How to Find People to Invest in Your Farm

Investing in a farm can be a costly endeavour, but there are many ways to find people to invest in your farm. Firstly, it's important to understand the different types of farming investments available. These include buying farmland directly, investing in farm REITs (real estate investment trusts), agricultural stocks, ETFs, and mutual funds, or even crowdfunding platforms. Each option has its own advantages and disadvantages in terms of liquidity, minimum investment, and potential returns.

When looking for people to invest in your farm, it's crucial to consider the market demand and trends in the agricultural sector. Investors will want to know that there is a demand for the products your farm will be producing. Additionally, the geographic location and suitability of the land for farming are key factors. A successful track record of farming in the area and suitable climate and soil conditions will attract investors.

Regulatory and environmental considerations are also important. Investors will want to ensure that the farm is compliant with all relevant regulations and preferably operating with sustainable and environmentally friendly practices. Access to resources and infrastructure, such as power, water, and transportation, are other factors that will influence investors' decisions.

To find people to invest in your farm, you can utilise government programs and subsidies, agricultural research institutions, and industry associations and networks. These resources can help connect you with potential investors and provide support throughout the investment process. Additionally, consulting a professional with expertise in farming investments can provide valuable insights and advice on how to attract investors.

| Characteristics | Values |

|---|---|

| Returns | 10-12.2% |

| Demand | Expected to increase up to 98% by 2050 |

| Recession-proof | Yes |

| ROI | High |

| Sustainability | Environmentally friendly |

| Tax incentives | Yes |

| Risks | Weather, market volatility, regulation |

| Investment types | Direct, REITs, stocks, mutual funds, ETFs, crowdfunding |

What You'll Learn

Direct investment in agricultural land or farmland

Direct private investment in farmland offers a direct and unfiltered experience of owning and managing agricultural land. There are several ways to go about this:

Purchasing farmland outright

This is the most straightforward method. Identify a piece of farmland for sale, assess its potential for profitability, and buy it. This approach allows full control over the land, including decisions on what crops to grow, when to harvest, and whether to lease the land to farmers.

Leasing to farmers

Once an investor owns a piece of farmland, they might choose not to farm it themselves, instead leasing it out to experienced farmers and collecting rent. This passive approach appeals to those who want the benefits of land ownership without the operational hassles of farming.

Partnering with an operating farmer

Some investors prefer a more collaborative approach. They might partner with an experienced farmer, wherein the investor provides the capital for land purchase, and the farmer manages the operations. Profits in such a setup are typically shared based on a pre-agreed ratio.

Land auctions

Auctions can be a viable way to acquire farmland. They offer potential investors the opportunity to bid on properties that might not be available through traditional real estate listings. But this method requires a keen understanding of the land’s value and the local farming community to make informed bidding decisions.

Direct private investment in farmland requires a significant financial commitment. According to the USDA, the average farm size in 2022 was 446 acres, with an average value of $3,800 per acre. This would mean an initial investment of nearly $1.7 million for an average-sized farm.

Direct investment in farmland also requires investors to be prepared to invest time, especially when navigating the diverse regulatory and legal landscapes that govern agricultural land ownership and operations. Each region may have rules regarding water rights, land usage, tenant-farmer rights, and environmental considerations.

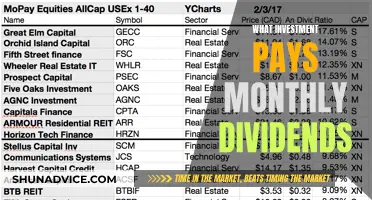

Farmland REITs

Prospective farmland investors lacking the capital for a direct investment can opt for an investment in farmland real estate investment trusts (REITs). REITs are corporate entities that own, operate, or finance income-producing agricultural real estate. They aggregate capital from multiple investors and use these funds to purchase and manage agricultural lands, which they then lease out to farmers. The rental income, after expenses, is distributed back to shareholders as dividends.

