Changes in interest rates can have a significant impact on consumption and investment. When interest rates rise, consumers may be more inclined to save money to take advantage of higher interest rates, while lower interest rates can encourage spending and investment. However, the impact of interest rate changes can vary depending on factors such as current rate levels, expected future rate changes, consumer confidence, and the overall health of the economy. Central banks adjust interest rates to influence economic activity and combat inflation. This can affect the cost of borrowing money, making it more or less expensive for individuals and businesses. The ultimate effect of interest rate changes depends on how consumers and investors respond to these changes and their perception of their financial situation.

| Characteristics | Values |

|---|---|

| When interest rates go up | Consumers may be more attracted to saving dollars that can earn higher interest rates rather than spend |

| When interest rates go down | People may no longer wish to save, but instead spend and invest, even taking out loans to consume at low interest rates |

| Lower interest rates | Make borrowing cheaper—allowing people to spend and invest more freely |

| Increasing rates | Make borrowing more costly and can rein in spending in favour of saving |

| The ultimate effect of interest rate changes | Primarily depends on the consensus attitude of consumers as to whether they are better off spending or saving in light of the change |

| The income effect | Increases consumption if the agent has positive savings, since her savings are worth more with higher interest rates |

What You'll Learn

- How do changes in interest rates affect an agent's consumption and savings decisions?

- How do changes in interest rates affect consumer spending habits?

- How do changes in interest rates affect the cost of borrowing?

- How do changes in interest rates affect the economy?

- How do changes in interest rates affect investment capital?

How do changes in interest rates affect an agent's consumption and savings decisions?

Interest rates can have a significant impact on an agent's consumption and savings decisions. When interest rates increase, borrowing becomes more expensive, which can discourage spending in favour of saving. This is because consumers may be more attracted to saving money that can earn higher interest rates rather than spending. On the other hand, when interest rates decrease, borrowing becomes cheaper, which can encourage spending and investment. Lower interest rates may also encourage consumers to take out loans to consume at low interest rates.

The effect of interest rate changes on consumption and savings decisions can depend on a number of factors, including current rate levels, expected future rate changes, consumer confidence, and the overall health of the economy. For example, if the economy is sluggish, central banks may lower interest rates to make borrowing cheaper and encourage spending and investment.

The income effect and the substitution effect also influence an agent's consumption choice. The income effect increases consumption if the agent has positive savings, as their savings are worth more with higher interest rates. However, lower interest rates can also encourage consumption across all states, as the substitution effect may dominate the income effect.

Acorn Investments: Interest Payments and Your Money

You may want to see also

How do changes in interest rates affect consumer spending habits?

Changes in interest rates can have a significant impact on consumer spending habits. When interest rates increase, borrowing money becomes more expensive, which can discourage people from spending and encourage them to save instead. On the other hand, when interest rates decrease, borrowing becomes cheaper, making it more attractive for people to spend and invest. Lower interest rates may also encourage people to take out loans to consume at low interest rates.

The effect of interest rate changes on consumer spending depends on several factors, including current rate levels, expected future rate changes, consumer confidence, and the overall health of the economy. For example, if the economy is sluggish, central banks may lower interest rates to stimulate economic activity and encourage spending. Conversely, if the economy is booming, central banks may raise interest rates to combat inflation and increase the cost of borrowing.

Empirical studies have examined the impact of interest rate changes on savings and consumption decisions. These studies suggest that both the income effect and the substitution effect influence an individual's consumption choices. The income effect states that consumption increases if an individual has positive savings, as their savings are worth more with higher interest rates. On the other hand, the substitution effect suggests that lower interest rates encourage consumption across all states, as individuals may prefer to spend rather than save when rates are low.

Overall, changes in interest rates can have a significant impact on consumer spending habits. The decision to spend or save depends on various factors, including the level of interest rates, the individual's financial situation, and the overall economic conditions. By adjusting interest rates, central banks can influence consumer behaviour and achieve their economic goals, whether it is combating inflation or stimulating economic growth.

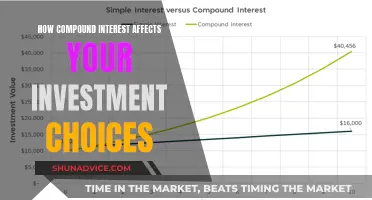

Invest Wisely: Harnessing the Power of Compound Interest

You may want to see also

How do changes in interest rates affect the cost of borrowing?

