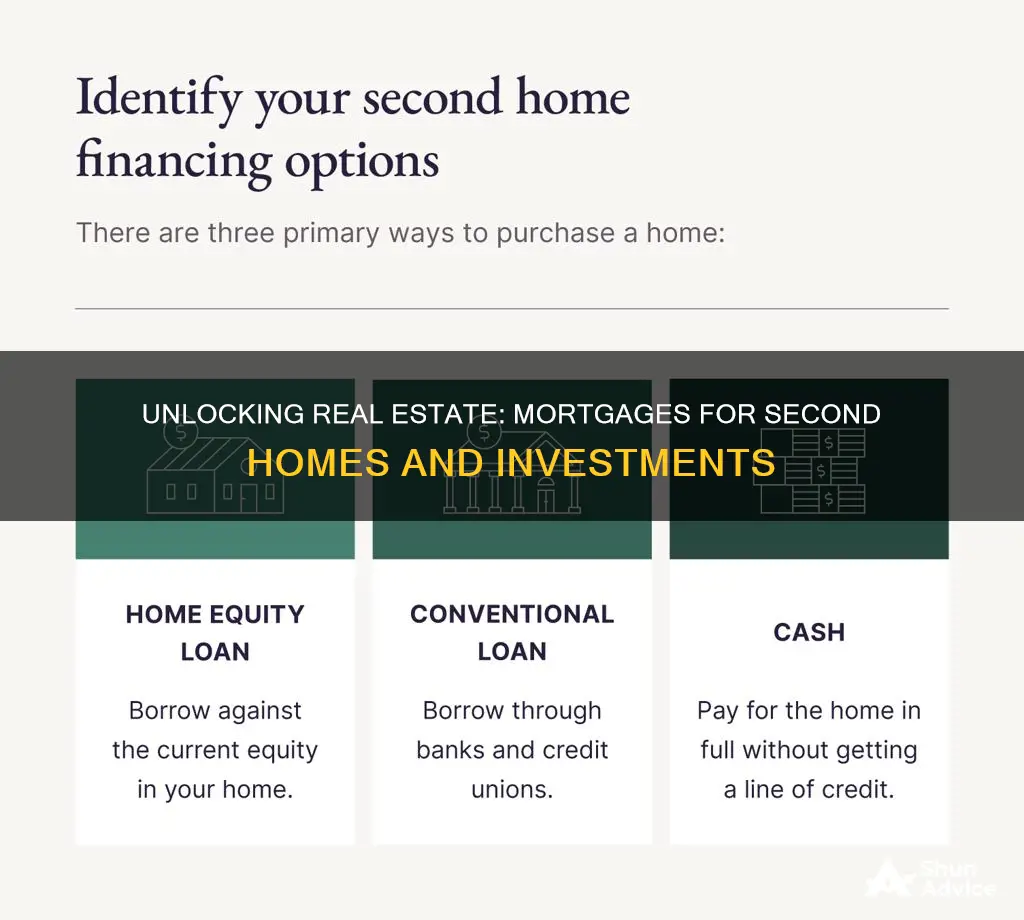

Mortgages for second homes or investments can be a complex financial decision. Understanding how they work is crucial for anyone looking to purchase a property for leisure, rental income, or both. This guide will explore the key aspects of mortgages for these types of properties, including the unique considerations, potential benefits, and challenges involved. From down payments and interest rates to tax implications and loan terms, we'll delve into the essential factors that can impact your financial journey. Whether you're a seasoned investor or a first-time homeowner, this overview will provide valuable insights to help you make informed decisions and navigate the process with confidence.

What You'll Learn

- Mortgage Types: Fixed-rate, adjustable-rate, and interest-only loans for second homes

- Down Payment Requirements: Typically higher for second homes, often 20-30%

- Closing Costs: Additional fees for second homes, including appraisal and title insurance

- Tax Implications: Tax benefits and deductions for second home mortgage interest

- Investment Property Management: Strategies for renting out and maintaining investment properties

Mortgage Types: Fixed-rate, adjustable-rate, and interest-only loans for second homes

When considering a mortgage for a second home or investment property, it's crucial to understand the different types of mortgage loans available to ensure you make the right financial decision. Here's an overview of the three primary mortgage types:

Fixed-Rate Mortgages: This type of mortgage offers a consistent interest rate for the entire term of the loan, typically ranging from 15 to 30 years. With a fixed-rate mortgage, your monthly payments remain the same, providing a stable and predictable financial commitment. This predictability is advantageous for budgeting, especially when planning for a second home or investment, as it allows you to plan for long-term expenses without the worry of fluctuating interest rates. The fixed nature of these mortgages also protects against potential rate increases, making it a reliable choice for those seeking financial stability.