Shares of farmland REITs trade on exchanges like any other stock and can be bought and sold via most brokerage platforms. Shares can be bought for a fraction of the cost of direct land ownership, thereby gaining exposure to the farmland market without requiring direct land ownership or management.

Online syndication and crowdfunding platforms

Online crowdfunding platforms have emerged as a popular tool for those keen to explore farmland investments. These platforms act like digital marketplaces, showcasing a range of farmland projects that need funding. Investors get access to various farm investment opportunities and can allocate some of their money to projects that resonate with them. Upon reaching the set funding target, the platform consolidates all the collected funds and channels them into acquiring or developing the identified farmland. The responsibility of managing the farm falls on the platform, either directly or through arrangements with experienced farmers.

Profits generated from these ventures, such as rent from tenants or value appreciation, are subsequently distributed among the investors proportionate to their initial contribution.

There is typically a minimum investment threshold for crowdfunding platforms, and liquidity can be an issue, with a stipulated period during which withdrawing or accessing funds might not be feasible. The platforms also charge for their services, either through ongoing management fees or a percentage of the profits.

Some notable farmland syndication and crowdfunding platforms include American Farm Investors, AcreTrader, FarmFundr, FarmTogether, and Harvest Returns.

Makeup Investment: Who's Spending?

You may want to see also

Farm REITs (real estate investment trusts)

Farm REITs are an innovative way to invest in farmland without the need for direct ownership of a farm. They are an excellent way to diversify your portfolio and provide access to the agriculture industry.

Farmland-focused REITs typically serve two purposes:

- Providing capital to farmers: Farm REITs often enter into sales-leaseback transactions with farmers. They buy farmland and lease it back to the farmer under a long-term lease, unlocking the value of the land while providing capital for expansion.

- Providing investors with access to farmland: Historically, only wealthy individuals could invest in farmland due to its high cost and operational requirements. REITs have democratized farmland investing by pooling capital from multiple investors to acquire parcels of farmland, which is then leased to farmers.

Advantages of Farm REITs

Portfolio Diversification:

Farmland offers investors returns that are uncorrelated to major asset classes like stocks, bonds, and cryptocurrencies. This helps to reduce the overall volatility of an investment portfolio.

Inflation Hedge:

Farmland has historically been an effective hedge against inflation, offering stability during economic uncertainties. There is a positive correlation between farmland values and the consumer price index.

Attractive Total Returns:

Farmland provides investors with two sources of returns: rental income from farmers and capital appreciation. From 1992 to 2021, farmland generated a combined average annual return of around 11%.

Disadvantages of Farm REITs

Interest Rate Risk:

Like other REITs, farmland REITs face interest rate risk, which affects their borrowing costs and ability to make acquisitions. Rising interest rates can also lead to a decrease in REIT valuations.

Natural Disasters and Crop Prices:

Farms are vulnerable to natural disasters like droughts and wildfires, which can impact harvests and rent payments. Additionally, crop prices, especially for annual commodity crops, can be volatile, affecting farm income and the ability of farmer-tenants to make rental payments.

Examples of Farm REITs

Gladstone Land Corporation (LAND):

Gladstone Land is the first farmland REIT, established in 1997. It owns nearly 113,000 acres of farmland across 14 states in the US. They follow an equity REIT model, renting out farmland to farmers and paying monthly dividends to investors.

Farmland Partners (FPI):

Farmland Partners is a larger player in the REIT space, owning over 160,000 acres of land across 17 states. They focus on both commodity crops (e.g. corn, soybeans) and specialty crops, providing investors with exposure to diverse agricultural sectors. FPI pays dividends quarterly and aims to enhance farm profitability for the benefit of both farmers and shareholders.

Farm REITs offer a unique opportunity to invest in the stability and potential returns of farmland without the complexities of direct ownership. They provide portfolio diversification, an inflation hedge, and attractive total returns. However, investors should also be aware of the risks associated with farmland investing, including interest rate fluctuations, natural disasters, and challenges faced by farmer-tenants.