Interest rates affect the cost of borrowing money over time. When interest rates are low, borrowing is cheaper, which allows people to spend and invest more freely. Conversely, when interest rates are high, borrowing becomes more expensive, which can encourage people to save rather than spend.

The effect of interest rate changes depends on the attitude of consumers. When interest rates are low, people may be incentivised to take out loans to consume at low interest rates. However, when interest rates are high, people may be more attracted to saving money that can earn higher interest rates rather than spending.

Central banks adjust interest rates to influence the economy. They raise interest rates to increase the cost of borrowing when the economy is doing well, and lower them to make borrowing cheaper when the economy is sluggish. This is done to combat inflation or spur economic activity when the economy slows.

The impact of interest rate changes on consumer spending habits can also depend on other factors, such as current rate levels, expected future rate changes, consumer confidence, and the overall health of the economy. For example, if consumers are uncertain about the future of the economy, they may be less likely to borrow money, even if interest rates are low.

Interest Rates: Impact on Savings and Investments

You may want to see also

How do changes in interest rates affect the economy?

Changes in interest rates can have a significant impact on the economy. Central banks adjust interest rates to combat inflation or stimulate economic activity when the economy slows down. When interest rates go up, consumers may be more inclined to save money to take advantage of higher interest rates, rather than spend. On the other hand, when interest rates go down, people may be less inclined to save and more likely to spend and invest, even taking out loans to consume at low-interest rates. Lower interest rates make borrowing cheaper, allowing people to spend and invest more freely. Increasing rates, however, make borrowing more expensive, which can discourage spending in favour of saving.

The effect of interest rate changes depends on a variety of factors, including current rate levels, expected future rate changes, consumer confidence, and the overall health of the economy. Additionally, the substitution effect and the income effect can influence an individual's consumption choices. The income effect increases consumption if the individual has positive savings, as their savings are worth more with higher interest rates.

Robinhood's Interest Policy: What Investors Need to Know

You may want to see also

How do changes in interest rates affect investment capital?

Changes in interest rates can have a significant impact on investment capital. When interest rates increase, borrowing money becomes more expensive, which can make people less likely to borrow money for investments. This can lead to a decrease in investment capital as people may be more inclined to save their money instead of investing it. On the other hand, when interest rates decrease, borrowing money becomes cheaper, encouraging people to borrow more for investments. This can result in an increase in investment capital as people may be more willing to take on debt to fund their investments.

The decision to save or invest depends on various factors, including current rate levels, expected future rate changes, consumer confidence, and the overall health of the economy. For example, if the economy is strong and interest rates are low, people may be more inclined to invest their money in riskier assets to take advantage of potential higher returns. On the other hand, if the economy is uncertain and interest rates are high, people may prefer to save their money in safer investments to protect their capital.

The income effect also plays a role in how interest rates affect investment capital. When interest rates are high, people with positive savings may be encouraged to invest more as their savings earn higher interest rates. This can lead to an increase in investment capital as people may have more funds available to invest. Conversely, when interest rates are low, the income effect may discourage people from investing as their savings earn lower interest rates, potentially resulting in a decrease in investment capital.

Additionally, changes in interest rates can impact the cost of debt financing for businesses, which can affect their investment decisions. When interest rates increase, the cost of borrowing money for businesses rises, which may cause them to reduce their investment spending. This can lead to a decrease in investment capital as businesses may opt to preserve cash flow instead of investing in new projects. Conversely, when interest rates decrease, businesses may find it more attractive to borrow money for investments, potentially increasing investment capital.

Overall, changes in interest rates can have a significant impact on investment capital. The decision to save or invest depends on a variety of factors, including interest rate levels, future expectations, consumer confidence, and economic conditions. By understanding these factors, individuals and businesses can make more informed decisions about their investment strategies in response to changes in interest rates.

Lower Interest Rates: Spending and Investment Impact

You may want to see also

Frequently asked questions

When interest rates go up, consumers are more likely to save money to take advantage of higher interest rates, rather than spend. When interest rates go down, people are more likely to spend and invest, as borrowing becomes cheaper.

Central banks adjust interest rates to combat inflation or encourage economic activity when the economy slows.

Lower interest rates make borrowing cheaper, allowing people to invest more freely.

Higher interest rates make borrowing more expensive, which can reduce spending in favour of saving.

Current rate levels, expected future rate changes, consumer confidence, and the overall health of the economy can all impact consumer spending habits.