Adjustable-Rate Mortgages (ARMs): ARMs offer an initial fixed interest rate for a specified period, often 5, 7, or 10 years, after which the rate adjusts annually based on market conditions. This type of mortgage can be attractive for those who plan to own the property for a shorter duration or anticipate future financial improvements that could benefit from lower interest rates. However, it's essential to carefully consider the potential risks. If interest rates rise, your monthly payments will increase, impacting your budget. Therefore, it's crucial to monitor market trends and have a clear understanding of your financial goals before opting for an ARM.

Interest-Only Loans: With an interest-only mortgage, you only pay the interest on the loan for a specified period, typically 5 to 10 years. During this initial phase, your monthly payments are lower, but you don't build equity in the property. This type of loan can be appealing for investors or those who plan to refinance or sell the property before the interest-only period ends. However, it's important to note that once the interest-only period ends, you'll need to start paying both principal and interest, which could result in significantly higher monthly payments. This mortgage type is best suited for those who can afford to make larger payments later or who have a clear exit strategy.

Understanding the differences between these mortgage types is essential for making an informed decision. Fixed-rate mortgages offer stability, ARMs provide flexibility, and interest-only loans can be advantageous for specific financial strategies. When choosing a mortgage, consider your financial goals, the length of your ownership plan, and the potential impact of market fluctuations. Consulting with a financial advisor or mortgage specialist can provide valuable insights tailored to your unique circumstances.

Forever Stamps: A Smart Investment?

You may want to see also

Down Payment Requirements: Typically higher for second homes, often 20-30%

When considering a mortgage for a second home or investment property, one of the most critical aspects to understand is the down payment requirement. Typically, lenders demand a more substantial down payment for these types of properties compared to primary residences. This is because second homes and investment properties are generally considered riskier investments due to the potential for lower rental income or occupancy rates.

The standard down payment requirement for a second home or investment property often falls between 20% and 30% of the property's purchase price. This percentage is significantly higher than the typical 20% down payment often required for a primary residence. For instance, if you're looking to buy a property worth $300,000, you might need to set aside between $60,000 and $90,000 as a down payment. This higher down payment requirement is a safeguard for lenders, ensuring that even if the property's value decreases or there are financial hardships, the borrower still has a substantial equity stake in the property.

The reason for this higher threshold is twofold. Firstly, it reduces the risk for the lender. With a larger down payment, the borrower's financial commitment to the property is more significant, making it less likely that they would default on the mortgage. Secondly, it protects the borrower from potential financial losses. A higher down payment means that even if the property's value drops, the borrower retains a substantial portion of their initial investment, thus minimizing potential losses.

It's important to note that the specific down payment requirements can vary based on several factors, including the borrower's credit score, the loan-to-value ratio, and the type of mortgage product chosen. Some lenders might offer options for a lower down payment, but these typically come with higher interest rates or other fees to compensate for the increased risk. Therefore, borrowers should carefully consider their financial situation and the potential risks before committing to a higher down payment.

In summary, understanding the down payment requirements for second homes and investment properties is crucial for anyone looking to enter the real estate market in this capacity. The higher down payment, typically ranging from 20% to 30%, is a standard practice that helps protect both the borrower and the lender, ensuring a more secure financial transaction.

Investing: A Guide for Every Age

You may want to see also

Closing Costs: Additional fees for second homes, including appraisal and title insurance

When purchasing a second home or investment property, it's crucial to understand the additional costs that come with securing a mortgage. One of the most significant expenses is closing costs, which encompass various fees associated with finalizing the home-buying process. These costs can vary depending on the location, property value, and the lender's policies.

Closing costs for second homes often include a home appraisal, which is a comprehensive assessment of the property's value. Lenders require this to ensure the mortgage amount is appropriate and to protect their investment. The appraisal process involves a professional inspector who analyzes the property's condition, location, and comparable sales to determine its market value. This fee is typically non-negotiable and can range from 1% to 5% of the purchase price.

In addition to these, there are other closing costs to consider, such as attorney fees, escrow fees, document preparation charges, and recording fees. These expenses are often shared between the buyer and seller, but the buyer typically covers a significant portion. It's essential to review the closing cost estimate provided by the lender and negotiate any potential savings or waivers, especially when purchasing an investment property. Understanding these costs upfront can help borrowers plan their finances effectively and ensure a smoother transaction process.

Omaxe Chandni Chowk: Worth the Investment?

You may want to see also

Tax Implications: Tax benefits and deductions for second home mortgage interest

Understanding the tax implications of a second home or investment property mortgage is crucial for homeowners looking to optimize their financial situation. When it comes to tax benefits and deductions, the Internal Revenue Service (IRS) has specific rules and guidelines that homeowners should be aware of.