Investing: Choosing Companies Wisely

You may want to see also

Investing in agricultural commodities or futures

Agricultural commodities are an area worth watching, as global food prices remain high and demand for food supplies is expected to increase. After the 2022 invasion of Ukraine, for example, there were disruptions to global wheat and corn supplies, highlighting the importance of agricultural commodities.

There are several ways to invest in agricultural commodities and futures. Here are some options:

Exchange-Traded Funds (ETFs)

ETFs are a popular option for investors as they offer diversified exposure to the agriculture sector. ETFs invest in a basket of securities, such as stocks or commodities, and can be traded on an exchange like a stock. Some ETFs focus specifically on agricultural commodities, such as the Teucrium Soybean Fund (SOYB), the Teucrium Corn Fund (CORN), and the Teucrium Wheat Fund (WEAT), which have provided strong returns in the past year.

Other ETFs provide exposure to a range of agricultural companies, such as the VanEck Agribusiness ETF (MOO), which includes companies like Bayer, Deere, and Zoetis.

Mutual Funds

Mutual funds are another option for investors interested in the farming sector. These funds may invest in agriculture-related firms or directly in commodities. An example of a mutual fund with exposure to agricultural firms and commodities is the Fidelity Global Commodity Stock Fund (FFGCX).

Commodity Futures

Investors can also gain exposure to agricultural commodities by purchasing futures contracts. Futures contracts allow investors to speculate on the price changes of commodities, such as wheat, corn, soybeans, and sugar. This can be a more direct way to invest in agricultural commodities, but it may also carry more risk.

Farmland Real Estate Investment Trusts (REITs)

REITs are companies that own or finance income-producing real estate. In the context of agriculture, REITs typically purchase farmland and lease it to farmers. This option offers higher liquidity than owning a farm directly and has a lower initial investment requirement. Examples of farmland REITs include Farmland Partners Inc. (FPI) and Gladstone Land Corporation (LAND).

Private Equity Funds

Private equity funds are another option for investing in farmland. These funds typically have a high minimum investment requirement, often in the millions. They use investor capital to purchase farmland, which is then leased to farmers.

Crowdfunding

Agriculture crowdfunding is a newer option, allowing investors to buy fractional equity in a farm with a relatively low upfront investment. This option provides investors with more control over the specific farmland they invest in and can offer higher returns.

Overall, there are several options for investors looking to gain exposure to agricultural commodities and futures. Each option has its own benefits and risks, so it is important for investors to carefully consider their investment goals and risk tolerance before deciding which path to take.

Investing in People: A Risky Business

You may want to see also

Farming partnerships or joint ventures

Farming partnerships and joint ventures are a great way to combine resources and expertise to achieve common goals. Both structures share similarities, but also have key differences that should be considered when forming an alliance.

Partnerships

A partnership is typically described as a voluntary association of two or more people who jointly own and manage a business for profit. It is an ongoing relationship defined by a partnership agreement, which outlines each partner's responsibilities, duties, ownership share, and management control. Partnerships usually engage in an indefinite period of business operations. Partners are jointly and severally liable for the partnership's obligations and actions of other partners and employees. This means that each partner can be held personally liable.

Joint Ventures (JVs)

Joint ventures are formed when two or more people come together for a single defined project or a series of transactions. A joint venture agreement outlines the common purpose, shared profits and losses, and each member's equal voice in controlling the project. Each member's share of ownership, profits, and control is usually specified in the agreement. JVs offer more flexibility in terms of structure and scope, and members are generally only liable to the extent of their investment.

Share Farming

Share farming is a business model where two or more farmers share their inputs and gross output from farming the same agricultural unit. Each farmer operates a separate business with their own bank accounts and tax returns. A commercial contract sets out the responsibilities of each party, including inputs, proceeds division, operational activities, and the duration of the agreement. Share farming offers flexibility, allowing different levels of involvement and investment. It is commonly used in livestock enterprises but can also be applied to arable and horticultural settings.

Machinery Joint Ventures

Farm operators can also form machinery joint ventures to control machinery costs and increase labour flexibility. This arrangement involves sharing equipment and machinery, which can lead to significant cost savings. It requires good record-keeping and cooperation between the operators. Machinery joint ventures can be informal or formal, with the latter requiring a separate entity such as a limited liability company or partnership. This structure allows for greater annual use of large machinery, more efficient labour utilisation, and volume discounts on purchases.

Millions Have $1M to Invest

You may want to see also

Investing in agricultural technology or equipment

Enhanced Productivity and Efficiency:

Agricultural equipment, such as tractors and harvesters, significantly increases the efficiency of farming operations. It allows farmers to cultivate larger areas and harvest more crops in less time. Modern agricultural machinery is designed to perform specific tasks with precision, reducing wastage of seeds, fertilisers, and other resources. This leads to improved resource efficiency and higher yields.

Time and Cost Savings:

Farm equipment reduces labour requirements and speeds up tasks, enabling farmers to complete planting, cultivating, and harvesting activities within optimal timeframes. This timely execution is crucial for maintaining crop quality and yield. While the initial investment in agricultural equipment can be significant, it often pays off in the long run through improved efficiency and reduced operational costs.

Environmental Benefits:

Certain agricultural equipment, such as no-till seeders and precision sprayers, can help reduce soil erosion and minimise pesticide use. Additionally, advancements in agricultural technology aim to improve sustainability by optimising water usage and reducing adverse effects on the environment. For example, controlled environment agriculture and precision agriculture techniques enable farmers to increase yields while using fewer resources.

Versatility and Flexibility:

Agricultural machinery can be adapted for various farming needs, allowing farmers to easily switch between tasks like planting, ploughing, and harvesting. This versatility provides flexibility in farm operations and enables farmers to respond to changing conditions.

Safety and Consistency:

Modern farm equipment often includes safety features that protect operators, reducing the risk of accidents and injuries. Additionally, machines can perform tasks consistently, ensuring uniformity in planting and harvesting. This consistency is crucial for maintaining crop quality and marketability.

Technological Advancements:

Agricultural technology has seen a wave of transformative advancements, including automation, smart farming, and data-driven decision-making. Sensors, analytics, and farm management systems enable farmers to monitor crop health, optimise growing conditions, and make informed choices. These advancements empower farmers with precision farming techniques, improving crop quality and yields.

Financing Options:

When considering investing in new agricultural equipment, it is essential to explore the available financing options. Leasing equipment can be a viable alternative to purchasing, offering flexibility and optimised cash flow.

In conclusion, investing in agricultural technology and equipment offers a range of benefits, including improved productivity, efficiency, sustainability, and safety. These advancements enable farmers to meet the growing global demand for food while reducing environmental impacts. By embracing innovative technologies and machinery, farmers can enhance their operations and secure a prosperous and sustainable future for their agricultural endeavours.

Silver's Investment History: 1800s

You may want to see also

Frequently asked questions

There are several ways to find investors for your farm. You can use crowdfunding platforms such as AcreTrader, FarmTogether, and FarmFundr. These platforms allow investors to buy a small slice of a real farm, lowering the minimum investment. You can also try to find investors through agricultural research institutions, industry associations, and networks. Additionally, you can seek out government programs dedicated to helping farming investors.

Investing in a farm can provide a high return on investment (ROI). For example, during the past 20 years, investments in US farmlands have maintained an average ROI of 12.24%. Farming is also considered a recession-proof investment as people still need to eat during economic crises. Additionally, farmland investments are sustainable and environmentally friendly, and they offer tax incentives and subsidies.

The most serious threats to farming investments include weather conditions, operational risks, and market volatility. Weather can influence livestock health and crop yields, impacting profitability. Market volatility can affect profit margins and ROI, and regulatory changes can impact the financial outcome of the investment.