Mortgage interest on a second home or investment property is generally deductible, but there are certain limitations and conditions. Homeowners can claim a deduction for the interest paid on the mortgage, up to a certain percentage of the adjusted gross income (AGI). The standard deduction for mortgage interest is typically limited to the sum of 100% of the interest on the first $750,000 of debt and 50% of the interest on the next $125,000 of debt. This means that if the mortgage amount exceeds these limits, only a portion of the interest may be deductible. For example, if the mortgage is for $1 million, the homeowner can deduct the interest on the first $750,000, but only 50% of the interest on the remaining $250,000.

To claim these deductions, homeowners must provide detailed documentation, including mortgage statements and interest payments. It is essential to keep accurate records and ensure that the property is used for personal or rental purposes, as the IRS has strict criteria for what constitutes a second home or investment property. The property must be used for at least 14 days of the year or rented for at least 10 days to qualify for these tax benefits.

Additionally, homeowners may be eligible for other tax deductions related to the second home or investment property. These can include property taxes, mortgage insurance premiums, and certain closing costs associated with the purchase. However, it is important to note that these deductions may be subject to specific limitations and rules, and not all expenses are deductible.

In summary, homeowners with second homes or investment properties can take advantage of tax benefits and deductions for mortgage interest. By understanding the IRS guidelines and keeping proper records, individuals can optimize their tax situation and potentially reduce their taxable income. It is always advisable to consult with a tax professional or accountant to ensure compliance with the latest tax laws and to maximize the available deductions.

Planning for Prosperity: Strategies for Investing Close to Retirement

You may want to see also

Investment Property Management: Strategies for renting out and maintaining investment properties

When it comes to investment property management, a well-structured strategy is essential to ensure profitability and long-term success. Here are some key approaches to consider:

Market Research and Selection: Begin by thoroughly researching the real estate market in your desired area. Identify neighborhoods or regions with high rental demand and potential for property value appreciation. Consider factors such as local employment rates, population growth, and the availability of amenities. This research will help you make informed decisions about the type of property to invest in, whether it's a single-family home, a multi-unit building, or a commercial space.

Rent Optimization: Maximizing rental income is crucial for a successful investment. Set competitive rental rates by analyzing similar properties in the market. Regularly review and adjust rents to keep up with market trends and inflation. Consider offering incentives such as short-term leases or referral programs to attract and retain tenants. Additionally, ensure that your property is well-maintained and presented to appeal to potential renters.

Tenant Screening and Management: Effective tenant screening is vital to minimize risks and ensure a steady income stream. Implement a rigorous screening process that includes credit checks, income verification, and reference checks. Look for tenants with a stable income and a history of responsible rent payment. Once you've selected tenants, establish clear communication channels and provide regular updates on property maintenance and any issues that arise. Promptly address tenant concerns to maintain a positive rental experience.

Property Maintenance and Upkeep: Regular maintenance is essential to preserve the value of your investment property. Create a comprehensive maintenance schedule that includes routine inspections, cleaning, and repairs. Stay proactive by addressing minor issues before they become major problems. Consider hiring professional maintenance services for specialized tasks, such as HVAC system maintenance or pest control. Keep detailed records of all maintenance activities and expenses for tax purposes and to ensure the property's longevity.

Financial Management: Efficient financial management is critical to the success of your investment. Set up a separate business bank account for your rental property to track income and expenses accurately. Keep detailed financial records, including rental income, property expenses, and mortgage payments. Regularly review your financial statements to identify areas for cost-saving and revenue growth. Consider consulting a financial advisor to optimize your investment strategy and explore tax benefits associated with rental properties.

Long-Term Planning: Think strategically about the long-term goals for your investment property. Develop a plan for potential property upgrades or renovations to increase its value and rental appeal. Stay informed about market trends and be prepared to adapt your strategy as needed. Regularly assess the performance of your investment and make adjustments to maximize returns while minimizing risks.

Solar Energy: The Rapid Return on Investment

You may want to see also

Frequently asked questions

Lenders typically have more stringent requirements for second homes and investment properties compared to primary residences. You'll need to demonstrate a stable income, a good credit score, and a substantial down payment. They may also consider the property's value, location, and potential rental income. It's essential to research and compare different lenders to find the best terms for your financial situation.

Owning an additional property can have tax benefits and obligations. You may be eligible for tax deductions for mortgage interest, property taxes, and certain expenses related to the rental or occupancy of the property. However, there are also potential drawbacks, such as the requirement to file a separate tax return for the rental income and potential capital gains taxes when you sell the property. Consulting a tax professional can help you understand the specific tax implications based on your circumstances.

Yes, several mortgage options are tailored to these types of properties. These may include adjustable-rate mortgages (ARMs) with lower initial interest rates, loan-to-value (LTV) ratios that are higher than primary residence mortgages, and different closing cost structures. Some lenders also offer specialized programs for investors, such as portfolio loans, which allow for more flexible underwriting criteria. It's advisable to explore these options and compare them to traditional mortgages to find the most suitable financing for your second home or investment venture.